What Is Cost Accounting With Example

adminse

Mar 28, 2025 · 7 min read

Table of Contents

Decoding Cost Accounting: A Comprehensive Guide with Real-World Examples

What if accurate cost information was the key to unlocking your business's true profit potential? Understanding cost accounting is not just about tracking expenses; it's about strategic decision-making that drives profitability and sustainable growth.

Editor’s Note: This article on cost accounting provides a comprehensive overview, updated with real-world examples to illustrate its practical applications. It's designed for business owners, managers, and anyone interested in gaining a deeper understanding of this crucial aspect of financial management.

Why Cost Accounting Matters:

Cost accounting is a powerful tool that goes beyond simply recording expenses. It provides detailed insights into the cost of producing goods or services, allowing businesses to make informed decisions about pricing, production processes, and resource allocation. Its relevance extends across various industries, from manufacturing and retail to healthcare and technology. By understanding the true cost of operations, businesses can identify areas for improvement, enhance efficiency, and ultimately increase profitability. The ability to accurately determine the cost of a product or service is essential for competitive pricing, strategic investment, and long-term sustainability.

Overview: What This Article Covers

This in-depth guide explores the fundamental principles of cost accounting, examining different costing methods, their applications, and limitations. We'll delve into real-world examples to illustrate the practical use of cost accounting in diverse business contexts. The article will cover:

- Definition and Core Concepts: A foundational understanding of cost accounting and its terminology.

- Cost Accounting Methods: Exploring various methods, including job order costing, process costing, and activity-based costing.

- Applications Across Industries: Real-world examples demonstrating the use of cost accounting in diverse sectors.

- Challenges and Solutions: Identifying potential pitfalls and offering strategies for effective cost accounting.

- The Role of Technology: Exploring how software and technology are transforming cost accounting practices.

The Research and Effort Behind the Insights

This article is the culmination of extensive research, drawing upon authoritative accounting texts, industry best practices, and real-world case studies. Every concept is explained clearly, with examples to ensure a practical understanding. The aim is to provide readers with accurate and actionable information.

Key Takeaways:

- Definition of Cost Accounting: A precise explanation of cost accounting principles.

- Types of Costs: Understanding different cost classifications (direct, indirect, fixed, variable).

- Costing Methods: A comparative analysis of job order costing, process costing, and activity-based costing.

- Cost Accounting Applications: Demonstrating practical use through real-world examples.

- Benefits and Limitations: A balanced perspective on the strengths and weaknesses of cost accounting.

Smooth Transition to the Core Discussion:

Now that we've established the importance of cost accounting, let's delve into the core concepts and methods that underpin this critical discipline.

Exploring the Key Aspects of Cost Accounting

1. Definition and Core Concepts:

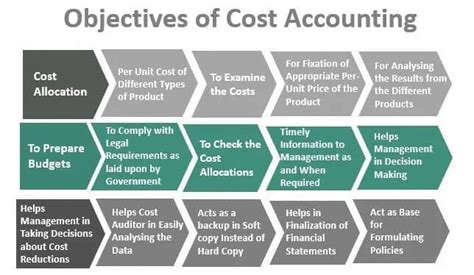

Cost accounting is a specialized branch of accounting that focuses on the systematic recording and analysis of business expenses. It aims to determine the cost of producing goods or services, allocating these costs to various departments or products, and providing management with the information needed to make informed decisions. Key concepts include:

- Direct Costs: Costs directly traceable to a specific product or service (e.g., raw materials, direct labor).

- Indirect Costs (Overhead): Costs not directly traceable to a specific product (e.g., rent, utilities, factory overhead).

- Fixed Costs: Costs that remain constant regardless of production volume (e.g., rent, salaries).

- Variable Costs: Costs that fluctuate with changes in production volume (e.g., raw materials, direct labor).

- Cost Allocation: The process of assigning costs to different products, departments, or projects.

2. Cost Accounting Methods:

Several methods are used in cost accounting, each with its strengths and weaknesses:

-

Job Order Costing: This method tracks costs for individual jobs or projects. It's suitable for businesses producing unique or customized products, such as construction companies or custom furniture makers.

- Example: A custom home builder uses job order costing to track the materials, labor, and overhead associated with each individual house built. This allows them to accurately determine the profitability of each project.

-

Process Costing: This method averages costs over a large number of identical units produced. It's suitable for businesses producing mass quantities of identical products, like food processing or chemical manufacturing.

- Example: A bakery using process costing tracks the total cost of producing 1000 loaves of bread and then divides that cost by 1000 to determine the cost per loaf.

-

Activity-Based Costing (ABC): This method assigns costs based on activities that consume resources. It's particularly useful for businesses with diverse product lines or complex manufacturing processes where overhead costs are significant.

- Example: A furniture manufacturer using ABC might track costs associated with specific activities like design, cutting, assembly, and finishing. This helps to identify which activities are most costly and where improvements can be made.

3. Applications Across Industries:

Cost accounting is relevant across a wide range of industries:

- Manufacturing: Determining the cost of goods sold (COGS), optimizing production processes, and setting competitive pricing.

- Retail: Managing inventory costs, analyzing sales data, and improving profitability.

- Healthcare: Tracking costs associated with patient care, managing resources, and improving efficiency.

- Technology: Determining the cost of software development, managing project budgets, and optimizing resource allocation.

4. Challenges and Solutions:

Implementing effective cost accounting can present challenges:

- Data Accuracy: Inaccurate data can lead to misleading cost figures and poor decision-making. Solutions include using robust data collection systems and regular data audits.

- Cost Allocation: Assigning indirect costs can be complex and subjective. Solutions include using activity-based costing (ABC) to improve cost allocation accuracy.

- Technological Limitations: Older accounting systems may lack the capabilities for advanced cost analysis. Solutions involve adopting modern accounting software and technology.

5. The Role of Technology:

Technology plays a crucial role in modern cost accounting. Enterprise Resource Planning (ERP) systems and specialized cost accounting software automate data collection, analysis, and reporting, providing real-time insights into cost performance. Data analytics techniques can further enhance decision-making by identifying cost trends and areas for improvement.

Exploring the Connection Between Budgeting and Cost Accounting

Budgeting and cost accounting are closely intertwined. Cost accounting provides the detailed cost data that informs the budgeting process. Accurate cost projections are essential for creating realistic budgets. The budget, in turn, serves as a benchmark against which actual cost performance can be measured, highlighting variances and areas needing attention.

Key Factors to Consider:

- Roles and Real-World Examples: A manufacturing company uses cost accounting data to set its annual production budget, projecting raw material costs, labor costs, and overhead based on historical data and production forecasts. Any deviations from the budget during the year are analyzed through cost variance reports.

- Risks and Mitigations: Failure to accurately allocate overhead costs can lead to inaccurate product pricing and poor investment decisions. Using ABC costing and regular cost reviews can help mitigate this risk.

- Impact and Implications: Accurate cost accounting ensures that pricing reflects true costs, enhancing profitability and competitiveness. It also informs decisions about product mix, resource allocation, and investment strategies.

Conclusion: Reinforcing the Connection

The relationship between budgeting and cost accounting is synergistic. Effective cost accounting provides the foundation for sound budgeting, leading to improved financial planning, operational efficiency, and ultimately, greater profitability.

Further Analysis: Examining Budgeting in Greater Detail

Budgeting involves forecasting future revenues and expenses, setting financial targets, and allocating resources to achieve those targets. It's a crucial process for managing cash flow, planning for growth, and ensuring the financial health of a business. Effective budgeting relies heavily on accurate cost data provided by cost accounting.

FAQ Section: Answering Common Questions About Cost Accounting

- What is the difference between cost accounting and financial accounting? Cost accounting focuses on internal decision-making, while financial accounting provides information to external stakeholders (investors, creditors).

- How do I choose the right costing method for my business? The best method depends on the nature of your business, its products, and its level of complexity. Job order costing is best for customized products, process costing for mass-produced items, and ABC costing for complex operations.

- What are some common cost accounting errors to avoid? Avoid inaccurate data collection, improper cost allocation, and neglecting to consider all relevant costs.

Practical Tips: Maximizing the Benefits of Cost Accounting

- Implement a robust data collection system: Use standardized procedures and technology to ensure accurate data entry.

- Regularly review and analyze cost data: Identify trends, variances, and opportunities for improvement.

- Use cost accounting information for decision-making: Inform pricing strategies, production planning, and resource allocation.

- Invest in cost accounting software: Automate data processing, analysis, and reporting.

Final Conclusion: Wrapping Up with Lasting Insights

Cost accounting is more than a mere accounting function; it’s a strategic management tool. By understanding and effectively implementing cost accounting principles, businesses can gain valuable insights into their operations, optimize resource allocation, improve profitability, and achieve sustainable growth. Accurate cost information empowers informed decisions, paving the way for success in today's competitive landscape.

Latest Posts

Latest Posts

-

Insurance Consortium Definition

Apr 24, 2025

-

Insurance Claim Definition

Apr 24, 2025

-

Insurable Interest Definition

Apr 24, 2025

-

Instrument Definition In Finance Economics And Law

Apr 24, 2025

-

Instructing Bank Definition

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about What Is Cost Accounting With Example . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.