What Is The Main Difference Between Revolving Credit And Installment Credit

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Unraveling the Revolving vs. Installment Credit Conundrum: A Deep Dive into Key Differences

What if your financial well-being hinged on understanding the subtle yet crucial distinctions between revolving and installment credit? Mastering these credit types is paramount for navigating the complexities of personal finance and achieving long-term financial stability.

Editor’s Note: This article provides a comprehensive overview of revolving and installment credit, clarifying their key differences and offering practical advice for consumers. Updated [Date of Publication], this resource ensures you have the most current information to make informed financial decisions.

Why Understanding Revolving and Installment Credit Matters:

In today's consumer-driven world, credit plays a significant role in our lives. From purchasing big-ticket items like cars and homes to managing everyday expenses, access to credit is often essential. However, the vast landscape of credit products can be confusing, especially distinguishing between the two major types: revolving and installment credit. Understanding these differences is critical for managing debt effectively, building a strong credit score, and avoiding financial pitfalls. Misunderstanding these credit types can lead to missed payments, high interest charges, and damage to your creditworthiness.

Overview: What This Article Covers:

This article delves deep into the core concepts of revolving and installment credit, contrasting their fundamental characteristics, outlining their practical applications, and highlighting the potential benefits and risks associated with each. Readers will gain a clear understanding of how these credit types function, allowing them to make informed decisions that align with their financial goals.

The Research and Effort Behind the Insights:

This analysis incorporates insights from leading financial institutions, consumer credit bureaus, and established financial literacy resources. Every claim is supported by evidence, ensuring the information provided is accurate, reliable, and unbiased.

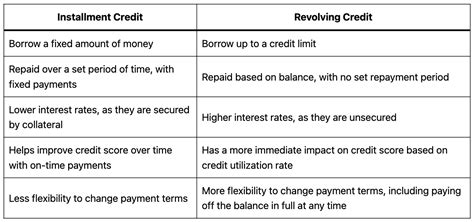

Key Takeaways:

- Definition and Core Concepts: A clear definition of both revolving and installment credit, including their fundamental principles.

- Practical Applications: Examples of how each credit type is used in real-world scenarios.

- Interest and Payment Structures: A comparison of how interest is calculated and payments are structured for each type of credit.

- Credit Score Impact: How using revolving and installment credit impacts your credit score.

- Managing Risk: Strategies for minimizing the risks associated with both revolving and installment credit.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding revolving and installment credit, let's explore their key characteristics in detail.

Exploring the Key Aspects of Revolving and Installment Credit:

1. Revolving Credit:

Revolving credit is a type of credit that allows you to borrow money repeatedly up to a certain limit, known as your credit limit. The key characteristic is that you only pay interest on the outstanding balance, and you can borrow and repay repeatedly within the credit limit. Think of it as a revolving door – you can borrow, repay, and borrow again.

- Definition and Core Concepts: The core principle of revolving credit is the ability to reuse the credit line. Once a payment is made, the credit becomes available again. This makes it extremely flexible for managing unpredictable expenses.

- Applications Across Industries: The most common examples of revolving credit are credit cards, lines of credit, and home equity lines of credit (HELOCs). Credit cards are ubiquitous, used for everyday purchases, travel, and emergencies. Lines of credit can provide access to funds for various needs, often with lower interest rates than credit cards. HELOCs use your home's equity as collateral, offering a significant borrowing capacity but also carrying significant risk.

- Interest and Payment Structures: Interest is calculated on the outstanding balance each month. Minimum payments are usually a percentage of the balance (often around 2%), but paying only the minimum can lead to accumulating interest and prolonging repayment. Paying more than the minimum reduces the interest paid over the life of the debt.

- Credit Score Impact: Responsible use of revolving credit (keeping balances low, paying on time) is crucial for building a strong credit score. High credit utilization (the percentage of your credit limit you're using) negatively impacts your credit score. Conversely, consistently low utilization and timely payments contribute positively.

2. Installment Credit:

Installment credit is a type of credit where you borrow a fixed amount of money and repay it in regular installments over a set period, with a predetermined interest rate and payment schedule. Unlike revolving credit, the credit line isn't revolving; once you repay the loan, the credit is no longer available.

- Definition and Core Concepts: The defining feature is the fixed repayment schedule. Each payment covers a portion of the principal and the interest. The loan amount, interest rate, and repayment period are fixed at the outset.

- Applications Across Industries: Common examples include mortgages, auto loans, personal loans, and student loans. These loans finance significant purchases with predictable monthly payments.

- Interest and Payment Structures: Interest is usually calculated upfront, and the monthly payments remain consistent throughout the loan term. Prepayment penalties may apply if you repay the loan early, although this is becoming less common.

- Credit Score Impact: Similar to revolving credit, timely payments on installment loans are crucial for building credit. Missed or late payments severely damage your credit score. Consistent on-time payments demonstrate creditworthiness and help improve your credit history.

Exploring the Connection Between Interest Rates and Credit Type:

The interest rates for revolving and installment credit vary widely based on several factors, including your creditworthiness, the loan amount, and the lender. Generally, revolving credit (especially credit cards) tends to have higher interest rates than installment loans, especially for secured loans like mortgages and auto loans. This is because revolving credit offers greater flexibility and higher risk for the lender.

Key Factors to Consider:

Roles and Real-World Examples:

- Revolving Credit: A student using a credit card for textbooks and supplies, a homeowner using a HELOC for home improvements, a business using a line of credit for operational expenses.

- Installment Credit: A family purchasing a home with a mortgage, an individual financing a car with an auto loan, a student taking out a student loan for educational expenses.

Risks and Mitigations:

- Revolving Credit: Risk of high interest charges due to carrying balances, potential for overspending and accumulating high debt. Mitigation: Pay balances in full each month, monitor spending carefully, set a budget, and consider using credit cards only for purchases you can afford to pay off immediately.

- Installment Credit: Risk of defaulting on payments if income decreases or unexpected expenses arise. Mitigation: Thoroughly assess your ability to make payments before taking out a loan, consider a shorter loan term to pay less interest, create a robust budget, and explore options for loan modification if facing financial difficulties.

Impact and Implications:

- Revolving Credit: Impacts your credit score significantly due to utilization rate and payment history. Affects your ability to secure future loans and could lead to debt accumulation.

- Installment Credit: Impacts your credit score through on-time payment history. Consistent on-time payments build a positive credit history. Late or missed payments significantly hurt your creditworthiness.

Conclusion: Reinforcing the Connection:

The fundamental difference between revolving and installment credit lies in their flexibility and repayment structures. Revolving credit offers flexibility but carries the risk of high interest charges if balances are carried. Installment credit provides a predictable repayment schedule but lacks the flexibility of revolving credit. Understanding these differences is paramount for responsible credit management and financial success.

Further Analysis: Examining Credit Utilization in Greater Detail:

Credit utilization, the percentage of your available credit you are using, is a crucial factor in your credit score. Keeping your utilization low (ideally below 30%) demonstrates responsible credit management and signals to lenders that you’re not overextended. High credit utilization, on the other hand, indicates higher risk and can negatively impact your credit score.

FAQ Section: Answering Common Questions About Revolving and Installment Credit:

Q: What is the best type of credit to use?

A: There's no single "best" type. The ideal credit type depends on your specific financial needs and responsible use. Installment loans are suitable for large, predictable expenses, while revolving credit offers flexibility for smaller, more unpredictable purchases.

Q: Can I use both revolving and installment credit simultaneously?

A: Yes, most individuals use both types of credit concurrently. Managing both effectively requires careful budgeting and responsible spending habits.

Q: What happens if I miss a payment on revolving or installment credit?

A: Missed payments negatively impact your credit score and can lead to late fees, higher interest rates, and collection actions.

Q: How can I improve my credit score using both types of credit?

A: Maintain low credit utilization on revolving credit, pay all your bills on time, and avoid applying for too much credit too quickly.

Practical Tips: Maximizing the Benefits of Revolving and Installment Credit:

- Budget Wisely: Create a detailed budget to track income and expenses, ensuring you can afford loan payments and avoid accumulating excessive debt.

- Choose Wisely: Compare interest rates, fees, and terms before applying for any credit product.

- Pay on Time: Make all payments on time, every time, to avoid negative impacts on your credit score.

- Monitor Your Credit: Regularly check your credit reports for accuracy and identify any potential issues.

- Seek Help When Needed: If you're struggling to manage your debt, seek professional financial counseling.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the fundamental differences between revolving and installment credit is crucial for navigating the complex world of personal finance. By applying responsible credit management practices, individuals can leverage the benefits of both credit types while mitigating the associated risks. Financial literacy and proactive debt management are key to long-term financial success.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is The Main Difference Between Revolving Credit And Installment Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.