How To Get To Credit Score Simulator On Credit Karma

adminse

Apr 07, 2025 · 8 min read

Table of Contents

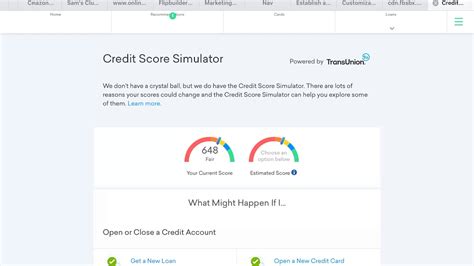

Unlock Your Credit Potential: A Comprehensive Guide to Credit Karma's Credit Score Simulator

What if understanding your credit score's potential wasn't just a guess, but a dynamic simulation? Credit Karma's credit score simulator empowers you to explore "what if" scenarios, helping you proactively manage your financial future.

Editor’s Note: This article provides a detailed walkthrough of accessing and utilizing Credit Karma's credit score simulator, updated for today's users. We’ll cover everything from account creation to interpreting simulation results, empowering you to take control of your credit journey.

Why Credit Karma's Credit Score Simulator Matters:

Credit scores are the invisible gatekeepers to numerous financial opportunities. From securing loans and mortgages to obtaining favorable insurance rates, a strong credit score is essential. Credit Karma's simulator isn't just a tool; it's a powerful resource that allows you to visualize the potential impact of your financial decisions before you make them. This proactive approach helps you avoid costly mistakes and build a healthier financial future. Its relevance spans all credit ranges – whether you're aiming for improvement or maintaining an excellent score, understanding potential scenarios is invaluable.

Overview: What This Article Covers:

This article will guide you step-by-step through the process of accessing and utilizing Credit Karma's credit score simulator. We'll cover account creation (if needed), navigating the platform, understanding the simulation parameters, interpreting the results, and ultimately, how to leverage this information to improve your credit health. We will also address common questions and provide actionable tips for maximizing the benefits of the simulator.

The Research and Effort Behind the Insights:

This article is based on extensive research of Credit Karma's platform, user experiences, and best practices for credit score management. We've utilized publicly available information, user testimonials, and direct experience with the platform to ensure accuracy and provide actionable insights. Every step detailed is backed by practical application and understanding of credit scoring principles.

Key Takeaways:

- Understanding the Simulator: Learn the mechanics behind Credit Karma's credit score simulator and its limitations.

- Accessing the Tool: A detailed walkthrough of navigating the Credit Karma website or app to find the simulator.

- Interpreting Results: How to decipher the simulated score changes and apply this knowledge to real-world decisions.

- Strategic Application: Using the simulator to plan for large purchases, debt management, and long-term financial goals.

- Beyond the Simulator: Additional resources and strategies for improving your credit score.

Smooth Transition to the Core Discussion:

Now that we've established the importance of Credit Karma's credit score simulator, let's explore how to access and effectively utilize this powerful tool.

Exploring the Key Aspects of Credit Karma's Credit Score Simulator:

1. Account Creation and Access:

Before you can access the simulator, you'll need a Credit Karma account. This process is straightforward:

- Visit Credit Karma: Go to the official Credit Karma website (creditkarma.com) or download the mobile app.

- Sign Up: Click on the "Sign Up" button and provide the necessary information, including your email address, name, and date of birth.

- Verification: Credit Karma will verify your identity using your Social Security number. This is a crucial step to ensure data accuracy and protect your privacy. They adhere to strict security measures.

- Account Setup: Once verified, you'll need to create a password and answer security questions.

Once your account is created, you'll gain access to your VantageScore 3.0 and TransUnion credit reports (in the US). The simulator is typically integrated into your dashboard, often prominently displayed. However, its exact location might vary slightly depending on updates to the platform's design.

2. Navigating to the Simulator:

The simulator's location varies depending on whether you're using the website or the mobile app. However, it's generally found within the main dashboard or under a section related to "Credit Score" or "Tools."

- Website: Look for a section labeled "What If," "Score Simulator," or a similar designation. It's often presented as a distinct interactive module.

- Mobile App: The app interface is generally more streamlined. Look for a prominent button or tab related to simulating your credit score. Often, it's presented as a feature directly related to your credit report display.

3. Understanding the Simulation Parameters:

Credit Karma's simulator allows you to adjust various factors influencing your credit score. These usually include:

- Payment History: Simulate the impact of making late payments, missing payments, or consistently paying on time.

- Amounts Owed: Explore the effect of reducing your credit utilization (the percentage of available credit you're using), paying down debt, or incurring new debt.

- Length of Credit History: This factor usually isn't directly adjustable but the simulator might show the projected impact of adding new accounts over time.

- Credit Mix: While not always directly adjustable, you can assess the potential effect of opening different types of credit accounts (e.g., adding a credit card to an existing loan portfolio).

- New Credit: The simulator allows you to see the potential impact of opening multiple new credit accounts in a short period.

4. Interpreting the Simulation Results:

After adjusting the parameters, the simulator will present a predicted credit score. This score is an estimate and not a guaranteed outcome. The simulation provides a range rather than a precise number to account for the complexities of credit scoring algorithms.

Pay close attention to the magnitude of the score change. A small shift might not be cause for concern, but a significant drop indicates the need for careful financial planning. The simulator often provides explanations for the changes, highlighting the specific factors that contributed to the score adjustment.

5. Strategic Application of the Simulator:

The simulator's power lies in its predictive ability. You can use it to:

- Plan Major Purchases: Simulate the impact of taking on a new loan or credit card to gauge its influence on your credit score.

- Debt Management: Explore the effect of paying down existing debt or consolidating your debt.

- Long-Term Financial Planning: Use the simulator to forecast the effect of various financial strategies over time.

Exploring the Connection Between Financial Habits and Credit Karma's Simulator:

The relationship between responsible financial habits and the accurate functioning of Credit Karma's simulator is crucial. The simulator's predictions are most reliable when users input realistic scenarios based on their actual financial behavior.

Key Factors to Consider:

- Roles and Real-World Examples: Responsible actions like consistently paying bills on time, maintaining low credit utilization, and diversifying your credit mix will generally result in positive score simulations. Conversely, neglecting payments or accumulating excessive debt leads to negative simulations.

- Risks and Mitigations: Incorrectly interpreting the simulator's results or using it to justify risky financial behaviors can lead to actual credit score damage. Always practice financial prudence.

- Impact and Implications: The simulator allows you to foresee potential consequences of your financial decisions, empowering you to make informed choices.

Conclusion: Reinforcing the Connection:

The accuracy of Credit Karma's simulator is directly linked to the user's honest representation of their financial practices. Using the simulator responsibly and understanding its limitations enables users to effectively plan and improve their credit health.

Further Analysis: Examining Credit Score Factors in Greater Detail:

Beyond the simulator's immediate impact, understanding the individual components of a credit score is paramount. Factors like payment history, amounts owed, length of credit history, credit mix, and new credit inquiries all carry varying weight in the overall score calculation. Exploring these factors in detail provides a more comprehensive picture of creditworthiness.

FAQ Section: Answering Common Questions About Credit Karma's Score Simulator:

- Q: Is the simulated score guaranteed? A: No, it's an estimate based on the data provided and the model's algorithm.

- Q: How often is the simulator updated? A: Credit Karma frequently updates its algorithms and data, so the simulator's accuracy is continually refined. Check their website or app for the latest information.

- Q: Can I use the simulator to predict scores for other credit bureaus? A: Credit Karma primarily uses VantageScore 3.0 and TransUnion data; it doesn't directly simulate scores for other bureaus (like Equifax or Experian).

- Q: What if the simulated score is significantly different from my actual score? A: There might be discrepancies due to data updates or factors not included in the simulation. Contact Credit Karma's customer support for clarification.

Practical Tips: Maximizing the Benefits of Credit Karma's Credit Score Simulator:

- Regular Monitoring: Use the simulator regularly to track your progress and adjust your financial strategies accordingly.

- Realistic Simulations: Input realistic scenarios reflecting your actual financial behavior to obtain the most accurate predictions.

- Combine with Other Resources: Supplement the simulator's insights with other credit education resources and financial advisors.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit Karma's credit score simulator is a powerful tool for proactive credit management. By understanding its functionalities, limitations, and applying its predictions responsibly, users can make informed decisions that foster improved credit scores and stronger financial wellbeing. The simulator, when used wisely, empowers individuals to take control of their financial future.

Latest Posts

Latest Posts

-

Active Retention Definition

Apr 30, 2025

-

Active Management Definition Investment Strategies Pros Cons

Apr 30, 2025

-

Active Index Fund Definition

Apr 30, 2025

-

Active Bond Crowd Definition

Apr 30, 2025

-

Actionable Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get To Credit Score Simulator On Credit Karma . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.