How To Learn Financial Management

adminse

Apr 06, 2025 · 8 min read

Table of Contents

Mastering Your Money: A Comprehensive Guide to Learning Financial Management

What if taking control of your finances unlocked a future filled with security and opportunity? Effective financial management isn't just about saving money; it's about building a life aligned with your goals and aspirations.

Editor’s Note: This article provides a comprehensive guide to learning financial management, covering budgeting, saving, investing, debt management, and more. It’s designed to equip readers with the knowledge and tools to take control of their financial futures.

Why Financial Management Matters:

In today's complex economic landscape, strong financial management skills are more crucial than ever. Whether you're aiming for early retirement, a down payment on a house, or simply greater financial security, understanding and applying sound financial principles is paramount. Financial literacy empowers individuals to make informed decisions about their money, reducing stress, increasing opportunities, and fostering long-term prosperity. It's not just about managing your current income; it's about building a solid foundation for a secure and fulfilling future.

Overview: What This Article Covers:

This comprehensive guide will explore the core tenets of financial management, covering budgeting techniques, effective saving strategies, various investment options, smart debt management, and the importance of financial planning. Readers will gain a practical understanding of how to create a personalized financial plan and navigate the complexities of personal finance.

The Research and Effort Behind the Insights:

This article draws upon extensive research from reputable financial institutions, academic studies, and expert advice. It synthesizes complex financial concepts into easily digestible information, providing readers with actionable strategies and evidence-based recommendations.

Key Takeaways:

- Budgeting Fundamentals: Learn to create and maintain a realistic budget that tracks income and expenses.

- Saving Strategies: Discover effective techniques for saving money and building an emergency fund.

- Investment Options: Explore a range of investment choices to grow your wealth.

- Debt Management: Understand different debt management strategies and learn how to minimize debt.

- Financial Planning: Learn to set financial goals and create a long-term financial plan.

Smooth Transition to the Core Discussion:

Now that we understand the importance of financial management, let's delve into the practical steps to mastering your money.

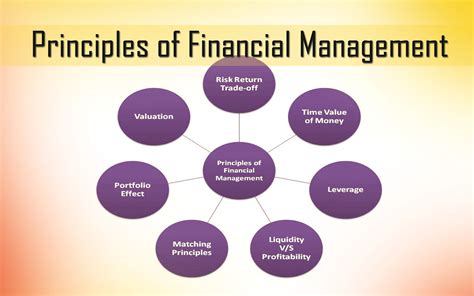

Exploring the Key Aspects of Financial Management:

1. Budgeting Fundamentals: The Foundation of Financial Health:

Creating a budget is the cornerstone of sound financial management. A budget is a simple yet powerful tool that allows you to track your income and expenses, helping you identify areas where you can save and allocate resources effectively. Several budgeting methods exist, including the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), the zero-based budget (allocating every dollar to a specific category), and envelope budgeting (allocating cash to different categories). Choose the method that best suits your personality and lifestyle. Regardless of the method, accurately tracking your income and expenses is critical. Utilize budgeting apps, spreadsheets, or even a simple notebook to record all transactions. Regularly review your budget to identify areas for improvement and adjust as needed.

2. Saving Strategies: Building a Secure Financial Future:

Saving is essential for building financial security and achieving long-term goals. Start by creating an emergency fund, ideally with 3-6 months' worth of living expenses. This fund acts as a safety net during unexpected events like job loss or medical emergencies. Once an emergency fund is established, focus on saving for specific goals, such as a down payment on a house, retirement, or your children's education. Utilize high-yield savings accounts, money market accounts, or certificates of deposit (CDs) to earn interest on your savings. Consider automating your savings by setting up automatic transfers from your checking account to your savings account each month.

3. Investment Options: Growing Your Wealth:

Investing allows your money to grow over time, outpacing inflation and building long-term wealth. Numerous investment options exist, each with varying levels of risk and return. Stocks represent ownership in a company, offering potential for high returns but also greater risk. Bonds are loans to governments or corporations, generally considered less risky than stocks. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Real estate investments can provide both income and appreciation potential. Before investing, research different options, understand your risk tolerance, and consider consulting a financial advisor. Diversification, spreading your investments across different asset classes, is crucial to mitigating risk.

4. Debt Management: Minimizing Financial Burden:

Debt can significantly impact your financial well-being. Develop a strategy for managing and reducing debt effectively. Prioritize high-interest debt, such as credit card debt, and explore options like debt consolidation or balance transfers to lower interest rates. Create a repayment plan and stick to it, ensuring you're making more than the minimum payments whenever possible. Avoid accumulating new debt unless absolutely necessary. Understanding your credit score and maintaining good credit health is crucial for securing favorable interest rates on loans and credit cards.

5. Financial Planning: Charting Your Course to Financial Success:

Financial planning involves setting financial goals, creating a roadmap to achieve those goals, and regularly reviewing your progress. Start by defining your short-term and long-term goals, such as buying a car, paying off student loans, or saving for retirement. Develop a comprehensive financial plan that outlines the steps you'll take to reach these goals. Regularly review your plan and adjust it as your circumstances change. Consider consulting a financial advisor to create a personalized financial plan tailored to your specific needs and goals.

Exploring the Connection Between Budgeting and Financial Management:

Budgeting forms the very foundation of effective financial management. Without a clear understanding of income and expenses, it's impossible to make informed decisions about saving, investing, and debt management. A well-structured budget provides the framework for achieving financial goals. It highlights areas of overspending, revealing opportunities to save and redirect resources towards investments or debt reduction. Regularly monitoring and adjusting the budget ensures it aligns with changing financial circumstances and evolving goals.

Key Factors to Consider:

- Roles and Real-World Examples: A tight budget allows for consistent savings, facilitating investment in assets like stocks or real estate, ultimately leading to wealth accumulation. Conversely, a poorly managed budget leads to financial strain, hindering progress towards financial goals.

- Risks and Mitigations: Failure to budget can result in overspending, debt accumulation, and missed financial opportunities. Careful budgeting, regular reviews, and adjusting spending habits mitigate these risks.

- Impact and Implications: Effective budgeting significantly impacts financial security, allowing for better financial planning, stress reduction, and a greater sense of control over one's financial future.

Conclusion: Reinforcing the Connection:

The inseparable link between budgeting and financial management cannot be overstated. Budgeting is the engine that drives financial success, providing the data-driven insights necessary to make informed financial decisions. By mastering the art of budgeting, individuals pave the way for a secure and prosperous financial future.

Further Analysis: Examining Investment Strategies in Greater Detail:

Investment strategies vary significantly based on individual risk tolerance, time horizon, and financial goals. Conservative investors might prefer low-risk options like bonds or savings accounts, while more aggressive investors might allocate a larger portion of their portfolio to stocks. Diversification is crucial to minimize risk. Dollar-cost averaging, investing a fixed amount regularly regardless of market fluctuations, is a common strategy to mitigate market timing risks. Index funds offer broad market exposure at low cost, making them a popular choice for long-term investors. Understanding different investment vehicles, associated risks, and potential returns is vital for making informed investment decisions. Consider seeking professional financial advice if you need guidance on creating an investment strategy aligned with your personal circumstances.

FAQ Section: Answering Common Questions About Financial Management:

What is financial management? Financial management encompasses all aspects of managing personal finances, including budgeting, saving, investing, and debt management.

How can I improve my financial literacy? Read books, articles, and websites on personal finance; take online courses or workshops; and seek advice from financial professionals.

What's the best way to start saving? Begin by creating a realistic budget, identifying areas to cut expenses, and automating regular savings transfers.

How can I reduce my debt? Prioritize high-interest debt, explore debt consolidation options, and increase your repayment amounts whenever possible.

What is a good investment strategy for beginners? Start with low-cost, diversified index funds and gradually increase your investment knowledge and risk tolerance.

Should I hire a financial advisor? A financial advisor can provide personalized guidance and create a tailored financial plan, particularly helpful for those with complex financial situations.

Practical Tips: Maximizing the Benefits of Financial Management:

- Track your spending: Use budgeting apps, spreadsheets, or notebooks to monitor all income and expenses.

- Set financial goals: Define your short-term and long-term goals to guide your financial decisions.

- Automate savings: Set up automatic transfers to your savings and investment accounts.

- Review your budget regularly: Adjust your budget as needed to reflect changing circumstances.

- Educate yourself: Continuously learn about personal finance through various resources.

- Seek professional advice: Consult a financial advisor for personalized guidance.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering financial management is a journey, not a destination. By consistently applying sound financial principles, individuals can build a secure financial future, achieving their goals and enjoying greater peace of mind. The effort invested in learning and implementing these strategies will yield significant rewards, empowering you to take control of your financial destiny and shape a future aligned with your aspirations. The key is consistent effort, continuous learning, and a proactive approach to managing your finances.

Latest Posts

Latest Posts

-

What Does Credit Usage Mean

Apr 08, 2025

-

Why Can T I Add A Credit Card To Cash App

Apr 08, 2025

-

Why Can T I Make A Payment On My Credit Card

Apr 08, 2025

-

Why Can T I Get A Cash Advance On My Credit Card

Apr 08, 2025

-

Why I Don T Have A Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Learn Financial Management . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.