Late Fee Charges

adminse

Apr 03, 2025 · 9 min read

Table of Contents

The Sticky Subject of Late Fee Charges: A Comprehensive Guide

What if the seemingly innocuous late fee charge is actually a complex web of legal, ethical, and financial considerations? This often-overlooked aspect of business and personal finance holds significant implications for both consumers and organizations.

Editor’s Note: This article on late fee charges has been published today, providing readers with the most up-to-date information and legal considerations surrounding this pervasive practice.

Why Late Fee Charges Matter: Relevance, Practical Applications, and Industry Significance

Late fee charges, seemingly small in individual instances, represent a substantial revenue stream for businesses across numerous sectors. From credit card companies and utility providers to landlords and subscription services, the consistent application of these fees significantly impacts their bottom lines. For consumers, these charges can quickly escalate, leading to significant financial strain and even impacting credit scores. Understanding the intricacies of late fees – their justification, legality, and potential pitfalls – is crucial for both businesses aiming for ethical and compliant practices, and consumers seeking to avoid unnecessary financial burdens. The ramifications extend beyond individual transactions; they influence consumer behavior, contribute to economic inequality, and shape the overall landscape of financial responsibility.

Overview: What This Article Covers

This article delves into the multifaceted world of late fee charges, exploring their legal frameworks, ethical implications, industry practices, and consumer protections. Readers will gain a comprehensive understanding of how these fees are determined, the potential consequences of late payments, and strategies for both businesses to implement fair policies and consumers to avoid incurring them. We'll examine specific examples across various industries and explore the future trends in late fee management.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon legal statutes, industry reports, consumer advocacy publications, and case studies. Data points regarding the prevalence and average amounts of late fees across various industries are included, along with analysis of relevant court cases and regulatory decisions. The aim is to provide readers with accurate, unbiased, and actionable information.

Key Takeaways:

- Definition and Core Concepts: A clear definition of late fees, including their purpose and legal basis.

- Practical Applications: How late fees are implemented across different industries (credit cards, utilities, rent, subscriptions, etc.).

- Challenges and Solutions: Examining the ethical and practical challenges associated with late fees and potential solutions for fair and transparent practices.

- Future Implications: Exploring potential changes in legislation, technology, and consumer expectations regarding late fees.

Smooth Transition to the Core Discussion:

Having established the importance of understanding late fee charges, let's now explore their key aspects in detail, examining the legal framework, ethical considerations, and industry best practices.

Exploring the Key Aspects of Late Fee Charges

1. Definition and Core Concepts:

A late fee is a penalty charge imposed for the failure to make a payment by a pre-determined deadline. These fees are designed to incentivize timely payments and compensate the creditor for administrative costs associated with late payments and potential losses due to delayed revenue. The legality and fairness of these fees often hinge on whether they are clearly disclosed, reasonably calculated, and proportionate to the actual costs incurred. The absence of clear communication regarding late fee policies can lead to disputes and legal challenges.

2. Applications Across Industries:

-

Credit Cards: Late fees on credit cards are a significant source of revenue for credit card issuers. These fees are typically a fixed percentage of the minimum payment due or a flat fee, depending on the card's terms and conditions. High interest rates further exacerbate the financial burden for those who consistently pay late.

-

Utilities (Electricity, Water, Gas): Utility companies generally impose late fees for overdue bills, usually a percentage of the outstanding balance. These fees are often necessary to cover the cost of collection efforts and to maintain the financial stability of the utility provider.

-

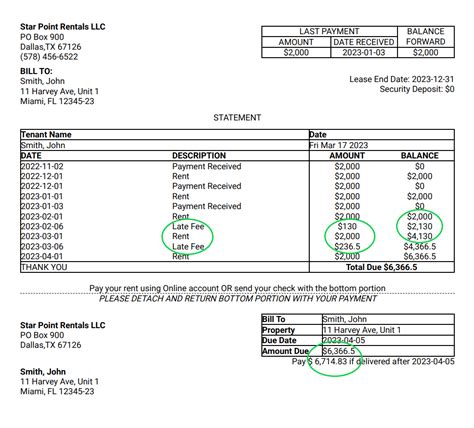

Rent: Landlords often include late fee clauses in their lease agreements. These fees can range from a small percentage of the monthly rent to a fixed amount. State and local laws may regulate the maximum allowable late fee.

-

Loans (Mortgages, Auto Loans, Personal Loans): Late payments on loans can trigger late fees, often combined with increased interest accrual. These fees can vary depending on the loan type and the lender's policies. Repeated late payments can significantly damage a borrower's credit score.

-

Subscription Services: Streaming services, software providers, and other subscription services typically charge late fees (or cancellation fees) if payments are missed. These fees are often intended to recoup lost revenue and cover administrative costs.

3. Challenges and Solutions:

-

Transparency and Disclosure: Many challenges arise from unclear or insufficient disclosure of late fee policies. Consumers should be clearly informed about the amount of the fee, the circumstances under which it applies, and the process for appealing a late fee charge.

-

Proportionality: Late fees should be reasonably proportional to the costs incurred by the creditor. Excessive fees can be deemed unfair and potentially illegal.

-

Enforcement and Collection Practices: Aggressive collection practices associated with late fees can lead to ethical and legal issues. Fair Debt Collection Practices Act (FDCPA) regulations are in place to protect consumers from abusive debt collection methods.

-

Accessibility and Affordability: For low-income individuals and families, late fees can disproportionately impact their financial stability, creating a cycle of debt. Initiatives to promote financial literacy and offer payment assistance programs can help mitigate this issue.

4. Impact on Innovation:

Technological advancements have introduced automated payment systems and improved communication channels, aiming to reduce the incidence of late payments. Mobile apps, online portals, and automatic payment deductions can minimize the need for late fee charges.

Closing Insights: Summarizing the Core Discussion

Late fee charges represent a significant aspect of the financial landscape, impacting both businesses and consumers. Understanding the legal parameters, ethical considerations, and industry practices surrounding late fees is crucial for navigating the complexities of timely payments and responsible financial management. The ongoing trend towards increased transparency and consumer protection reflects a growing societal awareness of the impact of these charges.

Exploring the Connection Between Credit Scores and Late Fee Charges

The relationship between credit scores and late fee charges is significant. Late payments, and the associated late fees, are major factors in calculating a credit score. A consistently poor payment history, marked by frequent late fees, can severely damage an individual's credit score, limiting their access to credit, loans, and even housing opportunities in the future.

Key Factors to Consider:

-

Roles and Real-World Examples: A single late payment, even with a small late fee, can negatively impact a credit score for several years. Multiple late payments significantly worsen the impact. Real-world examples include individuals denied loans or mortgages due to poor credit scores primarily resulting from late fee-inducing payment patterns.

-

Risks and Mitigations: The risks associated with late payments extend beyond the immediate financial penalty of the fee itself; the long-term impact on creditworthiness can be substantial. Mitigations include setting up automatic payments, using reminder systems, and establishing a budget to ensure timely payments.

-

Impact and Implications: The impact of late fees on credit scores significantly limits future financial opportunities. This can lead to a cycle of debt, where individuals struggle to access affordable credit, further hindering their financial stability.

Conclusion: Reinforcing the Connection

The strong correlation between late fees and credit scores underscores the importance of responsible financial management. By understanding the detrimental impact of late payments, individuals can take proactive steps to mitigate the risks and safeguard their long-term financial well-being.

Further Analysis: Examining Credit Reporting Agencies in Greater Detail

Credit reporting agencies (CRAs) – such as Equifax, Experian, and TransUnion – play a pivotal role in the credit scoring system. They collect and compile data on individuals' payment history, including information about late payments and associated late fees. This data is then used to generate credit reports, which form the basis for credit scores. Understanding how CRAs handle this information and the impact of late fees on these reports is vital for consumers and businesses alike.

FAQ Section: Answering Common Questions About Late Fee Charges

What is a late fee? A late fee is a penalty charge imposed for the failure to make a payment by the due date.

How are late fees calculated? Methods vary depending on the industry and the creditor's policies; they might be a flat fee or a percentage of the outstanding balance.

Can I dispute a late fee? You can attempt to dispute a late fee if you believe it was applied incorrectly or if the creditor's policy was not properly disclosed. Contact the creditor to explain your situation.

What are the consequences of repeated late payments? Repeated late payments can severely damage your credit score, limiting your access to credit and increasing interest rates on future loans.

How can I avoid late fees? Set up automatic payments, use reminder systems, and budget carefully to ensure timely payments.

Practical Tips: Maximizing the Benefits of Timely Payments

- Set up automatic payments: Many creditors offer automatic payment options, ensuring timely payments and eliminating the risk of late fees.

- Utilize online banking and bill pay features: Online banking platforms offer tools for scheduling payments, sending reminders, and tracking due dates.

- Create a budget and payment calendar: A well-organized budget and payment calendar helps you track your expenses and ensure timely payments.

- Set reminders: Use electronic reminders, calendar alerts, or sticky notes to remind you of upcoming due dates.

- Communicate with creditors: If you anticipate difficulty making a payment, contact the creditor immediately to explore possible payment arrangements.

Final Conclusion: Wrapping Up with Lasting Insights

Late fee charges, while seemingly small individual penalties, represent a substantial financial consideration for both consumers and businesses. Understanding the legal frameworks, ethical implications, and practical consequences associated with late fees is essential for promoting responsible financial practices. By embracing timely payment strategies, consumers can protect their credit scores and avoid the compounding negative effects of repeated late fees. Meanwhile, businesses can benefit from establishing transparent and fair late fee policies that balance the need for revenue protection with ethical considerations and consumer well-being. The evolving landscape of financial technology and consumer protection regulations continues to shape the future of late fee management, encouraging a move toward greater transparency and fairness.

Latest Posts

Latest Posts

-

Bank Of America Cash Rewards Visa Platinum Plus

Apr 06, 2025

-

How Does Bank Of America Cash Rewards Work

Apr 06, 2025

-

What Is Bank Of America Cash Rewards

Apr 06, 2025

-

Bank Of America Unlimited Cash Rewards Minimum Payment

Apr 06, 2025

-

Bank Of America Customized Cash Rewards Minimum Payment

Apr 06, 2025

Related Post

Thank you for visiting our website which covers about Late Fee Charges . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.