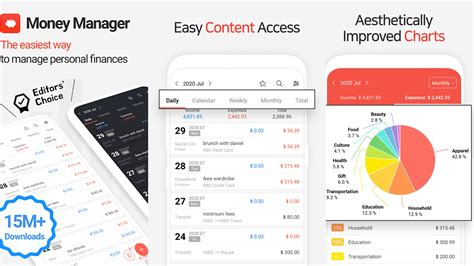

Top Rated Money Management Apps

adminse

Apr 06, 2025 · 8 min read

Table of Contents

What if effortless money management could unlock your financial goals?

Top-rated money management apps are revolutionizing personal finance, empowering individuals to take control of their spending, saving, and investing.

Editor’s Note: This article on top-rated money management apps was published today, offering readers up-to-date insights and reviews to help them choose the best app for their financial needs.

Why Money Management Apps Matter: Relevance, Practical Applications, and Industry Significance

In today's fast-paced digital world, managing personal finances effectively is more crucial than ever. The sheer volume of transactions – from online purchases to recurring subscriptions and investments – can quickly overwhelm even the most organized individuals. Money management apps offer a centralized, user-friendly platform to track spending, budget effectively, and plan for the future. Their relevance stems from their ability to simplify complex financial tasks, providing actionable insights that promote financial literacy and empower users to achieve their financial aspirations, whether it's saving for a down payment, paying off debt, or building a robust investment portfolio. The industry's growth underscores the increasing demand for convenient, accessible, and insightful personal finance tools.

Overview: What This Article Covers

This article delves into the world of top-rated money management apps, providing comprehensive reviews and comparisons of leading platforms. We’ll explore their key features, benefits, pricing models, and suitability for different user profiles. Readers will gain actionable insights to help them select the app that best aligns with their financial goals and technological preferences. We will also examine the importance of data security and privacy within these applications.

The Research and Effort Behind the Insights

This article is the result of extensive research, incorporating data from user reviews on platforms like the App Store and Google Play, expert opinions from financial advisors, and analyses of app features and functionalities. Every recommendation is supported by evidence, ensuring readers receive accurate and trustworthy information. We have considered factors like ease of use, security measures, available features, customer support, and pricing to create a balanced and comprehensive overview.

Key Takeaways: Summarize the Most Essential Insights

- Definition and Core Concepts: Understanding the basic functionalities of money management apps, including budgeting, expense tracking, and financial goal setting.

- Practical Applications: Exploring how these apps are used for various financial goals, such as debt reduction, saving for retirement, and investing.

- Comparative Analysis: Comparing the strengths and weaknesses of different top-rated apps based on their features and user experiences.

- Security and Privacy Considerations: Addressing the importance of data security and privacy when choosing a money management app.

- Choosing the Right App: Guidelines for selecting an app that aligns with individual needs and financial objectives.

Smooth Transition to the Core Discussion

With a clear understanding of why money management apps are essential in today's financial landscape, let's dive deeper into the key features and functionality of some of the top-rated applications available.

Exploring the Key Aspects of Top-Rated Money Management Apps

1. Budgeting and Expense Tracking: All top-rated apps offer robust budgeting and expense tracking features. Many allow users to categorize transactions automatically or manually, set budgets for different categories (e.g., groceries, entertainment, transportation), and receive alerts when approaching or exceeding budget limits. Some apps even leverage AI to predict spending patterns and offer personalized budgeting suggestions.

2. Financial Goal Setting: Setting financial goals is a crucial aspect of effective money management. Leading apps facilitate this process by allowing users to define specific goals (e.g., saving for a down payment, paying off student loans), setting target amounts, and establishing timelines. Many apps also provide progress tracking tools, visualizing the user's journey towards achieving their objectives.

3. Investment Tracking and Management: Some advanced apps integrate investment tracking and management features. Users can link their brokerage accounts to view their portfolio performance, track asset allocation, and even make trades directly within the app. These features are particularly beneficial for users who want a holistic view of their financial situation.

4. Debt Management Tools: For users struggling with debt, several apps offer specialized debt management tools. These tools help users track their debts, calculate minimum payments, explore different repayment strategies (e.g., snowball or avalanche method), and visualize the progress towards becoming debt-free.

5. Savings Goals and Automation: Many apps offer features to automate savings. Users can set up automatic transfers from their checking accounts to savings accounts, ensuring consistent contributions towards their financial goals. Some apps even provide "round-up" features, automatically rounding up transactions to the nearest dollar and transferring the difference to savings.

Examples of Top-Rated Money Management Apps:

While the "best" app depends heavily on individual needs and preferences, several consistently rank highly:

-

Mint: A well-known and widely used app, Mint provides comprehensive budgeting, expense tracking, and financial goal setting features. It’s free to use, supported by advertising, and integrates with numerous financial accounts.

-

Personal Capital: A more sophisticated option, Personal Capital caters to users with more complex financial situations. It offers advanced features like investment tracking, retirement planning tools, and wealth management advice. It’s free for basic features but has paid advisory services.

-

YNAB (You Need A Budget): YNAB takes a unique approach to budgeting, emphasizing zero-based budgeting where every dollar is assigned a purpose. While it has a subscription fee, many users find its methodology highly effective.

-

EveryDollar: Similar to YNAB in its zero-based approach, EveryDollar offers a more straightforward interface and a free version with limited features.

-

PocketGuard: This app focuses on showing users how much money they have left to spend after essential expenses are covered. It's a good option for those who need help understanding their disposable income.

Closing Insights: Summarizing the Core Discussion

Money management apps are no longer a luxury but a necessity for effective personal finance. Their ability to centralize financial information, automate tasks, and provide actionable insights empowers individuals to take control of their finances and achieve their financial goals. The diverse range of apps available caters to different needs and preferences, ensuring there’s a suitable option for everyone.

Exploring the Connection Between Data Security and Top-Rated Money Management Apps

Data security is paramount when choosing a money management app. These apps handle sensitive financial information, making robust security protocols essential. Users should look for apps that employ encryption to protect data both in transit and at rest, utilize two-factor authentication, and have a proven track record of protecting user data. Reading user reviews and checking the app's privacy policy are crucial steps to ensure data security and privacy.

Key Factors to Consider:

-

Roles and Real-World Examples: Several high-profile data breaches have highlighted the importance of robust security measures in financial apps. Choosing an app with a strong reputation for security is crucial to protect sensitive information.

-

Risks and Mitigations: The risks associated with poor security include identity theft, financial fraud, and unauthorized access to financial accounts. Mitigating these risks involves choosing reputable apps, enabling two-factor authentication, and regularly reviewing account activity for any suspicious transactions.

-

Impact and Implications: The impact of a data breach on a money management app can be severe, potentially leading to significant financial losses and reputational damage for both the app provider and its users.

Conclusion: Reinforcing the Connection

The relationship between data security and money management apps is inextricably linked. Choosing an app with strong security features is not just a matter of convenience; it's a crucial step in protecting personal finances.

Further Analysis: Examining User Reviews in Greater Detail

User reviews provide invaluable insights into the strengths and weaknesses of different money management apps. Analyzing reviews across multiple platforms (App Store, Google Play, etc.) provides a holistic perspective on user experience, app functionality, customer support, and security. Paying attention to recurring themes and concerns in user reviews can help identify potential red flags before downloading an app.

FAQ Section: Answering Common Questions About Top-Rated Money Management Apps

Q: Are money management apps safe?

A: Reputable money management apps employ robust security measures to protect user data. However, it's crucial to choose well-established apps with a strong track record of security and to enable available security features like two-factor authentication.

Q: How do I choose the right money management app for me?

A: Consider your financial goals, technological comfort level, and the features you need. Some apps are better suited for simple budgeting, while others offer advanced investment tracking and financial planning tools.

Q: Are money management apps free?

A: Some apps offer basic features for free, supported by advertising or in-app purchases. Others charge a subscription fee for access to premium features.

Q: Can I link multiple accounts to a money management app?

A: Most apps allow you to link multiple bank accounts, credit cards, and investment accounts to provide a comprehensive view of your finances.

Q: What if I have problems with the app?

A: Most reputable apps offer customer support through various channels, including email, phone, and online help resources.

Practical Tips: Maximizing the Benefits of Money Management Apps

-

Set Realistic Goals: Start with achievable goals and gradually increase the complexity of your budgeting and financial planning.

-

Regularly Review Your Finances: Make it a habit to check your app regularly to monitor your spending and progress towards your goals.

-

Utilize Automation Features: Leverage automation features like automatic savings transfers to build good financial habits.

-

Explore Advanced Features: As you become more comfortable, explore advanced features such as investment tracking and debt management tools.

-

Choose a Reputable App: Prioritize security and privacy when selecting a money management app.

Final Conclusion: Wrapping Up with Lasting Insights

Top-rated money management apps offer a powerful tool for individuals seeking to improve their financial well-being. By carefully considering individual needs and prioritizing data security, users can harness the power of these apps to achieve their financial goals, building a more secure and prosperous future. The journey to financial freedom starts with informed decision-making and leveraging the right tools – and money management apps are undoubtedly among the most impactful tools available today.

Latest Posts

Latest Posts

-

What Credit Score Do You Need To Get A Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Do You Need To Get Approved For Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Is Needed To Get A Tj Maxx Credit Card

Apr 08, 2025

-

How Much Will My Credit Score Go Down After Buying A Car

Apr 08, 2025

-

How Much Will My Credit Score Drop If I Buy A Car

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Top Rated Money Management Apps . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.