What Is Another Name For Interest Sensitive Whole Life Insurance 2

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Decoding the Names: Interest-Sensitive Whole Life Insurance Explained

What if your life insurance policy could adapt to fluctuating interest rates, offering greater flexibility and potential growth? This isn't science fiction; it's the reality of interest-sensitive whole life insurance, a product often known by other names that can be confusing.

Editor’s Note: This article provides a comprehensive overview of interest-sensitive whole life insurance, exploring its various names, features, benefits, drawbacks, and how it compares to traditional whole life insurance. We aim to demystify this financial product and empower readers to make informed decisions.

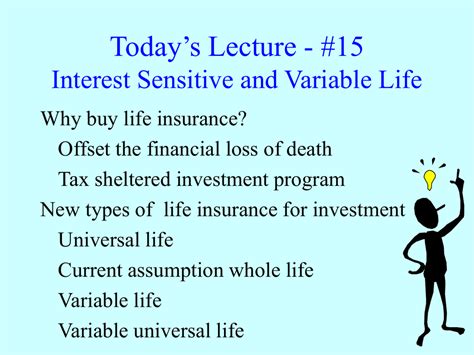

Why Interest-Sensitive Whole Life Insurance Matters:

Interest-sensitive whole life insurance, also known as a variety of other terms (which we’ll delve into shortly), offers a unique blend of life insurance coverage and a cash value component that adjusts based on current interest rates. This dynamic element distinguishes it from traditional whole life insurance, where the cash value growth is generally fixed or tied to a lower, guaranteed rate. Understanding this difference is crucial for those seeking long-term financial security and growth potential within a life insurance policy. The product's relevance stems from its ability to potentially outpace inflation and offer higher returns than traditional whole life policies, depending on market conditions.

Overview: What This Article Covers:

This article will unravel the complexities of interest-sensitive whole life insurance. We'll explore its various names, delve into its core features and mechanics, examine its advantages and disadvantages, compare it to traditional whole life insurance, and ultimately equip you with the knowledge to assess its suitability for your financial goals.

The Research and Effort Behind the Insights:

This article is the product of extensive research, drawing upon industry publications, regulatory documents, and analysis of various insurance product offerings. The information presented aims to be accurate and unbiased, providing readers with a clear and comprehensive understanding of this financial product.

Key Takeaways:

- Definition and Core Concepts: A precise definition of interest-sensitive whole life insurance and its underlying principles.

- Alternative Names: A comprehensive list of the different names used to describe this type of policy.

- How it Works: A detailed explanation of how interest-sensitive whole life insurance functions, including the role of fluctuating interest rates.

- Benefits and Drawbacks: A balanced assessment of the advantages and disadvantages of this insurance type.

- Comparison with Traditional Whole Life: A side-by-side comparison highlighting the key differences between these two policy types.

- Suitability and Considerations: Guidance on determining if this type of policy is right for your individual circumstances.

Smooth Transition to the Core Discussion:

Now that we’ve laid the groundwork, let’s delve into the specifics of interest-sensitive whole life insurance, beginning with the often confusing array of names associated with it.

Exploring the Key Aspects of Interest-Sensitive Whole Life Insurance

1. Definition and Core Concepts:

Interest-sensitive whole life insurance is a type of permanent life insurance that offers a death benefit alongside a cash value component. Unlike traditional whole life policies, the cash value growth in these policies is linked to current market interest rates or a specific index, meaning the rate of return is not fixed. This means the cash value has the potential to grow at a faster rate than traditional whole life policies, but also carries the risk of slower or even no growth if interest rates decline.

2. Alternative Names:

The lack of a standardized name for this type of policy contributes to its perceived complexity. You might encounter it under various names, including but not limited to:

- Current Assumption Whole Life Insurance: This name highlights that the cash value growth is based on current assumptions about interest rates.

- Market-Value Adjusted Whole Life Insurance: This emphasizes the adjustment of the cash value based on market fluctuations.

- Variable Whole Life Insurance (with a caveat): While some variable whole life policies have features similar to interest-sensitive whole life, the critical difference lies in how the cash value is invested. Interest-sensitive whole life typically invests in a broader range of assets, often including bonds and other fixed-income securities, unlike the direct investment options typically found in variable whole life.

- Equity-Indexed Whole Life Insurance: This type is similar, with cash value growth linked to a stock market index, but often with participation rates and caps that limit the upside potential. This is distinct from interest-sensitive whole life, which often has less emphasis on a specific index and more on broader market interest rate performance.

3. How Interest-Sensitive Whole Life Insurance Works:

The cash value component of interest-sensitive whole life insurance is typically invested in a portfolio of fixed-income securities, like bonds, whose returns are influenced by prevailing interest rates. When interest rates rise, the potential for cash value growth increases. Conversely, when interest rates fall, the growth rate may slow down. The insurer typically uses a complex formula to calculate the cash value growth, reflecting both the performance of the underlying investments and the insurer’s own expenses and profitability. The policy will usually outline the methodology used in the policy documents.

4. Benefits of Interest-Sensitive Whole Life Insurance:

- Potential for Higher Returns: The primary benefit is the potential for higher cash value growth compared to traditional whole life insurance policies. This is especially beneficial in periods of rising interest rates.

- Long-Term Growth: Permanent life insurance, by nature, provides long-term coverage. Interest-sensitive whole life can offer a mechanism for potentially growing wealth over time.

- Tax Advantages: Cash value accumulation typically grows tax-deferred. Withdrawals and loans may also offer tax advantages, although this depends on specific circumstances and should be verified with a tax professional.

5. Drawbacks of Interest-Sensitive Whole Life Insurance:

- Risk of Lower Returns: If interest rates fall, the cash value growth can significantly slow, potentially resulting in lower returns than a traditional whole life policy.

- Complexity: The underlying investment strategy and the calculation of the cash value can be complex, making it challenging for some to fully understand.

- Fees and Expenses: These policies often involve higher fees and expenses than term life insurance or traditional whole life insurance, impacting the overall return.

- No Guaranteed Rate of Return: Unlike traditional whole life, there's no guarantee of a minimum rate of return, making the outcome uncertain.

6. Comparison with Traditional Whole Life Insurance:

| Feature | Interest-Sensitive Whole Life | Traditional Whole Life |

|---|---|---|

| Cash Value Growth | Variable, based on current interest rates | Fixed or a minimum guaranteed rate |

| Return Potential | Higher potential, but also higher risk | Lower potential, but lower risk |

| Complexity | More complex | Simpler |

| Fees and Expenses | Generally higher | Generally lower |

| Risk | Higher risk of lower returns | Lower risk |

Exploring the Connection Between Investment Strategy and Interest-Sensitive Whole Life Insurance

The investment strategy employed by the insurance company significantly impacts the performance of interest-sensitive whole life insurance. Let's examine this crucial connection:

Roles and Real-World Examples:

Insurance companies managing these policies often invest premiums in a combination of bonds, government securities, and other fixed-income instruments. The specific mix will vary depending on the insurer’s risk tolerance and market conditions. For example, during periods of low interest rates, the portfolio might shift towards higher-yield bonds to maintain a desirable return, even though this might increase the risk profile slightly.

Risks and Mitigations:

A primary risk is a decline in interest rates. To mitigate this, some insurers might include mechanisms to provide a minimum rate of return or a participation rate that limits the downside while still allowing upside potential during periods of higher rates. However, these features will be detailed in the policy documents and should be reviewed carefully.

Impact and Implications:

The investment strategy’s impact is direct and significant. A well-managed investment portfolio can lead to substantial cash value growth, while a poorly performing one can result in minimal or even negative growth. It’s crucial to understand the investment approach of the insurer before committing to such a policy.

Conclusion: Reinforcing the Connection:

The link between investment strategy and interest-sensitive whole life insurance is inseparable. Understanding the insurer's approach to investing the cash value is essential for assessing the potential return and associated risks. It’s critical to compare strategies and carefully review policy documents before making a decision.

Further Analysis: Examining Interest Rate Fluctuations in Greater Detail

Interest rate fluctuations are the lifeblood of interest-sensitive whole life insurance. The Federal Reserve's monetary policy plays a significant role in these fluctuations, affecting the yields on bonds and other fixed-income securities. Economic factors like inflation, economic growth, and global events also influence interest rates, making accurate prediction extremely challenging. Investors and analysts constantly monitor these factors to anticipate interest rate movements.

FAQ Section: Answering Common Questions About Interest-Sensitive Whole Life Insurance

-

What is interest-sensitive whole life insurance? It's a type of permanent life insurance where the cash value grows based on current interest rates, offering the potential for higher returns but also greater risk compared to traditional whole life insurance.

-

What are the advantages and disadvantages? Advantages include higher potential returns and long-term growth. Disadvantages include the risk of lower returns, complexity, and potentially higher fees.

-

How is it different from traditional whole life insurance? Traditional whole life insurance offers a fixed or minimum guaranteed rate of return on cash value, whereas interest-sensitive whole life's growth fluctuates with interest rates.

-

Is it right for me? It depends on your risk tolerance, financial goals, and understanding of the complexities involved. Consult a qualified financial advisor to determine suitability.

-

What factors affect its performance? Prevailing interest rates, the insurer's investment strategy, and fees and expenses all play a critical role in determining the performance of the policy.

Practical Tips: Maximizing the Benefits of Interest-Sensitive Whole Life Insurance

- Understand the Investment Strategy: Carefully review the insurer’s investment approach and its potential risks.

- Compare Policies: Don’t just focus on the initial premiums; compare the overall costs, fees, and potential returns across different policies.

- Seek Professional Advice: Consult a qualified financial advisor to understand if this type of policy aligns with your risk tolerance and financial goals.

- Regularly Review Your Policy: Keep track of the policy’s performance and adjust your strategy if needed, always in consultation with your financial advisor.

Final Conclusion: Wrapping Up with Lasting Insights

Interest-sensitive whole life insurance presents a complex yet potentially rewarding investment opportunity. Its fluctuating returns necessitate a thorough understanding of the underlying mechanics, associated risks, and the insurer’s investment strategy. By carefully weighing the potential benefits against the risks and seeking professional advice, individuals can make informed decisions that align with their long-term financial goals. Remember, this is a long-term commitment; thus, prudent consideration and ongoing monitoring are essential for success.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is Another Name For Interest Sensitive Whole Life Insurance 2 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.