How To Teach Kids Financial Management

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Unlock Your Child's Financial Future: A Comprehensive Guide to Teaching Kids Financial Management

What if the key to your child's future success lies in mastering financial literacy? Teaching children about money management isn't just about saving for college; it's about empowering them with the skills to navigate the complexities of the modern financial world and build a secure future.

Editor’s Note: This comprehensive guide to teaching kids financial management provides practical strategies and age-appropriate techniques to help parents instill sound financial habits in their children. Updated with the latest research and best practices, this guide offers actionable insights for families at every stage.

Why Teaching Kids Financial Management Matters:

In a world increasingly driven by financial decisions, financial literacy is no longer a luxury; it's a necessity. Equipping children with the knowledge and skills to manage money effectively empowers them to make informed choices, avoid debt, achieve financial goals, and build a strong foundation for their future. The benefits extend beyond personal finance, fostering critical thinking, problem-solving abilities, and responsible decision-making in various aspects of their lives. From understanding the value of saving to making smart spending choices and investing wisely, these skills are crucial for long-term success and well-being. The earlier these principles are instilled, the better equipped children are to navigate the complexities of the financial world.

Overview: What This Article Covers:

This article provides a comprehensive framework for teaching children about financial management, covering age-appropriate strategies, practical techniques, and resources. We'll explore how to introduce basic concepts like saving, spending, and earning, progressing to more advanced topics like budgeting, investing, and debt management as children mature. The guide also addresses common challenges parents face and offers solutions to foster a positive and effective learning environment.

The Research and Effort Behind the Insights:

This article draws upon extensive research from leading financial literacy organizations, child development experts, and behavioral economists. Numerous studies on financial socialization and effective teaching methods have been reviewed to ensure the accuracy and practicality of the advice provided. Real-world examples and case studies illustrate the effectiveness of the strategies discussed.

Key Takeaways:

- Age-Appropriate Strategies: Understanding the developmental stages of children is crucial for tailoring teaching methods effectively.

- Hands-on Experiences: Practical experiences, such as managing allowances or participating in family budgeting, provide valuable learning opportunities.

- Open Communication: Creating an open dialogue about money eliminates financial stigma and fosters understanding.

- Long-Term Perspective: Instilling long-term financial goals, like saving for college or a down payment, helps children understand the power of delayed gratification.

- Adaptability: The approach needs to be flexible and adjusted according to individual needs and circumstances.

Smooth Transition to the Core Discussion:

Now that we've established the importance of financial literacy for children, let's delve into the practical strategies for teaching them effective money management skills at different age groups.

Exploring the Key Aspects of Teaching Kids Financial Management:

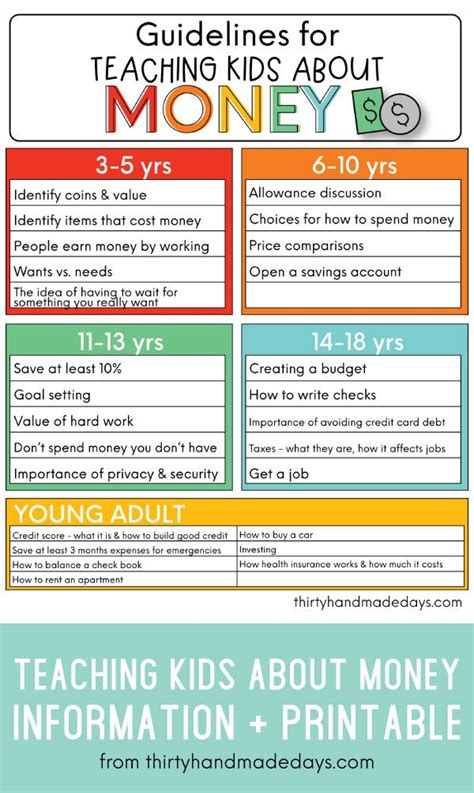

1. Early Childhood (Ages 3-7): Laying the Foundation

At this age, the focus is on introducing basic concepts in a fun and engaging way. Use visual aids, games, and storytelling to explain the difference between needs and wants. Introduce the concept of saving through piggy banks or simple savings jars. Make it a visual and tactile experience. Read books about saving and spending together. Short, simple conversations about the value of money are more effective than lengthy lectures.

- Activity: Use play money to simulate shopping trips, emphasizing the exchange of goods for money.

2. Middle Childhood (Ages 8-12): Building Financial Habits

Children in this age group can start understanding more complex concepts like budgeting and earning money. Introduce the concept of an allowance, linking it to chores and responsibilities. Help them create a simple budget, allocating funds for saving, spending, and charitable giving. Involve them in age-appropriate financial decisions, like choosing between different brands or comparing prices. Explain the importance of saving for short-term goals, such as a toy or a video game.

- Activity: Create a family budget together, allowing children to participate in discussions about spending and saving choices. This offers a transparent view of financial realities.

3. Adolescence (Ages 13-18): Expanding Financial Horizons

Teenagers are ready to learn more advanced financial concepts, such as banking, investing, and credit. Open a savings account in their name, encouraging them to deposit a portion of their allowance or earnings regularly. Introduce the concept of interest and compound interest, showing them how savings grow over time. Discuss the importance of avoiding debt and the dangers of credit card misuse. Introduce the concept of investing, starting with age-appropriate options like low-risk mutual funds. Teach them about taxes and the importance of responsible financial planning.

- Activity: Have them research different savings accounts or investment options, encouraging them to compare interest rates and fees.

4. Young Adulthood (Ages 18+): Preparing for Independence

As young adults transition to independence, focus on practical skills like budgeting, managing student loans, renting an apartment, and building credit. Help them create a realistic budget that covers essential expenses, such as rent, utilities, groceries, and transportation. Educate them about the importance of establishing good credit and the consequences of poor credit history. Discuss different types of insurance, such as health, auto, and renters insurance. Encourage them to start planning for long-term financial goals, such as buying a home or retirement planning.

- Activity: Have them create a detailed budget for a potential living situation and track their expenses for a month to see where their money goes.

Exploring the Connection Between Technology and Teaching Kids Financial Management:

Technology plays a significant role in teaching children about money. Many apps and online resources are specifically designed to engage children in learning about finances in an interactive and engaging way. These resources can gamify saving and budgeting, helping children understand financial concepts through interactive games and simulations. However, it’s crucial to monitor and supervise children's use of these apps, ensuring their safety and appropriate usage.

Key Factors to Consider:

Roles and Real-World Examples: Parents are the primary role models in teaching financial management. Children learn by observing their parents' financial habits. Consistent modeling of responsible financial behavior is vital. Sharing real-life examples, like paying bills or making investment decisions, helps children connect theory to practice.

Risks and Mitigations: One risk is that children may not understand the value of money if they are not given responsibilities. Mitigating this risk involves assigning age-appropriate chores or tasks, with a linked allowance that helps children connect their effort to financial reward. Another risk is the temptation to overspend or misuse credit cards. Teaching delayed gratification and responsible credit card use are vital countermeasures.

Impact and Implications: The long-term implications of good financial literacy include enhanced decision-making abilities, increased financial security, and reduced stress related to money matters. These skills contribute to better overall well-being and independence.

Conclusion: Reinforcing the Connection

The relationship between parents and children in shaping financial literacy is fundamental. By combining age-appropriate strategies, hands-on experiences, open communication, and the use of technology, parents can effectively equip their children with the necessary skills to navigate the financial world confidently and responsibly.

Further Analysis: Examining the Role of Parental Example in Greater Detail:

Parental behavior significantly impacts a child's financial outlook. Children often mimic their parents' spending habits and attitudes toward money. If parents demonstrate responsible financial behavior, children are more likely to adopt similar habits. Conversely, irresponsible financial behavior from parents can have negative consequences, leading to poor financial habits in their children.

FAQ Section: Answering Common Questions About Teaching Kids Financial Management:

Q: When should I start teaching my child about money?

A: The sooner, the better! You can start introducing basic concepts like saving and spending as early as age 3.

Q: How much allowance should I give my child?

A: The amount should be age-appropriate and tied to chores or responsibilities.

Q: What if my child doesn't understand financial concepts?

A: Be patient and use different teaching methods. Visual aids, games, and real-life examples can be helpful.

Q: How can I teach my teenager about credit cards?

A: Explain the importance of responsible credit card use and the consequences of debt.

Practical Tips: Maximizing the Benefits of Teaching Financial Literacy:

- Make it fun: Use games, apps, and interactive activities to make learning enjoyable.

- Be patient: It takes time for children to understand financial concepts.

- Lead by example: Demonstrate responsible financial behavior.

- Talk openly about money: Create a comfortable environment for discussing finances.

- Celebrate successes: Acknowledge and reward good financial habits.

Final Conclusion: Wrapping Up with Lasting Insights

Teaching kids about financial management is an investment in their future. By equipping them with the knowledge and skills to manage money wisely, parents empower them to make informed choices, achieve their goals, and build a secure financial future. The effort put into this education pays dividends throughout their lives. Remember, it's not just about money; it's about teaching valuable life skills that foster responsibility, decision-making, and overall well-being.

Latest Posts

Latest Posts

-

How Low Should My Credit Utilization Be

Apr 07, 2025

-

How Low Should Credit Usage Be

Apr 07, 2025

-

Tj Maxx Credit Limit

Apr 07, 2025

-

T J Maxx Credit Card Limit

Apr 07, 2025

-

When Does Fingerhut Increase Your Credit Limit

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Teach Kids Financial Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.