How To Calculate Credit Utilisation

adminse

Apr 07, 2025 · 7 min read

Table of Contents

Mastering Credit Utilization: A Comprehensive Guide to Calculation and Optimization

What if your credit score hinges on a single, easily misunderstood metric? Understanding and managing your credit utilization is crucial for achieving optimal credit health and securing favorable financial terms.

Editor's Note: This article on calculating and optimizing credit utilization was published today, providing readers with the most up-to-date information and strategies for improving their credit scores.

Why Credit Utilization Matters:

Credit utilization, simply put, is the ratio of your outstanding credit card debt to your total available credit. It's a significant factor in your credit score calculations, impacting your ability to secure loans, mortgages, and even rent an apartment. Lenders view high credit utilization as a sign of potential financial instability, leading to higher interest rates and potentially even loan denials. Conversely, maintaining low credit utilization demonstrates responsible credit management and can lead to better credit offers and lower interest rates. Understanding how to calculate and manage this ratio is key to building and maintaining a strong credit profile. This is particularly relevant in today’s economic climate where access to credit is crucial for many financial endeavors.

Overview: What This Article Covers:

This article provides a detailed exploration of credit utilization, covering its calculation methods, the importance of different credit card types in the calculation, strategies for reducing utilization, and the impact on credit scores. Readers will gain actionable insights, backed by examples and practical advice, to effectively manage their credit utilization and optimize their credit health.

The Research and Effort Behind the Insights:

This article is the culmination of extensive research, drawing upon information from leading credit bureaus (Experian, Equifax, TransUnion), financial experts, and reputable financial publications. The analysis incorporates real-world examples and data-driven insights to ensure accuracy and provide readers with practical, actionable strategies. Each claim is supported by evidence, ensuring readers receive trustworthy and credible information.

Key Takeaways:

- Definition and Core Concepts: A clear understanding of credit utilization and its components.

- Calculation Methods: Step-by-step guides on calculating credit utilization across different scenarios.

- Impact on Credit Scores: The significance of credit utilization in determining creditworthiness.

- Strategies for Improvement: Practical and actionable steps to lower credit utilization and improve credit scores.

- Long-Term Implications: The lasting benefits of maintaining healthy credit utilization.

Smooth Transition to the Core Discussion:

Now that we understand the importance of credit utilization, let's delve into the mechanics of calculating it and exploring effective strategies for improvement.

Exploring the Key Aspects of Credit Utilization:

1. Definition and Core Concepts:

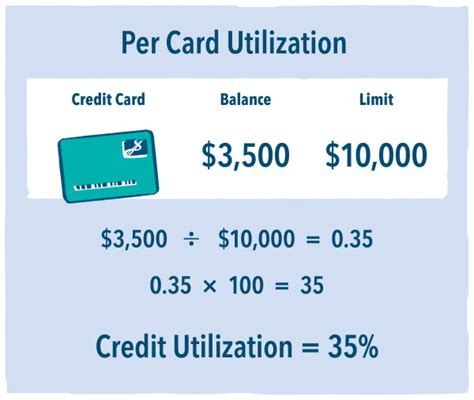

Credit utilization is the percentage of your total available credit that you are currently using. It's calculated separately for each credit card account and then considered holistically across all accounts. Total available credit represents the sum of all your credit card limits, while outstanding credit refers to the current balance you owe on each card.

2. Calculation Methods:

The basic formula for calculating credit utilization is straightforward:

(Outstanding Balance / Total Credit Limit) * 100 = Credit Utilization Percentage

Example:

Let's say you have one credit card with a $1000 limit and a current balance of $200. Your credit utilization would be:

($200 / $1000) * 100 = 20%

This 20% represents your utilization rate for that specific card. However, most individuals possess multiple credit cards. To calculate overall credit utilization, you need to consider all your credit cards:

Example with Multiple Cards:

Imagine you have two credit cards:

- Card 1: $1000 limit, $200 balance (20% utilization)

- Card 2: $500 limit, $400 balance (80% utilization)

To calculate your overall credit utilization, you first sum your total available credit ($1000 + $500 = $1500) and your total outstanding balance ($200 + $400 = $600). Then apply the formula:

($600 / $1500) * 100 = 40%

Your overall credit utilization is 40%. This overall percentage is what most significantly impacts your credit score.

3. The Role of Different Credit Card Types:

All credit cards, including store cards, secured cards, and unsecured cards, are considered when calculating total available credit and overall credit utilization. The impact of each card on your overall utilization depends on its credit limit and outstanding balance relative to your other cards.

4. Impact on Credit Scores:

Credit bureaus generally consider a credit utilization ratio of 30% or less as ideal. Utilization above 30% can negatively impact your credit score. Utilization exceeding 70% can significantly damage your score. This is because high utilization is seen as a potential risk factor for defaulting on debt. The exact impact varies between credit scoring models, but the principle remains consistent: lower utilization is generally better.

5. Impact on Innovation: The growing adoption of AI and machine learning in credit scoring enhances the sophistication of algorithms, placing even greater emphasis on consistent and responsible credit card management, particularly in managing credit utilization.

Closing Insights: Summarizing the Core Discussion:

Effectively managing your credit utilization is crucial for maintaining a healthy credit score. Calculating your utilization accurately, considering all your cards, and aiming for a ratio below 30% are essential steps in building strong credit. Remember, consistent responsible credit behavior consistently improves credit scores, regardless of individual scoring models.

Exploring the Connection Between Payment Habits and Credit Utilization:

The relationship between payment habits and credit utilization is directly proportional. Consistent on-time payments, even with relatively high credit utilization, demonstrate responsible credit management and mitigate the negative impact on your credit score. However, neglecting payments, regardless of your utilization, significantly damages your credit history.

Key Factors to Consider:

- Roles and Real-World Examples: Consistent on-time payments, even with slightly higher utilization, can mitigate negative impacts. Conversely, late payments exacerbate the negative effects of high utilization.

- Risks and Mitigations: Failing to pay bills can lead to increased interest charges, late payment fees, and a damaged credit history, even with low utilization. Budgeting and setting payment reminders are crucial mitigations.

- Impact and Implications: Poor payment habits, coupled with high utilization, can significantly hinder securing loans, mortgages, or even renting an apartment.

Conclusion: Reinforcing the Connection:

The interplay between payment habits and credit utilization underscores the importance of a holistic approach to credit management. Both factors contribute to a credit score, so consistently paying bills on time is vital regardless of current utilization.

Further Analysis: Examining Payment History in Greater Detail:

A closer look at payment history reveals its significant impact on credit scores, independent of credit utilization. Length of credit history, types of credit used, and the history of late or missed payments heavily influence credit scoring algorithms. Credit bureaus closely scrutinize payment patterns over time, identifying consistent, timely payments as a clear indicator of responsible financial behavior.

FAQ Section: Answering Common Questions About Credit Utilization:

Q: What is the ideal credit utilization ratio?

A: Credit scoring models generally favor a utilization ratio of 30% or less. Aiming for a utilization of under 10% is even better, though not always attainable for everyone.

Q: How often is my credit utilization reported?

A: Credit bureaus typically update credit reports monthly, reflecting the balances reported by credit card issuers.

Q: Can I improve my credit utilization quickly?

A: Yes, you can make significant improvements by paying down balances promptly, though changes are usually reflected in the following credit report update.

Q: What if I have a low credit limit?

A: A low credit limit can make it harder to keep utilization low. Contacting your credit card issuer to request a credit limit increase is a viable option if you consistently demonstrate responsible credit use.

Q: Does closing unused credit cards affect my credit utilization?

A: Closing unused credit cards can potentially increase your credit utilization ratio because it reduces your total available credit. However, if the card has a very low limit it may only have a small impact.

Practical Tips: Maximizing the Benefits of Credit Utilization Management:

- Track Your Spending: Monitor your spending carefully to avoid exceeding your credit limits.

- Pay Down Balances Promptly: Make at least the minimum payment, but aim for higher payments to lower your utilization quickly.

- Consider a Balance Transfer: Transfer high-interest balances to cards with lower interest rates.

- Request a Credit Limit Increase: Only request a limit increase if you can comfortably manage the additional credit responsibly.

- Use Multiple Cards Strategically: Distribute spending across multiple cards to avoid high utilization on any one card.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding and managing your credit utilization is a cornerstone of responsible financial management. By carefully calculating your utilization, making timely payments, and implementing the strategies outlined in this article, you can significantly improve your credit score and access more favorable financial opportunities. Maintaining a low credit utilization ratio, coupled with consistent on-time payments, demonstrates your creditworthiness to lenders and paves the way for a stronger financial future.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about How To Calculate Credit Utilisation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.