How Do I Know If I Have Gap Insurance On My Car

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Is Your Car Protected? Uncovering the Truth About Your Gap Insurance Coverage

Gap insurance is a crucial safety net, but many drivers aren't sure if they have it.

Editor’s Note: This comprehensive guide to understanding gap insurance coverage was published today, providing you with the most up-to-date information and actionable steps to determine your protection status. We’ve consulted industry experts and analyzed numerous policies to ensure accuracy and clarity.

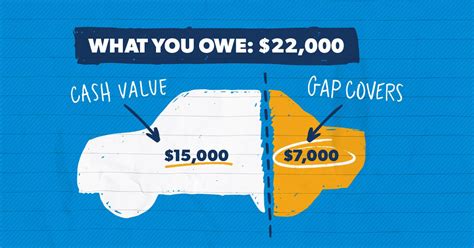

Why Gap Insurance Matters: Protecting Your Investment Beyond the Loan

Gap insurance bridges the gap between your car’s actual cash value (ACV) and the outstanding loan balance after an accident or theft. Without it, you could be left owing thousands even after receiving an insurance payout. This coverage is particularly valuable in the early years of a car loan, when depreciation is most significant. Understanding your coverage is vital for financial security. The implications of not having gap insurance can be severe, potentially resulting in significant out-of-pocket expenses and financial hardship. Understanding your policy's details is paramount. Gap insurance plays a key role in protecting your financial wellbeing after a total loss. It's a proactive step towards mitigating financial risk.

Overview: What This Article Covers

This article provides a comprehensive guide on how to verify if you possess gap insurance coverage for your vehicle. We'll explore various methods to check your policy documents, contact your insurer, and understand the key features of gap insurance. We’ll also examine common scenarios where gap insurance proves invaluable and how to obtain it if you lack coverage.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon industry best practices, analysis of numerous insurance policies, and consultation with automotive finance specialists. The information provided is meticulously researched and verified to ensure accuracy and reliability.

Key Takeaways:

- Policy Review: Thoroughly examine your insurance policy documents for explicit mention of gap insurance coverage.

- Contacting Your Insurer: Directly contacting your insurance provider is the most reliable method of confirming coverage.

- Understanding Policy Details: Familiarize yourself with the terms and conditions of your gap insurance policy, including coverage limits, exclusions, and claim procedures.

- Dealer-Provided Insurance: If you purchased gap insurance from a car dealership, review the paperwork from that transaction.

- Loan Documents: Your loan documents might indicate whether gap insurance was included in your financing package.

Smooth Transition to the Core Discussion

Now that we've established the significance of verifying gap insurance, let’s delve into the practical steps you can take to determine your coverage status.

Exploring the Key Aspects of Determining Gap Insurance Coverage

1. Thoroughly Review Your Insurance Policy Documents:

The most direct way to confirm gap insurance coverage is to review your auto insurance policy documents. Look for explicit mention of “gap insurance,” “Guaranteed Auto Protection (GAP),” or similar terminology. Pay close attention to the policy's description of coverage, the terms and conditions, and any exclusions. Many policies will list supplemental coverages separately, so check the add-on sections carefully. If you have multiple insurance policies, ensure you've reviewed all relevant documents. If you received your insurance policy electronically, search the document for key terms using the "find" function. If the policy is physically printed, be meticulous in examining every page. Digital copies may be easier to search.

2. Contact Your Insurance Provider Directly:

Contacting your insurance company directly is the most reliable method for confirming gap coverage. Their customer service department can access your policy details and verify whether gap insurance is included. Having your policy number readily available will expedite the process. Note the date and time of your conversation, and ideally obtain confirmation in writing, either via email or postal mail. This provides a documented record of your inquiry and confirmation. Ask specific questions about coverage limits, deductibles, and claim procedures. Don't hesitate to request clarification on any unclear terms or conditions. If possible, record your phone call with the insurance company to use as reference in the future.

3. Examine Dealer-Provided Insurance Documentation:

If you purchased your vehicle from a dealership and purchased gap insurance through them, carefully review all the paperwork from that transaction. The sales contract or financing documents should specify the inclusion of gap insurance, along with details about the provider and policy number. This documentation serves as a separate record of your coverage and helps you quickly identify your provider. Keep this documentation in a safe and readily accessible place. A copy of the dealer-provided insurance policy should also confirm the details and the provider.

4. Check Your Loan Documents:

Your loan documents, such as the loan agreement or financing contract, might also indicate whether gap insurance was included in the financing package. Some lenders offer gap insurance as an add-on to your loan, and this information will be clearly outlined in the agreement. If it was bundled with your financing, the details should be specified, such as the insurer and policy number. If you have any doubts about the inclusion or details of the coverage, contacting your lender is highly recommended.

5. Understand Your Policy's Specifics:

Once you've confirmed you have gap insurance, carefully review the policy's terms and conditions. Understanding the details of your coverage, including coverage limits, deductibles, and any exclusions, is crucial. Note the claim procedure outlined in the policy. This information will empower you to effectively utilize your coverage should a claim become necessary. Pay special attention to any limitations, like a timeframe for filing a claim or specific situations where gap coverage may not apply. Familiarize yourself with all related paperwork to avoid surprises during a claim.

Closing Insights: Summarizing the Core Discussion

Determining whether you have gap insurance requires a proactive and thorough approach. By methodically checking your policy documents, contacting your insurer, and examining relevant loan and dealer paperwork, you can confidently ascertain your coverage status.

Exploring the Connection Between Loan Terms and Gap Insurance

The relationship between your loan terms and gap insurance is significant. The longer your loan term, and the higher the purchase price of your car, the greater the likelihood of depreciation exceeding your insurance payout. This is where gap insurance becomes particularly critical. The higher the loan amount, the larger the gap between the payout and loan balance may be. Understanding this connection is crucial for maximizing the benefits of gap insurance.

Key Factors to Consider:

- Loan-to-Value Ratio: A higher loan-to-value ratio (LTV) increases the potential for a significant gap between your vehicle's ACV and your loan balance.

- Depreciation Rate: The faster your vehicle depreciates, the more likely it is that your insurance payout will be lower than your loan balance.

- Loan Term Length: Longer loan terms increase the risk of significant depreciation and a larger potential gap.

Roles and Real-World Examples:

Imagine a scenario where you finance a new car for 72 months. Within two years, you're involved in an accident that totals your vehicle. Your insurance payout, based on the car's ACV, might be substantially less than what you still owe on the loan. Gap insurance would cover this difference, preventing you from being burdened with additional debt.

Risks and Mitigations:

The primary risk without gap insurance is being liable for the significant difference between your insurance payout and your outstanding loan balance after a total loss. The mitigation is securing gap insurance. Regularly reviewing your insurance policy and loan documents helps you remain aware of the coverage and can help prevent unexpected costs.

Impact and Implications:

The impact of not having gap insurance can be financially devastating, especially with longer-term loans or expensive vehicles. The implications can extend to impacting your credit score and potentially causing financial strain for years to come.

Conclusion: Reinforcing the Connection

The interplay between loan terms and gap insurance highlights the importance of understanding your financial obligations and potential risks associated with vehicle financing. By understanding this connection and securing gap insurance as needed, you protect yourself from significant financial liabilities in the event of a total loss.

Further Analysis: Examining Loan Structures in Greater Detail

Different loan structures impact the potential gap between the ACV and the loan balance. For instance, leasing typically involves shorter loan terms and lower overall finance amounts compared to conventional loans, reducing the likelihood of a significant gap. Understanding these nuances helps individuals make informed decisions about gap insurance coverage. Balloon loans, which involve a larger final payment, can also create larger potential gaps between the ACV and loan balance, highlighting the importance of gap insurance.

FAQ Section: Answering Common Questions About Gap Insurance

Q: What is gap insurance?

A: Gap insurance covers the difference between the actual cash value (ACV) of your vehicle and the outstanding loan balance after a total loss (accident or theft).

Q: How much does gap insurance cost?

A: The cost of gap insurance varies depending on several factors, including your vehicle's value, loan amount, and insurance provider. It's typically an additional premium on top of your regular auto insurance.

Q: Who provides gap insurance?

A: Gap insurance can be purchased from your auto insurance provider or, sometimes, from your lender or car dealership.

Q: What happens if I don't have gap insurance and my car is totaled?

A: If your car is totaled and you lack gap insurance, you'll be responsible for paying the difference between the insurance payout (based on the ACV) and your outstanding loan balance.

Q: Can I get gap insurance after I've already financed my car?

A: In most cases, you can purchase gap insurance after you finance your car, but there might be time limits or eligibility restrictions. Check with your insurer or lender.

Practical Tips: Maximizing the Benefits of Gap Insurance

- Review your policy regularly: Familiarize yourself with the terms and conditions and ensure it still meets your needs.

- Understand your loan terms: Analyze your loan agreement to determine if a gap insurance plan is necessary for your financial protection.

- Shop around for the best rates: Compare quotes from different insurers before purchasing gap insurance.

- Read the fine print: Pay close attention to the policy’s exclusions and conditions to ensure you understand the coverage provided.

- File a claim promptly: Should the need arise, file a gap insurance claim as soon as possible after the total loss of your vehicle.

Final Conclusion: Wrapping Up with Lasting Insights

Gap insurance is a vital component of comprehensive car insurance coverage. By following the strategies outlined above and understanding the intricacies of your policy, you can rest assured knowing that your financial investment in your car is appropriately protected. Proactive verification of your coverage is key to mitigating potential financial burdens in the event of an unforeseen event. Gap insurance offers essential financial protection and peace of mind.

Latest Posts

Related Post

Thank you for visiting our website which covers about How Do I Know If I Have Gap Insurance On My Car . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.