How Do I Do A Balance Transfer From One Credit Card To Another

adminse

Mar 31, 2025 · 7 min read

Table of Contents

Unlock Savings: Your Comprehensive Guide to Credit Card Balance Transfers

What if you could dramatically reduce the interest you pay on your credit card debt? Balance transfers offer a powerful strategy to achieve significant savings and regain control of your finances.

Editor's Note: This article on credit card balance transfers was published today, providing you with the most up-to-date information and strategies to help you navigate this financial tool effectively.

Why Credit Card Balance Transfers Matter:

Credit card debt can feel overwhelming, with high interest rates quickly accumulating charges. Balance transfers offer a lifeline, allowing you to move high-interest debt to a card with a lower or even 0% introductory APR. This can save you hundreds or even thousands of dollars in interest over time, freeing up funds for other financial priorities. The strategic use of balance transfers can improve your credit score (though mishandling them can hurt it), demonstrating responsible debt management. This, in turn, can unlock better financial opportunities in the future, including securing loans with more favorable terms.

Overview: What This Article Covers:

This comprehensive guide will walk you through the entire balance transfer process, from understanding the basics to maximizing your savings and avoiding potential pitfalls. We'll cover eligibility requirements, finding the best balance transfer offers, the application process, potential fees, and strategies for successful debt repayment. You'll gain actionable insights to make informed decisions and effectively manage your credit card debt.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon information from leading financial institutions, credit bureaus, consumer finance experts, and regulatory bodies. Data from independent financial analysis firms has been used to support claims and provide readers with an objective and accurate overview of credit card balance transfers.

Key Takeaways:

- Understanding Balance Transfer Basics: Defining balance transfers, their mechanics, and how they work.

- Finding the Best Offers: Identifying key factors like APR, fees, and eligibility criteria.

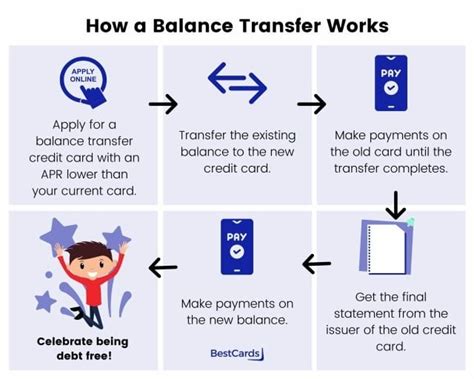

- The Application Process: A step-by-step guide to completing a balance transfer successfully.

- Managing Your Transfer: Strategies for avoiding fees and successfully paying off your debt.

- Potential Pitfalls and How to Avoid Them: Common mistakes and how to prevent them.

Smooth Transition to the Core Discussion:

Now that we understand the significance of balance transfers, let's delve into the specifics, exploring the key aspects and practical steps involved in this financial strategy.

Exploring the Key Aspects of Credit Card Balance Transfers:

1. Definition and Core Concepts:

A balance transfer involves moving your outstanding credit card balance from one credit card to another. The primary goal is to take advantage of a lower interest rate offered by the new card, thereby reducing the overall cost of repaying your debt. Many cards offer introductory 0% APR periods, typically lasting 12-18 months, during which you pay no interest on transferred balances. However, after this introductory period, a standard APR applies, often significantly higher than the promotional rate.

2. Applications Across Industries:

While seemingly limited to the credit card industry, the concept of balance transfers has broader applications in personal finance. The core principle of leveraging lower interest rates to reduce debt applies to other loan types, such as personal loans or auto loans. Understanding the mechanics of balance transfers can inform strategies for refinancing other debts to obtain better terms.

3. Challenges and Solutions:

One of the major challenges is finding a card with a suitable balance transfer offer. Creditworthiness plays a significant role, as issuers assess your credit score and financial history before approving an application. Another challenge is adhering to the repayment plan. Missing payments or exceeding the credit limit can negate the benefits of the transfer and incur penalties. Careful planning and budgeting are crucial for success.

4. Impact on Innovation:

The competitive credit card market has led to innovations in balance transfer offerings. Cards are constantly evolving to attract customers, with features like extended 0% APR periods, lower fees, and rewards programs. This competition benefits consumers, allowing them to find more favorable terms.

Closing Insights: Summarizing the Core Discussion:

Balance transfers are a powerful financial tool that can significantly reduce the cost of credit card debt, but they require careful planning and responsible management. By understanding the intricacies of the process and making informed choices, individuals can leverage balance transfers to improve their financial situation.

Exploring the Connection Between Credit Score and Balance Transfers:

A strong credit score significantly impacts your ability to secure a favorable balance transfer offer. Credit card issuers use your credit score as a measure of your creditworthiness, influencing their assessment of your risk and the terms they offer.

Key Factors to Consider:

- Roles and Real-World Examples: A high credit score increases your chances of approval for cards with attractive 0% APR periods and lower fees. Conversely, a low credit score may limit your options, resulting in less favorable terms or denial of the application. For example, a person with a 750+ credit score can likely secure a balance transfer with a 0% APR for 18 months, while someone with a 600 score may only qualify for a much shorter period and higher fees.

- Risks and Mitigations: Applying for multiple balance transfer cards in a short period can negatively impact your credit score. To mitigate this, research thoroughly and only apply for cards you're highly likely to be approved for. Moreover, a missed payment after a balance transfer can severely damage your credit. Diligent tracking and timely payments are vital.

- Impact and Implications: Successfully managing a balance transfer can positively impact your credit score over time, demonstrating responsible debt management. This, in turn, can unlock better financial opportunities in the future.

Conclusion: Reinforcing the Connection:

The interplay between your credit score and balance transfer success highlights the importance of responsible credit management. By maintaining a healthy credit score and understanding the nuances of balance transfers, individuals can effectively utilize this tool to reduce debt and improve their overall financial well-being.

Further Analysis: Examining Interest Rates in Greater Detail:

Interest rates are the cornerstone of balance transfer decisions. Understanding how they're calculated, what factors influence them, and how they impact your overall cost is crucial.

How Interest Rates are Calculated:

Interest is calculated on your outstanding balance, usually daily. The annual percentage rate (APR) is an annualized representation of this daily interest. The higher the APR, the more interest you pay. Understanding the difference between fixed and variable APRs is important. Fixed APRs remain constant throughout the loan term, while variable APRs fluctuate based on market conditions.

Factors Influencing Interest Rates:

Your creditworthiness is the most significant factor, with higher credit scores resulting in lower rates. The type of card (secured vs. unsecured), the length of the introductory period, and the balance transfer fee all influence the overall cost.

FAQ Section: Answering Common Questions About Balance Transfers:

Q: What is a balance transfer fee?

A: A balance transfer fee is a percentage of the amount you transfer (typically 3-5%), charged by the new credit card issuer.

Q: How long do 0% APR periods typically last?

A: 0% APR periods typically range from 12 to 18 months, but some offers may extend to 24 months or longer.

Q: What happens after the introductory 0% APR period ends?

A: After the promotional period ends, the standard APR for the credit card will apply to your outstanding balance. It's crucial to have a repayment plan in place to avoid accruing significant interest charges.

Q: Can I transfer my balance multiple times?

A: While you can technically transfer balances repeatedly, this is generally discouraged. Each transfer comes with fees, and frequent transfers can signal poor financial management, negatively impacting your credit score. It's a better strategy to consolidate your debt into a single, low-interest payment option.

Practical Tips: Maximizing the Benefits of Balance Transfers:

- Compare offers diligently: Don't settle for the first offer you see. Research several cards and compare APRs, fees, and introductory periods.

- Check your credit score: Understand your creditworthiness beforehand to manage expectations and avoid applications unlikely to be approved.

- Create a repayment plan: Develop a budget and repayment schedule to ensure you pay off the balance before the 0% APR period expires.

- Automate payments: Set up automatic payments to avoid late fees and ensure timely repayments.

- Avoid new charges: Refrain from using the card after the transfer to avoid accumulating new debt.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit card balance transfers represent a powerful tool for managing debt, offering potential savings on interest payments. However, successful implementation requires careful planning, diligent research, and responsible debt management. By understanding the intricacies, navigating the challenges, and leveraging the opportunities, you can effectively utilize balance transfers to achieve your financial goals. Remember, the key to success lies in proactive planning, meticulous budgeting, and responsible repayment.

Latest Posts

Latest Posts

-

How Does Inflation Affect Retirement Planning

Apr 29, 2025

-

How Do Interest Rates Affect Retirement Planning

Apr 29, 2025

-

Rollercoaster Swap Definition

Apr 29, 2025

-

Roll Down Return Definition How It Works Example

Apr 29, 2025

-

Why Are An Increasing Number Of Firms Focusing On Retirement Planning

Apr 29, 2025

Related Post

Thank you for visiting our website which covers about How Do I Do A Balance Transfer From One Credit Card To Another . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.