How To Outperform The Market

adminse

Mar 28, 2025 · 8 min read

Table of Contents

Cracking the Code: How to Outperform the Market

What if consistent market outperformance wasn't just luck, but a blend of strategy, discipline, and insightful analysis? This achievable goal requires a deep understanding of market dynamics and a commitment to a well-defined investment approach.

Editor’s Note: This article on outperforming the market was published today and offers actionable strategies based on current market trends and established investment principles. It aims to equip readers with the knowledge and tools to navigate the complexities of investing and potentially achieve above-average returns.

Why Outperforming the Market Matters:

The allure of beating the market is undeniable. While many investors aim for average market returns, a significant portion seeks to surpass them. This pursuit isn't solely about accumulating greater wealth; it’s about achieving financial independence sooner, securing a comfortable retirement, or funding specific life goals more efficiently. Outperforming the market can translate to a larger portfolio, greater financial flexibility, and enhanced peace of mind. This advantage extends beyond individual investors; for institutional investors, superior returns are crucial for exceeding benchmarks and attracting capital.

Overview: What This Article Covers:

This comprehensive guide delves into the multifaceted strategies and essential considerations required to outperform the market. We'll explore fundamental and technical analysis, portfolio diversification techniques, risk management strategies, and the importance of behavioral finance. The article will also cover the role of sector-specific knowledge, the impact of macroeconomic factors, and the significance of long-term investing versus short-term trading. Readers will gain actionable insights, backed by research and practical examples, to improve their investment decision-making process.

The Research and Effort Behind the Insights:

This article draws upon extensive research, encompassing academic studies on market efficiency, analyses of historical market data, and insights from successful investors. We have reviewed numerous books, articles, and financial reports to present a balanced and evidence-based perspective. The strategies discussed are not based on speculative claims but on well-established investment principles and proven methodologies.

Key Takeaways:

- Understanding Market Cycles: Recognizing and adapting to market cycles (bull, bear, and sideways) is crucial.

- Diversification Strategies: A well-diversified portfolio mitigates risk and increases the potential for outperformance.

- Fundamental Analysis Mastery: Thorough company analysis identifies undervalued assets.

- Technical Analysis Application: Identifying trends and patterns can improve timing and entry/exit points.

- Risk Management Discipline: Protecting capital is paramount; risk management is not optional.

- Behavioral Finance Awareness: Controlling emotions and avoiding cognitive biases is essential.

- Long-Term Perspective: Consistent outperformance requires patience and long-term commitment.

Smooth Transition to the Core Discussion:

Having established the significance of outperforming the market, let's explore the key strategies and considerations that underpin successful long-term investment performance.

Exploring the Key Aspects of Outperforming the Market:

1. Fundamental Analysis: This approach involves evaluating a company's intrinsic value by analyzing its financial statements, business model, competitive landscape, and management team. Investors seeking to outperform the market often identify companies trading below their intrinsic value (undervalued) and invest in them, anticipating that the market will eventually recognize their true worth. Key metrics include price-to-earnings ratio (P/E), price-to-book ratio (P/B), return on equity (ROE), and debt-to-equity ratio.

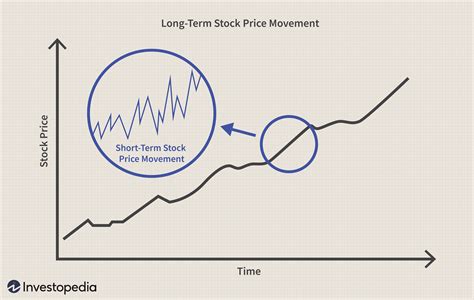

2. Technical Analysis: This method focuses on historical price and volume data to identify trends, patterns, and potential trading opportunities. Technical analysts use various tools and indicators (e.g., moving averages, relative strength index (RSI), MACD) to predict future price movements. While not a standalone strategy for outperforming the market, it can complement fundamental analysis by providing insights into optimal entry and exit points.

3. Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, commodities), sectors, and geographies significantly reduces risk and improves the odds of consistent returns. The principle of diversification is to reduce the impact of any single investment's poor performance on the overall portfolio. This doesn't guarantee outperformance, but it establishes a more robust foundation for achieving above-average returns.

4. Risk Management: Preserving capital is crucial for long-term success. Investors should establish clear risk tolerance levels and employ strategies to manage potential losses, such as stop-loss orders, diversification, and position sizing. A disciplined approach to risk management ensures that setbacks don't derail the overall investment strategy.

5. Behavioral Finance: Understanding behavioral biases (overconfidence, herd mentality, anchoring bias) is critical. Emotions can significantly impair investment decisions. Disciplined investors maintain objectivity, avoid impulsive trading, and stick to their pre-defined strategies, even during periods of market volatility.

6. Long-Term Investing: Outperforming the market rarely happens overnight. A long-term perspective is essential for weathering market fluctuations and reaping the rewards of compounding returns. Short-term market timing often leads to poor results; consistent, long-term investment in high-quality assets is a far more effective approach.

7. Sector-Specific Knowledge: Developing expertise in specific sectors can provide a competitive edge. By understanding the intricacies of a particular industry, investors can identify promising companies poised for growth before the broader market recognizes their potential. This requires continuous research, industry analysis, and a keen eye for emerging trends.

8. Macroeconomic Factors: Monitoring broader economic conditions (inflation, interest rates, economic growth) is crucial. These factors significantly influence market performance, and understanding their impact helps investors make informed decisions and adjust their portfolios accordingly.

Closing Insights: Summarizing the Core Discussion:

Outperforming the market consistently is a challenging but achievable goal. It demands a comprehensive understanding of fundamental and technical analysis, a disciplined approach to risk management, a clear grasp of behavioral finance principles, and a long-term investment horizon. Diversification across different asset classes and sectors, coupled with sector-specific knowledge and awareness of macroeconomic factors, enhances the probability of achieving above-average returns.

Exploring the Connection Between Value Investing and Outperforming the Market:

Value investing, a strategy championed by Warren Buffett, focuses on identifying undervalued securities based on fundamental analysis. The core principle is to buy assets trading below their intrinsic worth, anticipating that the market will eventually recognize their true value. This approach has a strong historical track record of outperforming the market over the long term.

Key Factors to Consider:

- Identifying Undervalued Assets: Requires rigorous fundamental analysis, focusing on financial statements, competitive advantage, and management quality.

- Margin of Safety: Buying assets significantly below their estimated intrinsic value provides a cushion against potential errors in valuation.

- Patience: Value investing requires patience, as it can take time for the market to recognize the true worth of undervalued assets.

- Contrarian Thinking: Value investors often go against the prevailing market sentiment, buying assets that are out of favor.

Risks and Mitigations:

- Valuation Errors: Incorrectly assessing a company's intrinsic value can lead to losses. Mitigation: Thorough due diligence, multiple valuation methods.

- Market Inefficiency: If the market efficiently prices assets, the value investing strategy's edge diminishes. Mitigation: Focus on less-followed companies or sectors.

- Extended Time Horizons: It might take years for an undervalued asset to reach its intrinsic value. Mitigation: Patience, diversification.

Impact and Implications:

Successful value investing can lead to significant long-term capital appreciation, exceeding market benchmarks and providing superior returns compared to passive investment strategies.

Conclusion: Reinforcing the Connection:

The connection between value investing and market outperformance is strong. By diligently following the principles of value investing and mitigating inherent risks, investors can significantly improve their chances of consistently achieving above-average returns.

Further Analysis: Examining Value Investing in Greater Detail:

Value investing's success hinges on identifying companies with strong fundamentals trading at a discount to their intrinsic value. This requires deep dives into financial statements, industry analysis, and competitive landscape assessments. Seeking companies with durable competitive advantages (moats) is another key aspect of successful value investing.

FAQ Section: Answering Common Questions About Outperforming the Market:

- Q: Is it possible to consistently outperform the market? A: While not guaranteed, consistent outperformance is achievable through a combination of skill, discipline, and a well-defined investment strategy.

- Q: What is the best strategy for outperforming the market? A: There's no single "best" strategy. A successful approach typically involves a blend of fundamental and technical analysis, risk management, and behavioral awareness.

- Q: How much risk is involved in trying to outperform the market? A: The level of risk depends on the chosen strategy and investment approach. Higher potential returns usually involve higher risk.

- Q: How long does it take to outperform the market? A: Consistent outperformance is typically a long-term endeavor, requiring patience and commitment.

Practical Tips: Maximizing the Benefits of a Disciplined Investment Approach:

- Define Your Investment Goals: Establish clear, measurable, achievable, relevant, and time-bound (SMART) goals.

- Develop a Diversified Portfolio: Spread your investments across different asset classes and sectors to mitigate risk.

- Conduct Thorough Due Diligence: Before investing in any asset, conduct comprehensive research to understand its potential risks and rewards.

- Implement a Risk Management Plan: Establish stop-loss orders and position sizing strategies to protect your capital.

- Monitor Your Portfolio Regularly: Track your investments and adjust your strategy as needed, based on market conditions and your overall goals.

- Stay Informed: Keep up-to-date on market trends, economic news, and industry developments.

- Seek Professional Advice (if needed): Consult with a qualified financial advisor for personalized guidance.

Final Conclusion: Wrapping Up with Lasting Insights:

Outperforming the market requires more than just luck; it demands a combination of skill, discipline, and a well-defined investment approach. By understanding market dynamics, mastering fundamental and technical analysis, implementing robust risk management strategies, and maintaining a long-term perspective, investors can significantly improve their chances of achieving above-average returns and building lasting wealth. Remember, consistent success is built on continuous learning, adaptation, and a steadfast commitment to your investment strategy.

Latest Posts

Latest Posts

-

Irs Publication 334 Tax Guide For Small Business Definition

Apr 25, 2025

-

Irs Publication 17 Definition

Apr 25, 2025

-

Irs Publication 1244 Employees Daily Record Of Tips And Report To Employer Definition

Apr 25, 2025

-

Irs Publication 15 B Employers Tax Guide To Fringe Benefits Definition

Apr 25, 2025

-

Irs Form 706 Gsd Generation Skipping Transfer Tax Return For Distributions Definition

Apr 25, 2025

Related Post

Thank you for visiting our website which covers about How To Outperform The Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.