How To Add A Partner To Health Insurance

adminse

Mar 28, 2025 · 7 min read

Table of Contents

Adding a Partner to Your Health Insurance: A Comprehensive Guide

What if securing comprehensive healthcare coverage for your loved one was simpler than you think? Adding a partner to your health insurance plan can be a straightforward process, offering peace of mind and financial security.

Editor’s Note: This article on adding a partner to your health insurance was published [Date]. This guide provides up-to-date information and actionable steps to navigate the process effectively. We've consulted multiple insurance provider websites and healthcare resources to ensure accuracy. However, individual plan specifics may vary, so always refer to your insurer's materials for the most precise details.

Why Adding a Partner to Your Health Insurance Matters:

Healthcare costs are a significant concern for many households. Adding a partner to your health insurance plan provides crucial coverage for their medical expenses, preventing potentially crippling financial burdens. It offers access to preventative care, routine checkups, and treatment for unexpected illnesses or injuries. Furthermore, having dual coverage often leads to lower premiums compared to purchasing separate individual plans. This is particularly beneficial for couples with pre-existing conditions or anticipated high healthcare needs. Beyond the financial aspects, adding a partner demonstrates commitment and ensures their well-being is equally prioritized.

Overview: What This Article Covers:

This article guides you through the process of adding a partner to your health insurance, covering eligibility requirements, documentation needed, deadlines, potential costs, and common questions. We’ll explore different insurance scenarios, including employer-sponsored plans, individual market plans, and the Affordable Care Act (ACA) marketplace. The goal is to equip you with the knowledge to navigate this process confidently and efficiently.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of major health insurance providers' websites, government resources like the Healthcare.gov website, and legal guidance on healthcare regulations. We’ve synthesized this information to provide a clear, concise, and accurate guide for readers.

Key Takeaways:

- Eligibility Requirements: Understanding who qualifies as a "partner" under your plan.

- Open Enrollment Periods: Navigating the specific times you can add a partner.

- Required Documentation: Gathering necessary forms and identification.

- Cost Implications: Understanding how adding a partner affects your premium.

- Potential Challenges: Addressing common issues and their solutions.

- Maintaining Coverage: Ensuring continuous coverage after adding a partner.

Smooth Transition to the Core Discussion:

Now that we've established the importance of adding a partner to your health insurance, let's delve into the specifics of how to achieve this.

Exploring the Key Aspects of Adding a Partner to Your Health Insurance:

1. Eligibility Requirements:

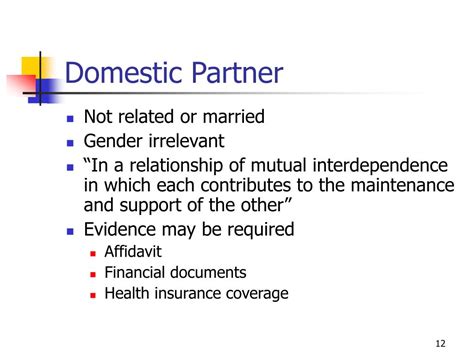

The definition of a "partner" varies depending on your insurance plan. Most plans consider legally married spouses, registered domestic partners (where legally recognized), and sometimes individuals in civil unions. Some plans may also offer coverage extensions to dependent children, but this usually involves different age limits and eligibility criteria. Carefully review your insurance policy's definition of eligible dependents. If your plan doesn't explicitly define "partner," contacting your insurance provider directly is crucial.

2. Open Enrollment Periods:

Adding a partner usually happens during specific timeframes known as open enrollment periods. These periods vary depending on the type of insurance:

- Employer-Sponsored Plans: These typically have a limited annual open enrollment period, usually in the fall. Missing this window often means waiting until the next open enrollment or experiencing a qualifying life event.

- Individual Market Plans: These plans may offer open enrollment periods throughout the year, often via the ACA Marketplace. However, specific windows might exist depending on state regulations.

- ACA Marketplace: The Affordable Care Act marketplace typically has an annual open enrollment period.

Outside of these periods, adding a partner usually requires a qualifying life event, such as marriage, birth of a child, or a change of residency. Documenting these life events is essential.

3. Required Documentation:

Preparing necessary documents beforehand streamlines the process. Common requirements include:

- Marriage Certificate or Proof of Domestic Partnership: This legal document confirms your relationship status.

- Partner's Social Security Number (SSN): Essential for identifying your partner within the insurance system.

- Partner's Driver's License or Other Government-Issued ID: Verifies your partner's identity.

- Completed Enrollment Forms: The specific forms needed are provided by your insurance company.

Failing to provide complete documentation can delay the process or result in denial of coverage.

4. Cost Implications:

Adding a partner invariably impacts your monthly premium. The increase depends on several factors:

- Plan Type: Family plans are typically more expensive than individual plans.

- Partner's Health Status: Pre-existing conditions might influence the premium adjustment.

- Insurance Provider: Different providers have different pricing structures.

It's crucial to obtain a premium quote from your insurance provider before adding a partner to fully understand the financial implications. In many cases, the combined premium for a family plan is still less expensive than purchasing two separate individual plans.

5. Potential Challenges:

Several challenges can arise during the process:

- Missing Deadlines: Failure to meet open enrollment deadlines can delay or prevent coverage.

- Incomplete Documentation: Missing crucial documents leads to processing delays.

- Pre-existing Conditions: Pre-existing conditions might affect the cost and availability of coverage.

- Communication Issues: Difficulties communicating with your insurance provider can hamper the process.

6. Maintaining Coverage:

Once your partner is added, ensure continued coverage by:

- Regularly Reviewing Your Policy: Stay informed of any changes to your plan.

- Promptly Reporting Life Changes: Report any significant changes in family status or address.

- Making Timely Premium Payments: Avoid coverage lapses by paying premiums on time.

Exploring the Connection Between Employer-Sponsored Plans and Adding a Partner:

Employer-sponsored plans often have straightforward processes for adding a partner. However, the open enrollment periods are strictly enforced. Many employers provide detailed information on their websites or through human resources departments. Understanding the specific enrollment process and deadlines set by your employer is critical. You usually need to complete an enrollment form and provide necessary documentation during the open enrollment period.

Key Factors to Consider with Employer-Sponsored Plans:

- Company-Specific Deadlines: These can vary significantly, so check with your HR department.

- Eligible Dependents: Clarify the definition of "partner" within your employer's plan.

- Premium Contributions: Understand how the premium is shared between you and your employer.

- Benefit Selection: Review your plan options to choose the most suitable coverage.

Risks and Mitigations:

The primary risk is failing to enroll within the open enrollment period, leading to a delay in coverage. Mitigation involves proactive planning, carefully noting deadlines, and promptly completing the required paperwork.

Impact and Implications:

Successfully adding a partner to an employer-sponsored plan provides extensive health coverage, offers financial protection, and demonstrates commitment to your partner's well-being.

Further Analysis: Examining Individual Market Plans in Greater Detail:

Adding a partner to an individual market plan involves navigating the ACA Marketplace or contacting your insurer directly. The process generally mirrors that of employer-sponsored plans but with added flexibility regarding enrollment periods, allowing for more options for enrolling outside of the annual open enrollment.

FAQ Section: Answering Common Questions About Adding a Partner to Health Insurance:

Q: What if my partner has a pre-existing condition?

A: Pre-existing conditions are covered under the ACA, preventing insurers from denying coverage based on them. However, they might affect the cost of your premium.

Q: Can I add a partner anytime, or are there specific periods?

A: Adding a partner is typically done during open enrollment periods. Outside of these periods, a qualifying life event is necessary.

Q: What happens if I miss the open enrollment deadline?

A: You might have to wait until the next open enrollment period, unless a qualifying life event occurs.

Q: How long does the process take?

A: The processing time varies, but expect several weeks for the change to be reflected in your insurance policy.

Q: What if I make a mistake on the application?

A: Contact your insurance provider immediately to correct the error.

Practical Tips: Maximizing the Benefits of Adding a Partner to Your Health Insurance:

- Plan Ahead: Note open enrollment deadlines well in advance.

- Gather Documentation: Collect all necessary documents before starting the process.

- Review Your Policy: Understand your plan's terms and conditions.

- Contact Your Insurer: If unsure about anything, contact your insurance provider.

- Compare Plans: Explore different plans if you're in the individual market to find the best value.

Final Conclusion: Wrapping Up with Lasting Insights:

Adding a partner to your health insurance is a crucial step in securing comprehensive healthcare coverage for your loved one. By understanding the eligibility requirements, timelines, documentation needs, and potential challenges, you can navigate this process efficiently and effectively. Remember to plan ahead, gather necessary documents, and promptly contact your insurance provider if you have any questions. Securing comprehensive healthcare coverage for your partner provides financial security and peace of mind, strengthening your relationship and ensuring both your well-being.

Latest Posts

Latest Posts

-

Chemo Xrt Definition

Apr 02, 2025

-

Palliative Xrt Definition

Apr 02, 2025

-

Xrt Definition Medical Terms

Apr 02, 2025

-

Xenocurrency Meaning

Apr 02, 2025

-

Xenocurrency Adalah

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about How To Add A Partner To Health Insurance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.