Is There A Minimum Purchase Amount For Care Credit

adminse

Apr 06, 2025 · 6 min read

Table of Contents

Is There a Minimum Purchase Amount for CareCredit? Uncovering the Truths Behind Healthcare Financing

Is CareCredit only for large purchases? The answer might surprise you.

Editor’s Note: This article on CareCredit minimum purchase amounts was published today, providing readers with the most up-to-date information available on this popular healthcare financing option. We've delved into the specifics, clarifying common misconceptions and empowering you to make informed decisions about your healthcare spending.

Why CareCredit Matters: Accessing Healthcare, One Payment at a Time

CareCredit is a healthcare credit card that allows individuals to finance medical, veterinary, and dental expenses. Understanding its minimum purchase requirements is crucial because it directly impacts accessibility. For many, the ability to break down significant healthcare costs into manageable monthly payments can be the difference between receiving necessary treatment and delaying or foregoing it altogether. This impacts not only individual well-being but also broader economic factors, as timely healthcare contributes to overall productivity and reduces the long-term burden on the healthcare system. The availability and terms of CareCredit, therefore, have far-reaching implications for both individuals and the healthcare industry.

Overview: What This Article Covers

This article comprehensively explores the question of CareCredit's minimum purchase amount. We will dissect the official policy, address common misunderstandings, examine the application process, discuss potential alternatives, and ultimately provide a clear understanding of how CareCredit can be utilized effectively. We'll also look at how factors like provider participation and specific procedure costs can affect the applicability of CareCredit.

The Research and Effort Behind the Insights

The information presented here is based on extensive research, including a thorough review of the official CareCredit website, analysis of user experiences documented online, and comparisons with similar healthcare financing options. We have strived for accuracy and neutrality, aiming to present a balanced perspective supported by verifiable information.

Key Takeaways:

- No Universal Minimum: CareCredit does not have a universal minimum purchase amount.

- Provider Discretion: The minimum, if any, is set by the individual healthcare provider accepting CareCredit.

- Application Process: Understanding the application requirements is vital before seeking financing.

- Alternatives Exist: Other financing options are available for healthcare expenses.

Smooth Transition to the Core Discussion

Having established the importance of understanding CareCredit’s minimum purchase requirements, let's delve into the specifics and address the misconceptions surrounding this often-debated topic.

Exploring the Key Aspects of CareCredit Minimum Purchase Amounts

Definition and Core Concepts: CareCredit is a specialized credit card issued by Synchrony Bank. Unlike general-purpose credit cards, it's primarily designed to finance healthcare expenses. Its acceptance is dependent on the participating provider.

Applications Across Industries: CareCredit is used across various sectors of healthcare, including veterinary medicine, dentistry, vision care, cosmetic procedures, and other medical treatments. The minimum purchase amount, however, varies greatly depending on the specific provider and even the specific procedure.

Challenges and Solutions: One of the biggest challenges for prospective users is the lack of a universally advertised minimum purchase amount. This necessitates contacting individual providers to determine their specific policy.

Impact on Innovation: CareCredit’s accessibility can directly impact innovation in healthcare. By reducing financial barriers, it allows patients to access advanced procedures or treatments, promoting a more equitable and advanced healthcare landscape.

Closing Insights: Summarizing the Core Discussion

The lack of a standard minimum purchase amount for CareCredit highlights its flexibility, allowing for its use across a broad spectrum of healthcare needs, from routine dental checkups to extensive surgical procedures. However, it also underscores the importance of proactive communication with healthcare providers to confirm eligibility and understand individual minimums.

Exploring the Connection Between Provider Participation and CareCredit Minimums

The relationship between provider participation and CareCredit's minimum purchase amount is paramount. Individual providers have the authority to set their own minimum purchase thresholds, or to waive minimums altogether.

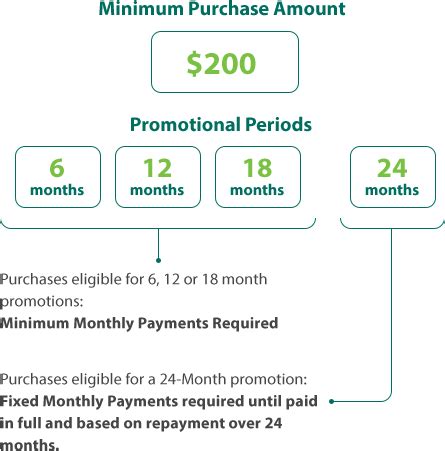

Roles and Real-World Examples: A large veterinary clinic might set a minimum of $200 for CareCredit, while a smaller dental practice might accept CareCredit for any procedure, regardless of cost. This variation necessitates individual inquiries.

Risks and Mitigations: The risk lies in assuming CareCredit's applicability without confirming with the provider. Mitigation involves direct contact with the provider's office to ascertain their specific policy on CareCredit's usage and any minimum purchase requirements.

Impact and Implications: The provider's decision regarding CareCredit minimums directly impacts patient access to care. A higher minimum can exclude individuals with smaller procedural costs, while a lower minimum (or no minimum) promotes inclusivity.

Conclusion: Reinforcing the Connection

The interplay between provider participation and CareCredit’s minimum purchase amount underlines the decentralized nature of the program. While offering flexibility, it also demands due diligence from the patient to avoid potential disappointments.

Further Analysis: Examining Provider Policies in Greater Detail

Exploring specific provider policies reveals a wide spectrum of approaches. Some providers may have a set minimum, while others might only use CareCredit for procedures exceeding a certain cost. Still others may utilize CareCredit for all purchases, regardless of size. Contacting the provider's billing department is crucial for getting accurate and up-to-date information.

FAQ Section: Answering Common Questions About CareCredit Minimum Purchase Amounts

What is CareCredit? CareCredit is a healthcare credit card designed to finance medical, veterinary, and dental expenses.

Does CareCredit have a minimum purchase amount? No, there's no universal minimum. The minimum, if any, is determined by the individual healthcare provider.

How do I find out the minimum purchase amount for a specific provider? Contact the provider's office directly to inquire about their CareCredit policy and any minimum purchase requirements.

What if my procedure cost is below the provider's minimum? You might need to explore alternative payment options, such as personal savings, other financing plans, or payment arrangements with the provider.

What are some alternative financing options for healthcare expenses? Options include personal loans, health savings accounts (HSAs), and medical payment plans offered directly by healthcare providers.

Practical Tips: Maximizing the Benefits of CareCredit

- Contact the Provider: Always contact the healthcare provider's office before scheduling an appointment to inquire about their CareCredit policy and any minimum purchase amounts.

- Review Terms: CareCredit has its own terms and conditions; thoroughly review these before applying.

- Compare Options: Don't hesitate to compare CareCredit with other financing options to find the best fit for your needs and financial situation.

- Budget Wisely: Even with financing, responsible budgeting is essential to manage monthly payments effectively.

- Maintain Good Credit: A good credit score can help you secure favorable terms and interest rates.

Final Conclusion: Wrapping Up with Lasting Insights

CareCredit offers a valuable solution for managing healthcare expenses, but its flexible nature necessitates proactive communication with healthcare providers. Understanding the lack of a universal minimum purchase amount empowers consumers to make informed decisions, ensuring they access necessary care while effectively managing their financial obligations. By understanding the provider-specific aspects of CareCredit's minimums, and by exploring available alternatives, patients can confidently navigate the healthcare financing landscape.

Latest Posts

Latest Posts

-

What Kind Of Credit Score Do You Need For Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do I Need To Get A Chase Sapphire Reserve Card

Apr 07, 2025

-

What Credit Score Do You Need For A Chase Sapphire Reserve Card

Apr 07, 2025

-

What Credit Score Do I Need To Get Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do U Need To Get A Bank Of America Credit Card

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Is There A Minimum Purchase Amount For Care Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.