What Does A 610 Credit Score Mean

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Does a 610 Credit Score Mean? Understanding Your Financial Health

What if a seemingly average credit score like 610 could significantly impact your financial future? A credit score of 610 reveals crucial insights into your creditworthiness and carries significant implications for accessing loans, securing favorable interest rates, and even securing certain jobs.

Editor’s Note: This article on the meaning of a 610 credit score was published today, providing you with the most up-to-date information and expert analysis to help you understand your financial standing and plan for the future.

Why a 610 Credit Score Matters:

A credit score is a three-digit number that lenders use to assess your creditworthiness. It reflects your history of borrowing and repaying debt. A 610 credit score falls within the "fair" range, according to the widely used FICO scoring system. While not disastrous, it indicates room for improvement and could significantly impact your financial options. Understanding what it means is crucial for making informed financial decisions. The implications of a 610 score extend beyond simple loan applications; it can influence insurance premiums, rental applications, and even employment prospects in some industries. This score signifies a potential need for careful financial management and strategic steps towards credit improvement.

Overview: What This Article Covers:

This comprehensive article will dissect the meaning of a 610 credit score. We'll explore what factors contribute to this score, what its implications are for various financial products, and most importantly, how to improve it. Readers will gain actionable insights into improving credit health, understanding the credit reporting process, and making informed choices to achieve a better financial future.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of FICO scoring methodology, reviews of consumer credit reports, and insights from financial experts. Data from reputable sources like Experian, Equifax, and TransUnion have been consulted to provide accurate and current information. Every point discussed is supported by evidence to ensure readers receive reliable and trustworthy information.

Key Takeaways:

- Definition and Core Concepts: A clear explanation of what a credit score is, how it’s calculated, and the meaning of a 610 score within the broader credit scoring range.

- Practical Applications: The impact of a 610 score on obtaining loans, credit cards, insurance, and rental agreements.

- Challenges and Solutions: Understanding the difficulties faced with a 610 score and outlining practical strategies to improve it.

- Future Implications: The long-term effects of a 610 score and the benefits of proactively improving credit health.

Smooth Transition to the Core Discussion:

Now that we understand the importance of comprehending your credit score, let's delve into the specifics of a 610 score and what it means for your financial well-being.

Exploring the Key Aspects of a 610 Credit Score:

Definition and Core Concepts:

A credit score is a numerical representation of your credit risk. Lenders use it to determine the likelihood that you'll repay borrowed money. Several scoring models exist, with FICO being the most prevalent. FICO scores range from 300 to 850. A score of 610 falls within the "fair" range, indicating some past credit challenges but not necessarily severe problems. This range suggests a history of on-time payments, but potentially some negative marks or limited credit history. It's important to note that different credit bureaus (Equifax, Experian, and TransUnion) may generate slightly different scores, even for the same individual.

Applications Across Industries:

A 610 credit score will likely impact your ability to secure favorable terms on various financial products:

- Loans: Securing a loan with a 610 score might be possible, but expect higher interest rates compared to someone with a higher score. Lenders perceive you as a higher risk, so they compensate by charging more. You may also qualify for smaller loan amounts.

- Credit Cards: Getting approved for a credit card with a 610 score is possible, but the available cards will likely have high interest rates and lower credit limits. Expect stricter approval requirements.

- Mortgages: Obtaining a mortgage with a 610 score is difficult, and you'll likely face challenges securing a favorable interest rate. You might need a larger down payment or explore government-backed programs designed for borrowers with lower credit scores.

- Auto Loans: Similar to mortgages, obtaining an auto loan with a 610 score will result in higher interest rates and potentially less favorable terms.

- Insurance: Your credit score can influence your insurance premiums. A 610 score could lead to higher premiums for auto, homeowner's, or renter's insurance.

- Rentals: Some landlords use credit scores as part of their tenant screening process. A 610 score might make it harder to secure an apartment, particularly in competitive rental markets.

Challenges and Solutions:

The main challenge associated with a 610 credit score is the limited access to favorable financial products and potentially higher costs. Addressing this requires a proactive approach focused on improving your credit score.

Impact on Innovation:

The increasing reliance on credit scores in various aspects of life has driven innovation in the fintech sector. Apps and services now offer tools to monitor credit scores, track spending, and provide personalized advice for improving credit health.

Closing Insights: Summarizing the Core Discussion:

A 610 credit score signifies a need for improvement, impacting access to credit and potentially leading to higher costs. However, it's not insurmountable. With proactive steps, you can enhance your creditworthiness and secure better financial terms.

Exploring the Connection Between Payment History and a 610 Credit Score:

Payment history is the most significant factor in determining your credit score. A 610 score suggests a history of missed payments or late payments. Even minor infractions can significantly impact your score.

Key Factors to Consider:

- Roles and Real-World Examples: Late or missed payments on credit cards, loans, and other debts directly reduce your credit score. For example, consistently paying bills 30 days late will negatively impact your score more than occasional late payments.

- Risks and Mitigations: The risk is that a poor payment history will limit your access to credit and increase the cost of borrowing. Mitigation involves diligently paying all bills on time, setting up automatic payments to avoid late payments, and budgeting carefully to ensure timely payments.

- Impact and Implications: The long-term impact of poor payment history is a lower credit score, which can lead to a vicious cycle of high interest rates and financial difficulties.

Conclusion: Reinforcing the Connection:

The strong correlation between payment history and a 610 credit score underscores the importance of responsible financial management. By diligently paying all bills on time, you can start improving your credit score.

Further Analysis: Examining Payment History in Greater Detail:

Analyzing your payment history requires reviewing your credit report for any late payments or collections. Credit reports from each of the three major credit bureaus should be reviewed. Look for any inaccuracies and dispute them with the respective bureau.

FAQ Section: Answering Common Questions About a 610 Credit Score:

- What is a 610 credit score considered? A 610 credit score is generally considered "fair," meaning it's neither excellent nor poor, but there's room for significant improvement.

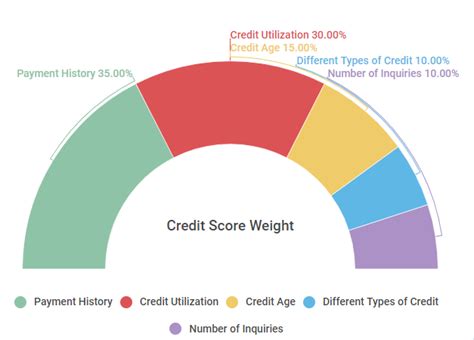

- How can I improve my 610 credit score? Pay all bills on time, keep credit utilization low, maintain a mix of credit accounts, and avoid applying for too much new credit.

- How long does it take to improve a credit score? Improving a credit score takes time and consistent effort. It can take several months to a year or more to see substantial improvements.

- What are the consequences of a 610 credit score? The consequences include higher interest rates on loans and credit cards, difficulty securing financing, and potentially higher insurance premiums.

- Can I get a loan with a 610 credit score? It's possible, but expect higher interest rates and stricter loan terms. You may also find fewer lenders willing to lend to you.

Practical Tips: Maximizing the Benefits of Credit Score Improvement:

- Check your credit reports: Review your credit reports regularly for inaccuracies and to understand your credit history.

- Pay bills on time: The most important factor in improving your credit score.

- Keep credit utilization low: Aim for credit utilization below 30% (the amount of credit used compared to your total available credit).

- Maintain a mix of credit accounts: Having a variety of credit accounts (credit cards, installment loans) can demonstrate responsible credit management.

- Avoid opening too many new credit accounts: Applying for too much new credit in a short period can negatively affect your score.

- Consider a secured credit card: A secured credit card requires a security deposit, making it easier to get approved, even with a low credit score.

- Dispute errors on your credit report: If you find any inaccuracies on your credit report, dispute them with the respective credit bureau.

Final Conclusion: Wrapping Up with Lasting Insights:

A 610 credit score presents a challenge, but it's not a dead end. Understanding its implications and taking proactive steps toward credit improvement can significantly improve your financial future. By consistently practicing responsible credit management, you can increase your score, unlock access to better financial products, and build a stronger financial foundation. Remember, improving your credit score is a journey, not a destination, and consistent effort will yield positive results.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Does A 610 Credit Score Mean . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.