What Does Basis Points Mean In Interest Rates

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Understanding Basis Points in Interest Rates: A Comprehensive Guide

What if seemingly small changes in interest rates had a monumental impact on financial markets and individual investments? Basis points, often overlooked, are the key to understanding these subtle yet significant shifts.

Editor’s Note: This article provides a comprehensive explanation of basis points, their significance in interest rates, and their practical applications in various financial contexts. The information presented is current as of today and aims to demystify this crucial financial concept for a broad audience.

Why Basis Points Matter: Relevance, Practical Applications, and Industry Significance

Basis points (bps) are a fundamental unit of measurement in finance, specifically when dealing with interest rates, yields, and other percentage-based changes. While seemingly insignificant, a single basis point can translate into substantial financial implications, impacting everything from individual savings accounts to large-scale corporate debt. Understanding basis points is crucial for investors, borrowers, lenders, and anyone involved in financial markets. Their use ensures precision and avoids ambiguity when discussing small percentage changes. This precision is critical for accurate analysis and informed decision-making.

Overview: What This Article Covers

This article delves into the core aspects of basis points, exploring their definition, significance, and practical applications across various financial instruments. Readers will gain a clear understanding of how basis points are calculated, their impact on different financial scenarios, and the importance of understanding them for informed decision-making. We will also explore the connection between basis points and other key financial metrics, demonstrating their relevance in broader economic contexts.

The Research and Effort Behind the Insights

This article is based on extensive research, drawing upon established financial literature, industry reports, and practical examples from financial markets. The information presented aims to be accurate, unbiased, and easily understandable for readers with varying levels of financial expertise.

Key Takeaways:

- Definition and Core Concepts: A thorough explanation of what basis points are and their foundational role in finance.

- Practical Applications: How basis points are used in various financial contexts, such as mortgages, bonds, and interest rate swaps.

- Impact on Investments: How changes in basis points affect the returns on different investment vehicles.

- Relationship to Other Financial Metrics: The connection between basis points and other important financial concepts.

- Real-World Examples: Practical illustrations of how basis points impact real-world financial decisions.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding basis points, let's delve into a detailed exploration of this crucial concept.

Exploring the Key Aspects of Basis Points

Definition and Core Concepts:

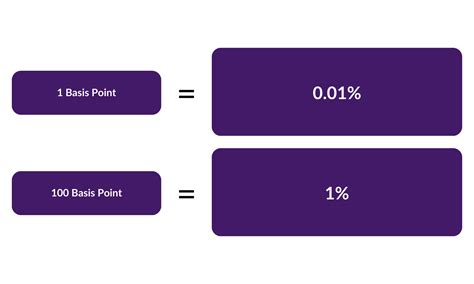

A basis point (bps) is one-hundredth of one percentage point, or 0.01%. This means 100 basis points (100 bps) equal 1 percentage point (1%). This seemingly small unit provides a level of precision crucial in financial markets where even minor changes in interest rates can have significant consequences. The use of basis points avoids confusion and promotes clear communication when discussing fractional changes in percentages.

Applications Across Industries:

Basis points find widespread application across various financial sectors:

- Fixed Income Securities: Bond yields are often expressed in basis points. A bond yield change of 25 basis points represents an increase of 0.25%. This precision is vital for understanding the price fluctuations of fixed-income investments.

- Interest Rate Swaps: These derivative instruments frequently involve changes in interest rates expressed in basis points. A swap's pricing and value are directly influenced by basis point shifts.

- Mortgages: Mortgage interest rates are commonly quoted and analyzed in terms of basis points. Even a small change, such as a 10-basis-point increase, can have a notable effect on the overall cost of a mortgage over its lifespan.

- Central Bank Policy: Central banks often adjust interest rates by increments of 25 or 50 basis points. These adjustments have far-reaching consequences for borrowing costs, investment strategies, and broader economic activity.

- Inflation: Inflation rates are often discussed and analyzed in terms of basis points. Tracking changes in inflation in terms of basis points allows economists and investors to closely monitor the direction and pace of inflation.

Challenges and Solutions:

The primary challenge in understanding basis points lies in their seemingly small numerical value. However, when dealing with large sums of money, even a few basis points can translate into substantial differences. The solution is to use clear and consistent communication, ensuring that all parties understand the magnitude of changes expressed in basis points. Financial professionals should actively educate clients and stakeholders to improve comprehension and transparency in all financial interactions.

Impact on Innovation:

The widespread adoption of basis points facilitates precise analysis and efficient communication in financial markets. This precision enables more sophisticated modeling, risk assessment, and investment strategies. This enhances market efficiency and encourages more effective risk management by enabling clear and consistent communication about fluctuations in interest rates and other percentage-based changes.

Exploring the Connection Between Basis Point Changes and Investment Returns

The impact of basis point changes on investment returns depends heavily on the size of the investment and the duration of the investment. For example:

- Large Investments: A 10-basis-point increase on a $1 million bond will result in a $1,000 difference in annual interest payments. This translates to a significant difference in total returns over time.

- Long-Term Investments: A seemingly small increase in basis points can accumulate significantly over the long term. Even a 5-basis-point difference in a mortgage rate can translate to thousands of dollars in additional interest paid over a 30-year period.

Key Factors to Consider:

- Investment Size: The larger the investment, the more pronounced the impact of basis point changes becomes.

- Investment Duration: Long-term investments are more sensitive to changes in basis points than short-term investments.

- Interest Rate Volatility: Periods of high interest rate volatility will amplify the impact of basis point changes.

Roles and Real-World Examples:

A real-world example is the pricing of corporate bonds. A corporate bond might be priced to yield 5%. If the interest rate environment changes, and the yield increases by 25 basis points (0.25%), this means the new yield would be 5.25%. This relatively small shift could lead to a significant price adjustment in the bond's market value. Similarly, a 25-basis-point reduction in a mortgage interest rate can save homeowners thousands of dollars over the life of the loan.

Risks and Mitigations:

A key risk associated with basis points is the potential for misunderstanding, leading to miscalculations and uninformed financial decisions. This risk can be mitigated through thorough education, transparency, and clear communication. Financial professionals should strive to ensure that clients understand the significance of even small basis point changes, particularly in the context of their overall financial goals and risk tolerance.

Impact and Implications:

The widespread use of basis points highlights the importance of precision and clarity in finance. Understanding this concept enhances decision-making capabilities for investors and financial professionals, fostering more informed and rational financial strategies. The long-term implication of understanding basis points includes reduced financial risks and improved investment outcomes.

Conclusion: Reinforcing the Importance of Basis Points

The seemingly insignificant basis point plays a critical role in the financial world. Its precision enables effective communication and clear financial analysis, ultimately leading to better decision-making for investors and businesses alike. By understanding the impact of basis point changes, stakeholders can mitigate risks, optimize investments, and navigate the complexities of financial markets with greater confidence.

Further Analysis: Examining the Interplay Between Basis Points and Macroeconomic Factors

Basis point changes are not isolated events. They are deeply interwoven with macroeconomic factors, including:

- Central Bank Monetary Policy: Central banks use basis point adjustments to influence interest rates, impacting borrowing costs, inflation, and economic growth. Understanding these linkages is crucial for investors to anticipate market movements and adjust investment strategies accordingly.

- Inflation Rates: Inflation directly impacts interest rates, and both are expressed and analyzed using basis points. Therefore, a thorough understanding of inflation's impact on basis point changes is crucial for effective risk management and investment planning.

- Government Debt: Changes in government borrowing costs, often expressed in basis points, influence overall economic stability and investment strategies. Monitoring government debt yields and their changes in terms of basis points enables investors to assess the risks associated with government bonds and their potential impact on the broader economy.

FAQ Section: Answering Common Questions About Basis Points

Q: What is the difference between a percentage point and a basis point?

A: A percentage point is a full 1% change, while a basis point is 0.01% or one-hundredth of a percentage point. 100 basis points equal one percentage point.

Q: How are basis points used in real-world financial transactions?

A: Basis points are extensively used in expressing changes in interest rates for mortgages, bonds, loans, and other financial instruments. They also appear in financial derivatives such as interest rate swaps.

Q: Why is precision important when discussing basis points?

A: In financial markets, even small percentage changes can have significant consequences, particularly for large investments. Basis points ensure clear communication and avoid any ambiguity regarding small percentage changes.

Practical Tips: Maximizing Understanding of Basis Points

- Familiarize yourself with the conversion: Understand that 100 basis points equal 1 percentage point.

- Practice calculating basis point changes: Work through examples to grasp how changes in basis points affect different financial instruments.

- Stay informed about macroeconomic trends: Understand how macroeconomic factors influence interest rates and basis point changes.

- Consult financial professionals: Don't hesitate to seek expert advice when dealing with complex financial matters involving basis points.

Final Conclusion: The Enduring Significance of Basis Points

Basis points are more than just a unit of measurement; they represent a vital tool for clear communication and precise analysis within the intricate world of finance. Their significance extends across various financial instruments and macroeconomic indicators. By mastering the concept of basis points, individuals can significantly enhance their financial literacy and make better-informed decisions in their personal and professional lives. The importance of understanding basis points will only continue to grow in today's dynamic and interconnected global financial markets.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Does Basis Points Mean In Interest Rates . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.