What Is A Bureau Credit Profile

adminse

Apr 08, 2025 · 8 min read

Table of Contents

Decoding Your Credit Profile: A Comprehensive Guide to Bureau Credit Reports

What if your financial future hinges on understanding your credit profile? This critical element dictates your access to loans, credit cards, and even certain employment opportunities.

Editor's Note: This article on understanding bureau credit profiles was published today and provides up-to-date information on this crucial aspect of personal finance. Understanding your credit report is vital for building a strong financial future.

Why Your Credit Profile Matters:

Your credit profile, a detailed record of your borrowing and repayment history, is far more than just a number. It's a comprehensive snapshot of your financial responsibility, impacting everything from securing a mortgage to obtaining favorable interest rates on loans. Lenders use this information to assess your creditworthiness – essentially, your ability and willingness to repay borrowed funds. A positive credit profile unlocks opportunities; a negative one can severely limit your financial options. Beyond lending, your credit history can even play a role in employment decisions, insurance premiums, and even renting an apartment.

Overview: What This Article Covers

This article will delve into the core components of a bureau credit profile, explaining what information is included, how it's compiled, and how you can understand and improve your own. We will explore the impact of various factors, address common misconceptions, and offer actionable steps to maintain a healthy credit profile.

The Research and Effort Behind the Insights

This comprehensive guide is the result of extensive research, drawing on information from leading credit bureaus, financial institutions, and consumer protection agencies. We've consulted reputable sources to ensure accuracy and provide readers with trustworthy and up-to-date information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of what constitutes a bureau credit profile and its key elements.

- Components of a Credit Report: A detailed breakdown of the information included in your report, including payment history, credit utilization, and length of credit history.

- The Three Major Credit Bureaus: An understanding of Equifax, Experian, and TransUnion and how their reports may differ.

- Understanding Your Credit Score: How your credit score is calculated and what factors influence it.

- Improving Your Credit Profile: Practical strategies to build and maintain a strong credit profile.

- Dispute Resolution: The process of correcting inaccuracies on your credit report.

- Protecting Your Credit: Measures to prevent identity theft and fraud.

Smooth Transition to the Core Discussion:

Now that we understand the significance of a credit profile, let's explore its key aspects in detail, beginning with its fundamental components.

Exploring the Key Aspects of a Bureau Credit Profile:

1. Definition and Core Concepts:

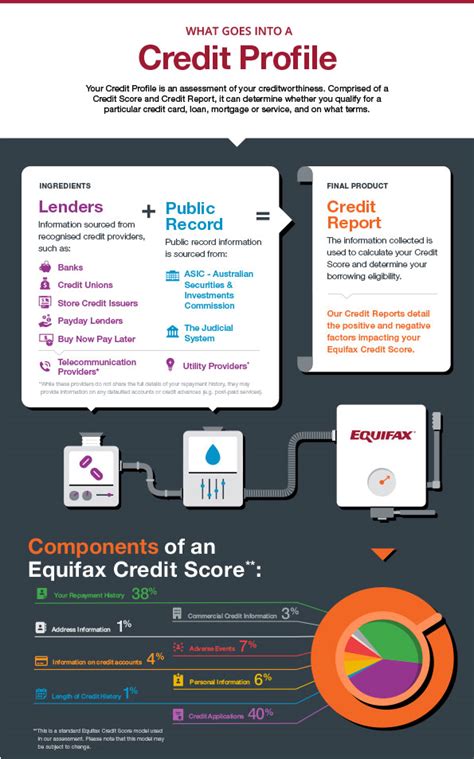

A bureau credit profile, or credit report, is a detailed record maintained by credit bureaus (like Equifax, Experian, and TransUnion) that summarizes your credit history. This report includes information on your borrowing habits, repayment performance, and any negative marks like late payments or bankruptcies. Lenders access these reports to assess your creditworthiness before extending credit. The information contained within these reports is used to calculate your credit score, a numerical representation of your credit risk.

2. Components of a Credit Report:

Your credit report typically contains the following key elements:

- Identifying Information: Your name, address, Social Security number, date of birth, and employment history.

- Credit Accounts: A list of all your credit accounts, including credit cards, loans, mortgages, and installment loans. This section includes account opening dates, account balances, credit limits, and payment histories.

- Payment History: This is the most crucial element. It records your payment performance over time, noting any missed or late payments. Even minor inconsistencies can impact your score negatively.

- Credit Utilization: This refers to the percentage of your available credit that you're currently using. High utilization (e.g., using 80% or more of your credit limit) can negatively impact your credit score.

- Length of Credit History: The longer your credit history, the more data lenders have to assess your creditworthiness. A longer history with responsible credit use generally leads to a better score.

- New Credit: This section tracks recent applications for new credit. Multiple applications in a short period can signal increased risk to lenders.

- Public Records: This section may include bankruptcies, foreclosures, tax liens, and judgments. These are significant negative marks that can severely impact your credit score.

- Inquiries: This section lists inquiries made by lenders when you applied for credit. While a few inquiries are normal, many inquiries in a short time can negatively affect your score.

3. The Three Major Credit Bureaus:

Equifax, Experian, and TransUnion are the three primary credit bureaus in the United States. Each maintains its own independent database of credit information, and your credit reports from these bureaus may differ slightly due to variations in data collection and reporting practices. It's recommended to obtain and review your reports from all three bureaus annually.

4. Understanding Your Credit Score:

Your credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850 (FICO score). It's calculated using a complex algorithm based on the information in your credit report, with different weighting given to different factors. A higher score indicates lower risk to lenders and usually translates into better interest rates and credit offers.

5. Improving Your Credit Profile:

Building and maintaining a positive credit profile requires consistent responsible financial behavior. Here are some key strategies:

- Pay Bills on Time: This is the single most important factor affecting your credit score. Make all payments on time, every time.

- Keep Credit Utilization Low: Avoid maxing out your credit cards. Aim to keep your credit utilization below 30% of your available credit.

- Maintain a Diverse Credit Mix: Having a mix of different types of credit (e.g., credit cards, installment loans) can be beneficial, but only if managed responsibly.

- Limit New Credit Applications: Avoid applying for too much new credit in a short period.

- Monitor Your Credit Reports Regularly: Check your reports from all three bureaus annually for errors or inaccuracies.

- Address Negative Marks: If you have negative marks on your report, take steps to resolve them and improve your financial habits.

Exploring the Connection Between Credit Monitoring and a Bureau Credit Profile:

Credit monitoring services play a crucial role in protecting your credit profile and helping you manage your financial health. These services typically provide alerts for changes to your credit report, allowing you to identify potential fraud or errors quickly. They also often offer tools to track your credit score and provide insights into your credit health.

Key Factors to Consider:

- Roles and Real-World Examples: Credit monitoring services can alert you to unauthorized credit applications, identity theft attempts, and inaccuracies on your credit report, preventing potential damage to your credit score.

- Risks and Mitigations: While credit monitoring services offer valuable protection, they aren't foolproof. It's still crucial to practice good financial habits and monitor your accounts regularly.

- Impact and Implications: By proactively addressing issues identified through credit monitoring, you can minimize negative impacts on your credit score and maintain a strong financial standing.

Conclusion: Reinforcing the Connection:

The interplay between credit monitoring and your bureau credit profile is essential for maintaining strong financial health. By utilizing credit monitoring services and practicing responsible financial habits, individuals can protect themselves from identity theft, fraud, and inaccuracies that could negatively affect their creditworthiness.

Further Analysis: Examining Credit Repair Services in Greater Detail:

Credit repair services often offer assistance to individuals looking to improve their credit profile. These services may help to dispute inaccuracies on credit reports, negotiate with creditors, and develop strategies for improving credit scores. However, it's crucial to choose reputable and ethical credit repair companies, as some may employ deceptive practices. Always research thoroughly before engaging with any credit repair service.

FAQ Section: Answering Common Questions About Bureau Credit Profiles:

- What is a bureau credit profile? A bureau credit profile, or credit report, is a detailed record of your credit history maintained by credit bureaus.

- How is my credit score calculated? Your credit score is calculated using a complex algorithm that weighs several factors from your credit report, including payment history, credit utilization, and length of credit history.

- How often should I check my credit report? You should check your credit reports from all three major bureaus annually.

- What if I find an error on my credit report? If you find an error, you should immediately contact the credit bureau and dispute the inaccuracy.

- Can I improve my credit score? Yes, by consistently practicing responsible financial behavior, such as paying bills on time and keeping credit utilization low, you can improve your credit score over time.

- What is the impact of a low credit score? A low credit score can limit your access to credit, result in higher interest rates, and affect your ability to secure loans, rent an apartment, or even get certain jobs.

Practical Tips: Maximizing the Benefits of Understanding Your Credit Profile:

- Obtain your credit reports: Request your free annual credit reports from AnnualCreditReport.com.

- Review your reports carefully: Examine each report for accuracy and identify any potential issues.

- Understand your credit score: Learn what your credit score is and what factors influence it.

- Develop a plan to improve your credit: Create a budget, pay down debt, and maintain responsible credit habits.

- Monitor your credit regularly: Set up alerts for changes to your credit report.

- Dispute any inaccuracies: Follow the proper procedures to challenge any errors on your reports.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding your bureau credit profile is crucial for navigating the financial landscape. By taking proactive steps to monitor, maintain, and improve your credit history, you can unlock financial opportunities, secure favorable terms on loans, and build a strong financial foundation for the future. Your credit profile is a powerful tool – use it wisely.

Latest Posts

Latest Posts

-

What Credit Score Do You Need To Get A Tesla Lease

Apr 08, 2025

-

What Credit Score Do You Need To Purchase A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Lease A Tesla Model Y

Apr 08, 2025

-

What Credit Score Do You Need To Get A Tesla

Apr 08, 2025

-

What Credit Score Do You Need To Buy A Tesla

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about What Is A Bureau Credit Profile . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.