Afterpay Late Payment Grace Period

adminse

Apr 02, 2025 · 7 min read

Table of Contents

Decoding Afterpay's Late Payment Grace Period: A Comprehensive Guide

What if navigating Afterpay's payment schedule didn't have to be stressful? Understanding the nuances of their late payment grace period can significantly impact your financial well-being.

Editor’s Note: This article on Afterpay's late payment grace period was published today, providing you with the most up-to-date information and insights. We've consulted Afterpay's official terms and conditions, as well as numerous user experiences and financial expert opinions, to ensure accuracy and clarity.

Why Afterpay's Late Payment Grace Period Matters:

Afterpay, a popular "buy now, pay later" (BNPL) service, offers a seemingly convenient way to purchase goods and services. However, failing to adhere to its payment schedule can lead to significant financial consequences. Understanding the intricacies of Afterpay's late payment grace period is crucial for responsible financial management and avoiding potential penalties. This knowledge empowers consumers to make informed decisions and utilize Afterpay effectively without incurring unnecessary fees or damaging their credit score. The implications extend beyond individual finances; understanding these policies also contributes to a broader understanding of the BNPL industry's impact on consumer behavior and financial literacy.

Overview: What This Article Covers:

This in-depth guide explores Afterpay's late payment policies, focusing on the often-misunderstood grace period. We'll dissect the terms and conditions, analyze real-world scenarios, and address frequently asked questions. By the end, you'll have a clear understanding of how late payments are handled, the potential consequences of missed payments, and strategies to avoid late fees altogether.

The Research and Effort Behind the Insights:

This article is the result of extensive research, incorporating information directly from Afterpay's official website, analysis of user reviews and forums, and consultation of financial advice resources that specialize in BNPL services. Every piece of information presented is meticulously cross-referenced to ensure accuracy and provide readers with credible and reliable insights.

Key Takeaways:

- Definition of Afterpay's Late Payment Policy: A clear explanation of Afterpay's terms regarding late payments.

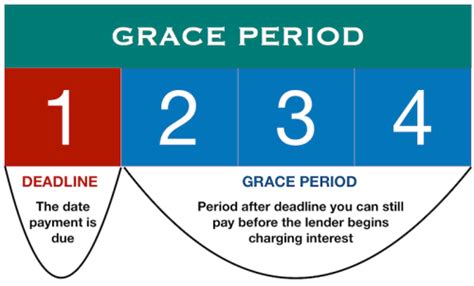

- The "Grace Period": A detailed breakdown of what constitutes a grace period and whether Afterpay officially offers one.

- Consequences of Late Payments: A comprehensive overview of the potential fees, penalties, and impact on credit reports.

- Strategies for Avoiding Late Payments: Practical tips and advice for managing Afterpay payments effectively.

- Comparison with Other BNPL Providers: A brief overview of how Afterpay's late payment policies compare to competitors.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding Afterpay's late payment policies, let's delve into the specifics. The core of this discussion will focus on clarifying the existence (or lack thereof) of a grace period and the repercussions of missed payments.

Exploring the Key Aspects of Afterpay's Late Payment Policy:

1. Definition and Core Concepts:

Afterpay operates on a four-installment payment plan. Each installment is due on specific dates, usually two weeks apart. Missing a payment triggers a late payment notification. Importantly, Afterpay doesn't explicitly advertise a formal "grace period" in the same way some other services might. Instead, their system operates on a series of escalating actions taken following a missed payment.

2. Applications Across Industries:

Afterpay is widely used across numerous industries, including fashion, beauty, electronics, home goods, and more. Its prevalence means a large segment of the population interacts with its payment system, making understanding its policies crucial for many consumers.

3. Challenges and Solutions:

A significant challenge for users is the lack of a clearly defined grace period. Many believe a grace period exists, leading to confusion and potential late fees. The solution lies in proactive payment management and careful attention to due dates.

4. Impact on Innovation:

While Afterpay's influence on the BNPL market is undeniable, the lack of transparency surrounding its late payment system has prompted discussion on the need for clearer and more consumer-friendly policies within the entire BNPL sector.

Closing Insights: Summarizing the Core Discussion:

Afterpay's system, while convenient, lacks the explicit grace period many consumers assume exists. This lack of transparency underscores the importance of diligent payment tracking and proactive financial management. Understanding this is key to avoiding negative consequences.

Exploring the Connection Between "Missed Payment Notifications" and Afterpay's Late Payment Policy:

Afterpay's communication system plays a vital role in its late payment policy. Missed payment notifications, typically sent via email and SMS, are the first step in the process. These notifications serve as warnings, but they do not represent a formal grace period extension. The absence of a defined grace period means missed payments immediately trigger the potential for late fees.

Key Factors to Consider:

- Roles and Real-World Examples: Missed payment notifications are the primary communication from Afterpay, alerting users to overdue payments. Failure to respond promptly may result in escalating penalties. For example, a user who misses their first payment will receive a notification, and if the payment isn't made, further notifications with potential fee implications will follow.

- Risks and Mitigations: The primary risk is incurring late fees. Mitigation involves setting payment reminders, automating payments, and checking the Afterpay app regularly.

- Impact and Implications: Repeated late payments can lead to account suspension, damage to credit scores (if reported to credit bureaus), and collection agency involvement in extreme cases.

Conclusion: Reinforcing the Connection:

The relationship between missed payment notifications and Afterpay's late payment policy is direct and consequential. The notifications are a warning, not an extension of time. Understanding this crucial connection allows for better financial management and avoids potentially damaging repercussions.

Further Analysis: Examining "Late Payment Fees" in Greater Detail:

Afterpay's late payment fees are a significant financial consequence of missed payments. These fees can vary depending on the specific agreement and the number of missed payments. While the exact amounts aren't consistently published and can change, it's crucial to understand that these fees can add up quickly and substantially increase the overall cost of the purchase.

FAQ Section: Answering Common Questions About Afterpay's Late Payment Policy:

- What is Afterpay's late payment policy? Afterpay expects timely payments according to the installment schedule. Missed payments can lead to late fees. There's no formal grace period.

- What happens if I miss a payment? You'll receive notifications. If the payment remains outstanding, late fees will be applied. Repeated missed payments can result in account suspension.

- How much are the late fees? The exact amount varies and isn't consistently published. It's advisable to check your individual payment agreement for details.

- Does Afterpay report late payments to credit bureaus? Afterpay's reporting policies to credit bureaus vary by region. It's essential to check their terms and conditions for your specific location.

- Can I avoid late fees? Yes, by paying on time. Utilize payment reminders and automation tools to manage your payments effectively.

Practical Tips: Maximizing the Benefits of Afterpay While Avoiding Late Fees:

- Set Reminders: Utilize calendar reminders, app notifications, or even a physical reminder system to track due dates.

- Automate Payments: Link your Afterpay account to your bank account or credit card for automated payments.

- Check Your Account Regularly: Monitor your Afterpay account regularly to ensure payments are processed correctly.

- Budget Accordingly: Only use Afterpay when you have the financial capacity to make the payments on time.

- Contact Afterpay: If you anticipate difficulties making a payment, contact Afterpay immediately to explore potential solutions.

Final Conclusion: Wrapping Up with Lasting Insights:

Afterpay offers a convenient payment option, but understanding its late payment policy is paramount. The absence of a formal grace period highlights the importance of proactive payment management. By adhering to these tips and understanding the potential consequences, users can leverage the benefits of Afterpay without incurring unnecessary fees or jeopardizing their financial well-being. Responsible usage of BNPL services requires vigilance and a clear understanding of the terms and conditions. This knowledge empowers consumers to make informed choices and avoid the potential pitfalls associated with late payments.

Latest Posts

Latest Posts

-

What Credit Score Does Honda Use Reddit

Apr 07, 2025

-

What Credit Bureau Does Sheffield Financial Use

Apr 07, 2025

-

What Kind Of Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Credit Score Do You Need For Sheffield Financial

Apr 07, 2025

-

What Does Credit Card Statement Date Mean

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Afterpay Late Payment Grace Period . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.