How To Get My Credit Score On Credit Karma

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Unlock Your Credit Score on Credit Karma: A Comprehensive Guide

What if effortlessly accessing your credit score could empower you to make smarter financial decisions? Credit Karma offers a free and accessible platform to do just that, providing valuable insights into your credit health.

Editor’s Note: This comprehensive guide on accessing your Credit Karma credit score was updated today to reflect the latest features and processes. We'll walk you through every step, ensuring you can confidently monitor and improve your financial well-being.

Why Your Credit Score Matters: Relevance, Practical Applications, and Industry Significance

Your credit score is a three-digit number that lenders use to assess your creditworthiness. It reflects your history of borrowing and repaying debts. A higher score typically translates to better interest rates on loans, lower insurance premiums, and even improved chances of securing rental properties. Understanding and monitoring your credit score is crucial for achieving your financial goals, whether it's buying a home, securing a car loan, or simply getting the best deals on financial products. Understanding your score through platforms like Credit Karma allows for proactive management and improvement.

Overview: What This Article Covers

This article provides a detailed walkthrough of how to get your credit score on Credit Karma, covering account creation, verification, score interpretation, and leveraging the platform's additional features. We'll also address common questions and provide tips for maximizing the benefits of using Credit Karma.

The Research and Effort Behind the Insights

This guide is based on extensive research of Credit Karma's website, user experiences, and industry best practices for credit score management. Information is drawn from official Credit Karma documentation and widely accepted credit scoring knowledge. The aim is to provide clear, concise, and accurate instructions for accessing and interpreting your credit score.

Key Takeaways:

- Account Creation: A simple process requiring basic personal information.

- Data Verification: Understanding the process and required information.

- Score Interpretation: Deciphering the meaning of your credit score and its components.

- Credit Report Access: Understanding the information contained in your report.

- Improving Your Score: Strategies and actionable tips for credit score improvement.

- Additional Features: Exploring other valuable tools and resources offered by Credit Karma.

Smooth Transition to the Core Discussion:

Now that we understand the importance of accessing your credit score, let's delve into the step-by-step process of obtaining it through Credit Karma.

Exploring the Key Aspects of Accessing Your Credit Score on Credit Karma

1. Account Creation: The first step is to create a free account on Credit Karma. Visit the Credit Karma website (www.creditkarma.com) or download the mobile app. Click on "Sign Up" or the equivalent button. You'll be prompted to provide some basic personal information, including your name, email address, and date of birth. Choose a strong password to protect your account. Credit Karma uses robust security measures to safeguard your data.

2. Data Verification: After creating your account, Credit Karma will require you to verify your identity. This is a crucial step to ensure the accuracy and security of the information provided. The verification process might involve answering a few security questions related to your personal and financial history. You may also need to provide your Social Security number (SSN). Rest assured that Credit Karma adheres to strict privacy regulations and employs advanced security protocols to protect your sensitive data.

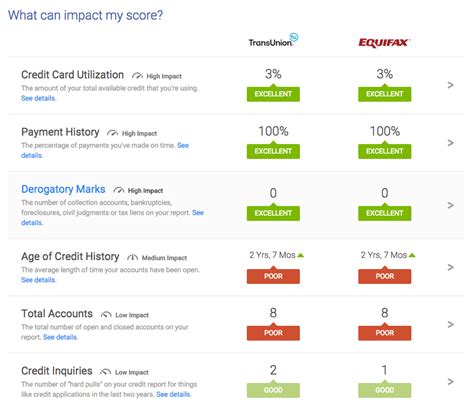

3. Accessing Your Credit Score and Report: Once your identity is verified, Credit Karma will pull your credit information from TransUnion and Equifax, two of the three major credit reporting bureaus (the third being Experian). Keep in mind that Credit Karma provides VantageScore 3.0, which differs slightly from the FICO scores used by many lenders. While not a direct substitute for a FICO score, VantageScore offers a good indication of your overall credit health. You’ll see your VantageScore displayed prominently on your dashboard along with your credit report summary. The report will detail your credit history, including open accounts, payment history, credit utilization, and inquiries. Understanding these factors is vital for improving your credit score.

4. Understanding Your Credit Score and Report: Credit Karma provides a detailed breakdown of your VantageScore, explaining the factors that contribute to your score. You'll see scores from both TransUnion and Equifax. These factors generally include:

- Payment History: This is the most significant factor (approximately 35% of your score), reflecting whether you’ve made payments on time.

- Amounts Owed: This refers to your credit utilization – the percentage of your available credit that you're using. Keeping this low is crucial (around 30%).

- Length of Credit History: The longer your credit history, the better. (around 15%)

- New Credit: Opening many new accounts in a short period can negatively impact your score. (around 10%)

- Credit Mix: Having a variety of credit accounts (credit cards, loans, etc.) can be beneficial. (around 10%)

Exploring the Connection Between Credit Monitoring and Credit Karma

Credit monitoring is a crucial aspect of maintaining good credit health. Credit Karma provides free credit monitoring, allowing you to track your credit score and report regularly. This enables you to identify potential issues early on, such as inaccurate information or suspicious activity. The real-time updates provided by Credit Karma offer valuable insights into your creditworthiness.

Key Factors to Consider:

- Data Accuracy: Regularly review your credit report for inaccuracies and dispute any errors promptly.

- Fraud Detection: Credit monitoring helps detect potential instances of identity theft or fraudulent activities.

- Proactive Management: Regular monitoring empowers you to take proactive steps to improve your credit score.

Risks and Mitigations: While Credit Karma is generally safe and secure, it's crucial to be aware of potential risks such as phishing scams and unauthorized access. Always access Credit Karma through the official website or app and be wary of suspicious emails or links. Employ strong passwords and enable two-factor authentication for enhanced security.

Impact and Implications: Effective credit monitoring leads to improved financial decision-making, better interest rates on loans, and improved access to financial products. It can also protect you from identity theft and potential financial losses.

Conclusion: Reinforcing the Connection

The connection between credit monitoring and Credit Karma is undeniable. Credit Karma provides a valuable free tool for monitoring your credit health and making informed decisions about your financial future.

Further Analysis: Examining Credit Report Details in Greater Detail

Credit Karma's report shows your credit utilization ratio, detailed account information, including open and closed accounts, credit inquiries, and payment history. Understanding these details is essential for pinpointing areas for improvement. A high utilization ratio, for instance, suggests you are using a large percentage of your available credit, which can lower your score. Similarly, negative marks on your payment history, like late payments, significantly impact your score.

FAQ Section: Answering Common Questions About Credit Karma

-

What is Credit Karma? Credit Karma is a free financial website and mobile app that provides users with access to their credit scores, reports, and other financial tools.

-

Is Credit Karma safe? Credit Karma employs robust security measures to protect user data, but users should always exercise caution and avoid suspicious links or emails.

-

How often does my score update? Your score on Credit Karma updates regularly, typically weekly, depending on when the credit bureaus provide data.

-

What if I see an error on my report? Credit Karma provides a mechanism for disputing inaccuracies on your credit report. Follow their instructions to initiate a dispute with the appropriate credit bureau.

-

What types of scores are provided? Credit Karma primarily provides VantageScore 3.0 from TransUnion and Equifax.

-

Can I get my FICO score on Credit Karma? No, Credit Karma doesn't directly provide FICO scores, which are the scores commonly used by lenders. However, the VantageScore is still a useful indicator.

Practical Tips: Maximizing the Benefits of Credit Karma

- Set up email alerts: Receive notifications of score changes, potentially fraudulent activity, and other important updates.

- Check your report regularly: Monitor your score and report for any irregularities.

- Understand your score components: Pay attention to the factors that influence your score and focus on improving them.

- Use the available tools: Credit Karma offers various tools to assist with credit score improvement, such as debt management resources and tips.

- Protect your account: Employ strong passwords and enable two-factor authentication.

Final Conclusion: Wrapping Up with Lasting Insights

Credit Karma provides a free and convenient way to access your credit score and monitor your credit health. By understanding your score, actively managing your credit, and utilizing the tools provided by Credit Karma, you can take control of your financial future and make smarter, more informed decisions. Regular monitoring and attention to detail are key to building and maintaining a strong credit profile.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Get My Credit Score On Credit Karma . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.