What Is A Good Credit Profile

adminse

Apr 08, 2025 · 8 min read

Table of Contents

Unlocking Financial Freedom: What Makes a Good Credit Profile?

What if your financial future hinges on understanding your credit profile? A strong credit profile is the key that unlocks access to better interest rates, lower insurance premiums, and a wider array of financial opportunities.

Editor’s Note: This article on building a good credit profile was published today and provides up-to-date information and strategies for improving your creditworthiness.

Why a Good Credit Profile Matters:

A good credit profile is far more than just a number; it's a reflection of your financial responsibility and trustworthiness. It impacts virtually every aspect of your financial life, influencing your ability to:

- Secure loans at favorable interest rates: A higher credit score often translates to lower interest rates on mortgages, auto loans, and personal loans, saving you thousands of dollars over the life of the loan.

- Obtain lower insurance premiums: Insurance companies often use credit scores to assess risk. A good credit score can lead to significantly lower premiums for car, home, and even life insurance.

- Rent an apartment or house more easily: Landlords frequently check credit reports to gauge a tenant's reliability in paying rent.

- Get approved for credit cards with better rewards: Credit card companies offer better interest rates, higher credit limits, and more lucrative rewards programs to individuals with strong credit histories.

- Improve your chances of securing employment: In some industries, particularly those involving finance or handling sensitive information, a credit check is part of the background screening process.

Overview: What This Article Covers

This comprehensive guide delves into the essential components of a good credit profile. We will explore the key elements that contribute to a high credit score, strategies for building and maintaining a positive credit history, and the potential pitfalls to avoid. Readers will gain actionable insights, supported by best practices and real-world examples.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating information from reputable credit bureaus like Experian, Equifax, and TransUnion, as well as financial experts and consumer advocacy groups. Every claim is supported by evidence, ensuring readers receive accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: Understanding credit scores, reports, and the factors that influence them.

- Building a Strong Credit History: Strategies for establishing and improving your credit score.

- Maintaining a Good Credit Profile: Best practices for ongoing credit management.

- Addressing Credit Challenges: Strategies for overcoming negative credit history.

- The Role of Debt Management: Understanding how debt impacts your credit profile.

Smooth Transition to the Core Discussion

Now that we understand the significance of a good credit profile, let's delve into the specific aspects that contribute to a positive credit history.

Exploring the Key Aspects of a Good Credit Profile

1. Understanding Credit Scores and Reports:

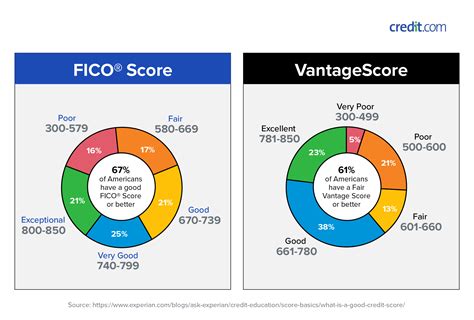

Your credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850 (depending on the scoring model used). A higher score indicates a lower risk to lenders. Credit reports, on the other hand, are detailed documents that contain your credit history, including payment history, amounts owed, length of credit history, credit mix, and new credit inquiries. The three major credit bureaus – Equifax, Experian, and TransUnion – maintain separate credit reports for each individual.

2. Payment History: The Cornerstone of a Good Credit Profile:

Your payment history accounts for a significant portion (typically 35%) of your credit score. Consistent on-time payments demonstrate your reliability and responsible financial behavior. Even one missed payment can negatively impact your score. Setting up automatic payments can help prevent missed payments.

3. Amounts Owed (Credit Utilization): Managing Your Debt Wisely:

This factor (typically 30% of your credit score) considers how much debt you have relative to your available credit. Keeping your credit utilization ratio low (ideally below 30%) is crucial for a good credit score. This means using only a small portion of your available credit. For example, if you have a credit card with a $1000 limit, it's best to keep your balance below $300.

4. Length of Credit History: The Test of Time:

The length of your credit history (typically 15% of your credit score) demonstrates your experience in managing credit responsibly over time. Maintaining older accounts in good standing helps boost your score. Avoid closing old accounts unless absolutely necessary.

5. Credit Mix: Diversifying Your Credit Portfolio:

Having a mix of different credit accounts (e.g., credit cards, installment loans, mortgages) can positively impact your credit score (typically 10%). This shows lenders you can manage various types of credit responsibly. However, don't open multiple accounts just for the sake of diversification; focus on responsible credit management.

6. New Credit Inquiries:

New credit inquiries, which represent applications for new credit accounts, can temporarily lower your credit score (typically 10%). Multiple inquiries within a short period suggest a higher risk to lenders. It’s wise to limit the number of credit applications you submit.

Exploring the Connection Between Debt Management and a Good Credit Profile

The relationship between effective debt management and a strong credit profile is undeniable. High levels of debt, especially if managed poorly, can severely damage your credit score. Conversely, responsible debt management—paying bills on time and keeping balances low—contributes significantly to a positive credit history.

Key Factors to Consider:

-

Roles and Real-World Examples: Individuals with high levels of unsecured debt (credit card debt, personal loans) often struggle to maintain a good credit score. Conversely, those who prioritize paying down debt and maintain low credit utilization ratios generally enjoy higher credit scores. For instance, someone consistently paying off their credit card balance in full each month will see a significant benefit compared to someone carrying a high balance month after month.

-

Risks and Mitigations: Failing to manage debt effectively can lead to defaults, collections, and significantly lower credit scores. Mitigation strategies include creating a budget, prioritizing debt repayment (perhaps using the debt snowball or avalanche methods), and seeking professional financial counseling if needed.

-

Impact and Implications: A damaged credit score due to poor debt management can make it difficult to obtain loans, rent an apartment, or secure favorable insurance rates. It can also have broader implications, impacting your ability to achieve financial goals and potentially affecting your overall financial well-being.

Conclusion: Reinforcing the Connection

The interplay between effective debt management and a positive credit profile is crucial. By prioritizing responsible financial habits, individuals can build and maintain a strong credit history, opening doors to a wider range of financial opportunities.

Further Analysis: Examining Debt Management Strategies in Greater Detail

Effective debt management involves more than just paying bills on time. It requires a proactive approach involving budgeting, understanding interest rates, and strategically paying down debt. Methods like the debt snowball (paying off smallest debts first for motivation) and the debt avalanche (paying off highest-interest debts first for financial efficiency) are popular strategies. Consulting with a financial advisor can provide personalized guidance tailored to individual circumstances.

FAQ Section: Answering Common Questions About Credit Profiles

Q: What is a good credit score?

A: While the exact definition varies, a credit score of 700 or higher is generally considered good. Scores above 800 are considered excellent.

Q: How often should I check my credit report?

A: You should check your credit reports at least annually from each of the three major bureaus (Equifax, Experian, and TransUnion) to monitor for errors and identify potential issues. You can access free credit reports annually at AnnualCreditReport.com.

Q: What should I do if I find an error on my credit report?

A: Immediately dispute the error with the credit bureau. Provide documentation to support your claim.

Q: How long does negative information stay on my credit report?

A: Most negative information, such as late payments or bankruptcies, remains on your credit report for seven years. Bankruptcies can stay for up to 10 years.

Practical Tips: Maximizing the Benefits of a Good Credit Profile

- Pay bills on time, every time: This is the single most important factor in building a good credit score.

- Keep credit utilization low: Avoid maxing out your credit cards.

- Diversify your credit mix: Have a combination of credit cards and installment loans.

- Monitor your credit reports regularly: Check for errors and inconsistencies.

- Limit new credit applications: Avoid applying for too much credit at once.

- Consider a secured credit card: If you have limited or bad credit, a secured card can help you build credit.

- Pay down high-interest debt first: Focus on eliminating debt with the highest interest rates.

- Budget effectively: Track your income and expenses to ensure responsible spending habits.

Final Conclusion: Wrapping Up with Lasting Insights

A good credit profile is a cornerstone of financial health and stability. By understanding the key components, employing effective debt management strategies, and consistently practicing responsible financial habits, individuals can build and maintain a strong credit history, unlocking numerous financial opportunities and securing a brighter financial future. It requires ongoing effort and vigilance, but the rewards are well worth the investment.

Latest Posts

Latest Posts

-

What Credit Score Do You Need To Get A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Buy A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Be Approved For A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Get Approved For A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Qualify For A Tesla

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Is A Good Credit Profile . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.