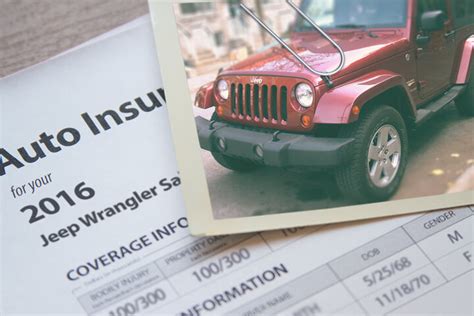

How Much Is Insurance For A Jeep

adminse

Mar 25, 2025 · 8 min read

Table of Contents

How Much is Insurance for a Jeep? Uncovering the Variables that Determine Your Cost

What if the cost of insuring your Jeep is far more nuanced than a simple price tag? Understanding the numerous factors influencing your insurance premium is key to securing the best possible coverage at a fair price.

Editor’s Note: This article on Jeep insurance costs was published today, providing you with the most up-to-date information and insights available.

Why Jeep Insurance Matters: Relevance, Practical Applications, and Industry Significance

Jeeps, renowned for their ruggedness and off-road capabilities, are popular vehicles among diverse demographics. However, their insurance costs can vary significantly depending on several factors. Understanding these factors is crucial for responsible vehicle ownership and financial planning. This knowledge allows Jeep owners to shop for the best deals, compare policies effectively, and avoid unexpected expenses. The cost of insurance isn't just about the price tag; it’s about securing financial protection in the event of an accident, theft, or damage.

Overview: What This Article Covers

This article delves into the complexities of Jeep insurance pricing, exploring the key factors influencing premiums. We’ll examine the role of Jeep model, age, driver profile, location, coverage type, and other crucial variables. Readers will gain actionable insights, empowering them to make informed decisions and secure the best insurance value for their Jeep.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon publicly available data from insurance comparison websites, industry reports, and analysis of insurance pricing models. We’ve synthesized this information to provide a comprehensive and accurate picture of Jeep insurance costs, avoiding generalizations and emphasizing the variability inherent in the process.

Key Takeaways:

- Jeep Model and Year: Different Jeep models (Wrangler, Cherokee, Grand Cherokee, Gladiator, etc.) have varying insurance costs due to factors like repair costs, theft rates, and accident statistics. Older Jeeps generally cost less to insure than newer models.

- Driver Profile: Your age, driving history (accidents, tickets), credit score, and even your occupation can significantly impact your premium.

- Location: Insurance rates vary geographically due to differences in accident rates, crime statistics, and the cost of vehicle repairs.

- Coverage Type: Choosing the right coverage (liability, collision, comprehensive) directly affects your premium. Higher coverage levels typically mean higher premiums.

- Discounts: Numerous discounts can reduce your overall insurance cost, including safe driver discounts, multi-vehicle discounts, and bundling home and auto insurance.

Smooth Transition to the Core Discussion

With a clear understanding of why understanding Jeep insurance costs is so vital, let’s explore the key factors that shape your premiums in more detail.

Exploring the Key Aspects of Jeep Insurance Costs

1. Jeep Model and Year:

The model and year of your Jeep significantly affect insurance costs. For instance, a new Jeep Wrangler Rubicon, known for its off-road capabilities and potential for damage, will likely command a higher premium than a used Jeep Compass. Repair costs for specialized parts and the higher risk of off-road accidents contribute to higher premiums for certain models. Older Jeeps, conversely, often have lower insurance premiums due to their depreciated value and lower repair costs.

2. Driver Profile:

Your personal characteristics play a crucial role in determining your insurance rate. Younger drivers, statistically, are involved in more accidents and therefore face higher premiums. Your driving history is another major factor. A clean driving record with no accidents or tickets will significantly lower your premium, while a history of claims can lead to substantially higher rates. Your credit score can also influence your premiums in many states, reflecting your perceived risk as an insurer. Even your occupation can be a factor, with some high-risk professions potentially leading to higher rates.

3. Location:

Where you live dramatically impacts your insurance costs. Areas with high accident rates, theft rates, and costly vehicle repairs will generally have higher insurance premiums. Urban areas tend to have higher rates than rural areas, reflecting increased traffic congestion and the higher frequency of accidents. Insurance companies utilize sophisticated actuarial models to assess risk based on geographical location.

4. Coverage Type:

The level of insurance coverage you select directly impacts the cost. Liability coverage, which is typically required by law, protects you against claims from others involved in an accident you caused. Collision coverage protects your Jeep in case of an accident regardless of fault, while comprehensive coverage covers damage from events like theft, vandalism, or weather damage. Higher coverage levels mean higher premiums, but provide greater financial protection. Understanding your needs and choosing the right coverage level is crucial.

5. Additional Factors:

Beyond the key factors above, several other variables can influence your Jeep insurance cost. These include:

- Deductible: A higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) will result in a lower premium.

- Safety Features: Jeeps equipped with advanced safety features like airbags, anti-lock brakes, and electronic stability control may qualify for discounts.

- Discounts: Insurance companies offer various discounts, including good student discounts, multi-vehicle discounts, and bundling discounts (combining auto and home insurance). Taking advantage of these discounts can substantially reduce your premium.

Closing Insights: Summarizing the Core Discussion

Jeep insurance costs are not a fixed number; they are a reflection of numerous interconnected variables. By understanding the influence of your Jeep’s model and year, your driving history, your location, your chosen coverage, and the available discounts, you can effectively navigate the insurance market and secure the best possible coverage at a fair price.

Exploring the Connection Between Driving Habits and Jeep Insurance

The connection between your driving habits and your Jeep insurance premium is undeniable. Safe driving significantly reduces your risk profile, leading to lower premiums. This isn't merely about avoiding accidents; it's about demonstrating responsible vehicle operation.

Key Factors to Consider:

- Roles and Real-World Examples: Drivers with a history of speeding tickets, reckless driving, or at-fault accidents face significantly higher premiums. Conversely, drivers with a clean driving record and a history of defensive driving benefit from lower rates and potentially discounts.

- Risks and Mitigations: Aggressive driving increases the likelihood of accidents and resulting claims, escalating insurance costs. Mitigation strategies include defensive driving courses, adopting safer driving habits, and maintaining your vehicle regularly.

- Impact and Implications: Your driving habits directly impact the cost of your Jeep insurance, influencing both your premium and the likelihood of claims. Safe driving is not just about safety on the road; it's a financial investment in lower insurance costs.

Conclusion: Reinforcing the Connection

The link between driving habits and Jeep insurance costs is undeniable. By prioritizing safe driving practices, drivers can significantly reduce their risk profile and consequently their insurance premiums. This connection highlights the importance of responsible vehicle operation, not just for safety, but also for financial well-being.

Further Analysis: Examining Driving Record in Greater Detail

A driver's record is scrutinized by insurance companies to assess risk. This involves examining the number and severity of accidents, the nature of traffic violations (speeding, reckless driving, DUI), and the time elapsed since any incidents. Insurance algorithms weight these factors to calculate a risk score, influencing the final premium. A clean record is a powerful asset in securing affordable Jeep insurance.

FAQ Section: Answering Common Questions About Jeep Insurance

Q: What is the average cost of Jeep insurance?

A: There is no single average cost. The price varies significantly based on the factors discussed above. It's best to get personalized quotes from multiple insurers.

Q: How can I lower my Jeep insurance cost?

A: Explore discounts, compare quotes from multiple insurers, consider raising your deductible, and maintain a clean driving record. Defensive driving courses can also help.

Q: Does my Jeep's modifications affect insurance?

A: Yes. Significant modifications, particularly those affecting performance or safety, can impact your premiums. Always disclose modifications to your insurer.

Q: Can I get Jeep insurance if I have a poor driving record?

A: Yes, but you will likely pay significantly higher premiums. Consider working with a specialized insurer or taking defensive driving courses to improve your standing.

Q: What type of coverage should I choose?

A: Liability coverage is usually mandatory. Consider adding collision and comprehensive coverage for greater protection, depending on your budget and risk tolerance.

Practical Tips: Maximizing the Benefits of Jeep Insurance

- Shop around: Obtain quotes from multiple insurance companies to compare prices and coverage options.

- Maintain a clean driving record: Safe driving habits are crucial for lower premiums.

- Bundle policies: Combining auto and home insurance often leads to significant discounts.

- Explore discounts: Ask your insurer about available discounts (good student, multi-vehicle, etc.).

- Review your coverage regularly: Ensure your coverage aligns with your needs and risk profile.

Final Conclusion: Wrapping Up with Lasting Insights

Securing affordable and appropriate Jeep insurance requires understanding the complex interplay of factors that determine the cost. By diligently researching options, comparing quotes, and driving responsibly, you can achieve the best balance between cost and comprehensive protection for your vehicle. Remember that proactive management of your insurance is an integral part of responsible Jeep ownership.

Latest Posts

Latest Posts

-

Who Owns Caliber Loans

Mar 31, 2025

-

Who Is Caliber Home Loans Backed By

Mar 31, 2025

-

Who Bought Caliber Mortgage

Mar 31, 2025

-

Who Purchased Caliber Home Loans

Mar 31, 2025

-

Who Acquired Caliber Home Loans

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How Much Is Insurance For A Jeep . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.