How Many Days Stock Market Open In A Month

adminse

Mar 28, 2025 · 7 min read

Table of Contents

How Many Days is the Stock Market Open in a Month? Unlocking the Trading Calendar's Secrets

What if your investment strategy hinged on precisely knowing the number of trading days in a month? Mastering the stock market calendar is crucial for optimizing trading strategies and maximizing returns.

Editor’s Note: This article on the number of stock market trading days per month was published today, providing up-to-date information and insights for investors of all levels. We aim to clarify common misconceptions and provide a practical guide to navigating the trading calendar.

Why Knowing the Number of Trading Days Matters:

Understanding the precise number of stock market trading days each month is not merely a detail; it's a fundamental aspect of effective investment management. This knowledge impacts various crucial areas:

- Performance Measurement: Accurately assessing investment performance requires considering only trading days, not calendar days. A simple percentage change over a month can be misleading if it doesn't account for market closures.

- Risk Management: Understanding the condensed trading time in shorter months can help refine risk assessment and position sizing strategies. Fewer trading days mean less opportunity to react to market fluctuations.

- Algorithmic Trading: High-frequency trading algorithms rely heavily on precise knowledge of trading days and hours to execute trades efficiently and minimize latency.

- Options Strategies: Options pricing and strategy implementation are significantly affected by the time decay factor, which is directly related to the number of trading days until expiration.

- Fundamental Analysis: Comparing company performance across different months necessitates adjusting for variations in trading days to ensure a fair comparison.

Overview: What This Article Covers:

This comprehensive guide explores the intricacies of determining the number of stock market trading days in a month. We will delve into the factors that influence this number, including holidays, weekends, and any unexpected closures. We will also explore the implications for various investment strategies and provide practical tips for managing your portfolio effectively given these variations.

The Research and Effort Behind the Insights:

This article draws on extensive research, incorporating data from major stock exchanges like the New York Stock Exchange (NYSE) and Nasdaq, as well as reliable financial calendars and regulatory announcements. The information provided is based on established practices and aims to deliver clear, actionable insights.

Key Takeaways:

- Variability: The number of stock market trading days in a month is not fixed and varies from month to month.

- Key Factors: Weekends and holidays are the primary determinants of trading days.

- Calendar Importance: Using a dedicated financial calendar is essential for accurate tracking.

- Strategic Implications: Understanding this variability significantly improves investment strategy.

- Data Sources: Reliable sources for this information are readily available online.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding the number of trading days, let's explore the factors that influence this figure and provide practical methods for accurate determination.

Exploring the Key Aspects of Stock Market Trading Days:

1. The Base Calculation: Trading Days vs. Calendar Days: A month contains approximately 30 days. However, the stock market is typically closed on weekends (Saturday and Sunday). This immediately reduces the potential trading days to around 22, accounting for four weekends.

2. The Impact of Holidays: The number of trading days is further reduced by stock market holidays. These holidays vary by country and exchange. In the United States, major holidays that typically result in stock market closure include:

- New Year's Day

- Martin Luther King Jr. Day

- Presidents' Day

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

The exact dates of these holidays shift annually, influencing the number of trading days each month. Some exchanges may also have additional regional or locally observed holidays.

3. Unexpected Closures: In extraordinary circumstances, such as severe weather events or national emergencies, the stock market may close unexpectedly. These unpredictable closures are rare but can significantly impact trading day counts.

4. Utilizing Financial Calendars: Rather than attempting manual calculations, investors should consult reliable financial calendars. These calendars are readily available online from reputable sources, including financial news websites, brokerage platforms, and specialized financial data providers. These calendars offer a precise count of trading days, considering all holidays and potential market closures.

5. Global Variations: The number of trading days also varies significantly depending on the specific stock exchange and the country's holiday schedule. While the US market provides a good example, the situation can differ greatly in Asian or European markets.

Closing Insights: Summarizing the Core Discussion:

The number of stock market trading days in a month is not a constant; it varies due to weekends and holidays, and occasionally due to unforeseen closures. This variability necessitates using accurate financial calendars to avoid miscalculations in performance analysis, risk management, and other aspects of investment decision-making.

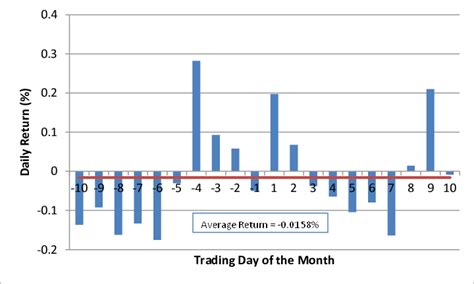

Exploring the Connection Between Market Volatility and Trading Day Count:

The number of trading days within a month can subtly influence market volatility. While not a direct causal relationship, fewer trading days can sometimes lead to increased volatility. This is because:

- Compressed Timeframe: A shorter trading period concentrates market reactions, potentially magnifying price swings.

- Reduced Liquidity: Fewer trading days can sometimes translate to slightly lower liquidity, making it harder to execute large trades without impacting prices.

- News Concentration: News events impacting the market are condensed into a shorter period, leading to more abrupt price reactions.

Key Factors to Consider:

-

Roles and Real-World Examples: During months with fewer trading days, investors might observe sharper price movements than in months with a higher number of trading days. For example, a significant news event occurring towards the end of a short trading month might trigger a more dramatic overnight price change than the same event in a longer trading month.

-

Risks and Mitigations: Investors should adjust their risk management strategies to account for potential increased volatility in shorter trading months. This might involve reduced position sizing or the implementation of tighter stop-loss orders.

-

Impact and Implications: The subtle impact of trading day count on volatility should be considered when designing trading strategies, particularly for short-term trades.

Conclusion: Reinforcing the Connection:

The relationship between trading days and market volatility is an important nuance in investment management. While not always dramatic, understanding this subtle link allows for more informed decision-making and risk management.

Further Analysis: Examining Market Liquidity in Relation to Trading Day Count

Market liquidity, the ease with which an asset can be bought or sold without significantly impacting its price, is also affected by the number of trading days. Shorter months, with fewer trading days, can sometimes experience reduced liquidity, particularly in less actively traded stocks. This reduced liquidity can increase price volatility and make it more challenging for investors to execute trades quickly and efficiently. This is particularly relevant for larger institutional investors attempting to execute substantial transactions.

FAQ Section: Answering Common Questions About Stock Market Trading Days:

Q: How can I find a reliable calendar for stock market trading days?

A: Many financial websites, brokerage platforms, and dedicated financial data providers offer accurate stock market calendars. Look for reputable sources with established track records.

Q: Are there any differences in trading day counts between different stock exchanges?

A: Yes, the holidays and any additional closures vary significantly between different stock exchanges globally. Always consult the calendar specific to the exchange you are trading on.

Q: Does the number of trading days significantly impact long-term investment strategies?

A: While the impact is less pronounced on long-term strategies, understanding the number of trading days helps refine performance measurement and risk management over extended periods, allowing for a more accurate assessment of returns adjusted for the actual trading time.

Practical Tips: Maximizing the Benefits of Understanding Trading Day Counts:

-

Utilize Financial Calendars: Make a dedicated financial calendar an integral part of your investment planning process.

-

Adjust Performance Metrics: When evaluating investment performance, always base calculations on trading days rather than calendar days.

-

Refine Risk Management: Tailor your risk management techniques to account for potential increased volatility in shorter trading months.

-

Plan Trading Activities: Consider the number of trading days when scheduling trading activities, especially for time-sensitive strategies.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the number of stock market trading days in a month is more than just a detail; it's a crucial element of effective investment strategy. By utilizing reliable resources, adjusting your metrics, and refining risk management, investors can optimize their approach and improve their chances of success. The variability of trading days highlights the importance of continuous learning and adapting to the nuances of the market calendar.

Latest Posts

Latest Posts

-

Interim Ceo Definition

Apr 24, 2025

-

What Is An Interest Rate Derivative Definition And Examples

Apr 24, 2025

-

Interest Rate Swap Definition Types And Real World Example

Apr 24, 2025

-

Interest Rate Sensitivity Definition What It Measures And Types

Apr 24, 2025

-

Interest Rate Risk Definition And Impact On Bond Prices

Apr 24, 2025

Related Post

Thank you for visiting our website which covers about How Many Days Stock Market Open In A Month . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.