How To Calculate Minimum Payment On A Loan

adminse

Apr 06, 2025 · 9 min read

Table of Contents

Decoding the Minimum Payment: A Comprehensive Guide to Loan Calculations

What if understanding your loan's minimum payment unlocked significant long-term savings and financial stability? Mastering this seemingly simple calculation is crucial for responsible debt management and achieving your financial goals.

Editor’s Note: This article on calculating minimum loan payments has been meticulously researched and updated to reflect current lending practices. It provides a practical, step-by-step guide for anyone looking to better understand and manage their loan repayments.

Why Understanding Minimum Payments Matters:

Understanding your minimum payment isn't just about avoiding late fees; it's foundational to sound financial planning. Knowing this figure allows you to budget effectively, prioritize debt repayment strategies, and avoid the pitfalls of long-term high-interest debt. Understanding how the minimum payment is calculated empowers you to make informed decisions about your financial future, whether you're tackling student loans, a mortgage, a car loan, or personal debt. The implications extend beyond simply meeting payment deadlines; it influences your credit score, overall financial health, and your ability to achieve other financial aspirations.

Overview: What This Article Covers:

This comprehensive guide will walk you through the various methods used to calculate minimum loan payments, exploring the factors that influence this amount. We will delve into different loan types, examine the impact of interest rates and loan terms, and highlight the long-term consequences of only paying the minimum. The article will also discuss strategies for paying down debt more efficiently and resources available to help manage your loan repayments.

The Research and Effort Behind the Insights:

This article draws upon established financial principles, widely accepted loan calculation formulas, and real-world examples from the lending industry. The information provided is intended to be educational and informative, offering practical strategies for responsible debt management.

Key Takeaways:

- Definition and Core Concepts: Understanding the fundamental elements involved in minimum payment calculations.

- Methods of Calculation: Exploring different approaches to determining the minimum payment.

- Factors Influencing Minimum Payments: Analyzing the impact of interest rates, loan terms, and loan type.

- Consequences of Only Paying the Minimum: Highlighting the long-term financial implications.

- Strategies for Accelerated Debt Repayment: Exploring methods to pay off loans faster and save money on interest.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding minimum loan payments, let's delve into the mechanics of how these payments are calculated. The process varies slightly depending on the type of loan, but several core principles remain consistent.

Exploring the Key Aspects of Minimum Payment Calculation:

1. Definition and Core Concepts:

The minimum payment on a loan is the smallest amount you can pay each month without incurring a late fee or negatively impacting your credit score. This payment typically covers a portion of the principal (the original amount borrowed) and the accrued interest. The proportion allocated to principal versus interest varies depending on the loan's terms and repayment schedule. The goal of any loan repayment plan is to eventually pay off the entire principal balance.

2. Methods of Calculation:

There isn't a single, universally applied method for calculating minimum payments. Lenders often use proprietary algorithms that incorporate various factors. However, several common approaches are used, and understanding these principles helps decipher your own loan statement. These include:

-

Simple Interest Method: This method, while less common for long-term loans, calculates interest based solely on the outstanding principal balance. The minimum payment might be a fixed percentage of the outstanding balance or a fixed dollar amount.

-

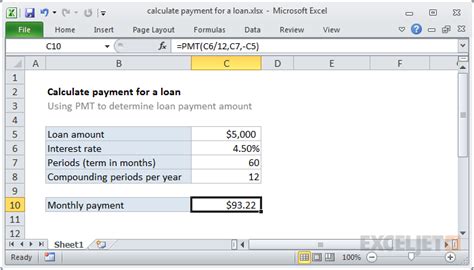

Amortization Schedule: This is the most common method for loans like mortgages and auto loans. An amortization schedule calculates a fixed monthly payment that covers both interest and principal over the loan's term. The payment remains constant throughout the loan's life, but the proportion allocated to interest gradually decreases as the principal balance reduces. This method ensures the loan is repaid in full by the end of its term. The calculation requires sophisticated formulas that account for the time value of money, but many online calculators can simplify this process.

-

Interest-Only Payments: Some loans, especially short-term loans or certain business loans, may allow for interest-only payments. In this case, the minimum payment covers only the interest accrued during the month, leaving the principal balance untouched until a later date. This approach can be risky as it extends the repayment period significantly and may lead to substantially higher total interest paid.

3. Factors Influencing Minimum Payments:

Several crucial factors interact to determine your minimum payment:

-

Interest Rate: The interest rate is the cost of borrowing money. A higher interest rate translates to a larger minimum payment, as a greater portion of each payment goes toward interest.

-

Loan Term: The loan term (length of the loan) significantly impacts the minimum payment. A longer loan term results in smaller monthly payments but a higher total interest paid over the life of the loan. Conversely, a shorter loan term means higher monthly payments but significantly less interest paid in total.

-

Loan Amount: This is the initial amount borrowed. A larger loan amount obviously necessitates a higher minimum payment.

-

Loan Type: Different loan types (mortgages, auto loans, student loans, personal loans) may have varying minimum payment calculation methods and requirements. Some loans may have introductory rates or special repayment structures that initially alter the minimum payment.

4. Consequences of Only Paying the Minimum:

While paying only the minimum avoids late fees, it's often financially detrimental in the long run. Here's why:

-

Increased Total Interest Paid: Paying only the minimum extends the loan's repayment period. This translates to a substantial increase in total interest paid over the life of the loan, costing you significantly more money.

-

Slower Debt Reduction: Paying only the minimum means a minimal reduction in the principal balance each month, leaving you indebted for a much longer duration.

-

Limited Financial Flexibility: A large portion of your income continues to be allocated to debt repayment, limiting your ability to save, invest, or address other financial priorities.

-

Potential for Financial Stress: The burden of prolonged debt repayment can lead to financial stress and anxiety.

5. Strategies for Accelerated Debt Repayment:

To mitigate the negative consequences of only paying the minimum, consider these strategies:

-

Increase Your Monthly Payments: Even a small increase in your monthly payment can significantly reduce the total interest paid and shorten the loan's repayment period.

-

Make Extra Payments: Whenever possible, make additional payments beyond the minimum. These extra payments directly reduce the principal balance, accelerating the repayment process.

-

Debt Snowball or Avalanche Method: These debt repayment strategies prioritize certain loans for faster repayment, either based on the smallest balance (snowball) or the highest interest rate (avalanche).

-

Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify repayments and potentially reduce your monthly payment.

-

Refinance Your Loan: Refinancing your loan to a lower interest rate can reduce your monthly payments and save you money on interest.

Exploring the Connection Between Amortization Schedules and Minimum Payments:

Amortization schedules are the cornerstone of calculating minimum payments for many loans. An amortization schedule details the breakdown of each payment into principal and interest components over the loan's life. Understanding this schedule is crucial because it reveals how much of your payment goes toward reducing the debt versus paying interest. The initial payments primarily consist of interest, with a smaller portion allocated to principal. As the loan progresses, the proportion allocated to principal increases, while the interest portion diminishes.

Key Factors to Consider:

-

Roles and Real-World Examples: A $200,000 mortgage at a 5% interest rate over 30 years will have a significantly lower monthly minimum payment than a 15-year loan with the same terms. However, the 15-year loan will result in far less interest paid overall.

-

Risks and Mitigations: The primary risk of using only the minimum payment is prolonged debt and substantial interest expenses. Mitigating this risk involves increasing payments whenever possible.

-

Impact and Implications: The long-term impact of only making minimum payments is a significant increase in the total cost of the loan and reduced financial freedom.

Conclusion: Reinforcing the Connection:

The relationship between the amortization schedule and the minimum payment is inextricably linked. The minimum payment is essentially the calculated amount from the amortization schedule needed to repay the loan in full within the agreed-upon term. Understanding this connection is vital for responsible debt management.

Further Analysis: Examining Amortization Schedules in Greater Detail:

Amortization schedules are generated using complex mathematical formulas that consider the loan's principal, interest rate, and term. These formulas calculate a fixed monthly payment that precisely pays off the loan's principal and interest by the end of its term. Many online calculators readily perform these calculations, allowing you to input your loan details and receive a detailed amortization schedule. This schedule reveals the exact breakdown of principal and interest for each payment, providing a clear picture of your loan's repayment trajectory.

FAQ Section: Answering Common Questions About Minimum Loan Payments:

-

Q: What happens if I miss a minimum payment? A: Missing a minimum payment can result in late fees, damage to your credit score, and potential collection actions from the lender.

-

Q: Can I negotiate a lower minimum payment? A: In some cases, you may be able to negotiate with your lender for a modified repayment plan, but this is not always guaranteed.

-

Q: How can I find my amortization schedule? A: Your lender typically provides an amortization schedule when you obtain the loan, or you can access it through online banking portals or by contacting your lender directly. Many online loan calculators can also generate a schedule for you.

-

Q: Are there penalties for paying off a loan early? A: Some loans may include prepayment penalties, but these are becoming increasingly rare.

Practical Tips: Maximizing the Benefits of Understanding Minimum Payments:

-

Budgeting: Incorporate your minimum payments into your monthly budget to avoid unexpected financial strains.

-

Tracking: Track your payments and monitor your loan's progress regularly using your amortization schedule.

-

Financial Planning: Factor your loan repayment into your overall financial planning to ensure you can meet your other financial goals.

-

Seek Help: Don't hesitate to seek professional financial advice if you're struggling to manage your debt or understand your loan's repayment terms.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how minimum loan payments are calculated is a cornerstone of responsible financial management. By grasping the underlying principles and employing effective repayment strategies, you can avoid the pitfalls of long-term debt and achieve better financial well-being. While the minimum payment might seem like a small detail, its impact on your long-term financial health is considerable. Taking control of your loan repayments allows you to make informed choices and pave the way for a more secure financial future.

Latest Posts

Latest Posts

-

How Does Heloc Impact Credit Score

Apr 07, 2025

-

How Does Paying Off A Heloc Affect Your Credit Score

Apr 07, 2025

-

Does Heloc Balance Affect Credit Score

Apr 07, 2025

-

Will Getting A Heloc Affect My Credit Score

Apr 07, 2025

-

How Long Does A Heloc Affect Your Credit Score

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Minimum Payment On A Loan . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.