What Is The Difference Between A Credit Score And A Credit Rating Brainly

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Credit Score vs. Credit Rating: Unveiling the Differences

What if the key to unlocking financial opportunities lies in understanding the subtle yet significant differences between a credit score and a credit rating? These two crucial financial metrics, while often conflated, play distinct roles in shaping your financial future.

Editor’s Note: This article on the difference between a credit score and a credit rating was published today, providing readers with the most up-to-date information and insights into these critical financial concepts.

Why This Distinction Matters:

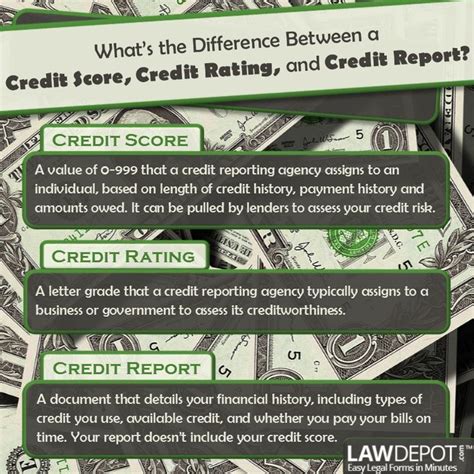

Understanding the difference between a credit score and a credit rating is paramount for navigating the complexities of personal finance. A credit score primarily impacts your access to credit and the interest rates you'll pay, while a credit rating reflects the creditworthiness of larger entities like corporations and governments. This article will demystify these concepts, explaining their respective calculations, uses, and implications for individuals and businesses.

Overview: What This Article Covers:

This article will provide a comprehensive comparison of credit scores and credit ratings. We'll explore their definitions, the factors that influence them, how they are calculated, their applications in various financial scenarios, and the potential consequences of a low score or rating.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon information from leading credit bureaus, financial institutions, and reputable academic sources. We’ve carefully analyzed the methodologies behind credit score and rating calculations to ensure accuracy and offer clear, actionable insights.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of credit scores and credit ratings and their fundamental principles.

- Calculation Methods: A detailed breakdown of how these metrics are calculated, highlighting the key factors involved.

- Applications and Uses: An overview of how credit scores and ratings are utilized by lenders, investors, and other stakeholders.

- Impact on Financial Decisions: An analysis of the consequences of high and low credit scores and ratings.

- Improving Credit Scores and Ratings: Practical strategies for improving both metrics.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding this distinction, let's delve into the core aspects of credit scores and credit ratings, exploring their unique characteristics and interrelationships.

Exploring the Key Aspects of Credit Scores and Credit Ratings:

1. Credit Scores: A Personal Financial Snapshot

A credit score is a three-digit numerical representation of an individual's creditworthiness. It summarizes an individual's credit history, providing lenders with a quick assessment of their risk. The most widely used credit scores in the United States are FICO scores, developed by the Fair Isaac Corporation, and VantageScore, a competing model. These scores typically range from 300 to 850, with higher scores indicating lower risk and greater creditworthiness.

-

Factors Affecting Credit Scores: Several key factors influence credit scores, including:

- Payment History: The most significant factor, reflecting on-time payments of credit accounts.

- Amounts Owed: The proportion of available credit used (credit utilization ratio).

- Length of Credit History: The duration of an individual's credit accounts.

- New Credit: Recent applications for new credit.

- Credit Mix: The diversity of credit accounts (e.g., credit cards, loans).

-

Calculation Methods: Credit scoring models use complex algorithms to weigh these factors, resulting in a single numerical score. The exact weighting of each factor can vary depending on the specific scoring model.

-

Applications of Credit Scores: Credit scores are used extensively by lenders to assess credit risk before approving loans, credit cards, mortgages, and other forms of credit. Insurers also use them to determine premiums for certain types of insurance. Landlords may use them in tenant screening.

2. Credit Ratings: Evaluating Larger Entities

Credit ratings, unlike credit scores, are assigned to larger entities such as corporations, governments, and financial institutions. These ratings reflect the creditworthiness of these entities and their ability to repay their debts. Major credit rating agencies, such as Moody's, Standard & Poor's (S&P), and Fitch Ratings, provide these assessments.

-

Factors Affecting Credit Ratings: The factors considered in credit rating assessments are more complex and comprehensive than those used for credit scores. They include:

- Financial Performance: Revenue, profitability, cash flow, and debt levels.

- Liquidity: The entity's ability to meet its short-term obligations.

- Capital Structure: The mix of debt and equity financing.

- Management Quality: The effectiveness and experience of the entity's management team.

- Industry Conditions: The overall health and outlook of the industry in which the entity operates.

- Legal and Regulatory Environment: The regulatory framework and potential legal risks.

-

Calculation Methods: Credit rating agencies use sophisticated analytical models and qualitative assessments to determine credit ratings. They consider a wide range of financial and non-financial information to arrive at a rating.

-

Applications of Credit Ratings: Credit ratings are crucial for investors, lenders, and other stakeholders who need to assess the credit risk of larger entities. They influence the cost of borrowing for corporations and governments, as well as the pricing of corporate bonds and other debt securities.

Exploring the Connection Between Credit Utilization and Credit Scores:

Credit utilization, the percentage of available credit used, is a pivotal factor impacting credit scores. High credit utilization ratios signal a greater risk to lenders, as it suggests a higher likelihood of missed payments. Maintaining a low credit utilization ratio (ideally below 30%) is crucial for maintaining a healthy credit score.

-

Roles and Real-World Examples: A person with multiple credit cards approaching their credit limits will see their credit score negatively impacted. Conversely, someone who consistently keeps their credit utilization low will likely have a higher credit score.

-

Risks and Mitigations: Ignoring credit utilization can lead to a significant drop in credit score, hindering access to favorable credit terms. Regularly monitoring credit card balances and paying down debt can mitigate this risk.

-

Impact and Implications: A low credit score due to high credit utilization can result in higher interest rates on loans, difficulty securing credit, and even rejection of loan applications.

Key Factors to Consider:

Credit scores and credit ratings serve different purposes and cater to different entities. Credit scores are designed for individuals, while credit ratings focus on larger organizations. Their calculation methodologies differ significantly, reflecting the distinct types of information considered.

Conclusion: Reinforcing the Distinctions

The distinction between credit scores and credit ratings is critical for understanding one's personal financial standing and the financial health of larger entities. Credit scores, while impacting individual access to credit, are significantly different from credit ratings used for evaluating corporations and governments. Understanding these differences allows for informed financial decision-making and effective risk management.

Further Analysis: Examining Credit Reporting Agencies in Greater Detail

Credit reporting agencies play a central role in both credit scores and credit ratings. The three major credit bureaus in the United States – Equifax, Experian, and TransUnion – collect and compile credit information from various sources, including lenders, creditors, and public records. This information forms the basis for calculating credit scores and informing credit rating assessments. It's crucial to understand that these agencies may have slightly different data, leading to variations in credit scores across bureaus.

FAQ Section: Answering Common Questions About Credit Scores and Credit Ratings

-

What is a good credit score? Generally, a credit score of 700 or higher is considered good. Scores above 800 are excellent.

-

How often are credit scores updated? Credit scores are typically updated monthly, reflecting changes in credit activity.

-

Can I check my credit score for free? Many financial institutions and credit card companies offer free credit score access to their customers. You can also access your credit report for free annually from each of the three major credit bureaus.

-

What is a credit rating scale? Credit rating scales vary slightly among agencies, but generally range from AAA (highest rating) to D (default).

-

How long does it take to improve a credit score? Improving a credit score takes time and consistent effort. Positive changes may be visible within a few months, but substantial improvement often requires longer-term commitment.

Practical Tips: Maximizing the Benefits of Understanding Credit Scores and Ratings

-

Monitor your credit report regularly: Check your credit reports from all three major bureaus for accuracy and identify any potential errors.

-

Pay your bills on time: Consistent on-time payments are crucial for building a strong credit history.

-

Maintain low credit utilization: Keep your credit card balances low to avoid negatively impacting your credit score.

-

Diversify your credit: Having a mix of credit accounts (e.g., credit cards, loans) can be beneficial.

-

Avoid opening too many new credit accounts in a short period: Applying for multiple new credit accounts in a short time can negatively impact your credit score.

Final Conclusion: Wrapping Up with Lasting Insights

Credit scores and credit ratings are fundamental elements of the financial landscape, affecting individuals' access to credit and the financial stability of larger organizations. By understanding their differences, the factors influencing them, and the strategies to improve them, both individuals and businesses can navigate the complexities of the credit system and achieve their financial goals. The information presented here serves as a starting point for informed decision-making in all aspects of credit and financial responsibility. Remember to consult with financial professionals for personalized advice tailored to your specific circumstances.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Is The Difference Between A Credit Score And A Credit Rating Brainly . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.