How To Check Business Credit Score Chase

adminse

Apr 08, 2025 · 8 min read

Table of Contents

Unlocking Your Business's Potential: A Comprehensive Guide to Checking Your Chase Business Credit Score

What if accessing your Chase business credit score could unlock significant opportunities for your business's growth? Understanding and monitoring your business credit is crucial for securing funding, negotiating favorable terms, and building a strong financial reputation.

Editor’s Note: This article provides an in-depth guide to understanding and checking your business credit score through Chase, updated [Insert Date]. We've compiled information from various sources to offer a comprehensive resource for business owners.

Why Checking Your Chase Business Credit Score Matters:

Your business credit score is a numerical representation of your business's creditworthiness. It's a vital factor considered by lenders, suppliers, and even potential business partners. A higher score translates to better loan terms, lower interest rates, higher credit limits, and increased negotiating power. Ignoring your business credit score can severely limit your business's growth potential. Chase, being a major financial institution, plays a significant role in the business credit landscape, making understanding how to check your score through them especially pertinent.

Overview: What This Article Covers:

This article provides a step-by-step guide on how to check your business credit score with Chase, exploring various Chase business credit products and services. It will address common questions, misconceptions, and practical tips for improving your business credit score. We will also analyze the importance of monitoring your score regularly and the resources available to help you understand your business credit health.

The Research and Effort Behind the Insights:

The information presented here is based on extensive research, including reviews of Chase's official website, analysis of industry best practices, and examination of relevant financial regulations. We have focused on providing accurate and up-to-date information to ensure the reliability of the guidance provided.

Key Takeaways:

- Understanding Business Credit Scores: Defining business credit scores and their importance.

- Accessing Scores Through Chase: Exploring various Chase services and products that provide access to business credit information.

- Interpreting Your Score: Understanding the scoring ranges and what they signify.

- Improving Your Score: Strategies to build and maintain a healthy business credit score.

- Utilizing Chase Business Services: Leveraging Chase's resources for effective business credit management.

Smooth Transition to the Core Discussion:

Now that we understand the significance of business credit scores, let's explore how to effectively check your score using Chase's services and resources.

Exploring the Key Aspects of Checking Your Chase Business Credit Score:

1. Understanding Chase Business Credit Products:

Chase offers a range of business credit products and services, including business credit cards, lines of credit, and business loans. Depending on the products you utilize, access to credit score information may vary. Some Chase business credit cards may provide access to your score directly through your online account dashboard. Other services might require separate subscriptions or partnerships with credit bureaus.

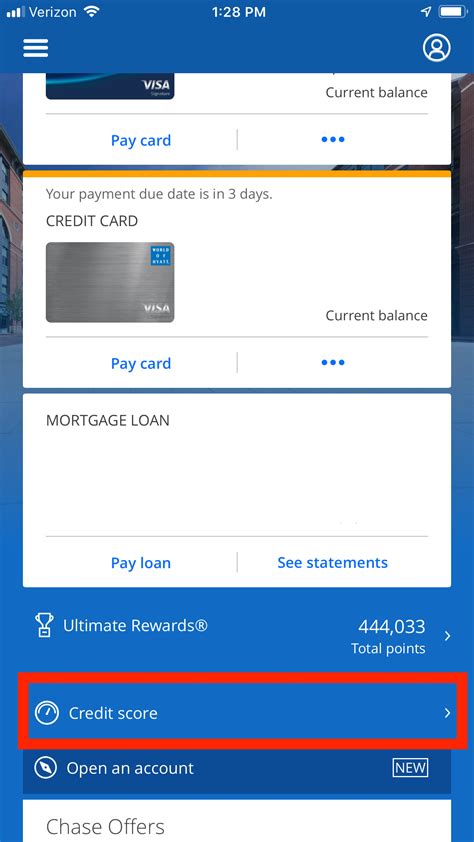

2. Accessing Your Score Through Your Online Chase Business Account:

If you have a Chase business credit card or other relevant business account, log in to your online account. Look for sections labeled "Credit Score," "Credit Report," or similar. The exact location may vary depending on your specific account type and the Chase platform version. Some accounts might offer free access, while others may require a subscription for detailed credit reports.

3. Utilizing Third-Party Credit Reporting Services:

Chase doesn't directly provide a universal business credit score. Instead, it may integrate with third-party credit reporting agencies like Experian, Equifax, or Dun & Bradstreet (D&B). These agencies maintain separate business credit files, and accessing your score might involve subscribing to their services or using a credit monitoring platform that includes business credit reports.

4. Understanding Different Business Credit Scores:

Unlike personal credit scores, business credit scores are not standardized. Different agencies use varying scoring models and data points, resulting in potentially different scores across agencies. A score from Experian might differ from a D&B score, for example. Understanding these nuances is essential for a comprehensive view of your business credit health.

5. Interpreting Your Chase Business Credit Score (if provided):

Once you access your score (either directly through Chase or via a third-party service), understand what the numbers mean. Each agency typically provides a score range and corresponding creditworthiness ratings. A higher score reflects a lower risk to lenders, signifying a stronger financial history.

Exploring the Connection Between Business Practices and Chase Business Credit Score:

Your business practices significantly influence your Chase business credit score (or any business credit score). Let's examine this crucial connection:

Key Factors to Consider:

Roles and Real-World Examples:

- Payment History: Consistently paying all your business debts on time is the most significant factor impacting your score. Late payments severely harm your creditworthiness. Example: A business that consistently pays its Chase business credit card bill on time will see a positive impact on its score.

- Credit Utilization: Keeping your credit utilization low (the amount of credit you use compared to your available credit) is crucial. High utilization indicates higher risk. Example: Maintaining a low balance on your Chase business credit card relative to your credit limit positively affects your score.

- Credit Age: The length of your business's credit history also matters. Older accounts with a history of responsible borrowing contribute to a better score. Example: A business with a long-standing relationship with Chase and a history of responsible borrowing on its business accounts will typically have a better credit score.

- New Credit: Applying for multiple new credit accounts in a short period can negatively impact your score. Example: Applying for multiple business credit cards simultaneously with various lenders could lower your score, even if you manage them responsibly.

- Credit Mix: Having a mix of different types of business credit (e.g., credit cards, loans, lines of credit) can positively influence your score. Example: A business using a Chase business credit card along with a business loan from another lender shows a healthy credit mix.

Risks and Mitigations:

- Risk of Low Score: A low score severely restricts access to funding and favorable credit terms. Mitigation: Address any late payments, reduce credit utilization, and work on improving payment history.

- Risk of Identity Theft: Protect your business's credit information from theft. Mitigation: Implement strong security measures and monitor your credit reports regularly for any suspicious activity.

- Risk of Misinformation: Ensure the information on your credit reports is accurate. Mitigation: Regularly check your credit reports from each agency and dispute any inaccuracies.

Impact and Implications:

The impact of a strong or weak business credit score is far-reaching. A high score unlocks numerous opportunities, including:

- Securing loans with favorable interest rates.

- Accessing lines of credit with higher limits.

- Negotiating better terms with suppliers.

- Improving your business's reputation and trustworthiness.

Conversely, a low score can lead to:

- Difficulty obtaining financing.

- Higher interest rates on loans.

- Limited access to credit.

- Damaged business reputation.

Conclusion: Reinforcing the Connection:

The connection between your business practices and your Chase business credit score (or score from any agency) is undeniable. By proactively managing your finances, paying debts on time, and maintaining a healthy credit utilization ratio, you can significantly improve your score and unlock numerous opportunities for your business's growth.

Further Analysis: Examining Business Credit Reporting Agencies in Greater Detail:

Understanding the role of major credit reporting agencies like Experian, Equifax, and D&B is crucial. These agencies collect and compile your business's credit information from various sources, including lenders, suppliers, and public records. They then use this information to calculate your business credit score. Knowing which agencies Chase might use (either directly or indirectly) helps you target your efforts to improve your credit standing across the board.

FAQ Section: Answering Common Questions About Checking Your Chase Business Credit Score:

Q: Does Chase directly provide my business credit score?

A: Chase doesn't directly provide a universal business credit score. Access might be available through specific business credit products, but typically involves integration with third-party credit reporting agencies.

Q: How often should I check my business credit score?

A: Ideally, check your score at least once a quarter (every three months) to monitor your credit health and identify any potential issues early on.

Q: What if I find inaccuracies on my business credit report?

A: Immediately contact the relevant credit reporting agency (Experian, Equifax, D&B) to dispute any inaccuracies. Provide supporting documentation to prove the errors.

Q: How can I improve my business credit score quickly?

A: While there's no magic bullet, consistent on-time payments, low credit utilization, and maintaining a good credit mix are the most effective strategies for rapid improvement.

Q: What if I don't have a Chase business account?

A: You can still access your business credit report and score through independent credit reporting agencies like Experian, Equifax, or Dun & Bradstreet.

Practical Tips: Maximizing the Benefits of Monitoring Your Business Credit Score:

- Set up Credit Monitoring: Subscribe to a credit monitoring service that includes business credit reports to track changes in your score over time.

- Pay Bills on Time: This is the single most important factor impacting your score. Automate payments whenever possible.

- Maintain Low Credit Utilization: Keep your credit card balances low relative to your credit limits.

- Diversify Your Credit: Have a mix of business credit accounts (credit cards, loans, lines of credit).

- Check for Errors: Regularly review your credit reports for any inaccuracies and dispute them promptly.

Final Conclusion: Wrapping Up with Lasting Insights:

Regularly checking and monitoring your Chase business credit score (or your score from any reporting agency) is not just a good practice; it's essential for your business's financial health and growth. By understanding the factors that influence your score and implementing the strategies outlined in this article, you can build a strong credit profile, access favorable financing options, and ultimately achieve greater success for your business. Remember, proactive credit management is a key component of a thriving business.

Latest Posts

Latest Posts

-

How Long To Increase Capital One Credit Limit

Apr 08, 2025

-

How To Increase Capital One Credit Limit Uk

Apr 08, 2025

-

How To Increase Capital One Credit Limit Reddit

Apr 08, 2025

-

How To Increase Capital One Credit Limit Canada

Apr 08, 2025

-

How To Increase Capital One Credit Limit

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about How To Check Business Credit Score Chase . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.