What Does A Credit Score Under 600 Mean

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Does a Credit Score Under 600 Mean? Navigating the Challenges and Pathways to Improvement

What if your financial future hinges on understanding your credit score? A credit score below 600 signals significant challenges, but it's not a life sentence; it's a call to action.

Editor's Note: This article on credit scores under 600 was published today, providing you with the most up-to-date information and strategies for improving your financial standing.

Why a Credit Score Under 600 Matters:

A credit score below 600 is generally considered "poor" or "subprime." This designation significantly impacts your ability to access credit, secure favorable interest rates, and even obtain certain jobs or insurance policies. The implications extend beyond simply borrowing money; it affects your overall financial health and future opportunities. Understanding why a low score is problematic and what steps to take to improve it is crucial for building a secure financial future. This impacts not just individuals, but also families and businesses who rely on credit to operate.

Overview: What This Article Covers:

This article provides a comprehensive exploration of credit scores below 600. We'll define what constitutes a poor credit score, analyze its underlying causes, examine its consequences, and, most importantly, outline practical steps to improve it. We will also address frequently asked questions and offer actionable tips for building better credit habits.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable sources including consumer credit reporting agencies (like Experian, Equifax, and TransUnion), financial literacy organizations, and expert opinions from financial advisors. All claims are supported by data and evidence, ensuring accurate and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of credit scores and what a score under 600 signifies.

- Causes of Poor Credit: Identifying the key factors contributing to a low credit score.

- Consequences of a Low Credit Score: Exploring the significant financial implications.

- Strategies for Improvement: Detailed steps to rebuild credit and improve your score.

- Addressing Common Concerns: Answering frequently asked questions about credit repair.

Smooth Transition to the Core Discussion:

Now that we understand the gravity of a credit score under 600, let's delve into the specifics of what it means and how to address this financial challenge.

Exploring the Key Aspects of Credit Scores Under 600:

1. Definition and Core Concepts:

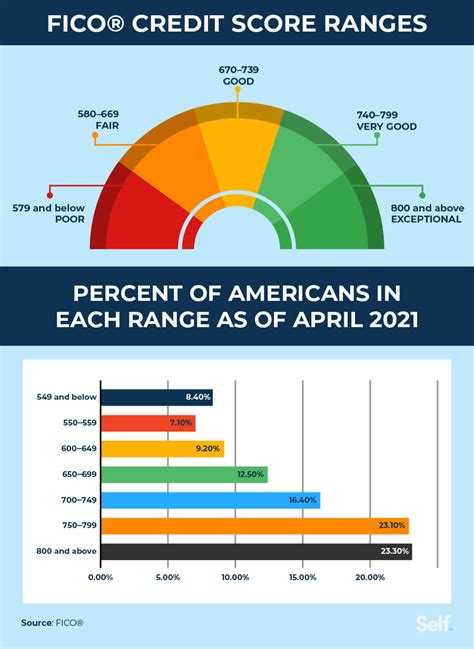

Credit scores are numerical representations of your creditworthiness, based on your credit history. The most common scoring models are FICO scores and VantageScores. These scores range from 300 to 850, with higher scores indicating better credit. A score below 600 falls within the "poor" or "subprime" range, signifying a higher risk to lenders. This means that lenders perceive you as a higher risk of defaulting on loans or credit obligations.

2. Causes of Poor Credit:

Several factors can contribute to a credit score under 600:

- High Credit Utilization: Using a significant percentage (generally above 30%) of your available credit limits across all accounts.

- Late Payments: Consistently paying bills late or missing payments altogether negatively impacts your credit history. Even one late payment can have a detrimental effect.

- Debt Collection Accounts: Outstanding debts that have been sent to collections agencies seriously damage your credit score.

- Bankruptcies and Foreclosures: These significant financial events severely impact your credit profile, often leading to a substantially low score.

- Many Recent Credit Applications: Applying for multiple lines of credit in a short period can indicate a higher risk to lenders.

- Short Credit History: Lenders prefer to see a consistent and established track record of responsible credit usage. A short credit history can limit your score.

- Public Records: Negative information appearing on your credit report, such as judgments or tax liens, can significantly lower your score.

3. Consequences of a Low Credit Score:

The consequences of a credit score under 600 are far-reaching:

- High Interest Rates: Lenders charge higher interest rates on loans and credit cards to compensate for the perceived higher risk. This can make borrowing significantly more expensive.

- Credit Application Denials: Obtaining approval for loans, mortgages, or even credit cards becomes extremely difficult, if not impossible.

- Higher Insurance Premiums: Insurance companies often use credit scores to determine premiums. A low credit score can result in paying significantly more for auto, home, or renters insurance.

- Difficulty Renting an Apartment: Some landlords use credit checks as part of their tenant screening process. A poor credit score may prevent you from renting the desired apartment.

- Job Application Challenges: Certain employers conduct credit checks as part of their hiring process, particularly for positions involving financial responsibilities. A low score can negatively impact your chances.

- Limited Financial Opportunities: A low credit score restricts your access to various financial products and services, hindering your ability to manage your finances effectively.

4. Strategies for Improvement:

Rebuilding credit takes time and effort, but it’s achievable. The following steps can help improve your credit score:

- Pay Bills on Time: This is the single most important factor influencing your credit score. Set up automatic payments or reminders to avoid late payments.

- Reduce Credit Utilization: Keep your credit utilization ratio below 30%. Paying down existing debt is crucial.

- Dispute Errors: Carefully review your credit reports from all three major credit bureaus (Experian, Equifax, and TransUnion) for any errors or inaccuracies. Dispute any discrepancies promptly.

- Address Collection Accounts: Negotiate with creditors or collection agencies to settle outstanding debts. A paid collection account is better than an unpaid one.

- Become an Authorized User: Ask a trusted friend or family member with excellent credit to add you as an authorized user on their credit card. This can help build your credit history.

- Consider a Secured Credit Card: Secured credit cards require a security deposit, which serves as your credit limit. Responsible use of a secured card can help establish a positive credit history.

- Monitor Your Credit Regularly: Track your credit score and report regularly to identify any issues and address them quickly.

- Avoid Opening Multiple Accounts: Applying for multiple lines of credit in a short time frame can negatively affect your score. Only apply for credit when necessary.

Exploring the Connection Between Debt Management and Credit Scores Under 600:

The relationship between effective debt management and a credit score under 600 is paramount. High levels of debt, especially unsecured debt like credit card debt, are a major contributor to a low score.

Key Factors to Consider:

- Roles and Real-World Examples: Consider a person with multiple high-interest credit cards maxed out. This scenario directly leads to a high credit utilization ratio, and late payments are more likely, resulting in a poor credit score. In contrast, someone diligently paying down their debts and maintaining low credit utilization will see a positive impact on their score.

- Risks and Mitigations: Failing to address high debt levels increases the risk of further financial difficulties. Mitigations include creating a budget, prioritizing debt repayment (consider debt consolidation or balance transfers), and seeking professional financial advice.

- Impact and Implications: The long-term consequences of ignoring high debt levels include ongoing low credit scores, higher interest rates, and limited financial opportunities.

Conclusion: Reinforcing the Connection:

Effective debt management is essential for improving a credit score under 600. By addressing high debt, individuals can significantly improve their creditworthiness and unlock better financial opportunities.

Further Analysis: Examining Debt Consolidation in Greater Detail:

Debt consolidation involves combining multiple debts into a single loan, often with a lower interest rate. This can simplify repayments and potentially reduce the total amount of interest paid. However, it’s vital to research options carefully and ensure the new loan terms are beneficial.

FAQ Section: Answering Common Questions About Credit Scores Under 600:

- What is a credit score? A credit score is a numerical representation of your creditworthiness, based on your credit history.

- How is my credit score calculated? Credit scores are calculated using various factors including payment history, amounts owed, length of credit history, new credit, and credit mix.

- How long does it take to improve my credit score? Improving a credit score takes time and consistent effort. It can take several months or even years to see significant improvements.

- Can I get a loan with a credit score under 600? While it's more difficult, some lenders offer loans to individuals with poor credit, but they usually come with higher interest rates.

- What if I can't afford to pay my debts? If you're struggling to manage your debt, contact a credit counselor for guidance and potential debt management solutions.

Practical Tips: Maximizing the Benefits of Credit Repair:

- Create a Realistic Budget: Track your income and expenses to identify areas where you can reduce spending and allocate more funds towards debt repayment.

- Prioritize Debt Payments: Focus on paying down high-interest debts first to minimize the total interest paid.

- Negotiate with Creditors: Contact creditors to discuss potential payment arrangements or settlement options if you're facing financial hardship.

- Seek Professional Financial Advice: Consult a financial advisor for personalized guidance and support in developing a comprehensive financial plan.

Final Conclusion: Wrapping Up with Lasting Insights:

A credit score under 600 presents challenges, but it's not insurmountable. Through proactive steps, diligent debt management, and consistent effort, individuals can improve their creditworthiness and unlock better financial opportunities. Remember, building good credit is a long-term commitment, requiring patience and perseverance. The rewards, however, are significant, leading to a more stable and secure financial future.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Does A Credit Score Under 600 Mean . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.