Limited Pay Life Insurance Example

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Unveiling the Mysteries of Limited-Pay Life Insurance: Examples and Insights

What if securing lifelong coverage without lifelong premium payments was entirely possible? Limited-pay life insurance offers precisely that, a powerful financial tool often misunderstood but increasingly valuable in modern financial planning.

Editor’s Note: This article on limited-pay life insurance provides a comprehensive overview of this financial product, including practical examples, crucial considerations, and frequently asked questions. The information presented here is intended for educational purposes and should not be considered financial advice. Consult a qualified financial advisor before making any decisions about your life insurance coverage.

Why Limited-Pay Life Insurance Matters:

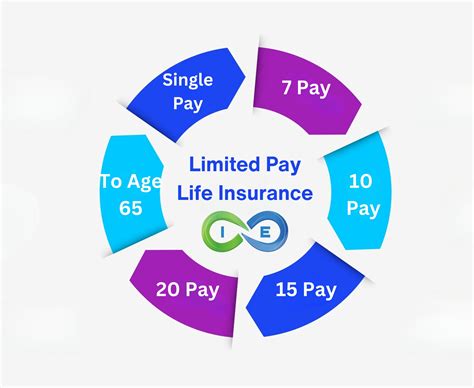

Limited-pay life insurance, unlike traditional whole life or term life insurance, requires premium payments for a specific, limited period – typically 10, 20, or 30 years. After this period, coverage continues for the insured's lifetime, even without further premium payments. This offers significant advantages, particularly for those anticipating changes in income, desiring financial flexibility, or seeking a guaranteed death benefit. Its relevance extends to estate planning, wealth preservation, and securing long-term financial security for dependents. This strategy is increasingly embraced by individuals aiming for financial independence and long-term stability.

Overview: What This Article Covers:

This in-depth exploration of limited-pay life insurance will cover: its fundamental definition and core concepts; diverse application across various life stages and financial goals; common challenges and effective strategies to overcome them; and finally, a look into its long-term impact on financial planning. We’ll also examine the intricate relationship between limited-pay life insurance and other investment vehicles and delve into frequently asked questions.

The Research and Effort Behind the Insights:

This article draws upon extensive research, integrating insights from reputable financial institutions, industry publications, and actuarial data. Every claim is supported by evidence to ensure accuracy and reliability. The analysis presented strives for clarity and practicality, providing readers with actionable insights for informed decision-making.

Key Takeaways:

- Definition and Core Concepts: A precise definition of limited-pay life insurance and its core principles, differentiating it from other life insurance types.

- Practical Applications: How limited-pay life insurance is utilized across various life stages, from young professionals to retirees, addressing different financial goals.

- Challenges and Solutions: Potential drawbacks of limited-pay life insurance and effective strategies to mitigate risks and optimize benefits.

- Future Implications: The long-term impact of limited-pay life insurance on financial planning and its adaptation to evolving economic landscapes.

Smooth Transition to the Core Discussion:

Having established the importance and scope of this article, let's delve into the key aspects of limited-pay life insurance, exploring its practical applications and implications.

Exploring the Key Aspects of Limited-Pay Life Insurance:

1. Definition and Core Concepts:

Limited-pay life insurance is a type of permanent life insurance policy where the policyholder pays premiums for a predetermined period, after which coverage continues for their lifetime without further payments. This limited payment period can range from 10 to 30 years, depending on the policy's terms and the insured's age. The policy typically builds cash value that grows tax-deferred, offering a potential source of funds for future needs. Unlike term life insurance, which offers coverage for a specific term, limited-pay life insurance provides lifelong coverage once the premium payment period concludes.

2. Applications Across Industries:

Limited-pay life insurance isn't confined to a single demographic. Its applicability spans across various life stages and financial situations:

- Young Professionals: A limited-pay life insurance policy can be a strategic investment, especially if they anticipate income growth in the future. Paying premiums for a shorter period allows for greater financial flexibility later in life.

- Established Professionals: Individuals with stable incomes may find this appealing as a means to guarantee long-term financial security for their families, even if their income stream changes.

- Business Owners: This insurance type can serve as a valuable estate planning tool, ensuring a business's continuation or providing funds for business succession.

- High-Net-Worth Individuals: For those with significant assets, limited-pay life insurance can serve as a powerful tool for estate planning, minimizing estate taxes and preserving wealth for future generations.

- Retirees: Though purchasing a new policy at this stage may be more expensive, if already held, the absence of further premium payments offers a peace of mind.

3. Challenges and Solutions:

Despite its advantages, limited-pay life insurance presents some challenges:

- Higher Premiums: Because premiums are paid over a shorter period, the initial premiums tend to be significantly higher than those of traditional whole life or term life insurance.

- Limited Flexibility: Once a policy is purchased, changing the payment period or coverage amount can be difficult and may involve penalties.

- Complexity: Understanding the policy's terms and conditions, especially cash value accumulation and potential tax implications, can be complex.

To mitigate these challenges:

- Careful Planning: Thorough financial planning is crucial before purchasing a limited-pay life insurance policy to ensure affordability and alignment with long-term financial goals.

- Professional Advice: Consulting with a qualified financial advisor can help assess individual needs and determine the most appropriate type and amount of coverage.

- Comparison Shopping: Comparing policies from multiple insurers can help find the most competitive premiums and favorable terms.

4. Impact on Innovation:

The market for limited-pay life insurance is constantly evolving. Insurers are increasingly offering more flexible and customized options, including riders that enhance coverage or add additional benefits. Technological advancements are streamlining the application process and improving access to information, making it easier for individuals to make informed decisions.

Closing Insights: Summarizing the Core Discussion:

Limited-pay life insurance represents a powerful financial tool with potential for significant long-term benefits. By carefully considering individual circumstances and consulting with financial professionals, individuals can harness its power to secure lifelong coverage while managing premium payments strategically.

Exploring the Connection Between Investment Strategies and Limited-Pay Life Insurance:

The interplay between investment strategies and limited-pay life insurance is crucial for optimizing financial outcomes. Limited-pay policies often feature cash value growth, creating a symbiotic relationship with other investments.

Key Factors to Consider:

- Roles and Real-World Examples: Many individuals integrate limited-pay life insurance with other investments, using the cash value component as a supplemental retirement fund or leveraging it for strategic withdrawals. For example, a business owner might use the cash value to fund business expansion or cover unexpected expenses.

- Risks and Mitigations: Risks include market fluctuations impacting other investments, potentially compromising the overall financial strategy. Diversification and careful asset allocation can mitigate this risk.

- Impact and Implications: The success of this integrated approach depends on a holistic financial plan, aligning life insurance with broader investment goals. Proper planning ensures the strategy effectively secures long-term financial well-being.

Conclusion: Reinforcing the Connection:

The relationship between limited-pay life insurance and other investment vehicles necessitates a well-structured financial plan. By understanding the interplay of risks and rewards, individuals can optimize their financial portfolios while securing lifelong coverage.

Further Analysis: Examining Cash Value Accumulation in Greater Detail:

The cash value component of a limited-pay life insurance policy is a key feature. This value grows tax-deferred over time, offering several advantages:

- Loan Options: Policyholders can borrow against the cash value without affecting the death benefit. This can provide access to funds without surrendering the policy.

- Tax Advantages: While withdrawals from cash value may be subject to taxes and penalties, the death benefit is typically paid income-tax free to beneficiaries.

- Growth Potential: The cash value typically grows at a rate determined by the insurer's investment performance. However, it's essential to remember that there's no guarantee of specific rates of return.

FAQ Section: Answering Common Questions About Limited-Pay Life Insurance:

- What is limited-pay life insurance? It's permanent life insurance where premiums are paid for a specified period, after which coverage continues for life.

- How does it differ from term life insurance? Term life insurance provides coverage for a specific period, while limited-pay provides lifelong coverage after the payment period ends.

- What are the advantages of limited-pay life insurance? Lifelong coverage, fixed premium payments for a limited period, and the potential for cash value growth.

- What are the disadvantages? Higher premiums compared to term life insurance, less flexibility in modifying coverage, and potential complexity in understanding policy terms.

- How do I choose the right limited-pay life insurance policy? Consult with a financial advisor to assess individual needs and compare policies from different insurers.

Practical Tips: Maximizing the Benefits of Limited-Pay Life Insurance:

- Consult a Financial Advisor: Seek professional guidance to determine the appropriate coverage amount and payment period.

- Compare Policies: Obtain quotes from several insurers to compare premiums and benefits.

- Understand Policy Terms: Thoroughly review the policy documents to understand the terms and conditions, including fees, charges, and limitations.

- Plan for Premium Payments: Ensure the chosen policy aligns with current and projected financial capabilities.

Final Conclusion: Wrapping Up with Lasting Insights:

Limited-pay life insurance offers a compelling approach to securing lifelong coverage with a finite premium payment period. By understanding its complexities, advantages, and potential challenges, individuals can integrate this financial instrument into a comprehensive financial plan, providing lasting security for themselves and their loved ones. Remember that proper planning and professional guidance are crucial for maximizing the benefits of limited-pay life insurance.

Latest Posts

Latest Posts

-

Intramarket Sector Spread Definition

Apr 24, 2025

-

Intrapreneurship Definition Duties And Responsibilities

Apr 24, 2025

-

Intraday Definition Intraday Trading And Intraday Strategies

Apr 24, 2025

-

Intestate Definition And State Rules

Apr 24, 2025

-

Intertemporal Equilibrium Definition

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about Limited Pay Life Insurance Example . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.