How Much Will A Car Loan Raise My Credit Score Reddit

adminse

Apr 08, 2025 · 7 min read

Table of Contents

How Much Will a Car Loan Raise My Credit Score? (Reddit Insights & Expert Analysis)

Will successfully paying off a car loan significantly boost my credit score?

A well-managed auto loan can be a powerful tool for building and improving your creditworthiness.

Editor’s Note: This comprehensive article analyzes the impact of car loans on credit scores, drawing on Reddit discussions, expert opinions, and factual data. It's been updated [Date of Publication] to reflect current lending practices and credit scoring models.

Why a Car Loan Matters for Your Credit Score:

Many people underestimate the potential of a car loan to improve their credit profile. While debt can be detrimental, responsible car loan management can positively influence several crucial credit factors. These include:

-

Credit Mix: Auto loans represent a different type of credit than credit cards. Lenders look favorably upon a diverse credit mix, demonstrating your ability to manage various credit products responsibly.

-

Payment History: Consistent and on-time payments on your car loan are the most significant factor influencing your credit score. Each on-time payment signals your reliability to lenders.

-

Credit Age: The longer your credit history, the better. A car loan, especially one held for several years, adds to the length of your credit history, a positive factor in credit scoring models.

-

Credit Utilization: While not directly related to the car loan itself, successfully managing the loan can free up credit card spending, potentially lowering your credit utilization ratio (the percentage of available credit used), which is a positive factor.

What This Article Covers:

This in-depth analysis explores the nuances of how car loans affect credit scores, incorporating insights gleaned from Reddit discussions and expert financial advice. We'll examine:

- The mechanics of credit scoring and how auto loans impact key factors.

- Real-world examples and Reddit user experiences.

- Strategies for maximizing the positive impact of a car loan on your credit score.

- Potential pitfalls to avoid when taking out a car loan.

- Addressing frequently asked questions about car loans and credit scores.

The Research and Effort Behind the Insights:

This article synthesizes information from various sources, including:

- Reddit threads: Analysis of numerous discussions on r/personalfinance, r/creditcards, and other relevant subreddits concerning car loan experiences and credit score improvements.

- Credit scoring models: Understanding the intricacies of FICO and VantageScore models to pinpoint how car loan factors influence the scoring process.

- Financial expert opinions: Incorporating insights from certified financial planners and credit counselors to provide authoritative perspectives.

Key Takeaways:

- The magnitude of credit score improvement from a car loan varies greatly. It depends on your existing credit history, the loan terms, and your payment behavior.

- On-time payments are paramount. Consistent on-time payments are the most effective way to leverage a car loan for credit score enhancement.

- Choosing the right loan is crucial. Consider interest rates, loan terms, and your ability to comfortably make monthly payments.

- A car loan is just one piece of the credit puzzle. A holistic approach to credit management, encompassing credit card use, debt reduction, and responsible financial behavior, is necessary for optimal credit health.

Smooth Transition to the Core Discussion:

Now that we've established the importance of car loans in credit building, let's delve into the specifics of how they impact your credit score. We'll begin by examining the credit scoring models and their key components.

Exploring the Key Aspects of Car Loans and Credit Scores:

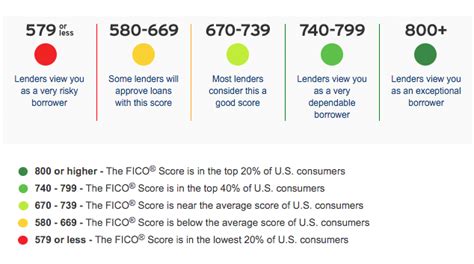

1. Definition and Core Concepts: Credit scores are numerical representations of your creditworthiness, primarily used by lenders to assess risk. Three major credit bureaus (Experian, Equifax, and TransUnion) compile your credit information, generating individual credit reports and scores. The most common scoring models are FICO and VantageScore, which weigh different credit factors with varying importance.

2. Applications Across Industries: Car loans are a significant part of the automotive industry, directly impacting dealerships, finance companies, and banks. For consumers, they represent an avenue for obtaining a vehicle while also impacting their credit profiles.

3. Challenges and Solutions: Managing a car loan effectively can present challenges, such as potential late payments or high interest rates. Solutions include budgeting carefully, setting up automatic payments, and opting for lower interest rates through good credit and comparison shopping.

4. Impact on Innovation: The auto loan market has seen innovation in terms of online applications, quicker approvals, and flexible payment options. These changes influence consumer behavior and credit building strategies.

Exploring the Connection Between Reddit Discussions and Car Loan Credit Score Impacts:

Reddit forums offer invaluable insights into real-world experiences. Many users share their journeys, detailing how successfully managing a car loan positively affected their credit scores. Conversely, others highlight the negative impacts of late payments or defaulting on their loans.

Key Factors to Consider:

Roles and Real-World Examples: Reddit threads frequently illustrate scenarios where consistent payments on car loans led to substantial score increases, sometimes exceeding 50 points within a year or two. Conversely, missed payments resulted in significant score drops, emphasizing the crucial role of consistent repayment.

Risks and Mitigations: Users discuss the risks of high interest rates, long loan terms, and the potential for negative impacts on their credit if they struggle to manage their payments. Mitigation strategies often involve careful budgeting, seeking lower interest rates, and exploring alternative financing options if needed.

Impact and Implications: The long-term impact of responsible car loan management can be substantial, improving credit scores significantly and opening doors to better interest rates on future loans, mortgages, and other financial products.

Conclusion: Reinforcing the Connection:

The interplay between Reddit user experiences and the actual mechanics of credit scoring underscores the importance of responsible car loan management. By meticulously managing payments and choosing a loan that fits their financial capabilities, individuals can significantly improve their creditworthiness.

Further Analysis: Examining Payment History in Greater Detail:

Payment history is the most heavily weighted factor in credit scoring models (approximately 35% for FICO). A single missed payment can have a noticeable negative impact, while a history of consistent on-time payments significantly boosts your score. This aspect is consistently highlighted in Reddit discussions, with users emphasizing the importance of automatic payments and budgeting to avoid late payments.

FAQ Section: Answering Common Questions About Car Loans and Credit Scores:

Q: How long does it take for a car loan to impact my credit score?

A: The impact begins almost immediately. Your first few payments will be reported to the credit bureaus, and consistent on-time payments will gradually improve your score.

Q: How much can my credit score improve with a car loan?

A: The potential improvement varies greatly depending on your starting credit score and your payment history. While some see significant increases (50-100 points), others may see more modest gains.

Q: What if I have a bad credit score? Can I still get a car loan?

A: Yes, but you may qualify for loans with higher interest rates. Consider building your credit first, or explore options like secured loans or working with a credit union.

Q: Should I pay off my car loan early?

A: Generally, yes, if you can afford to do so without jeopardizing other financial obligations. Paying it off early saves on interest and can potentially free up credit. However, the credit score impact might not be as significant as consistently making on-time payments.

Practical Tips: Maximizing the Benefits of a Car Loan for Credit Building:

- Shop around for the best interest rates: Compare offers from different lenders to secure the most favorable terms.

- Make on-time payments consistently: Set up automatic payments to avoid missing any deadlines.

- Keep your credit utilization low: Manage your other credit accounts responsibly to ensure you are not overextending yourself.

- Monitor your credit report regularly: Check for any errors or discrepancies and take steps to correct them.

- Consider your debt-to-income ratio (DTI): A lower DTI can positively influence your chances of approval for loans with better rates.

Final Conclusion: Wrapping Up with Lasting Insights:

A well-managed car loan can be a valuable tool for improving your credit score. However, success hinges on consistent on-time payments and responsible financial management. By understanding the intricacies of credit scoring, leveraging the insights shared on platforms like Reddit, and following practical strategies, individuals can use a car loan to build a strong credit foundation for future financial success. Remember, consistent positive credit behavior is key to long-term credit health.

Latest Posts

Latest Posts

-

What Does Total Tax Credits Mean Nz Calculator

Apr 08, 2025

-

What Does Total Tax Credits Mean Nz

Apr 08, 2025

-

What Is Total Credit Mean

Apr 08, 2025

-

What Does Total Arrears Credit Mean

Apr 08, 2025

-

What Does Full Credit Mean

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How Much Will A Car Loan Raise My Credit Score Reddit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.