How To Do A Balance Transfer With Chase Freedom Unlimited

adminse

Apr 01, 2025 · 8 min read

Table of Contents

Unlock Savings: Mastering the Chase Freedom Unlimited Balance Transfer

Is juggling high-interest credit card debt keeping you from achieving your financial goals? A strategic balance transfer with your Chase Freedom Unlimited card could be the key to significant savings and improved financial health.

Editor’s Note: This article provides up-to-date information on how to perform a balance transfer with your Chase Freedom Unlimited card as of October 26, 2023. Interest rates, fees, and specific program details are subject to change, so always refer to the official Chase website for the most current information before initiating a balance transfer.

Why a Chase Freedom Unlimited Balance Transfer Matters:

High-interest credit card debt can feel overwhelming. The interest alone can quickly outpace your minimum payments, making it difficult to pay down the principal balance. A balance transfer, where you move your debt from a high-interest card to a lower-interest one, offers a powerful way to reduce your interest burden and accelerate debt repayment. The Chase Freedom Unlimited card, while not typically known for its balance transfer options, can be a part of a broader strategy to manage debt effectively. This could involve using a Chase Freedom Unlimited balance transfer partner card or transferring balances to another card altogether.

Overview: What This Article Covers:

This comprehensive guide will walk you through the process of strategically managing debt with a focus on balance transfers, even if your primary card is a Chase Freedom Unlimited. We'll cover:

- Understanding Balance Transfer Basics: Interest rates, fees, and eligibility criteria.

- Identifying Potential Transfer Partners: Exploring alternative Chase cards and other issuers with favorable balance transfer offers.

- The Step-by-Step Process: A detailed guide on how to initiate a balance transfer.

- Avoiding Common Pitfalls: Tips to prevent costly mistakes and maximize your savings.

- Long-Term Debt Management Strategies: Developing a plan to pay off your transferred balance efficiently.

The Research and Effort Behind the Insights:

This article is based on extensive research into Chase's credit card offerings, balance transfer policies, and industry best practices. Information has been gathered from official Chase documentation, reputable financial websites, and expert opinions to ensure accuracy and provide actionable advice.

Key Takeaways:

- Balance transfers are a valuable tool for managing high-interest credit card debt.

- Understanding the terms and conditions of balance transfer offers is crucial.

- A strategic approach to debt management is essential for long-term financial success.

- Alternative cards might be better suited for balance transfers than the Chase Freedom Unlimited itself.

Smooth Transition to the Core Discussion:

While the Chase Freedom Unlimited excels as a rewards card, it's not designed for low-interest balance transfers. Let's explore the best avenues for managing debt using the Chase ecosystem and beyond.

Exploring the Key Aspects of Balance Transfers:

1. Definition and Core Concepts:

A balance transfer involves moving the outstanding balance from one credit card to another. The primary goal is to take advantage of a lower interest rate on the new card, reducing the overall cost of borrowing and accelerating debt repayment. Important considerations include the balance transfer fee (usually a percentage of the transferred amount), the introductory APR (Annual Percentage Rate) period, and the regular APR after the introductory period ends.

2. Applications Across Industries:

Balance transfers aren't limited to personal finance. Businesses can also use them to manage their credit card debt, helping them improve cash flow and reduce interest expenses.

3. Challenges and Solutions:

- High Balance Transfer Fees: Some cards charge substantial fees, negating potential savings. Carefully compare offers to find the lowest fees.

- Introductory APR Expiration: Introductory low rates are temporary. Develop a repayment plan to pay off the balance before the regular APR kicks in.

- Credit Score Impact: Applying for a new credit card can temporarily lower your credit score. Check your score before applying and choose offers that align with your financial goals.

4. Impact on Innovation:

The balance transfer market is constantly evolving. Credit card companies are innovating with new products and offers to attract customers, offering a wider range of options for consumers.

Exploring the Connection Between Chase Freedom Unlimited and Balance Transfers:

The Chase Freedom Unlimited itself is not typically positioned as a balance transfer card. Its strength lies in its cash back rewards program. However, it can indirectly play a role in a successful balance transfer strategy.

Key Factors to Consider:

Roles and Real-World Examples:

A cardholder might use their Chase Freedom Unlimited for everyday spending while transferring high-interest balances to a dedicated balance transfer card. This strategy allows them to continue earning rewards on everyday purchases without sacrificing the benefits of a low-interest rate on their debt.

Risks and Mitigations:

- Missing the introductory APR period: Failing to pay off the balance before the introductory period ends will lead to higher interest charges. Create a strict repayment schedule to avoid this.

- Incurring additional debt: Avoid using the new card for additional purchases after the balance transfer, as this will increase the overall debt burden.

- Ignoring the balance transfer fee: The fee can significantly reduce the savings. Always factor it into your calculations.

Impact and Implications:

Effectively using balance transfers can significantly reduce the overall cost of debt, freeing up funds for other financial priorities like savings or investments.

Conclusion: Reinforcing the Connection:

While the Chase Freedom Unlimited isn't the ideal tool for balance transfers directly, it can be part of a larger financial plan. By strategically using other Chase cards or cards from other issuers offering balance transfer promotions, cardholders can leverage the benefits of low-interest rates to efficiently manage their debt.

Further Analysis: Examining Chase's Balance Transfer Options in Greater Detail:

Chase offers several credit cards that are better suited for balance transfers than the Freedom Unlimited. These cards often feature promotional 0% APR periods and competitive fees. It's crucial to thoroughly research and compare these offerings before making a decision. Pay close attention to the terms and conditions, including the length of the introductory period, the regular APR, and any associated fees. Compare these to offers from other issuers to find the most favorable option.

Finding the Right Balance Transfer Card:

Researching alternative options is crucial. Look for cards with:

- Low or 0% introductory APR: This helps reduce interest charges during the introductory period.

- Low or no balance transfer fee: Minimizes upfront costs.

- Lengthy introductory period: Gives you ample time to pay down your balance.

- Acceptable credit requirements: Ensure you meet the eligibility criteria.

Step-by-Step Guide to Performing a Balance Transfer:

- Check your credit score: A good credit score improves your chances of approval for a balance transfer card.

- Research balance transfer offers: Compare interest rates, fees, and introductory periods from various issuers.

- Apply for a balance transfer card: Complete the application process with the chosen issuer.

- Receive your new card: Once approved, activate your new card.

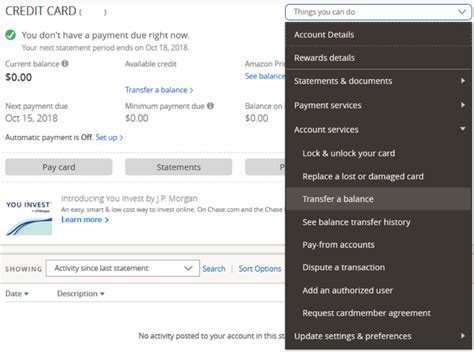

- Initiate the balance transfer: You can usually do this online through your new card's account portal. You'll need to provide the details of the card you're transferring from.

- Monitor your progress: Track your payments and ensure you're on track to pay off the balance before the introductory APR expires.

FAQ Section: Answering Common Questions About Chase Freedom Unlimited and Balance Transfers:

Q: Can I directly transfer a balance from my Chase Freedom Unlimited to another Chase card?

A: While you can transfer balances between Chase cards, the Freedom Unlimited is not typically designed for low-interest balance transfers. You're better off seeking out other Chase cards specifically offering balance transfer promotions.

Q: What happens if I don't pay off my balance before the introductory APR expires?

A: The regular APR will apply to the remaining balance, resulting in higher interest charges. Plan your repayments carefully.

Q: How long does a balance transfer take to process?

A: The processing time varies depending on the issuer. Allow several business days for the transfer to complete.

Q: What is the impact of a balance transfer on my credit score?

A: While applying for a new card can temporarily lower your score, managing the transferred balance responsibly can improve your creditworthiness over time.

Practical Tips: Maximizing the Benefits of a Balance Transfer:

- Create a realistic repayment plan: Break down your balance into manageable monthly payments to avoid accumulating further debt.

- Automate your payments: Set up automatic payments to ensure you never miss a due date.

- Avoid new purchases on the transferred card: Focus solely on paying down the existing balance.

- Monitor your account activity: Regularly check your statements to ensure the transfer was processed correctly and that you're making progress.

Final Conclusion: Wrapping Up with Lasting Insights:

Mastering balance transfers requires careful planning and execution. While your Chase Freedom Unlimited card serves as a valuable tool for daily spending and rewards, managing high-interest debt effectively requires a strategic approach that might involve other cards offering better balance transfer terms. By carefully selecting a balance transfer card, developing a realistic repayment plan, and diligently monitoring your account, you can substantially reduce the cost of your debt and pave the way for a healthier financial future. Remember to always check the official Chase website for the most current information on balance transfer offers and terms.

Latest Posts

Latest Posts

-

What Credit Score Do You Need For Tj Maxx Mastercard

Apr 08, 2025

-

Tj Maxx Credit Card Score Needed

Apr 08, 2025

-

What Credit Score Do I Need For Tj Maxx

Apr 08, 2025

-

Is It Hard To Get Approved For A Tj Maxx Credit Card

Apr 08, 2025

-

What Credit Score Do You Need For A Tjmaxx Credit Card

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Do A Balance Transfer With Chase Freedom Unlimited . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.