Adding Late Fees To Invoices

adminse

Apr 03, 2025 · 8 min read

Table of Contents

The Art of Adding Late Fees to Invoices: A Comprehensive Guide

What if streamlined late fee implementation could significantly improve your cash flow and minimize financial strain? Strategic late fee policies are not just about recouping losses; they’re about fostering responsible payment practices and ensuring business sustainability.

Editor’s Note: This article on adding late fees to invoices was published today, offering up-to-date legal and practical advice for businesses of all sizes seeking to improve their invoicing and collections processes.

Why Adding Late Fees to Invoices Matters:

Late payments are a significant challenge for businesses of all sizes. They disrupt cash flow, impacting operational efficiency, growth initiatives, and even employee compensation. Adding late fees to invoices isn't merely a punitive measure; it's a proactive strategy for maintaining financial stability, encouraging timely payments, and establishing clear expectations with clients. The consistent application of late fees contributes to a more predictable revenue stream, allowing businesses to better plan for expenses and investments. Furthermore, a well-defined late fee policy demonstrates professionalism and strengthens a company's financial standing. This proactive approach is crucial for sustaining a healthy business model and building a robust financial foundation. The implementation of a clear and legally sound late fee policy sends a strong message to clients regarding the importance of timely payments, contributing to a healthier and more sustainable business relationship.

Overview: What This Article Covers

This article provides a detailed guide to adding late fees to invoices, covering legal considerations, best practices for implementation, strategies for communication, and methods for effective collections. Readers will gain actionable insights into crafting a policy that is both effective and legally sound, ultimately enhancing their cash flow management and fostering stronger client relationships. We'll explore different late fee structures, examine the importance of clear communication, discuss legal compliance across various jurisdictions, and offer practical tips for managing the entire process.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon legal precedents, industry best practices, and financial management expertise. Information presented is based on reputable sources, ensuring accuracy and reliability. The content reflects current legal and business standards, offering practical and actionable strategies for businesses seeking to optimize their invoicing and collections. We've analyzed various late fee structures, communication strategies, and collection methodologies to provide readers with a comprehensive understanding of this critical aspect of business finance.

Key Takeaways:

- Legal Compliance: Understanding the legal requirements for late fees in your jurisdiction.

- Effective Communication: Clearly communicating your late fee policy to clients.

- Policy Implementation: Establishing a clear and consistent late fee policy.

- Collection Strategies: Employing effective methods for collecting late payments.

- Technology Integration: Utilizing invoicing software to automate late fee application.

Smooth Transition to the Core Discussion:

Now that we understand the importance of adding late fees to invoices, let's delve into the specifics of creating and implementing an effective policy that is both legally sound and practically efficient.

Exploring the Key Aspects of Adding Late Fees to Invoices:

1. Definition and Core Concepts:

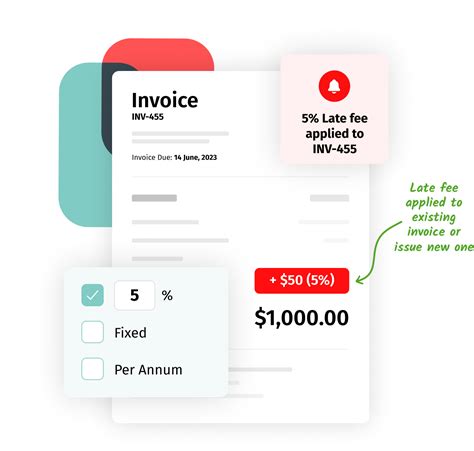

A late fee is an additional charge applied to an invoice when payment is not received by the agreed-upon due date. The amount of the late fee can be a fixed amount (e.g., $25) or a percentage of the outstanding invoice (e.g., 1.5% per month). The key is clarity – the fee amount and the calculation method must be explicitly stated on the invoice and in the company's terms and conditions. This transparency protects the business legally and fosters trust with clients.

2. Applications Across Industries:

The application of late fees is widespread across various industries, from construction and manufacturing to professional services and retail. While the specific amounts and calculation methods may vary based on industry norms and contractual agreements, the underlying principle remains consistent: ensuring timely payment for services rendered or goods delivered. Larger businesses often have more sophisticated systems for managing late payments, while smaller businesses may rely on simpler methods. Regardless of size, a clear and enforceable late fee policy is crucial for financial health.

3. Challenges and Solutions:

One common challenge is client resistance to paying late fees. Proactive communication, clearly stated policies, and a consistent approach can mitigate this. Another challenge is the administrative burden of manually tracking and applying late fees. Automation through invoicing software can significantly reduce this burden. Further challenges include understanding the legal limits on late fees and navigating potential disputes with clients.

4. Impact on Innovation:

The evolution of invoicing software and online payment platforms has significantly impacted how late fees are managed. Automated systems can streamline the entire process, from generating invoices with late fee clauses to automatically applying fees and sending reminders. This increased efficiency allows businesses to focus on core operations while minimizing the administrative overhead associated with collections.

Closing Insights: Summarizing the Core Discussion:

Adding late fees to invoices is a crucial aspect of sound financial management. A well-defined policy not only protects a company's cash flow but also cultivates responsible payment habits amongst clients. Clear communication and effective implementation are key to minimizing disputes and maximizing the positive impact of a late fee policy.

Exploring the Connection Between Clear Communication and Effective Late Fee Implementation:

Clear communication is paramount to the success of any late fee policy. Ambiguity can lead to disputes and resentment, undermining the intended purpose of the fee. This section will explore how effective communication strategies can minimize conflict and ensure compliance.

Key Factors to Consider:

-

Roles and Real-World Examples: Consider a scenario where a client disputes a late fee due to a misunderstanding of the due date. Clear communication, such as prominent due date placement on invoices and automated email reminders, can prevent such disputes.

-

Risks and Mitigations: The risk of alienating clients is real. Mitigating this risk involves clear, upfront communication of the policy, along with a grace period and opportunities for flexible payment arrangements.

-

Impact and Implications: Effective communication not only reduces disputes but also builds trust. Clients are more likely to pay on time when they understand the policy and its implications.

Conclusion: Reinforcing the Connection:

The connection between clear communication and successful late fee implementation is undeniable. By prioritizing clear and proactive communication, businesses can minimize disputes, maintain strong client relationships, and ultimately achieve the financial benefits of a well-structured late fee policy.

Further Analysis: Examining Legal Considerations in Greater Detail:

Navigating the legal landscape surrounding late fees is crucial. This section delves into the specific legal requirements and best practices to ensure compliance. Laws vary by jurisdiction, so understanding the specifics of your location is essential. This includes adhering to any regulations regarding the maximum allowable late fee percentage or the required notice periods before fees are applied. It is highly recommended to consult with legal counsel to ensure your late fee policy aligns with all applicable laws and regulations.

FAQ Section: Answering Common Questions About Adding Late Fees to Invoices:

Q: What is the legal limit for late fees?

A: There's no single universal limit. Late fee limits vary significantly by jurisdiction and sometimes even by industry. Always consult local laws and regulations or legal counsel to determine the permissible limits in your area.

Q: How should I communicate my late fee policy?

A: Clearly state your policy on the invoice itself, in your terms and conditions, and in any communications with clients. Consider using multiple channels, such as email reminders and automated payment systems.

Q: What if a client disputes a late fee?

A: Have a clear process for handling disputes. This might involve reviewing the payment history, confirming the due date, and offering flexible payment options if appropriate. Document all communication and interactions thoroughly.

Q: What invoicing software can help manage late fees?

A: Many invoicing software platforms offer automated late fee calculations and reminders, streamlining the process. Research different options and choose one that suits your business needs.

Practical Tips: Maximizing the Benefits of a Late Fee Policy:

-

Clearly Define Due Dates: Make due dates prominent on invoices and provide ample notice (e.g., 30 days).

-

Choose an Appropriate Fee Structure: Select a fee structure that is both effective in encouraging timely payments and reasonable for your clients.

-

Use Automated Reminders: Utilize automated email or text reminders to remind clients of upcoming due dates and approaching late fees.

-

Offer Flexible Payment Options: Consider offering payment plans or alternative payment methods for clients experiencing financial hardship.

-

Document Everything: Keep detailed records of all invoices, payments, and communications related to late fees.

Final Conclusion: Wrapping Up with Lasting Insights:

Implementing a well-structured late fee policy is a proactive step toward improving cash flow, fostering responsible client behavior, and ensuring the financial health of your business. By combining clear communication, a legally sound policy, and efficient administrative processes, businesses can maximize the benefits of late fees while maintaining positive client relationships. Remember that a well-designed late fee policy is not about punishment; it’s about establishing clear expectations and ensuring fair and consistent payment practices. Proactive communication and a client-focused approach are vital to ensuring its success and maintaining strong business relationships.

Latest Posts

Latest Posts

-

How Much Will Getting A Car Loan Affect My Credit Score

Apr 08, 2025

-

How Much Will Paying Off A Car Loan Raise My Credit Score

Apr 08, 2025

-

How Much Does A Car Loan Raise Your Credit Score

Apr 08, 2025

-

How Much Will A Car Loan Affect My Credit Score

Apr 08, 2025

-

How Much Will A Car Loan Raise My Credit Score Reddit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Adding Late Fees To Invoices . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.