What Does A Credit Score Of 600 Mean In South Africa

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Decoding a 600 Credit Score in South Africa: Understanding Your Financial Health

What does a credit score of 600 truly mean for your financial future in South Africa? A score of 600 signals a need for careful attention and proactive steps to improve your creditworthiness.

Editor’s Note: This article on understanding a 600 credit score in South Africa was published today, providing readers with the most up-to-date information and insights into navigating the South African credit landscape.

Why Your Credit Score Matters: Navigating the South African Financial System

In South Africa, a good credit score is the key to unlocking numerous financial opportunities. It influences your ability to secure loans (home loans, personal loans, vehicle finance), credit cards with favorable interest rates, and even insurance premiums. A healthy credit score reflects responsible financial behavior, signaling to lenders that you're a low-risk borrower. Conversely, a poor credit score can severely limit your financial options, leading to higher interest rates, rejected applications, and difficulties accessing essential credit facilities.

Overview: What This Article Covers

This article provides a comprehensive overview of a 600 credit score in the South African context. We'll delve into the meaning of this score, its implications for accessing credit, steps to improve it, and address common misconceptions. Readers will gain actionable insights and a clear understanding of how to navigate their financial journey effectively.

The Research and Effort Behind the Insights

This article draws upon extensive research, incorporating data from reputable credit bureaus operating in South Africa, including TransUnion and Experian. Information regarding credit scoring methodologies, common factors influencing scores, and strategies for improvement is based on publicly available resources and industry best practices.

Key Takeaways:

- Understanding the South African Credit Scoring System: A detailed explanation of how credit scores are calculated and the factors that contribute to them.

- Implications of a 600 Credit Score: The practical consequences of having a 600 score, including limitations on credit access and potential financial disadvantages.

- Strategies for Improvement: Actionable steps to enhance your credit score, including paying down debt, maintaining consistent payment history, and monitoring your credit report.

- Common Misconceptions: Addressing common myths and misunderstandings surrounding credit scores and credit repair.

Smooth Transition to the Core Discussion

Having established the significance of credit scores in South Africa, let's now explore what a 600 score represents and what it means for individuals seeking financial opportunities.

Exploring the Key Aspects of a 600 Credit Score

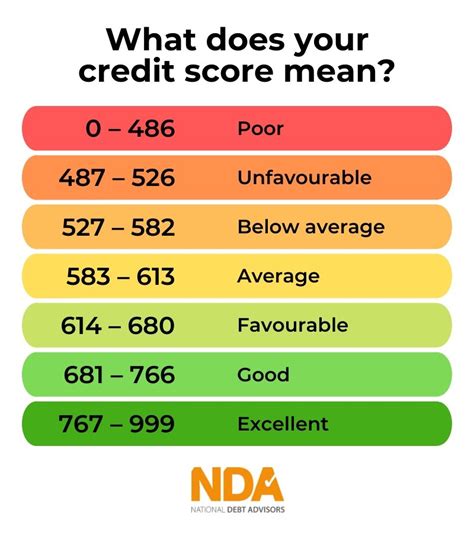

Definition and Core Concepts: In South Africa, credit scores typically range from 300 to 900. While the exact scoring model varies slightly between credit bureaus, a score of 600 generally falls within the "subprime" or "fair" range. This indicates a level of credit risk that is considered higher than average. Lenders may view borrowers with this score as having a greater chance of defaulting on their loan repayments.

Implications for Credit Access: A 600 credit score significantly restricts access to favorable credit terms. Applying for a home loan, car loan, or credit card might result in rejection or the offering of loans with very high interest rates. These higher interest rates can substantially increase the overall cost of borrowing, making it more difficult to manage debt. Insurance companies may also charge higher premiums due to the perceived higher risk.

Challenges and Solutions: The primary challenges associated with a 600 credit score are limited access to credit and higher borrowing costs. To overcome this, individuals need to focus on improving their creditworthiness. This involves paying off existing debts, maintaining consistent payment history, and keeping credit utilization low.

Impact on Financial Well-being: A low credit score doesn't just impact immediate borrowing; it can have long-term financial consequences. It can affect your ability to rent an apartment, secure employment in certain sectors, and even obtain certain types of insurance. Building a positive credit history is crucial for long-term financial stability.

Exploring the Connection Between Payment History and a 600 Credit Score

Payment history is arguably the most significant factor influencing credit scores. A 600 score often suggests a history of missed or late payments on existing credit accounts. This demonstrates a lack of consistent financial responsibility, making lenders hesitant to extend credit.

Roles and Real-World Examples: Let's consider an individual with a 600 score who applies for a personal loan. The lender reviews their credit report and sees a pattern of late payments on previous credit accounts. This instantly raises red flags, increasing the perceived risk. The lender might reject the application or offer a loan with a significantly higher interest rate to compensate for the perceived risk.

Risks and Mitigations: The risk associated with a poor payment history is the accumulation of debt and potential damage to creditworthiness. To mitigate this, prioritize paying bills on time and setting up automatic payments to prevent missed deadlines.

Impact and Implications: The long-term impact of a poor payment history can be substantial, making it harder to secure credit in the future and potentially impacting other aspects of financial life, such as securing insurance or renting a property.

Key Factors to Consider in Improving a 600 Credit Score

Beyond payment history, several other factors contribute to a credit score. These include:

- Credit utilization: The amount of credit used relative to the total credit available. Keeping credit utilization low (ideally below 30%) demonstrates responsible credit management.

- Credit age: The length of time credit accounts have been open. Longer credit history generally results in a higher score.

- Credit mix: Having a variety of credit accounts (credit cards, loans, etc.) shows a diverse credit profile.

- Inquiries: Too many credit applications in a short period can negatively impact scores.

Practical Tips for Improving Your Credit Score

- Pay all bills on time: This is the single most effective way to improve your credit score.

- Reduce credit utilization: Pay down existing debt to lower the percentage of credit used.

- Avoid opening multiple new accounts: Limit credit applications to only when necessary.

- Check your credit report regularly: Monitor for errors or fraudulent activity.

- Consider a credit-builder loan: These loans are specifically designed to help individuals build their credit history.

- Seek professional help: If you’re struggling to manage your debt, consider seeking financial advice.

Further Analysis: Debt Management and Its Impact on Credit Scores

High levels of debt significantly impact credit scores. Debt-to-income ratio (DTI), a key indicator of financial health, plays a crucial role. A high DTI suggests that a considerable portion of your income is allocated to debt repayment, potentially making lenders wary of your ability to manage additional debt.

Effective debt management strategies include creating a budget, prioritizing high-interest debt, consolidating debts, and negotiating payment plans with creditors. Consider debt counseling services if overwhelmed by debt.

FAQ Section: Answering Common Questions About Credit Scores in South Africa

Q: How often are credit scores updated? A: Credit scores are typically updated monthly, reflecting recent credit activity.

Q: Can errors on my credit report affect my score? A: Yes, inaccuracies on your credit report can negatively impact your score. Dispute any errors with the credit bureau immediately.

Q: How long does it take to improve my credit score? A: Improving your credit score takes time and consistent effort. Significant improvements might take several months or even years.

Q: What is the difference between TransUnion and Experian credit scores? A: While both are major credit bureaus in South Africa, they may use slightly different scoring models and data sources, resulting in minor score variations.

Q: Can I get my credit report for free? A: Yes, you are entitled to a free credit report from each credit bureau annually.

Final Conclusion: Taking Control of Your Financial Future

A 600 credit score in South Africa presents a challenge but not an insurmountable obstacle. By understanding its implications, actively managing debt, and diligently following responsible financial practices, individuals can significantly improve their creditworthiness and unlock future financial opportunities. Remember, consistent effort, responsible financial behavior, and proactive steps are key to building a strong credit history and securing a secure financial future.

Latest Posts

Latest Posts

-

Actuarial Deficit Definition

Apr 30, 2025

-

Actuarial Basis Of Accounting Definition

Apr 30, 2025

-

Actuarial Analysis Definition

Apr 30, 2025

-

Actuarial Age Definition

Apr 30, 2025

-

Actual Cash Value Acv Definition Example Vs Replacementa

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Does A Credit Score Of 600 Mean In South Africa . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.