Is A 650 Credit Score Good At 18

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Is a 650 Credit Score Good at 18? Navigating the Early Stages of Credit Building

Is establishing a strong credit foundation at 18 years old crucial for long-term financial success?

A 650 credit score at age 18 represents a solid start, but significant opportunities for improvement exist, paving the way for a brighter financial future.

Editor’s Note: This article on credit scores for 18-year-olds was published today, providing readers with the most up-to-date information and actionable advice on credit building strategies.

Why a Credit Score Matters at 18:

Having a good credit score is not just a number; it's a key to unlocking various financial opportunities. A strong credit history influences access to favorable interest rates on loans (auto, student, mortgage), credit card limits, rental approvals, and even employment opportunities in some fields. Starting early builds a positive credit foundation that compounds over time, yielding significant long-term benefits. At 18, the journey towards financial independence begins, and a good credit score significantly influences this journey's trajectory.

Overview: What This Article Covers:

This article explores the significance of a 650 credit score at age 18, examining its strengths and weaknesses. It will delve into the factors contributing to credit scores, provide practical tips for improvement, address common misconceptions, and offer a roadmap for building a robust credit history. We'll also explore the unique challenges faced by young adults building credit and outline strategies to overcome them.

The Research and Effort Behind the Insights:

This comprehensive guide draws upon extensive research from reputable sources, including financial literacy organizations, credit bureaus (Experian, Equifax, TransUnion), and financial experts. The information presented is based on established credit scoring models and reflects the current landscape of credit management.

Key Takeaways:

- Understanding Credit Scores: A detailed explanation of how credit scores are calculated and the factors influencing them.

- 650 Credit Score Analysis: A thorough evaluation of a 650 score at 18, highlighting its positives and areas for improvement.

- Credit Building Strategies: Practical and actionable steps for improving a credit score, tailored for young adults.

- Common Mistakes to Avoid: Identifying pitfalls to avoid during the credit-building process.

- Long-Term Financial Planning: Connecting credit scores to broader financial goals and future financial well-being.

Smooth Transition to the Core Discussion:

Now that we understand the importance of credit at a young age, let's dissect what a 650 credit score means for an 18-year-old and explore strategies for further improvement.

Exploring the Key Aspects of Credit Scores and a 650 Score at 18:

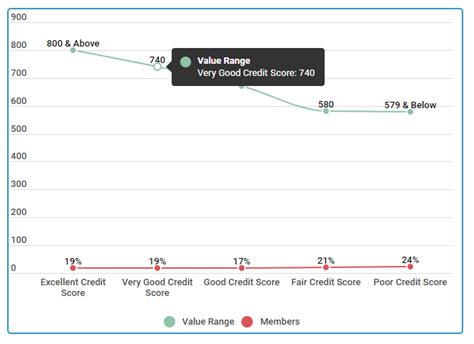

Definition and Core Concepts: Credit scores are numerical representations of an individual's creditworthiness, based on their credit history. The most widely used scoring models are FICO and VantageScore, which use a range of factors to determine a score. These scores typically range from 300 to 850, with higher scores indicating lower risk to lenders.

A 650 score generally falls within the "fair" range. While not excellent, it's better than a "poor" or "subprime" score. At 18, having a fair score suggests some level of responsible credit use, but there's considerable room for improvement. It's important to remember that lenders view applicants with different levels of risk, and this score might still lead to higher interest rates on loans compared to those with higher credit scores.

Applications Across Industries: A 650 credit score might suffice for some credit applications, particularly secured credit cards or loans with higher interest rates. However, it might limit access to more favorable options, such as lower interest rates on auto loans, student loans, or mortgages. Rental applications may also be impacted, with landlords potentially preferring applicants with higher scores.

Challenges and Solutions: The primary challenge with a 650 score is that it's not considered ideal for securing the best financial products. The solution involves actively working on improving the credit score by focusing on responsible credit management strategies (discussed in detail below).

Impact on Innovation: The credit scoring system is constantly evolving, with new technologies and data sources influencing the assessment of creditworthiness. Understanding this evolving landscape helps young adults proactively manage their credit and anticipate future changes.

Exploring the Connection Between Payment History and a 650 Credit Score:

Payment history constitutes the most significant factor (35%) in calculating FICO scores. A 650 score suggests a history of mostly on-time payments but likely includes some late payments or other minor credit issues.

Roles and Real-World Examples: Consistent on-time payments are vital. Even a single missed payment can negatively impact a score. Conversely, a consistent history of timely payments significantly boosts a credit score.

Risks and Mitigations: Failing to make payments on time is the biggest risk. Mitigation involves setting up automatic payments, setting reminders, and budgeting effectively to ensure timely payments.

Impact and Implications: The long-term impact of consistently late payments is severely detrimental to building a strong credit profile.

Further Analysis: Examining Payment History in Greater Detail:

Payment history goes beyond simply making payments on time. It includes the length of credit history, the types of credit accounts (credit cards, loans), and the overall consistency of on-time payments across all accounts. A young adult with a 650 score should carefully review their payment history to identify any areas for improvement and focus on maintaining impeccable payment behavior moving forward.

Exploring the Connection Between Credit Utilization and a 650 Credit Score:

Credit utilization ratio (the amount of credit used compared to the total available credit) accounts for 30% of the FICO score. A 650 score might indicate a relatively high credit utilization, potentially exceeding 30%, which negatively impacts creditworthiness.

Roles and Real-World Examples: Using more than 30% of available credit on credit cards can signal higher risk to lenders. Keeping utilization below 30%, ideally below 10%, demonstrates responsible credit management.

Risks and Mitigations: High credit utilization increases the perceived risk of default. Mitigating this involves paying down credit card balances regularly and requesting higher credit limits as creditworthiness improves.

Impact and Implications: Chronically high credit utilization can significantly lower a credit score, hindering access to better financial products.

Further Analysis: Examining Credit Utilization in Greater Detail:

Understanding the impact of credit utilization requires monitoring credit card balances closely. By paying down debts regularly and avoiding maxing out credit cards, an 18-year-old can significantly improve their credit utilization ratio, ultimately leading to a better credit score.

FAQ Section: Answering Common Questions About Credit Scores at 18:

Q: What is a good credit score at 18? A: While there's no magic number, a score above 700 is generally considered good. A 650 score is a fair start, but striving for a higher score is beneficial.

Q: How can I improve my credit score quickly? A: While quick improvements are challenging, consistent on-time payments and lowering credit utilization are the fastest ways.

Q: What if I have no credit history at 18? A: Consider applying for a secured credit card, which requires a security deposit, or becoming an authorized user on a parent or guardian's credit card with a good credit history.

Q: What are the consequences of a low credit score? A: A low score can lead to higher interest rates on loans, difficulty securing credit, and even challenges in renting an apartment or getting a job.

Practical Tips: Maximizing the Benefits of Credit Building:

- Pay Bills On Time: Establish automatic payments whenever possible to prevent missed payments.

- Keep Credit Utilization Low: Aim to keep your credit card balance below 30% of your credit limit.

- Monitor Credit Reports: Regularly check your credit reports for errors and to track your progress.

- Diversify Credit: Consider applying for different types of credit (credit cards, installment loans) over time to demonstrate responsible credit management across various accounts.

- Avoid Opening Multiple Accounts Simultaneously: This can negatively impact your score, especially early on.

- Consider a Secured Credit Card: If you lack credit history, a secured card is a great option to start building credit.

Final Conclusion: Wrapping Up with Lasting Insights:

A 650 credit score at 18 is not a cause for alarm but rather an opportunity for growth. By understanding the factors influencing credit scores, actively practicing responsible credit management, and consistently monitoring progress, young adults can build a strong credit foundation that will positively impact their financial future. Remember, credit building is a marathon, not a sprint. Consistent effort and responsible financial habits will yield long-term benefits. A strong credit history opens doors to various financial opportunities, fostering greater financial independence and security throughout life.

Latest Posts

Related Post

Thank you for visiting our website which covers about Is A 650 Credit Score Good At 18 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.