How Do I Do A Balance Transfer On My Virgin Credit Card

adminse

Mar 31, 2025 · 8 min read

Table of Contents

How Do I Do a Balance Transfer on My Virgin Credit Card? Unlock Savings and Manage Debt

What if effortlessly saving money on your credit card debt was as simple as a balance transfer? A strategic balance transfer can significantly reduce your overall interest payments and provide valuable financial flexibility.

Editor’s Note: This article on Virgin credit card balance transfers was published today and provides up-to-date information on the process, benefits, and potential drawbacks. We’ve compiled everything you need to know to make an informed decision about whether a balance transfer is right for you.

Why Virgin Credit Card Balance Transfers Matter:

High interest rates on credit cards can quickly spiral your debt out of control. A Virgin credit card balance transfer allows you to move your existing balance to a new credit card offering a lower interest rate, potentially saving you hundreds or even thousands of pounds in interest charges over the life of your debt. This strategy can provide a much-needed financial breather, enabling you to focus on paying down your debt more efficiently. Moreover, it can improve your credit utilization ratio (the amount of credit you use compared to your total credit limit), a positive factor in your overall credit score.

Overview: What This Article Covers

This comprehensive guide details the process of performing a balance transfer on your Virgin credit card. We’ll explore eligibility requirements, the application process, potential fees, and crucial factors to consider before initiating a transfer. We'll also address common questions and offer practical tips to maximize your savings.

The Research and Effort Behind the Insights

This article draws on extensive research, including analysis of Virgin Money's official website, comparison of various balance transfer credit cards offered by different providers, and examination of financial advice from reputable sources. We've ensured accuracy and clarity to provide readers with actionable and trustworthy information.

Key Takeaways:

- Understanding Balance Transfer Basics: A clear definition and explanation of how balance transfers work.

- Eligibility Criteria: A detailed outline of the requirements for a successful balance transfer application.

- The Application Process: A step-by-step guide to transferring your balance.

- Fees and Charges: A comprehensive overview of associated costs to avoid hidden surprises.

- Choosing the Right Balance Transfer Card: Factors to consider when selecting a new card.

- Maximizing Savings: Strategic tips for effectively utilizing a balance transfer.

- Potential Drawbacks: Understanding the risks and limitations involved.

Smooth Transition to the Core Discussion:

Now that we’ve established the importance of understanding Virgin credit card balance transfers, let’s delve into the specifics, guiding you through each stage of the process.

Exploring the Key Aspects of Virgin Credit Card Balance Transfers

1. Definition and Core Concepts:

A balance transfer involves moving your outstanding balance from your existing Virgin credit card to a new credit card from a different provider. The goal is to take advantage of a lower interest rate offered by the new card, thus reducing the overall cost of repaying your debt. It's crucial to understand that balance transfers are not a way to avoid paying your debt; rather, they're a tool to manage it more effectively.

2. Eligibility Criteria:

Before initiating a balance transfer, ensure you meet the eligibility requirements set by the new credit card provider. These typically include:

- Good credit history: Lenders prefer applicants with a demonstrably responsible credit history. Poor credit scores may disqualify you.

- Sufficient income: You'll need to demonstrate a stable income sufficient to make regular repayments.

- Available credit limit: The new card must have a sufficient credit limit to accommodate your Virgin credit card balance.

3. The Application Process:

The process typically involves these steps:

- Research and compare balance transfer cards: Use comparison websites to find the most suitable card with the lowest interest rate and a 0% introductory period (if available). Consider fees carefully.

- Apply for the new credit card: Complete the online application form, providing accurate and truthful information.

- Acceptance and credit check: The new lender will perform a credit check. If approved, you'll receive your new card.

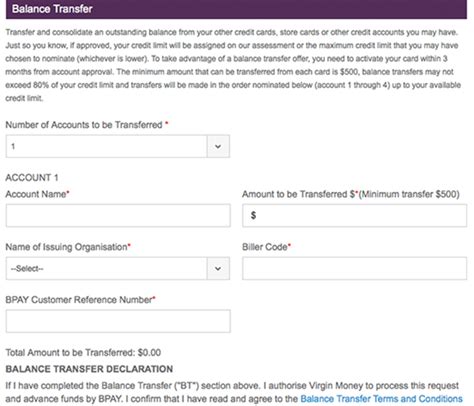

- Transferring your balance: Once you receive your new card, initiate the balance transfer by contacting either Virgin Money directly or logging into your online account. You may need to provide your Virgin credit card details.

- Monitor your accounts: Regularly track your payments on both cards to ensure the balance transfer is completed successfully.

4. Fees and Charges:

Be aware of potential fees associated with balance transfers:

- Balance transfer fee: This is a percentage of the transferred balance, usually ranging from 1% to 3%.

- Annual fee: Some credit cards charge an annual fee, which can negate some of the interest savings.

- Late payment fees: Missed payments will incur penalties.

5. Choosing the Right Balance Transfer Card:

The best balance transfer card depends on your individual circumstances. Consider:

- 0% introductory APR period: This offers a period (often 6-24 months) where no interest is charged. Ensure you can repay the balance before the promotional period ends.

- Balance transfer fee: Compare fees across different cards to minimize costs.

- Annual fee: Avoid cards with high annual fees.

- Credit limit: Ensure the credit limit is sufficient to cover your existing Virgin credit card debt.

- Ongoing APR: The interest rate charged after the introductory period expires. Choose a card with a low ongoing APR.

6. Maximizing Savings:

To maximize savings:

- Pay more than the minimum payment: Aim to repay the balance as quickly as possible within the 0% introductory period, if applicable.

- Budget effectively: Create a realistic budget to ensure you can afford the repayments.

- Avoid new purchases: Using the new card for new purchases can increase your debt.

7. Potential Drawbacks:

- High balance transfer fees: These can offset some of the interest savings.

- Missed deadlines: Failure to repay the balance before the 0% introductory period ends results in high interest charges.

- Impact on credit score: While a balance transfer can improve your credit utilization ratio, the application process may temporarily lower your score.

Closing Insights: Summarizing the Core Discussion:

Successfully executing a balance transfer on your Virgin credit card can lead to substantial savings on interest payments, providing much-needed financial relief. However, thorough research, careful planning, and diligent management are crucial for realizing these benefits. Failing to meet payment deadlines or overlooking fees can quickly negate any potential savings.

Exploring the Connection Between Credit Score and Virgin Credit Card Balance Transfers

A strong credit score is essential when applying for a balance transfer credit card. Lenders use credit scores to assess your creditworthiness and determine the risk of lending you money. A higher credit score generally leads to better interest rates and more favorable terms.

Key Factors to Consider:

Roles and Real-World Examples: A low credit score might result in rejection of your balance transfer application or an offer with less favourable terms, such as a higher interest rate or a shorter 0% period. Conversely, a high credit score increases your chances of securing a card with a low interest rate and a lengthy 0% introductory period.

Risks and Mitigations: Poor credit management after a balance transfer can negatively impact your credit score. Consistent and timely payments are vital to maintaining a good credit score and avoiding late payment fees.

Impact and Implications: A damaged credit score can affect your ability to secure loans, mortgages, and other financial products in the future. Maintaining a healthy credit score is essential for long-term financial health.

Conclusion: Reinforcing the Connection:

The relationship between your credit score and your success in obtaining a beneficial balance transfer is undeniable. A strong credit score is crucial for securing the best possible terms, maximizing savings, and avoiding potential pitfalls.

Further Analysis: Examining Credit Score Improvement Strategies

Improving your credit score before applying for a balance transfer can significantly increase your chances of success and securing a more favorable offer. Strategies include:

- Paying bills on time: Consistent timely payments are the most crucial factor in a good credit score.

- Keeping credit utilization low: Maintain a low balance on your existing credit cards.

- Checking your credit report regularly: Monitor your credit report for inaccuracies.

- Addressing negative marks: If there are negative marks on your credit report, take steps to resolve them.

FAQ Section: Answering Common Questions About Virgin Credit Card Balance Transfers

Q: What is the maximum amount I can transfer with a balance transfer? A: The maximum amount you can transfer depends on the available credit limit on the new card you apply for.

Q: How long does a balance transfer take to process? A: The processing time varies depending on the lenders involved, but it typically takes a few days to a couple of weeks.

Q: What happens if I miss a payment after a balance transfer? A: Missing payments will result in late payment fees and potentially damage your credit score.

Q: Can I do a balance transfer if I have a poor credit score? A: It is more difficult, but not impossible. You may be offered less favorable terms, or your application could be rejected.

Practical Tips: Maximizing the Benefits of a Virgin Credit Card Balance Transfer

- Compare Cards Thoroughly: Use comparison websites and read reviews to find the best balance transfer card for your circumstances.

- Calculate Total Costs: Factor in all fees and interest to accurately determine the potential savings.

- Create a Repayment Plan: Develop a realistic budget to repay the balance within the 0% introductory period, if applicable.

- Monitor Your Accounts: Regularly check your statements for accuracy and identify any issues promptly.

Final Conclusion: Wrapping Up with Lasting Insights

A Virgin credit card balance transfer can be a powerful tool for managing debt and saving money on interest charges. However, it's crucial to understand the process, fees, and potential risks involved. By following the steps outlined in this guide and making informed decisions, you can significantly improve your financial situation. Remember, a well-planned balance transfer, combined with responsible financial management, can lead to lasting financial success.

Latest Posts

Latest Posts

-

Why Is Income Shifting Considered Such A Major Tax Planning Concept

Apr 28, 2025

-

Explain How Tax Compliance Differs From Tax Planning

Apr 28, 2025

-

Rich Valuation Definition

Apr 28, 2025

-

Ricardian Equivalence Definition History And Validity Theories

Apr 28, 2025

-

Who Helped Rand Paul Create His Tax Planning

Apr 28, 2025

Related Post

Thank you for visiting our website which covers about How Do I Do A Balance Transfer On My Virgin Credit Card . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.