How Is Paypal Minimum Payment Calculated

adminse

Apr 05, 2025 · 8 min read

Table of Contents

Decoding PayPal Minimum Payment Calculations: A Comprehensive Guide

What if understanding PayPal's minimum payment calculation could save you money and prevent late fees? This intricate process, often shrouded in ambiguity, can be demystified with a clear understanding of its underlying mechanics.

Editor’s Note: This article on PayPal minimum payment calculations was published today, offering up-to-date information and insights into this important aspect of managing your PayPal account. We aim to provide clarity and actionable advice to help users effectively manage their PayPal balances.

Why PayPal Minimum Payment Matters:

Understanding your PayPal minimum payment is crucial for several reasons. Failing to meet the minimum payment can result in late fees, negatively impacting your credit score (if you've linked a credit card or taken out a PayPal credit product), and potentially leading to account suspension. Furthermore, carrying a balance on your PayPal account can incur interest charges, significantly increasing your overall debt. Understanding the calculation helps you budget effectively and avoid these financial pitfalls. This is particularly important for businesses using PayPal for transactions, ensuring smooth cash flow management. Accurate minimum payment knowledge facilitates responsible financial planning and prevents unforeseen financial burdens.

Overview: What This Article Covers:

This article provides a comprehensive overview of how PayPal calculates its minimum payment. We will explore the factors influencing this calculation, clarify common misconceptions, address specific scenarios, and offer actionable advice for effective balance management. Readers will gain a clear understanding of the process, enabling them to avoid late fees and manage their PayPal accounts efficiently.

The Research and Effort Behind the Insights:

This article draws upon publicly available information from PayPal's official website, user forums, and financial expert opinions. We have meticulously analyzed the terms and conditions related to PayPal credit and account balances to ensure accuracy and clarity. The information presented is intended to be a helpful guide, not financial advice. Always refer to PayPal's official documentation for the most up-to-date information.

Key Takeaways:

- Definition of Minimum Payment: The minimum amount due on your PayPal account to avoid late fees.

- Factors Influencing Calculation: Outstanding balance, interest accrued, fees, and promotional offers.

- Scenario-Based Analysis: Examples illustrating the calculation in different situations.

- Practical Tips: Strategies for managing your PayPal balance and avoiding late payments.

- Understanding PayPal Credit: Specific calculation details for those using PayPal Credit.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding PayPal's minimum payment calculation, let's delve into the specifics of how it's determined.

Exploring the Key Aspects of PayPal Minimum Payment Calculation:

1. Definition and Core Concepts:

The PayPal minimum payment is the smallest amount you can pay to avoid late payment fees and maintain your account in good standing. It's not a fixed percentage of your total balance but rather a dynamically calculated amount based on several factors.

2. Factors Influencing the Calculation:

Several elements contribute to PayPal's minimum payment calculation:

-

Outstanding Balance: This is the most significant factor. The higher your outstanding balance, the higher your minimum payment will likely be. This includes purchases made using PayPal, any outstanding fees, and accrued interest.

-

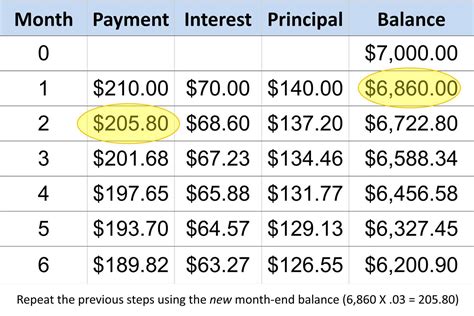

Accrued Interest: If your account carries a balance, interest charges are added daily. This interest is included in the minimum payment calculation. The interest rate will vary depending on your region and any specific credit agreements you have with PayPal.

-

Fees: Any late payment fees, transaction fees, or other applicable fees are also factored into your minimum payment calculation. These fees can significantly impact the minimum payment amount if you've incurred them.

-

Promotional Offers and Payment Plans: PayPal sometimes offers promotional periods with reduced interest rates or payment plans. These can temporarily alter the minimum payment calculation but will eventually revert to the standard calculation once the promotional period ends. Understanding the terms of these promotions is crucial.

-

PayPal Credit vs. Standard Balance: The minimum payment calculation differs depending on whether you're using PayPal Credit (a revolving credit line) or simply carrying a balance from unpaid transactions. PayPal Credit usually has a more complex calculation involving a minimum payment percentage of the balance plus accrued interest.

3. Applications Across Industries:

While the minimum payment calculation primarily affects individuals using PayPal for personal purchases, it's also relevant for businesses. Businesses using PayPal for transactions need to understand how minimum payments are calculated to manage their cash flow and avoid late payment penalties. Accurate financial forecasting requires a clear grasp of these calculations.

4. Challenges and Solutions:

One primary challenge is the lack of transparency in the exact formula used by PayPal. The minimum payment is presented as a final figure without a clear breakdown of the contributing factors. This opacity can make budgeting difficult. The solution lies in diligent record-keeping, regularly checking your PayPal statements, and contacting PayPal customer support for clarifications if needed.

5. Impact on Innovation:

While not directly an innovation driver, clear and accessible information about minimum payment calculations promotes financial literacy and allows for better financial management tools and strategies to be developed. Transparency in financial processes is crucial for fostering trust and encouraging responsible financial behavior.

Closing Insights: Summarizing the Core Discussion:

The PayPal minimum payment calculation is a dynamic process influenced by several interdependent factors. Understanding these factors is key to effectively managing your PayPal account and avoiding potential financial penalties.

Exploring the Connection Between Interest Rates and PayPal Minimum Payment:

The relationship between interest rates and the PayPal minimum payment is significant. Higher interest rates directly increase the accrued interest component of the minimum payment. This, in turn, leads to a higher overall minimum payment.

Key Factors to Consider:

-

Roles and Real-World Examples: If you have a high outstanding balance and a high interest rate, your minimum payment will be substantially higher than someone with a low balance and a lower interest rate. For example, a $1000 balance with a 20% APR will result in a significantly higher minimum payment than a $100 balance with the same APR.

-

Risks and Mitigations: Failing to understand the interest rate implications can lead to unexpected increases in the minimum payment, potentially resulting in late fees and a negative impact on your credit score. Regularly reviewing your PayPal statement and understanding your interest rate are crucial mitigations.

-

Impact and Implications: High interest rates coupled with a large outstanding balance can create a debt cycle that is difficult to break. This highlights the importance of responsible spending habits and timely payments.

Conclusion: Reinforcing the Connection:

The interplay between interest rates and PayPal's minimum payment calculation underscores the importance of being informed and proactive in managing your PayPal account. Understanding how interest rates affect your minimum payment empowers you to make informed financial decisions and avoid potential financial pitfalls.

Further Analysis: Examining Interest Rates in Greater Detail:

PayPal's interest rates vary depending on your location, credit history, and the type of PayPal product you are using (e.g., PayPal Credit). It is crucial to carefully review your PayPal Credit agreement or contact customer service to understand your specific interest rate. This information is essential for accurate minimum payment estimations and effective financial planning.

FAQ Section: Answering Common Questions About PayPal Minimum Payment Calculation:

What is PayPal's minimum payment? It's the lowest amount you must pay to avoid late fees. The specific amount varies depending on your outstanding balance, accrued interest, and any applicable fees.

How is the minimum payment calculated? PayPal doesn't publicly disclose the precise formula, but the calculation considers your outstanding balance, accrued interest, and fees.

What happens if I don't pay the minimum payment? You will likely incur late fees, which could negatively impact your credit score if linked to a credit card or PayPal Credit.

Can I change my minimum payment? No, the minimum payment is automatically calculated by PayPal based on the factors mentioned above. You can, however, pay more than the minimum.

Where can I find my minimum payment information? Your PayPal account statement clearly shows the minimum payment due.

How can I avoid late fees? Set up automatic payments, monitor your balance regularly, and pay your balance in full whenever possible.

Practical Tips: Maximizing the Benefits of Understanding PayPal Minimum Payment:

-

Regularly Check Your Statement: Monitor your PayPal account activity and statement regularly to track your balance and ensure you're aware of the minimum payment due.

-

Set Up Automatic Payments: Automate your payments to avoid accidental late payments. This ensures you consistently meet your minimum payment obligation.

-

Pay More Than the Minimum: Whenever possible, pay more than the minimum payment to reduce your outstanding balance and interest charges faster.

-

Budget Effectively: Plan your spending carefully to ensure you can consistently meet your minimum payment obligations.

-

Contact PayPal Support: Don't hesitate to contact PayPal customer support if you have any questions or concerns about your minimum payment calculation.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding how PayPal calculates its minimum payment is crucial for responsible financial management. By understanding the factors involved, monitoring your account activity, and utilizing effective strategies, you can avoid late fees, manage your balance efficiently, and maintain a healthy financial standing. Proactive account management is key to maximizing the benefits of using PayPal and preventing potential financial difficulties.

Latest Posts

Latest Posts

-

How Is American Express Minimum Payment Calculated

Apr 05, 2025

-

How Does American Express Calculate Minimum Payment

Apr 05, 2025

-

What Is The Minimum Repayment On Barclaycard

Apr 05, 2025

-

How Does Barclays Calculate Minimum Payment

Apr 05, 2025

-

How Is Barclaycard Minimum Payment Calculated

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about How Is Paypal Minimum Payment Calculated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.