What Is An Insurance Waiting Period

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Decoding the Mystery: What is an Insurance Waiting Period?

What if your most crucial need for insurance coverage coincided with a pre-existing condition or a newly acquired illness? This seemingly inconvenient delay is precisely what insurance waiting periods are designed to manage. Understanding insurance waiting periods is paramount to making informed decisions about your coverage and avoiding unexpected financial burdens.

Editor’s Note: This comprehensive article on insurance waiting periods has been published today, providing readers with up-to-date information and insights. It aims to demystify this often-overlooked aspect of insurance policies and empower individuals to make informed decisions about their coverage.

Why Insurance Waiting Periods Matter: Relevance, Practical Applications, and Industry Significance

Insurance waiting periods are integral to the financial stability of insurance companies. They serve as a crucial mechanism to mitigate risk, particularly related to pre-existing conditions and immediately high-cost claims. For consumers, understanding these periods ensures they're not misled about the extent of their coverage and helps prevent costly surprises when a claim is filed. This knowledge is crucial across various insurance types, from health and disability to home and auto. Ignoring waiting periods can lead to significant out-of-pocket expenses, potentially impacting financial security. The relevance extends to employers who offer group insurance plans, as they need to understand these periods to manage employee expectations and ensure appropriate coverage.

Overview: What This Article Covers

This article will delve into the intricacies of insurance waiting periods, exploring their various forms across different insurance types, the reasons behind their implementation, common exclusions and exceptions, and how to navigate them effectively. Readers will gain a clear understanding of what to expect, how to avoid common pitfalls, and how to make informed choices when selecting an insurance plan.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon industry reports, legal documents related to insurance regulations, consumer protection guidelines, and multiple insurance policy examples. The information provided is intended to be informative and accurate, but readers are encouraged to consult their specific policy documents for precise details related to their individual coverage.

Key Takeaways:

- Definition and Core Concepts: A comprehensive explanation of insurance waiting periods and their fundamental principles.

- Types of Waiting Periods: Exploring the variations in waiting periods across health, disability, life, homeowners, and auto insurance.

- Reasons for Waiting Periods: Understanding the rationale behind these periods from the insurance provider's perspective.

- Common Exclusions and Exceptions: Identifying specific circumstances where waiting periods may not apply or are shortened.

- Navigating Waiting Periods: Practical strategies for understanding and managing waiting periods effectively.

Smooth Transition to the Core Discussion

Having established the significance of understanding insurance waiting periods, let’s now delve into the specific details of what they entail and how they function across different insurance categories.

Exploring the Key Aspects of Insurance Waiting Periods

1. Definition and Core Concepts:

An insurance waiting period is a specified period after the policy's effective date or after a change in coverage before benefits become payable for a particular condition or type of claim. This period is not a denial of coverage, but rather a delay in the commencement of benefits. The length of the waiting period varies significantly depending on the type of insurance, the specific condition, and the insurer's policy.

2. Types of Waiting Periods Across Different Insurance Types:

-

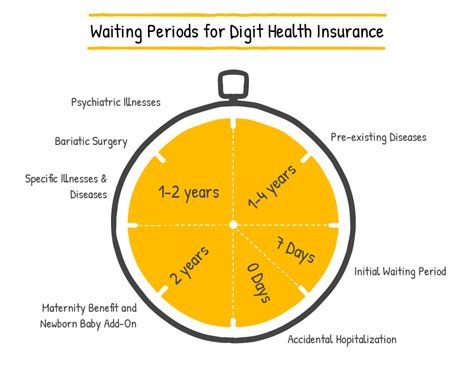

Health Insurance: Health insurance waiting periods are perhaps the most commonly known. These periods typically apply to pre-existing conditions, meaning coverage for treatments or conditions that existed before the policy's effective date might be delayed. The waiting period can vary from a few months to a year, depending on the insurer and the specific plan. Some plans may also have waiting periods for specific services, such as maternity care or mental health treatment.

-

Disability Insurance: Disability insurance policies often have waiting periods before benefits commence. These periods, often referred to as "elimination periods," usually range from 30 to 90 days. This means that if a person becomes disabled, they must typically wait a specified number of days before receiving disability income benefits.

-

Life Insurance: Life insurance policies generally do not have waiting periods in the traditional sense. Coverage is usually effective immediately upon policy issuance, provided all necessary requirements are met. However, there might be a contestability period, typically two years, during which the insurer can investigate the accuracy of information provided in the application and void the policy if material misrepresentations are discovered.

-

Homeowners and Renters Insurance: Waiting periods for homeowners and renters insurance are usually shorter, often just a few days or weeks. This typically refers to the time before coverage kicks in for certain perils, such as theft or damage. However, waiting periods are more likely to apply to specific endorsements or additions to the base policy.

-

Auto Insurance: Auto insurance policies generally don't have waiting periods for liability coverage, which protects you in case you cause an accident. However, there might be waiting periods for certain optional coverages, such as comprehensive or collision coverage.

3. Reasons for Waiting Periods:

Insurance companies implement waiting periods to manage risk and prevent adverse selection. Adverse selection refers to the tendency for individuals with a higher risk of needing insurance to be more likely to purchase coverage. Waiting periods help to mitigate this risk by preventing immediate claims from individuals who knew they were about to incur significant medical expenses or other insured events. They also allow insurers to assess the risk associated with new policyholders.

4. Common Exclusions and Exceptions:

Not all conditions or events are subject to waiting periods. Some insurance policies may have specific exceptions or exclusions that shorten or eliminate waiting periods for certain situations. These exceptions vary widely based on the policy and insurer. It is crucial to carefully review the policy documents to understand these exceptions. For instance, some health insurance plans may waive waiting periods for accidents or emergency situations.

5. Navigating Waiting Periods:

-

Read the Fine Print: Thoroughly review the policy documents, paying close attention to the sections outlining waiting periods for different benefits or types of coverage.

-

Ask Questions: Don't hesitate to contact the insurance provider or your broker to clarify any ambiguities or concerns about waiting periods.

-

Understand Pre-Existing Conditions: Be aware of any pre-existing conditions that may be subject to a waiting period.

-

Consider the Elimination Period: When selecting disability insurance, carefully consider the elimination period (waiting period) and choose a length that aligns with your financial capabilities.

Closing Insights: Summarizing the Core Discussion

Insurance waiting periods are a fundamental aspect of insurance contracts, serving as a crucial risk management tool for insurers. Understanding these periods is essential for consumers to make informed decisions and avoid potential financial surprises. By carefully reviewing policy documents, asking clarifying questions, and being aware of relevant exceptions, individuals can effectively navigate waiting periods and ensure appropriate coverage when needed.

Exploring the Connection Between Pre-Existing Conditions and Insurance Waiting Periods

The relationship between pre-existing conditions and insurance waiting periods is particularly important. Pre-existing conditions, by definition, existed before the insurance policy commenced. Insurers often impose waiting periods for coverage related to these conditions to mitigate the risk of immediate and potentially substantial claims.

Key Factors to Consider:

-

Roles and Real-World Examples: A person with a history of heart disease might face a waiting period before their new health insurance policy covers related treatments. Similarly, someone with a history of back problems might find their disability insurance has a waiting period before benefits for back-related disability are paid.

-

Risks and Mitigations: The risk lies in individuals facing significant out-of-pocket expenses during the waiting period. Mitigation strategies include carefully reviewing the waiting period length, exploring supplemental insurance options to bridge the gap, and having sufficient emergency savings.

-

Impact and Implications: The impact of waiting periods on individuals with pre-existing conditions can be substantial, potentially leading to delayed or forgone treatments, financial strain, and increased stress.

Conclusion: Reinforcing the Connection

The connection between pre-existing conditions and insurance waiting periods highlights the complexity of risk assessment in insurance. While waiting periods protect insurers from immediate high-cost claims, they also pose challenges for individuals with pre-existing conditions. Navigating this requires careful planning, thorough policy review, and open communication with insurance providers.

Further Analysis: Examining Pre-Existing Condition Definitions in Greater Detail

The definition of a "pre-existing condition" varies among insurers and jurisdictions. It generally refers to a condition for which medical advice or treatment was sought or received within a specific timeframe before the policy's effective date. This timeframe can vary from months to years. The specific criteria used to define a pre-existing condition and its implications for waiting periods should be clearly outlined in the policy documents.

FAQ Section: Answering Common Questions About Insurance Waiting Periods

-

Q: What is the typical waiting period for health insurance? A: The waiting period for health insurance varies greatly depending on the insurer, plan, and specific condition. It can range from a few months to a year or even longer for pre-existing conditions.

-

Q: Does my waiting period apply to accidents? A: Many insurance policies have exceptions for accidents. Check your policy details as accidental injuries might not be subject to the standard waiting period.

-

Q: What happens if I need treatment during the waiting period? A: You would likely be responsible for the full cost of treatment during the waiting period, unless the policy has specific exceptions.

-

Q: Can I shorten my waiting period? A: Generally, it's not possible to shorten a waiting period unless there are specific circumstances outlined in your policy or by the insurance provider.

-

Q: What is the difference between a waiting period and an elimination period? A: While both are delays in receiving benefits, a waiting period generally applies to a wide range of coverages in different insurance types, while an elimination period typically refers specifically to the delay before disability income benefits begin.

Practical Tips: Maximizing the Benefits of Understanding Waiting Periods

-

Compare Policies: Before purchasing insurance, carefully compare policies from different insurers, paying close attention to the length and specifics of waiting periods.

-

Understand Your Needs: Assess your specific healthcare needs and potential risks to choose a policy with a waiting period that aligns with your circumstances.

-

Maintain Documentation: Keep detailed records of your medical history, treatment dates, and insurance policies.

-

Seek Professional Advice: Consult with an insurance broker or financial advisor to gain personalized guidance on selecting appropriate insurance coverage.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding insurance waiting periods is not merely about navigating bureaucratic hurdles; it's about protecting your financial well-being. By actively engaging with the terms and conditions of your insurance policy and utilizing available resources, you can make informed decisions and avoid the unforeseen challenges that waiting periods can present. Ultimately, proactive planning and a comprehensive understanding of these periods contribute significantly to your peace of mind and financial security.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is An Insurance Waiting Period . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.