How Much Will My Monthly Loan Payment Be

adminse

Apr 06, 2025 · 6 min read

Table of Contents

How Much Will My Monthly Loan Payment Be? Unlocking the Secrets of Loan Amortization

Calculating your monthly loan payment is crucial for responsible borrowing. Understanding the factors involved empowers you to make informed financial decisions.

Editor’s Note: This article on calculating monthly loan payments was published today and provides up-to-date information and formulas to help you accurately estimate your monthly obligations. We've included various scenarios and tools to assist you in navigating the complexities of loan repayment.

Why Understanding Your Monthly Loan Payment Matters

Knowing your precise monthly loan payment is paramount for several reasons. It allows you to:

- Budget effectively: Accurately predicting your monthly outflow helps create a realistic budget, ensuring you can afford the loan without compromising other financial goals.

- Avoid financial strain: Overestimating or underestimating your payment can lead to financial hardship. A clear understanding prevents unexpected debt burdens.

- Compare loan offers: By calculating payments for different loan options, you can compare interest rates and terms to choose the most suitable financing.

- Plan for long-term financial stability: Integrating loan repayments into your long-term financial plan allows for better savings and investment strategies.

Overview: What This Article Covers

This comprehensive guide explores the factors influencing monthly loan payments, providing various methods for calculation, including manual computation and the use of online calculators. We'll also delve into the concept of loan amortization, explore common loan types, and offer advice on responsible borrowing practices.

The Research and Effort Behind the Insights

This article is based on established financial principles, widely accepted loan calculation formulas, and publicly available data. Numerous sources, including financial textbooks, reputable websites, and government resources, have been consulted to ensure accuracy and clarity.

Key Takeaways:

- Loan Amount: The principal sum borrowed directly impacts the monthly payment.

- Interest Rate: A higher interest rate increases the total cost and monthly payment.

- Loan Term: A longer loan term lowers the monthly payment but increases the total interest paid.

- Amortization Schedule: A detailed breakdown of each payment, showing the allocation between principal and interest.

- Loan Type: Different loan types (e.g., mortgages, auto loans, personal loans) have varying calculation methods and terms.

Smooth Transition to the Core Discussion

Now that we've established the importance of understanding your monthly loan payment, let's delve into the mechanics of calculating it. We'll start with the fundamental formula and then explore practical applications and variations.

Exploring the Key Aspects of Calculating Monthly Loan Payments

1. The Loan Payment Formula:

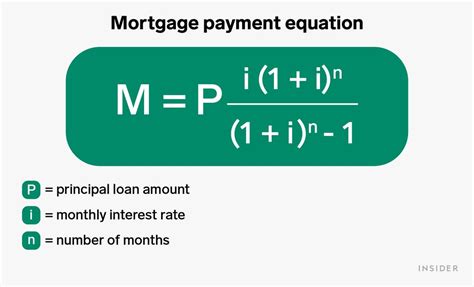

The most common formula used to calculate monthly loan payments is based on the concept of amortization. This formula considers the loan amount (P), the annual interest rate (r), and the loan term in months (n):

M = P [ i(1 + i)^n ] / [ (1 + i)^n – 1]

Where:

- M = Monthly Payment

- P = Principal Loan Amount

- i = Monthly Interest Rate (Annual Interest Rate / 12)

- n = Number of Months (Loan Term in Years * 12)

2. Step-by-Step Calculation:

Let's illustrate with an example: You borrow $20,000 at an annual interest rate of 5% for a 5-year term.

- Step 1: Calculate the monthly interest rate: 5% / 12 = 0.004167

- Step 2: Calculate the number of months: 5 years * 12 months/year = 60 months

- Step 3: Apply the formula:

M = 20000 [ 0.004167 (1 + 0.004167)^60 ] / [ (1 + 0.004167)^60 – 1]

- Step 4: Solve the equation (using a calculator): M ≈ $377.42

Therefore, your estimated monthly payment would be approximately $377.42.

3. Using Online Loan Calculators:

Numerous online loan calculators simplify this process. Simply input the loan amount, interest rate, and loan term, and the calculator will provide the estimated monthly payment. These calculators often offer additional features, such as amortization schedules.

4. Amortization Schedules:

An amortization schedule details each monthly payment, showing the portion allocated to principal repayment and the portion allocated to interest. This schedule demonstrates how your loan balance decreases over time.

Exploring the Connection Between Interest Rates and Monthly Loan Payments

The interest rate is a critical factor influencing your monthly payment. A higher interest rate means a larger portion of your monthly payment goes towards interest, resulting in a higher overall cost and a larger monthly payment. Conversely, a lower interest rate reduces your monthly payment and the total interest paid over the loan's life.

Key Factors to Consider:

- Roles and Real-World Examples: Consider two identical loans, one with a 4% interest rate and another with a 7% interest rate. The higher interest rate loan will demand a significantly larger monthly payment.

- Risks and Mitigations: High interest rates pose a significant risk of financial strain. Shop around for competitive interest rates and consider strategies to improve your credit score, which can qualify you for lower rates.

- Impact and Implications: The choice of interest rate has long-term implications for your finances. A lower rate can save thousands of dollars in interest over the loan term.

Conclusion: Reinforcing the Connection

The relationship between interest rates and monthly loan payments is inextricable. Understanding this connection is crucial for making informed decisions about borrowing.

Further Analysis: Examining Loan Terms in Greater Detail

The loan term (the length of time you have to repay the loan) also significantly impacts your monthly payment. A longer loan term lowers the monthly payment but increases the total interest paid over the life of the loan. A shorter term increases the monthly payment but reduces the overall interest expense.

FAQ Section: Answering Common Questions About Monthly Loan Payments

Q: What factors other than loan amount, interest rate, and loan term affect my monthly payment?

A: Some loans may include additional fees (e.g., origination fees, closing costs) that can increase your monthly payment.

Q: How can I get a better interest rate on my loan?

A: A higher credit score typically qualifies you for lower interest rates. Shop around for competitive offers from different lenders.

Q: What happens if I miss a loan payment?

A: Missing payments can damage your credit score and result in late fees and penalties. Contact your lender immediately if you anticipate difficulties making a payment.

Practical Tips: Maximizing the Benefits of Understanding Your Loan Payments

- Create a realistic budget: Before taking out a loan, assess your income and expenses to ensure you can comfortably afford the monthly payments.

- Shop around for the best rates: Compare offers from multiple lenders to find the most favorable interest rate and terms.

- Read the loan agreement carefully: Understand all terms and conditions, including fees and penalties.

- Make extra payments when possible: Paying extra towards your principal can reduce the loan's overall cost and shorten the repayment term.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding your monthly loan payment is a cornerstone of responsible borrowing. By using the formulas, online calculators, and the insights provided in this article, you can accurately estimate your monthly obligations, make informed decisions, and navigate the complexities of loan repayment with confidence. Remember, responsible borrowing involves careful planning, comparison shopping, and a commitment to timely payments.

Latest Posts

Latest Posts

-

How Much Will A Tradeline Boost My Credit

Apr 07, 2025

-

Can You Add A Tradeline To Your Credit

Apr 07, 2025

-

Is It Legal To Add Tradelines To Your Credit

Apr 07, 2025

-

How To Add Tradelines To Credit

Apr 07, 2025

-

How Do You Add Tradelines To Your Credit

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about How Much Will My Monthly Loan Payment Be . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.