What Can I Get With A 700 Credit Score

adminse

Apr 07, 2025 · 7 min read

Table of Contents

What Can You Get with a 700 Credit Score? Unlocking Financial Opportunities

What if your credit score opened doors to a world of financial advantages? A 700 credit score is a significant achievement, offering access to a range of financial products and services that might otherwise be out of reach.

Editor’s Note: This article provides up-to-date information on the financial opportunities available to individuals with a 700 credit score. The information is based on current industry standards and practices, but individual experiences may vary based on lender policies and other factors.

Why a 700 Credit Score Matters: Relevance, Practical Applications, and Industry Significance

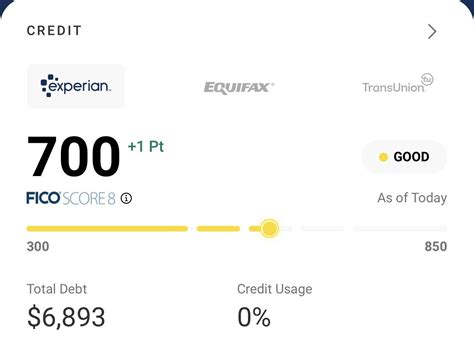

A 700 credit score falls firmly into the "good" range, according to the widely used FICO scoring system. This means you've demonstrated responsible credit management, paying your bills on time and maintaining manageable levels of debt. This responsible behavior translates into tangible benefits, significantly impacting your access to loans, credit cards, insurance rates, and more. Lenders view a 700 score as a lower-risk borrower, leading to more favorable terms and increased approval odds. Understanding what you can achieve with this score is crucial for making informed financial decisions and maximizing your financial well-being.

Overview: What This Article Covers

This article delves into the diverse financial landscape available to those with a 700 credit score. We will explore the types of loans you can qualify for, the credit card options available, potential savings on insurance, and other financial advantages. Furthermore, we'll discuss factors beyond the credit score that influence lender decisions and offer practical tips for maximizing your financial potential.

The Research and Effort Behind the Insights

This article is based on extensive research, drawing upon data from reputable credit reporting agencies, financial institutions, and industry experts. Information on interest rates, loan terms, and credit card features is current as of the publication date but is subject to change. We strive to present accurate and unbiased information to empower readers in their financial planning.

Key Takeaways:

- Access to a Wider Range of Financial Products: A 700 credit score unlocks a significantly broader array of financial options.

- Lower Interest Rates and Fees: Lenders offer more competitive interest rates and fees to individuals with good credit.

- Improved Approval Odds: The likelihood of loan and credit card applications being approved increases substantially.

- Enhanced Bargaining Power: A good credit score gives you a stronger negotiating position when applying for credit.

- Potential Savings on Insurance: Good credit can translate into lower premiums for auto, home, and renters insurance.

Smooth Transition to the Core Discussion:

Having established the significance of a 700 credit score, let's now examine the specific financial opportunities it unlocks.

Exploring the Key Aspects of a 700 Credit Score:

1. Loan Opportunities:

With a 700 credit score, you're in a strong position to secure various loans, including:

- Personal Loans: Used for debt consolidation, home improvements, or other personal expenses, you'll likely qualify for lower interest rates and more favorable repayment terms compared to those with lower scores.

- Auto Loans: Securing a car loan becomes significantly easier with a 700 score. You'll likely be offered lower interest rates, potentially saving thousands of dollars over the loan's lifetime.

- Mortgages: While a 700 score isn't the highest possible, it's generally sufficient to qualify for a mortgage. You'll have access to a wider range of mortgage products and might be able to negotiate a lower interest rate. However, other factors like your income and debt-to-income ratio also play a crucial role.

- Home Equity Loans and Lines of Credit (HELOCs): If you own a home, a 700 credit score increases your chances of securing a home equity loan or HELOC, allowing you to borrow against your home's equity.

2. Credit Card Options:

A 700 credit score opens doors to a wider selection of credit cards, including those with:

- Lower Interest Rates: Cards with lower APRs become accessible, reducing the cost of carrying a balance.

- Rewards Programs: You can qualify for credit cards that offer valuable rewards such as cash back, travel points, or merchandise.

- Higher Credit Limits: Lenders are more likely to approve higher credit limits for individuals with good credit, providing greater financial flexibility.

- Premium Cards: You may be eligible for premium credit cards with added benefits like travel insurance, concierge services, and airport lounge access.

3. Insurance Savings:

Many insurance companies use credit scores to assess risk, and a good score often translates into lower premiums. You can potentially save money on:

- Auto Insurance: A 700 credit score can significantly reduce your auto insurance premiums.

- Homeowners Insurance: Similarly, homeowners insurance premiums are often lower for those with good credit.

- Renters Insurance: Even renters insurance premiums may be impacted by your credit score.

4. Renting an Apartment:

Landlords often check credit scores when considering rental applications. A 700 score greatly increases your chances of approval and may even improve your negotiating position for rent or lease terms.

Exploring the Connection Between Debt-to-Income Ratio and a 700 Credit Score:

The relationship between your debt-to-income (DTI) ratio and your ability to leverage a 700 credit score is crucial. Your DTI ratio represents the percentage of your monthly income that goes towards debt payments. Even with a 700 score, a high DTI ratio can negatively impact your loan approval chances and the interest rates offered. Lenders prefer borrowers with lower DTI ratios, indicating a greater capacity to manage debt.

Key Factors to Consider:

- Roles and Real-World Examples: A lower DTI ratio, even with a 700 credit score, can lead to approval for larger loans at lower interest rates. For example, someone with a 700 credit score and a 20% DTI might qualify for a larger mortgage than someone with the same credit score but a 40% DTI.

- Risks and Mitigations: A high DTI ratio can counteract the positive impact of a 700 credit score. Mitigation strategies include reducing existing debt, increasing income, or applying for smaller loans.

- Impact and Implications: Understanding your DTI ratio is essential for maximizing the benefits of your 700 credit score. A lower DTI ratio improves your borrowing power and access to more favorable loan terms.

Conclusion: Reinforcing the Connection:

The interplay between your DTI ratio and a 700 credit score highlights the importance of a holistic approach to financial management. While a good credit score is a significant asset, managing debt responsibly is equally crucial for achieving financial success.

Further Analysis: Examining Debt Management Strategies in Greater Detail:

Effective debt management is paramount for maintaining a good credit score and securing favorable financial terms. This involves strategies such as creating a realistic budget, prioritizing high-interest debt, exploring debt consolidation options, and consistently making on-time payments.

FAQ Section: Answering Common Questions About a 700 Credit Score:

Q: What is a good credit score?

A: A 700 credit score is generally considered "good," placing you in a favorable position for obtaining various financial products and services.

Q: How can I improve my credit score?

A: Focus on paying your bills on time, keeping your credit utilization low (the amount of credit you use relative to your available credit), and maintaining a diverse mix of credit accounts.

Q: What if I have a 700 credit score but am denied a loan?

A: While a 700 score significantly improves your chances, other factors such as income, employment history, and debt-to-income ratio can also influence lender decisions.

Q: Does my credit score affect my insurance premiums?

A: Yes, many insurance companies use credit scores to assess risk, and a good score can lead to lower premiums.

Practical Tips: Maximizing the Benefits of a 700 Credit Score:

- Shop Around: Compare offers from different lenders before making any financial decisions.

- Negotiate: Don't be afraid to negotiate interest rates and loan terms.

- Monitor Your Credit Report: Regularly check your credit reports for errors and inaccuracies.

- Maintain Good Credit Habits: Continue to practice responsible credit management to maintain your score.

Final Conclusion: Wrapping Up with Lasting Insights:

A 700 credit score represents a significant achievement, opening doors to a wide array of financial opportunities. By understanding the factors that influence lender decisions and utilizing effective debt management strategies, you can maximize the benefits of your good credit and achieve your financial goals. Remember, consistent responsible financial behavior is key to maintaining a healthy credit profile and securing a brighter financial future.

Latest Posts

Related Post

Thank you for visiting our website which covers about What Can I Get With A 700 Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.