What Happens To Aggregate Demand If Interest Rates Increase

adminse

Mar 25, 2025 · 9 min read

Table of Contents

What Happens to Aggregate Demand if Interest Rates Increase? A Deep Dive into Monetary Policy's Impact

What if the stability of our economies hinges on the delicate dance between interest rates and aggregate demand? A rise in interest rates is a powerful tool, capable of significantly influencing the overall demand for goods and services within an economy.

Editor’s Note: This article on the impact of interest rate increases on aggregate demand was published today, providing readers with up-to-date insights into this crucial macroeconomic relationship.

Why Interest Rate Changes Matter: Relevance, Practical Applications, and Industry Significance

Interest rates, the price of borrowing money, are a central lever used by central banks to manage inflation and economic growth. Changes in interest rates have far-reaching consequences, impacting everything from consumer spending and investment decisions to government borrowing costs and exchange rates. Understanding this relationship is crucial for businesses, investors, and policymakers alike. A rise in interest rates, specifically, is often employed as a contractionary monetary policy tool to cool down an overheating economy and curb inflation.

Overview: What This Article Covers

This article will delve into the intricate relationship between interest rate increases and aggregate demand (AD). We'll explore the various transmission mechanisms through which higher interest rates impact different components of AD – consumption, investment, government spending, and net exports – and ultimately affect overall economic activity. The analysis will incorporate real-world examples and consider potential variations depending on the economic context.

The Research and Effort Behind the Insights

This article draws upon established macroeconomic theory, empirical evidence from numerous economic studies, and data from various central banks and international organizations. The analysis integrates multiple perspectives to provide a comprehensive understanding of the complex interplay between interest rates and aggregate demand.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of aggregate demand and the mechanisms through which interest rate changes influence it.

- Transmission Mechanisms: A detailed exploration of how interest rate hikes affect consumption, investment, government spending, and net exports.

- Impact on Economic Activity: Analysis of the overall effect of higher interest rates on GDP, employment, and inflation.

- Limitations and Considerations: Acknowledgment of the complexities and potential limitations of using interest rate changes as a policy tool.

- Real-world Examples: Illustrative examples from past economic events to demonstrate the effects of interest rate increases on aggregate demand.

Smooth Transition to the Core Discussion

Having established the importance of understanding this relationship, let's now explore the key channels through which an increase in interest rates impacts aggregate demand.

Exploring the Key Aspects of Interest Rate Increases and Aggregate Demand

1. Definition and Core Concepts:

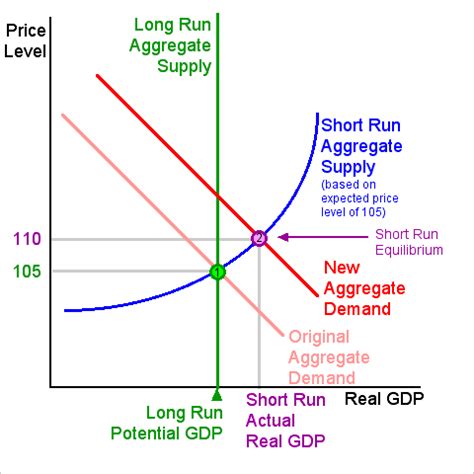

Aggregate demand (AD) represents the total demand for goods and services in an economy at a given price level. It's composed of four key components: consumption (C), investment (I), government spending (G), and net exports (NX). An increase in interest rates affects each of these components, leading to a shift in the aggregate demand curve.

2. Transmission Mechanisms:

-

Consumption (C): Higher interest rates increase the cost of borrowing for consumers. This makes it more expensive to finance large purchases like houses, cars, and durable goods, leading to a reduction in consumer spending. Furthermore, higher rates can encourage saving over spending as the return on savings increases. The magnitude of this effect depends on factors such as consumer confidence, the availability of credit, and the interest rate sensitivity of consumer spending.

-

Investment (I): Investment spending, particularly in capital goods and business expansion, is highly sensitive to interest rate changes. Higher rates raise the cost of borrowing for firms, making new investments less profitable. This leads to a decrease in business investment, affecting production capacity and future economic growth. Firms may postpone or cancel projects altogether, contributing to a decline in aggregate demand.

-

Government Spending (G): Government spending is typically less sensitive to interest rate fluctuations compared to consumption and investment. However, higher interest rates increase the cost of government borrowing, potentially leading to a reduction in government spending if fiscal policy is constrained by debt levels. This effect might be more pronounced in countries with high levels of public debt.

-

Net Exports (NX): Higher interest rates can attract foreign investment, increasing the demand for the domestic currency and causing it to appreciate. This makes exports more expensive for foreign buyers and imports cheaper for domestic consumers, leading to a decline in net exports (NX = Exports - Imports). The strength of this effect depends on the responsiveness of trade flows to exchange rate movements.

3. Impact on Economic Activity:

The combined effect of these transmission mechanisms is a decrease in aggregate demand. The overall reduction in spending leads to a lower level of equilibrium output (GDP), potentially resulting in slower economic growth or even a recession. Lower demand can also lead to a decrease in inflation, as businesses respond to lower demand by reducing prices. However, the impact on employment can be complex, as reduced demand might lead to job losses in some sectors while others remain unaffected or even experience growth.

4. Challenges and Solutions:

While interest rate increases can be effective in controlling inflation, they are not without challenges. The lag between the implementation of monetary policy and its impact on the economy can make it difficult to fine-tune policy responses. Furthermore, the effectiveness of interest rate changes can vary depending on factors like the state of the economy, inflation expectations, and global economic conditions. Central banks need to carefully consider these factors when making policy decisions. Sometimes, alternative measures might be necessary to mitigate undesirable side effects, such as government intervention to support specific industries or fiscal stimulus measures to counter negative economic impacts.

5. Impact on Innovation:

Higher interest rates can stifle innovation by reducing investment in research and development. Businesses might be less willing to take risks on new projects when the cost of borrowing is high, potentially hindering technological advancement and long-term economic growth. This effect is particularly relevant for firms relying heavily on external funding for their innovative activities.

Closing Insights: Summarizing the Core Discussion

An increase in interest rates is a potent tool for managing macroeconomic conditions, but its impact on aggregate demand is multifaceted and complex. By influencing consumption, investment, government spending, and net exports, it can lead to a significant decrease in overall demand, potentially slowing down economic growth and lowering inflation. However, policymakers must carefully consider the potential negative consequences, such as job losses and reduced investment in innovation, and adjust their strategies accordingly.

Exploring the Connection Between Inflation and Interest Rate Increases

Inflation, a sustained increase in the general price level, is often a primary reason for central banks to raise interest rates. The connection is based on the inverse relationship between inflation and the real interest rate. When inflation is high, the real interest rate (nominal interest rate minus inflation) becomes lower, making borrowing cheaper in real terms. This can stimulate demand and further fuel inflation, creating an inflationary spiral. Raising interest rates helps to curb this by increasing the real cost of borrowing, reducing demand, and ultimately dampening inflationary pressures.

Key Factors to Consider:

-

Roles and Real-World Examples: The 1970s stagflationary period provides a classic example. High inflation combined with slow economic growth prompted central banks to significantly increase interest rates, leading to a deep recession but eventually bringing inflation under control. Similarly, the Federal Reserve's actions following the 2008 financial crisis involved both reducing interest rates to stimulate the economy and later raising them to control inflationary risks.

-

Risks and Mitigations: The risk of raising interest rates too aggressively is triggering a recession. Central banks aim for a "soft landing" where inflation is reduced without causing significant economic hardship. This requires careful monitoring of economic indicators and adjustments to monetary policy as needed.

-

Impact and Implications: The impact of interest rate increases on different sectors of the economy varies. Interest-rate-sensitive sectors, such as housing and construction, are generally more affected. The long-term implications can include changes in investment patterns, shifts in consumption habits, and alterations in global capital flows.

Conclusion: Reinforcing the Connection

The relationship between inflation and interest rate increases is a fundamental principle of monetary policy. While raising interest rates can effectively combat inflation, it’s a double-edged sword. Policymakers must carefully balance the need to control inflation with the potential risks to economic growth and employment.

Further Analysis: Examining the Role of Expectations

Expectations about future inflation and interest rates play a crucial role in shaping the effectiveness of monetary policy. If individuals and businesses expect inflation to remain high, they may continue to make decisions that perpetuate inflation despite interest rate increases. Conversely, if they expect inflation to fall as a result of tighter monetary policy, their behavior might reinforce the effectiveness of the interest rate hikes. Central banks try to manage expectations through clear communication of their policy intentions.

FAQ Section: Answering Common Questions About Interest Rates and Aggregate Demand

Q: What is the immediate impact of an interest rate increase?

A: The immediate impact is typically a decrease in investment spending by businesses. Consumer spending may also decrease, but this response usually lags somewhat.

Q: How long does it take for an interest rate increase to affect aggregate demand?

A: There's a significant time lag. The effects are not felt instantly; they unfold gradually over several months or even years.

Q: Can interest rate increases lead to a recession?

A: Yes, if interest rates are raised too aggressively or if the economy is already weak, it can trigger a recession.

Q: What other factors influence the impact of interest rate increases on aggregate demand?

A: Several factors, including consumer and business confidence, global economic conditions, and exchange rate movements, influence the effectiveness and impact of interest rate changes.

Practical Tips: Understanding and Navigating Interest Rate Changes

-

Monitor economic indicators: Stay informed about inflation rates, employment data, and other key economic indicators to anticipate potential interest rate changes.

-

Understand your personal financial situation: Analyze how interest rate changes might affect your borrowing costs, savings returns, and investment portfolio.

-

Diversify investments: Reduce risk by spreading investments across different asset classes, lessening the impact of interest rate fluctuations on your portfolio.

-

Plan for the long term: Interest rate changes are part of the normal economic cycle. Maintain a long-term financial plan that accounts for the possibility of interest rate volatility.

Final Conclusion: Wrapping Up with Lasting Insights

The impact of interest rate increases on aggregate demand is a critical aspect of macroeconomic management. While it’s a powerful tool for controlling inflation, policymakers must proceed cautiously, balancing the need to stabilize prices with the potential risks of slowing economic growth and increasing unemployment. A deep understanding of the transmission mechanisms, potential challenges, and the role of expectations is vital for both policymakers and economic actors navigating the complexities of this crucial relationship. Continuous monitoring of economic indicators and careful adjustments to monetary policy are essential for achieving sustainable economic stability.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Happens To Aggregate Demand If Interest Rates Increase . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.