What Is The Minimum Payment On A $500 Credit Card Capital One

adminse

Apr 04, 2025 · 7 min read

Table of Contents

Decoding Capital One's Minimum Payment: A Comprehensive Guide for $500 Credit Card Holders

What if your understanding of credit card minimum payments could save you hundreds, even thousands, of dollars over time? Mastering this seemingly simple aspect of credit card management is crucial for building a strong financial foundation.

Editor’s Note: This article provides up-to-date information on calculating and understanding Capital One's minimum credit card payments, specifically focusing on a $500 balance. It's important to note that specific minimum payment amounts are subject to change based on your individual account and outstanding balance. Always refer to your statement for the most accurate figure.

Why Understanding Capital One's Minimum Payment Matters

Understanding your minimum payment isn't just about avoiding late fees; it's about managing debt effectively and avoiding the crippling effects of high interest charges. For a $500 Capital One credit card balance, paying only the minimum can significantly extend your repayment timeline and ultimately cost you far more in interest than the initial debt. This article will delve into the mechanics of minimum payments, explore the potential consequences of only paying the minimum, and offer strategies for faster debt repayment.

What This Article Covers

This comprehensive guide will explore the following key areas concerning Capital One's minimum payments on a $500 credit card:

- Defining the Minimum Payment: A clear explanation of how Capital One calculates minimum payments.

- Factors Influencing Minimum Payment Amounts: Understanding the variables that affect your minimum payment calculation.

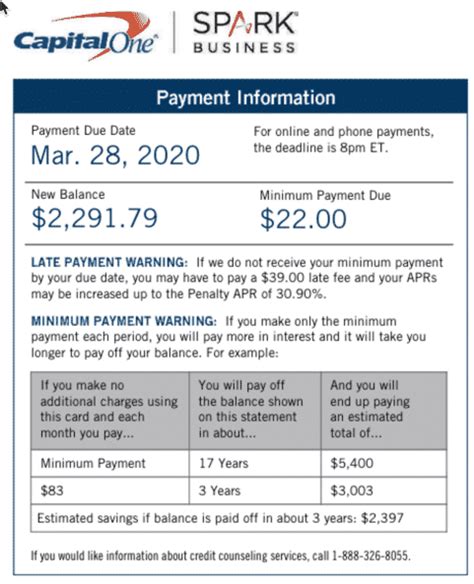

- The High Cost of Minimum Payments: Illustrating the financial implications of solely paying the minimum payment.

- Strategies for Accelerated Debt Repayment: Practical steps to pay off your $500 balance more quickly and efficiently.

- Understanding Your Capital One Statement: Deciphering the key information provided on your monthly statement.

- Contacting Capital One: Knowing how to access your account information and seek clarification if needed.

The Research and Effort Behind the Insights

This article draws upon publicly available information from Capital One's website, industry best practices in credit card management, and financial analysis techniques to provide accurate and actionable insights. The information presented is based on general principles and may vary slightly depending on individual account terms and conditions.

Key Takeaways:

- Capital One's minimum payment is generally a percentage of your outstanding balance plus any interest accrued.

- Paying only the minimum payment significantly increases the total interest paid and extends the repayment period.

- Strategic budgeting and debt repayment plans can significantly accelerate debt elimination.

- Understanding your statement is vital for effective debt management.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding minimum payments, let's dive into the specifics of how Capital One calculates these amounts and explore the implications of various payment strategies.

Exploring the Key Aspects of Capital One's Minimum Payment Calculation

Definition and Core Concepts: Capital One, like most credit card issuers, doesn't publicly state a fixed minimum payment percentage. Instead, the minimum payment is typically calculated as a percentage of your balance (often between 1% and 3%), plus any accrued interest and fees. This means that your minimum payment will fluctuate month to month depending on your balance and interest charges. A higher balance usually results in a higher minimum payment.

Factors Influencing Minimum Payment Amounts: Several factors can influence the minimum payment calculated by Capital One:

- Outstanding Balance: The larger your balance, the higher your minimum payment will generally be.

- Interest Accrued: Interest charges are added to your balance each month, increasing the minimum payment.

- Fees: Late payment fees, over-limit fees, or other charges will also increase your minimum payment.

- Promotional Periods: Some promotional periods may offer reduced interest rates, but the minimum payment calculation will still include the accruing interest, albeit at a lower rate.

Challenges and Solutions: The primary challenge associated with minimum payments is the potential for long-term debt and increased interest costs. The solution is proactive debt management, involving budgeting, exploring debt consolidation options, and making payments that exceed the minimum.

Impact on Financial Health: Consistently paying only the minimum payment can severely impact your credit score, increase your debt burden, and limit your financial flexibility.

Exploring the Connection Between Interest Rates and Minimum Payments

The connection between your Capital One credit card's interest rate and your minimum payment is significant. A higher interest rate means more interest will accrue each month, consequently leading to a higher minimum payment. This creates a vicious cycle: the higher the interest, the more you owe, and the more you're required to pay (at least minimally) each month.

Roles and Real-World Examples: Let's imagine a $500 balance on a Capital One card with a 20% APR (Annual Percentage Rate). If you only pay the minimum, which might be around $25–$30 (depending on the percentage calculation used), a significant portion of your payment goes towards interest, leaving little to reduce the principal balance. This results in slow repayment and accumulating interest costs.

Risks and Mitigations: The primary risk is that the interest charged surpasses your minimum payment, leading to a perpetually growing debt. Mitigation involves making payments that exceed the minimum, even if it's by a small amount.

Impact and Implications: The long-term impact of only paying the minimum can be financially devastating, delaying your financial goals, and potentially affecting your credit rating.

Further Analysis: Examining Interest Rates in Greater Detail

Understanding your APR is paramount. The APR is the annual cost of borrowing money, expressed as a percentage. This percentage is applied to your outstanding balance to calculate the daily interest accrued. Capital One's APR varies based on your creditworthiness and the specific card you possess. Checking your credit report and card agreement will provide the exact APR for your account.

Frequently Asked Questions (FAQ) Section

Q: What is the typical minimum payment percentage on a Capital One credit card?

A: Capital One doesn't advertise a fixed minimum payment percentage. It usually falls between 1% and 3% of the outstanding balance, plus any interest and fees. The exact percentage is determined individually for each cardholder and is listed on their monthly statement.

Q: Can my minimum payment change from month to month?

A: Yes, your minimum payment can fluctuate depending on your balance, interest charges, and any added fees.

Q: What happens if I only pay the minimum payment?

A: While you'll avoid late fees, paying only the minimum significantly prolongs the repayment period and increases the total interest paid over the life of the debt. This can have a negative impact on your credit score.

Q: How can I calculate my minimum payment myself?

A: You cannot accurately calculate your minimum payment without accessing your Capital One account statement, as the exact calculation considers the balance, accrued interest, and any outstanding fees.

Q: What happens if I miss a minimum payment?

A: Missing a minimum payment will result in a late payment fee and a negative impact on your credit score. It will also increase the total amount you owe.

Practical Tips: Maximizing the Benefits of Efficient Debt Repayment

- Understand the Basics: Familiarize yourself with your APR and the mechanics of how your minimum payment is calculated.

- Create a Budget: Track your income and expenses meticulously. Allocate a portion of your income specifically towards paying down your credit card debt.

- Pay More Than the Minimum: Even a small increase in your monthly payment will significantly shorten your repayment timeline and reduce total interest costs.

- Consider Debt Consolidation: If you have multiple high-interest debts, explore debt consolidation options to lower your overall interest rate and simplify your payments.

- Negotiate with Capital One: Contact Capital One directly to discuss potential options, such as hardship programs or lower interest rates, if you're struggling to make payments.

Final Conclusion: Taking Control of Your Capital One Credit Card Debt

Understanding your Capital One credit card's minimum payment and its implications is a crucial step in managing your finances effectively. While the minimum payment avoids immediate late fees, prioritizing payments exceeding the minimum significantly reduces long-term interest costs and accelerates debt repayment. By employing the strategies outlined in this article, you can gain control of your finances and avoid the pitfalls of prolonged debt. Remember, proactive financial management empowers you to achieve your financial goals more rapidly and confidently.

Latest Posts

Latest Posts

-

What Is The Minimum Ssdi Benefit

Apr 05, 2025

-

What Is The Minimum Ssdi

Apr 05, 2025

-

What Is The Lowest Payment For Ssdi

Apr 05, 2025

-

What Is The Minimum Amount For Ssdi

Apr 05, 2025

-

What Is The Minimum Disability Payment From Social Security

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about What Is The Minimum Payment On A $500 Credit Card Capital One . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.