How Do Interest Rates Affect Pension Annuity Payments

adminse

Mar 25, 2025 · 9 min read

Table of Contents

How Do Interest Rates Affect Pension Annuity Payments? Unlocking the Secrets of Your Retirement Income

What if the security of your pension annuity hinges on fluctuating interest rates? Understanding this complex relationship is crucial for securing a comfortable retirement.

Editor’s Note: This article on how interest rates affect pension annuity payments was published today, providing readers with the most up-to-date insights and analysis in this ever-evolving financial landscape. This is particularly relevant given the current climate of economic uncertainty and fluctuating global interest rates.

Why Interest Rates Matter for Your Pension Annuity:

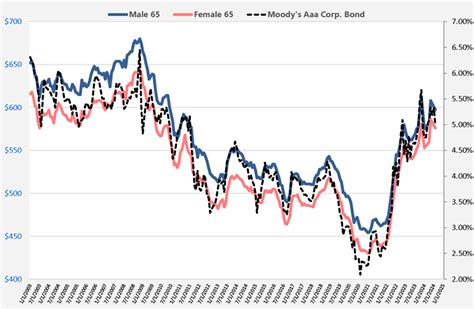

Interest rates play a pivotal role in the financial markets, impacting everything from borrowing costs to investment returns. For those relying on pension annuity payments, understanding this influence is paramount. The value of annuity payments, and indeed the very ability of pension providers to meet their obligations, are inextricably linked to the prevailing interest rate environment. This is because pension funds often invest heavily in interest-bearing assets, such as government bonds, to generate the returns needed to fund annuity payments.

Overview: What This Article Covers:

This article delves into the intricate relationship between interest rates and pension annuity payments. We will explore how different interest rate scenarios impact annuity values, the mechanisms behind this relationship, and strategies for mitigating potential risks. Readers will gain a clear understanding of this complex issue and actionable insights to help navigate their retirement planning.

The Research and Effort Behind the Insights:

This analysis is based on extensive research, incorporating insights from actuarial reports, financial market data, and regulatory documents. We have analyzed historical interest rate trends and their correlation with annuity payments, drawing upon reputable sources to ensure accuracy and reliability. The information presented offers a comprehensive overview of this critical topic, designed to empower informed decision-making.

Key Takeaways:

- Definition and Core Concepts: Understanding the fundamental mechanics of annuities and how interest rates underpin their valuation.

- Impact of Rising Interest Rates: Exploring the effects of higher interest rates on both existing and future annuity payments.

- Impact of Falling Interest Rates: Analyzing the consequences of declining interest rates on annuity payments and pension fund solvency.

- Hedging Strategies: Examining strategies employed by pension providers and individuals to mitigate interest rate risk.

- Future Implications: Considering the long-term outlook for interest rates and their potential impact on retirement planning.

Smooth Transition to the Core Discussion:

Now that we understand the importance of interest rates in the context of pension annuities, let's delve deeper into the specific mechanisms and impacts.

Exploring the Key Aspects of Interest Rate Influence on Pension Annuity Payments:

1. Definition and Core Concepts:

An annuity is a financial product that provides a guaranteed stream of income for a specified period, often for life. Pension annuities are typically purchased with a lump sum from a pension pot upon retirement. The amount of the annuity payment is determined by several factors, most significantly, the size of the lump sum and the prevailing interest rate environment. A crucial concept to grasp is the "discount rate," which reflects the return an investor expects to receive on a given investment. This discount rate is heavily influenced by interest rates. Lower discount rates lead to higher annuity payments (as the present value of future payments is higher), and vice-versa.

2. Impact of Rising Interest Rates:

When interest rates rise, it generally leads to lower annuity payments for new annuities. This is because higher interest rates make it cheaper for pension providers to guarantee future income streams. They can earn higher returns on their investments, meaning they need to allocate less capital to fulfill their annuity obligations. Existing annuity holders are generally unaffected by rising interest rates, as their payments are locked in at the rate agreed upon at the time of purchase. However, the value of their annuity might increase in the secondary market, should they decide to sell their annuity.

3. Impact of Falling Interest Rates:

Conversely, falling interest rates lead to higher annuity payments for new annuities. This is because pension providers need to invest more capital to achieve the same returns in a lower-interest-rate environment. To compensate for lower investment yields, they offer larger annuity payments to attract customers. For existing annuitants, their payments remain unchanged. However, a prolonged period of low interest rates can put pressure on pension funds’ ability to meet their long-term obligations, particularly if they have significant liabilities tied to guaranteed annuity payments. This is because their investment returns may not adequately cover the payouts.

4. Hedging Strategies:

Pension providers employ various hedging strategies to manage interest rate risk. These strategies aim to minimize the impact of interest rate fluctuations on their ability to meet their obligations. Common strategies include using derivatives (like interest rate swaps) to lock in future interest rates or investing in assets whose values move inversely to interest rates (like inflation-linked bonds). These measures aim to stabilize the cash flows needed to meet annuity payments, reducing the impact of unexpected interest rate shifts.

5. Impact on Innovation:

The sensitivity of annuity payments to interest rates has spurred innovation in the pension industry. There's a growing focus on products that offer more flexibility and less exposure to interest rate risk. This includes hybrid products combining elements of annuities with other investment options, providing income while retaining some investment growth potential.

Exploring the Connection Between Inflation and Pension Annuity Payments:

Inflation plays a significant role alongside interest rates in determining annuity payouts. Inflation erodes the purchasing power of money over time. To mitigate this, some annuity contracts offer inflation-linked payments, adjusting the payments annually to reflect changes in the cost of living. However, even with inflation-linked annuities, interest rates still significantly influence the initial annuity payment and the provider's ability to sustain those payments over the long term. A low interest rate environment might make it difficult to offer generous inflation-linked annuity payments.

Key Factors to Consider:

-

Roles and Real-World Examples: The 2008 financial crisis, characterized by sharply falling interest rates, highlighted the vulnerability of some pension schemes to prolonged low-interest rate environments. The subsequent period saw many providers struggling to provide the promised annuity levels, leading to reduced payments or increased premiums in some cases. Conversely, periods of high interest rates (such as the early 1980s) saw lower annuity payouts for new contracts but didn't impact existing agreements.

-

Risks and Mitigations: The main risk lies in interest rate volatility. Sudden and sharp drops in interest rates can negatively impact pension funds' solvency, as their investment returns decline. To mitigate this, providers use diversification, hedging strategies, and stringent risk management protocols. Individual annuitants can diversify their retirement income streams by not solely relying on a single annuity but incorporating other sources like savings or part-time work.

-

Impact and Implications: Interest rate changes have long-term implications for retirement planning. Individuals need to consider the prevailing interest rate environment when making decisions about their pension annuity options. A low-interest-rate environment might encourage people to delay retirement or make more aggressive investment choices with their pension savings before annuitization.

Conclusion: Reinforcing the Connection:

The connection between interest rates and pension annuity payments is profound and multifaceted. Understanding this relationship allows for more informed retirement planning. By considering the impact of interest rate fluctuations and employing appropriate risk mitigation strategies, both pension providers and individuals can enhance the security and predictability of their retirement income.

Further Analysis: Examining the Role of Government Regulation:

Government regulations play a crucial role in the pension annuity market. Regulatory bodies set standards and oversight to ensure the solvency of pension providers and the protection of annuitants. These regulations influence the pricing and structure of annuity products and can impact how interest rates affect annuity payouts. For example, regulatory requirements concerning capital adequacy for pension funds may necessitate adjustments in annuity pricing to ensure that providers can meet their obligations even in challenging interest rate environments. These regulations aim to create a stable and transparent market to protect retirees' interests.

FAQ Section: Answering Common Questions About Pension Annuity Payments and Interest Rates:

-

Q: How are annuity payments calculated? A: Annuity payments are calculated using a complex actuarial model that considers factors like the purchase price, the annuitant's age and life expectancy, the interest rate environment (the discount rate), and the type of annuity (e.g., fixed, indexed).

-

Q: What happens if interest rates fall significantly after I've purchased my annuity? A: If you’ve already purchased a fixed annuity, the payment amount won’t change. However, the purchasing power of your payments might diminish if inflation increases faster than the interest rate, or if the interest rate continues to decline, potentially affecting the provider's future ability to provide annuity payments (although this is highly unlikely due to regulatory safeguards).

-

Q: Are there any ways to protect myself against interest rate risk? A: Diversifying your retirement income sources, potentially including part-time work or investments alongside your annuity, can help mitigate the risks associated with interest rate volatility. Choosing an inflation-linked annuity can also protect against inflation eroding the purchasing power of your retirement income.

-

Q: What is the role of the government in regulating annuity payments? A: Governments play a vital role in ensuring the stability and solvency of the annuity market through regulatory oversight of pension funds and providers. This includes setting minimum capital requirements, imposing restrictions on investment strategies, and safeguarding annuitants' rights.

Practical Tips: Maximizing the Benefits of Your Pension Annuity:

-

Understand the Basics: Before purchasing an annuity, thoroughly understand the terms and conditions, including the impact of interest rates on your payments. Seek professional financial advice if needed.

-

Consider Your Risk Tolerance: Assess your risk tolerance regarding interest rate fluctuations. This will help guide your choice between fixed-rate and inflation-linked annuities.

-

Diversify Your Income Streams: Don't rely solely on your pension annuity for retirement income. Supplement it with other sources like savings, investments, or part-time work to provide financial resilience against market fluctuations.

-

Stay Informed: Keep abreast of economic developments and interest rate trends to better understand how they might impact your retirement plans.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding the intricate interplay between interest rates and pension annuity payments is crucial for securing a financially comfortable retirement. While interest rate fluctuations introduce inherent uncertainties, informed decisions, diversification, and a clear understanding of the factors influencing annuity calculations can equip individuals and providers to navigate the complexities of this critical financial landscape. By actively managing risk and adapting to changing market conditions, a more secure and sustainable retirement becomes attainable.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Do Interest Rates Affect Pension Annuity Payments . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.