What Credit Score Do You Need For Chase Freedom Rise

adminse

Apr 07, 2025 · 8 min read

Table of Contents

What Credit Score Do You Need for a Chase Freedom Rise Credit Card?

Securing a Chase Freedom Rise card requires a strategic approach to credit building, and understanding the score range is key.

Editor’s Note: This article on the Chase Freedom Rise credit card and its credit score requirements was published [Date]. This information is current to the best of our knowledge but credit card requirements can change. Always check directly with Chase for the most up-to-date details.

Why a Chase Freedom Rise Credit Card Matters:

The Chase Freedom Rise is a popular credit card offering due to its attractive features for consumers building credit. It offers cash back rewards, no annual fee, and is designed to help individuals establish a positive credit history. Understanding the credit score needed for approval is critical for prospective applicants to manage their expectations and increase their chances of success. Its accessibility to those with limited credit history makes it a valuable tool for financial growth.

Overview: What This Article Covers:

This comprehensive guide explores the credit score requirements for obtaining a Chase Freedom Rise credit card. We’ll examine various factors influencing approval beyond just your credit score, discuss strategies for improving creditworthiness, and provide answers to frequently asked questions.

The Research and Effort Behind the Insights:

This article draws upon publicly available information from Chase, credit reporting agencies, and financial experts. We've analyzed numerous consumer experiences and credit reports to provide an accurate reflection of the approval process. The information presented is intended to be informative and should not be considered financial advice. Always consult with a financial professional for personalized guidance.

Key Takeaways:

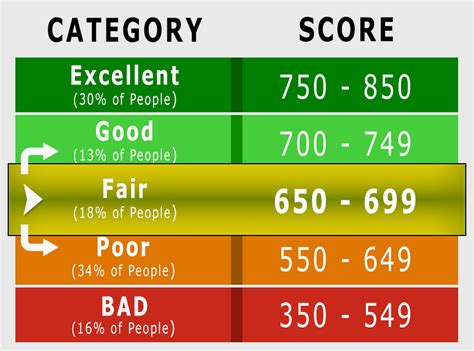

- Credit Score Range: While Chase doesn't publicly state a minimum credit score, data suggests approval is most likely with a score above 670.

- Factors Beyond Credit Score: Income, debt-to-income ratio, and credit history length are also considered.

- Improving Your Credit Score: Strategies include paying bills on time, reducing debt, and monitoring your credit reports.

- Alternative Options: If you're denied, explore other credit-building options.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding credit score requirements for the Chase Freedom Rise, let's delve into the specifics.

Exploring the Key Aspects of Chase Freedom Rise Credit Score Requirements:

1. The Elusive Minimum Credit Score:

Chase does not publicly disclose a specific minimum credit score for the Freedom Rise card. This is a common practice among many credit card issuers, as the approval process considers numerous factors beyond just a numerical score. However, based on widespread consumer experience and analysis of credit score data, a credit score generally above 670 significantly increases the likelihood of approval.

2. Beyond the Numbers: Other Crucial Factors:

While a good credit score is essential, several other factors significantly influence your chances of approval for the Chase Freedom Rise:

- Credit History Length: The length of your credit history matters. Lenders prefer to see a consistent record of responsible credit use over time. Even with a good score, a short credit history might raise concerns.

- Debt-to-Income Ratio (DTI): This ratio represents the percentage of your monthly income used to pay debts. A lower DTI indicates better financial stability and increases your approval odds.

- Income: Chase will assess your income to ensure you can manage the credit card responsibly. A stable and sufficient income demonstrates your ability to repay borrowed funds.

- Recent Credit Applications: Applying for numerous credit accounts within a short period can negatively impact your score (a phenomenon known as "rate shopping"). This suggests high credit risk to lenders.

- Types of Credit: A mix of credit types (credit cards, installment loans) shows diversification in credit management, which can be viewed favorably.

- Payment History: Late or missed payments significantly damage your credit score and reduce your chances of approval.

3. Building and Improving Your Credit Score:

If your credit score falls below the range where approval is most likely, proactive steps can improve your chances:

- Pay Bills On Time: This is the most crucial factor influencing your credit score. Consistent on-time payments demonstrate responsible credit management.

- Reduce Existing Debt: Lowering your outstanding debt reduces your debt-to-income ratio, making you a less risky borrower. Consider strategies like debt consolidation or balance transfers.

- Monitor Your Credit Reports: Regularly check your credit reports from all three major bureaus (Equifax, Experian, and TransUnion) to identify and dispute any inaccuracies. Services like AnnualCreditReport.com provide free access to your reports.

- Use Credit Wisely: Avoid maxing out your credit cards. Keeping your credit utilization ratio (the amount of credit you use compared to your available credit) low is vital for a healthy score. Aim to keep it below 30%.

- Consider a Secured Credit Card: If you have limited or poor credit, a secured credit card (requiring a security deposit) can be a stepping stone to building credit. Responsible use of a secured card can help you improve your score over time.

4. Alternative Options If Denied:

If your application for the Chase Freedom Rise is denied, don't be discouraged. Explore alternative options:

- Secured Credit Cards: As mentioned above, these cards require a security deposit but can be a good way to build credit.

- Credit Builder Loans: These loans are specifically designed to help you build credit. Regular on-time payments will positively impact your score.

- Becoming an Authorized User: Being added as an authorized user on a credit card with a good payment history can positively influence your credit score. However, ensure the primary cardholder has a strong credit history.

Exploring the Connection Between Credit Utilization and Chase Freedom Rise Approval:

Credit utilization is the percentage of your available credit that you're using. It's a significant factor influencing your credit score, and consequently, your chances of getting approved for the Chase Freedom Rise. A high credit utilization ratio (e.g., using 80% of your available credit) signals high debt, making lenders hesitant to approve your application. Conversely, a low credit utilization ratio (ideally below 30%) shows responsible credit management, increasing your approval likelihood.

Key Factors to Consider:

- Roles: Credit utilization plays a crucial role in determining your creditworthiness.

- Real-World Examples: Someone with multiple credit cards and high utilization is less likely to be approved than someone with lower utilization.

- Risks and Mitigations: High utilization poses a significant risk; mitigation involves paying down debt to lower the ratio.

- Impact and Implications: Maintaining low utilization is crucial for maintaining a healthy credit score and improving your chances of approval for future credit products.

Conclusion: Reinforcing the Connection:

The connection between credit utilization and Chase Freedom Rise approval is undeniable. By keeping your credit utilization low and managing your debt responsibly, you significantly increase your chances of approval for the card.

Further Analysis: Examining Credit History Length in Greater Detail:

Credit history length signifies the duration of your borrowing history. A longer history, marked by consistent on-time payments, conveys stability and reliability to lenders. Even if your credit score is within the acceptable range, a very short credit history might cause hesitation among lenders like Chase. Building a longer history requires consistent and responsible credit use over time.

FAQ Section: Answering Common Questions About Chase Freedom Rise Credit Score:

Q: What is the absolute minimum credit score needed for a Chase Freedom Rise card?

A: Chase doesn't disclose a specific minimum. However, scores above 670 significantly improve approval chances.

Q: If I have a low credit score, am I completely out of luck?

A: Not necessarily. Explore strategies to improve your score, and consider alternative options like secured credit cards or credit builder loans.

Q: How long does it take to get approved for a Chase Freedom Rise?

A: The approval process typically takes a few minutes to a few days, depending on the verification process.

Q: What happens if my application is denied?

A: Chase will provide a reason for denial. Work on improving your credit profile and try again later, or consider alternative credit-building options.

Practical Tips: Maximizing the Benefits of Applying for a Chase Freedom Rise:

- Check Your Credit Reports: Review your reports from all three bureaus for errors or areas for improvement.

- Pay Down Debt: Lower your credit utilization and overall debt levels.

- Improve Your DTI: Increase your income or reduce expenses to improve your debt-to-income ratio.

- Avoid Multiple Applications: Don't apply for numerous credit cards within a short time frame.

- Be Patient: If denied, continue working on your credit and reapply later.

Final Conclusion: Wrapping Up with Lasting Insights:

Obtaining a Chase Freedom Rise credit card requires a strategic understanding of credit scores and associated factors. While a good credit score is crucial, other elements like credit history length, debt-to-income ratio, and payment history also significantly influence approval. By proactively improving your credit profile and understanding the requirements, you significantly enhance your chances of securing this valuable financial tool. Remember, building a strong credit history is a marathon, not a sprint. Consistent responsible credit management will ultimately benefit you in the long run.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about What Credit Score Do You Need For Chase Freedom Rise . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.