How To Determine Monthly Loan Payment

adminse

Apr 06, 2025 · 7 min read

Table of Contents

How can you easily calculate your monthly loan payment?

Mastering loan payment calculations empowers you to make informed financial decisions.

Editor’s Note: This article on determining monthly loan payments was published today, providing you with the most up-to-date information and formulas to accurately calculate your monthly obligations. We've broken down the process step-by-step, making it accessible to everyone, regardless of their financial background.

Why Determining Monthly Loan Payments Matters:

Understanding how to calculate your monthly loan payment is crucial for several reasons. It allows you to:

- Budget effectively: Knowing your exact monthly payment helps you create a realistic budget and ensure you can afford the loan.

- Compare loan offers: You can compare different loan offers (mortgages, auto loans, personal loans) based on their monthly payments, helping you choose the most suitable option.

- Avoid financial surprises: Accurate calculation prevents unexpected financial strain due to underestimated payments.

- Negotiate better terms: Understanding the calculation allows you to negotiate better interest rates or loan terms with lenders.

- Plan for long-term financial stability: Accurate loan payment calculations are essential for long-term financial planning and debt management.

Overview: What This Article Covers:

This article will guide you through several methods of calculating your monthly loan payment, from simple manual calculations using the standard formula to utilizing online calculators and spreadsheet functions. We’ll explore the key variables involved, discuss common loan types, and address potential complications. By the end, you'll be equipped to confidently calculate your monthly payments for any loan.

The Research and Effort Behind the Insights:

The information presented in this article is based on established financial principles and formulas widely used in loan calculations. We've referenced standard financial textbooks and online resources to ensure accuracy and clarity. The examples provided use realistic scenarios to illustrate the application of the concepts.

Key Takeaways:

- Understanding the Loan Payment Formula: Learn the fundamental formula and the meaning of each variable.

- Manual Calculation Techniques: Master the step-by-step process of calculating monthly payments using the formula.

- Utilizing Online Calculators: Explore the convenience and ease of using online loan payment calculators.

- Spreadsheet Functions (Excel, Google Sheets): Learn how to use built-in functions for efficient calculation.

- Understanding Amortization Schedules: Learn how to interpret an amortization schedule to track loan repayment.

Smooth Transition to the Core Discussion:

Now that we understand the importance of accurate loan payment calculations, let's delve into the practical methods for determining your monthly obligations.

Exploring the Key Aspects of Determining Monthly Loan Payments:

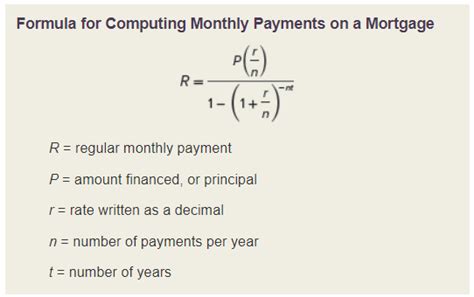

1. The Loan Payment Formula:

The most fundamental method for calculating a monthly loan payment uses the following formula:

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly payment

- P = Principal loan amount (the total amount borrowed)

- i = Monthly interest rate (annual interest rate divided by 12)

- n = Total number of payments (loan term in years multiplied by 12)

2. Manual Calculation:

Let's illustrate the manual calculation with an example:

Suppose you borrow $20,000 (P) at an annual interest rate of 6% (annual interest rate), for a loan term of 5 years (loan term).

-

Calculate the monthly interest rate (i): 6% annual interest rate / 12 months = 0.06 / 12 = 0.005

-

Calculate the total number of payments (n): 5 years * 12 months/year = 60 months

-

Apply the formula:

M = 20000 [ 0.005 (1 + 0.005)^60 ] / [ (1 + 0.005)^60 – 1]

M = 20000 [ 0.005 (1.34885) ] / [ 1.34885 – 1]

M = 20000 [ 0.00674425 ] / [ 0.34885 ]

M = 137.26

Therefore, the approximate monthly payment would be $386.66. Note: Slight variations might occur due to rounding during calculations.

3. Using Online Calculators:

Numerous free online loan calculators are available. Simply input the loan amount, interest rate, and loan term, and the calculator will provide the monthly payment. These calculators are convenient and user-friendly, eliminating the need for manual calculations.

4. Spreadsheet Functions (Excel, Google Sheets):

Spreadsheets offer built-in functions to simplify loan payment calculations. In Excel and Google Sheets, the PMT function is used:

=PMT(rate, nper, pv, [fv], [type])

Where:

- rate: The monthly interest rate (annual interest rate/12).

- nper: The total number of payments (loan term in years * 12).

- pv: The present value (loan amount, entered as a negative number).

- fv: The future value (optional, usually 0).

- type: (optional, 0 for payments at the end of the period, 1 for payments at the beginning).

Using our previous example:

=PMT(0.005, 60, -20000)

The result will be approximately $386.66 (the negative sign indicates an outflow of money).

5. Understanding Amortization Schedules:

An amortization schedule is a table showing the breakdown of each loan payment over the life of the loan. It details the principal amount paid, the interest paid, and the remaining loan balance for each payment period. This schedule helps you track your loan repayment progress and understand how much of each payment goes towards principal versus interest. Most online loan calculators and spreadsheet functions can generate amortization schedules.

Exploring the Connection Between Interest Rates and Monthly Loan Payments:

The interest rate significantly impacts your monthly loan payment. A higher interest rate leads to a higher monthly payment, while a lower interest rate results in a lower payment. This relationship is directly proportional. Understanding this connection is crucial for comparing loan offers and negotiating favorable terms.

Key Factors to Consider:

-

Roles and Real-World Examples: A borrower with a higher credit score typically qualifies for a lower interest rate, resulting in a lower monthly payment. Conversely, a borrower with a lower credit score may face a higher interest rate and consequently, a higher monthly payment.

-

Risks and Mitigations: Borrowers should carefully consider their budget and affordability before taking on a loan. Failing to accurately calculate monthly payments can lead to financial difficulties. Using online calculators and amortization schedules can mitigate this risk.

-

Impact and Implications: The interest rate's impact on monthly payments significantly affects the total amount paid over the life of the loan. Higher interest rates increase the total cost.

Conclusion: Reinforcing the Connection:

The relationship between interest rates and monthly loan payments is fundamental to understanding loan affordability and the overall cost of borrowing. By accurately calculating monthly payments and analyzing amortization schedules, borrowers can make informed decisions about loan selection and management.

Further Analysis: Examining Interest Rate Fluctuations in Greater Detail:

Interest rates are not static; they fluctuate based on various economic factors. Understanding these fluctuations and their potential impact on monthly payments is important for long-term financial planning. Economic indicators, central bank policies, and market conditions all play a role in determining interest rates. Monitoring these factors helps borrowers anticipate potential changes in their monthly loan payments.

FAQ Section: Answering Common Questions About Determining Monthly Loan Payments:

Q: What is the difference between simple interest and compound interest?

A: Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal plus accumulated interest. Most loans use compound interest.

Q: What happens if I make extra payments on my loan?

A: Extra payments reduce the principal balance, leading to lower interest payments and a shorter loan term. Amortization schedules can show the impact of extra payments.

Q: Can I refinance my loan to lower my monthly payment?

A: Yes, refinancing can potentially lower your monthly payment by securing a lower interest rate or extending the loan term. However, consider the total interest paid over the life of the loan.

Q: What are some common loan types?

A: Common loan types include mortgages, auto loans, personal loans, student loans, and business loans. Each type may have different interest rates and repayment terms.

Practical Tips: Maximizing the Benefits of Accurate Loan Payment Calculation:

-

Use multiple methods: Compare results from manual calculations, online calculators, and spreadsheet functions to ensure accuracy.

-

Understand amortization schedules: Analyze the schedule to track your progress and see how interest and principal payments change over time.

-

Explore different loan options: Compare interest rates and loan terms before committing to a loan.

-

Factor in other expenses: Don't forget to include insurance, taxes, and other fees when budgeting for your loan payment.

-

Plan for unexpected expenses: Build a financial buffer to handle unexpected events that may impact your ability to make payments.

Final Conclusion: Wrapping Up with Lasting Insights:

Accurately determining your monthly loan payment is paramount for responsible borrowing. By understanding the formulas, utilizing available resources, and carefully considering all relevant factors, you can gain control over your finances and achieve long-term financial success. Remember that proactive planning and accurate calculation empower you to make informed decisions and avoid potential financial pitfalls.

Latest Posts

Latest Posts

-

What Credit Score You Need For Chase Sapphire Reserve

Apr 07, 2025

-

What Kind Of Credit Score Do You Need For Chase Sapphire Reserve

Apr 07, 2025

-

What Credit Score Do I Need To Get A Chase Sapphire Reserve Card

Apr 07, 2025

-

What Credit Score Do You Need For A Chase Sapphire Reserve Card

Apr 07, 2025

-

What Credit Score Do I Need To Get Chase Sapphire Reserve

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Determine Monthly Loan Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.