What Is A 600 Credit Score

adminse

Apr 07, 2025 · 8 min read

Table of Contents

Decoding the 600 Credit Score: What It Means and How to Improve It

What if your financial future hinges on understanding your credit score? A 600 credit score represents a significant hurdle in accessing many financial products and services, but it's not a dead end.

Editor’s Note: This article on understanding a 600 credit score was published today, providing you with the most up-to-date information and strategies for credit improvement.

Why a 600 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

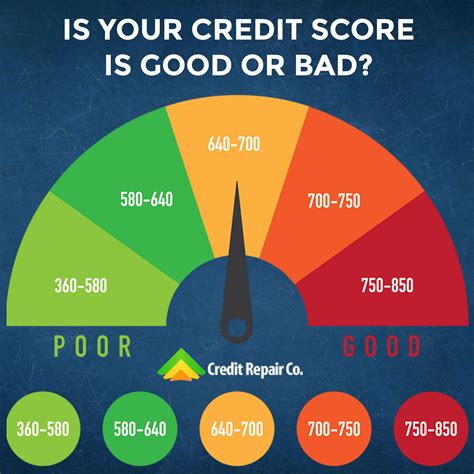

A credit score is a three-digit number that lenders use to assess your creditworthiness. It summarizes your history of borrowing and repaying debt. A 600 credit score falls within the "fair" range, according to the FICO scoring model, the most widely used system. While not disastrous, it significantly limits your access to favorable financial options. This score impacts your ability to secure loans (mortgages, auto loans, personal loans) at competitive interest rates, rent an apartment, obtain a credit card with favorable terms, and even secure employment in certain industries. Understanding a 600 score is crucial for navigating the financial landscape and improving your future prospects.

Overview: What This Article Covers

This article will provide a comprehensive overview of a 600 credit score. We'll explore its meaning, the factors influencing it, the challenges it presents, strategies for improvement, and what resources are available to help individuals navigate this situation. Readers will gain a clear understanding of their options and actionable steps they can take to build a stronger financial future.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from leading credit bureaus (Equifax, Experian, TransUnion), financial experts, and reputable consumer finance websites. The information provided is based on established credit scoring models and industry best practices.

Key Takeaways: Summarize the Most Essential Insights

- Definition and Core Concepts: A 600 credit score is considered "fair," indicating some credit history but with room for significant improvement.

- Practical Applications: A 600 score limits access to favorable loan terms, credit cards, and rental opportunities.

- Challenges and Solutions: Securing loans and credit at competitive rates is difficult with a 600 score. Strategies for improvement include addressing negative items on credit reports and establishing positive credit habits.

- Future Implications: Improving a 600 credit score can unlock significant financial opportunities and improve long-term financial health.

Smooth Transition to the Core Discussion

Now that we understand the significance of a 600 credit score, let's delve deeper into its components and explore practical steps for improvement.

Exploring the Key Aspects of a 600 Credit Score

Definition and Core Concepts: A credit score isn't a single number; it's a range. FICO scores generally range from 300 to 850. A 600 falls within the "fair" range, suggesting a mix of positive and negative credit history. It indicates that while you've established some credit, there are areas that need attention to qualify for better financial products.

Applications Across Industries: A 600 credit score significantly impacts your ability to access financial products. Lenders view this score as moderately risky. This means:

- Higher Interest Rates: You'll likely face higher interest rates on loans, meaning you'll pay significantly more over the life of the loan.

- Loan Denials: Some lenders may outright deny your application for a loan, credit card, or even an apartment rental.

- Limited Credit Card Options: You'll likely be offered credit cards with high interest rates and low credit limits.

- Difficulties Securing Insurance: In some cases, insurers might charge higher premiums due to the perceived higher risk associated with a fair credit score.

Challenges and Solutions: The primary challenge with a 600 credit score is limited access to favorable financial products. The solutions involve proactively addressing the underlying issues contributing to the low score:

- Review Your Credit Report: Obtain a free credit report from AnnualCreditReport.com. Look for errors, inaccuracies, or negative marks (late payments, collections, bankruptcies). Dispute any errors with the respective credit bureaus.

- Address Negative Items: If you have outstanding debts, work with creditors to establish a payment plan or negotiate a settlement. Consider credit counseling services to manage your debts effectively.

- Pay Bills on Time: This is the single most important factor affecting your credit score. Make all payments on time, every time. Set up automatic payments to avoid late fees.

- Reduce Credit Utilization: Keep your credit utilization ratio (the percentage of available credit you're using) low – ideally below 30%. This shows lenders that you're managing your credit responsibly.

- Increase Your Credit Mix: A diverse mix of credit accounts (credit cards, installment loans) can positively impact your score. However, only apply for new credit when necessary.

- Monitor Your Credit Score Regularly: Track your progress over time to ensure your efforts are paying off. Many credit card companies and financial institutions offer free credit score monitoring.

Impact on Innovation: While a 600 credit score doesn't directly impact innovation, it indirectly limits access to financial resources that could be used to pursue innovative ventures. Improving your score opens doors to funding for small businesses, personal investments, and education, all of which can fuel innovation.

Closing Insights: Summarizing the Core Discussion

A 600 credit score presents significant challenges, but it's not insurmountable. By addressing negative credit history, establishing responsible financial habits, and monitoring progress, individuals can significantly improve their scores and unlock better financial opportunities.

Exploring the Connection Between Debt Management and a 600 Credit Score

Debt management plays a pivotal role in shaping a 600 credit score. High levels of debt, especially unpaid or delinquent debt, are major contributors to a low score. Understanding this connection is crucial for improving creditworthiness.

Key Factors to Consider:

Roles and Real-World Examples: High credit card debt with missed payments directly lowers a credit score. Similarly, collections accounts significantly damage credit. For example, a person with $10,000 in credit card debt and several late payments will likely have a lower score than someone with the same debt but a consistent payment history.

Risks and Mitigations: The primary risk is loan denials and higher interest rates. Mitigating this requires actively managing debt through repayment plans, debt consolidation, or credit counseling.

Impact and Implications: Failing to manage debt effectively can lead to a vicious cycle of low credit scores, high-interest rates, and further debt accumulation. Conversely, successful debt management significantly improves creditworthiness, opening doors to better financial opportunities.

Conclusion: Reinforcing the Connection

The relationship between debt management and a 600 credit score is undeniable. Effective debt management is the cornerstone of credit score improvement. Addressing existing debt and maintaining responsible credit habits are crucial steps toward achieving a healthier financial future.

Further Analysis: Examining Debt Management in Greater Detail

Effective debt management involves several strategies:

- Creating a Budget: Understand your income and expenses to identify areas for saving and debt reduction.

- Prioritizing Debts: Focus on high-interest debts first to minimize overall interest payments.

- Debt Consolidation: Combining multiple debts into a single loan can simplify repayment and potentially lower interest rates.

- Debt Negotiation: Work with creditors to negotiate lower payments or settle outstanding balances.

- Credit Counseling: Seek professional guidance from a reputable credit counseling agency to develop a personalized debt management plan.

FAQ Section: Answering Common Questions About a 600 Credit Score

Q: What is a 600 credit score?

A: A 600 credit score is considered "fair" according to FICO scoring models. It indicates that while you have some credit history, there are areas needing improvement to qualify for better financial products.

Q: How is a 600 credit score applied in real-world scenarios?

A: A 600 score can lead to higher interest rates on loans, difficulty securing credit cards, challenges in renting an apartment, and even potential difficulties securing employment in certain industries.

Q: What are the long-term implications of having a 600 credit score?

A: A low credit score can lead to a cycle of higher interest payments, limited financial opportunities, and potential financial instability. Improving your score is crucial for long-term financial health and security.

Q: Can a 600 credit score be improved?

A: Yes, a 600 credit score is improvable. By addressing negative items on your credit report, establishing positive credit habits, and consistently making timely payments, you can gradually raise your score.

Practical Tips: Maximizing the Benefits of Credit Score Improvement

- Check Your Credit Report Regularly: Monitor your report for errors and negative marks.

- Pay Bills on Time Consistently: This is the most important factor in improving your credit score.

- Keep Credit Utilization Low: Aim for under 30% of your available credit.

- Establish a Good Credit Mix: Diversify your credit accounts responsibly.

- Consider Credit Counseling: Seek professional guidance for debt management and credit improvement.

Final Conclusion: Wrapping Up with Lasting Insights

A 600 credit score presents challenges, but it's not a life sentence. Through proactive steps, consistent effort, and responsible financial management, individuals can significantly improve their creditworthiness and build a stronger financial future. Remember that improving your credit score takes time and dedication, but the rewards are well worth the effort.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Is A 600 Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.