How Do I Do A Balance Transfer Chase

adminse

Mar 31, 2025 · 7 min read

Table of Contents

Unlock Savings: Your Comprehensive Guide to Chase Balance Transfers

Is juggling multiple credit card debts leaving you stressed and financially strained? Strategic balance transfers can significantly reduce your interest burden and pave the way for a debt-free future.

Editor’s Note: This article provides a comprehensive overview of Chase balance transfers, updated for accuracy and relevance. We'll guide you through the process, highlighting key considerations and helping you make informed decisions.

Why Chase Balance Transfers Matter:

Chase, a leading financial institution, offers a range of credit cards with balance transfer options, making it a popular choice for debt consolidation. Successfully executing a balance transfer can lead to substantial savings on interest charges, freeing up your budget for other priorities. This strategy is particularly effective for high-interest credit card debt, where even a small percentage point reduction can translate into hundreds, or even thousands, of dollars saved over time. Furthermore, consolidating multiple debts into a single payment simplifies your financial management, improving your credit utilization ratio and overall financial health.

What This Article Covers:

This article provides a step-by-step guide to navigating Chase balance transfers. We will explore eligibility requirements, the application process, potential fees, interest rates, and crucial factors to consider before initiating a transfer. We’ll also discuss strategies for maximizing the benefits and avoiding common pitfalls. Finally, we will address frequently asked questions to ensure you have a complete understanding of this powerful debt management tool.

The Research and Effort Behind the Insights:

The information presented here is based on thorough research of Chase's official website, publicly available information, and industry best practices. We've analyzed numerous user experiences and expert opinions to provide you with accurate, up-to-date, and actionable insights.

Key Takeaways:

- Understanding Chase Balance Transfer Offers: Learn how to identify and evaluate the best balance transfer offers from Chase.

- Eligibility Requirements: Determine if you meet the criteria for a Chase balance transfer.

- Application Process: Step-by-step guide to submitting a successful balance transfer application.

- Fees and Interest Rates: Analyze the costs associated with balance transfers and compare them to your existing debts.

- Maximizing Savings: Strategies to optimize your balance transfer for maximum financial benefit.

- Potential Pitfalls and How to Avoid Them: Understanding common mistakes and how to prevent them.

Smooth Transition to the Core Discussion:

Now that we've established the importance of understanding Chase balance transfers, let's delve into the specifics of how to successfully navigate this process.

Exploring the Key Aspects of Chase Balance Transfers:

1. Definition and Core Concepts:

A Chase balance transfer involves moving existing debt from one credit card (possibly from a different institution) to a Chase credit card. The primary goal is to take advantage of a lower interest rate offered by the Chase card, thereby reducing the overall interest paid over the repayment period. This process usually requires a balance transfer application, which may involve a review of your credit history.

2. Applications Across Industries:

While not specific to industries, balance transfers are a widely used personal finance strategy. Individuals from diverse backgrounds – students, professionals, entrepreneurs – utilize balance transfers to manage high-interest credit card debt.

3. Challenges and Solutions:

- High Balance Transfer Fees: Many Chase cards charge a balance transfer fee, typically a percentage of the transferred amount. To mitigate this, compare offers from multiple Chase cards to find one with a lower fee or potentially a promotional period with no fee.

- Interest Rate Increases After Promotional Period: Introductory low interest rates on balance transfers are often temporary. Ensure you understand the terms, including when the promotional rate expires and what the standard APR will be. Develop a plan to pay off the balance before the promotional period ends to avoid higher interest charges.

- Credit Score Impact: Applying for a new credit card can temporarily lower your credit score. If you have multiple applications pending, this impact can be more significant. Consider your credit score before applying for multiple cards simultaneously.

- Meeting Minimum Payment Requirements: Failing to make minimum payments on time can severely damage your credit score and potentially negate the benefits of the balance transfer. Establish a budget and create an automatic payment system to avoid missed payments.

4. Impact on Innovation:

While not directly an innovation, the balance transfer facility is a financial innovation that allows individuals to proactively manage their debt and improve their financial well-being.

Closing Insights: Summarizing the Core Discussion:

Chase balance transfers offer a powerful tool for managing debt, but understanding the associated fees, interest rates, and eligibility criteria is critical for success. A well-planned balance transfer can lead to significant long-term savings, while a poorly executed one could lead to further financial difficulties.

Exploring the Connection Between Credit Score and Chase Balance Transfers:

Your credit score plays a pivotal role in your eligibility for a Chase balance transfer and the terms you'll receive. A higher credit score generally leads to better offers, including lower interest rates and potentially waived balance transfer fees.

Key Factors to Consider:

- Roles and Real-World Examples: A high credit score increases your chances of approval for a Chase balance transfer with favorable terms. For instance, someone with a credit score above 750 might qualify for a 0% APR promotional period and a lower balance transfer fee compared to someone with a score below 650.

- Risks and Mitigations: A low credit score could lead to denial of your application or less favorable terms. To mitigate this risk, improve your credit score by paying off existing debts on time, keeping your credit utilization low, and monitoring your credit report for errors.

- Impact and Implications: Your credit score directly influences the cost of borrowing. A good credit score makes balance transfers a cost-effective strategy for debt consolidation, while a poor credit score can limit your options and increase your borrowing costs.

Conclusion: Reinforcing the Connection:

The relationship between your credit score and your ability to obtain a beneficial Chase balance transfer cannot be overstated. Focusing on maintaining a healthy credit score is essential for maximizing the savings potential of this debt management tool.

Further Analysis: Examining Credit Score in Greater Detail:

Your credit score is a numerical representation of your creditworthiness, calculated using information from your credit report. Factors such as payment history, credit utilization, length of credit history, and the types of credit you use contribute to your score.

FAQ Section: Answering Common Questions About Chase Balance Transfers:

- What is a Chase balance transfer? A Chase balance transfer is the process of moving debt from another credit card to a Chase credit card, often to take advantage of a lower interest rate.

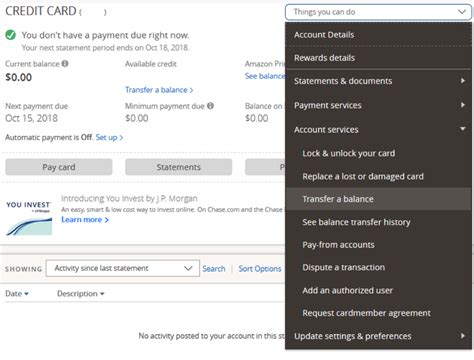

- How do I apply for a Chase balance transfer? You can apply online through the Chase website or by contacting Chase customer service.

- How long does a Chase balance transfer take? The transfer can take several weeks to process.

- What are the fees associated with Chase balance transfers? Fees vary depending on the specific card and may include a percentage of the transferred balance and/or an annual fee.

- What happens if I miss a payment after a balance transfer? Missing payments can negatively impact your credit score and result in higher interest charges.

- Can I transfer a balance from a non-Chase card to a Chase card? Yes, you can typically transfer balances from cards issued by other financial institutions.

- What is the difference between a promotional APR and a regular APR? A promotional APR is a temporary, lower interest rate, often for a limited time, while the regular APR is the standard interest rate after the promotional period ends.

Practical Tips: Maximizing the Benefits of Chase Balance Transfers:

- Compare Offers: Compare interest rates, balance transfer fees, and other terms offered by various Chase cards.

- Check Your Credit Score: Improve your credit score before applying to increase your chances of approval and obtain better terms.

- Plan Your Repayment: Create a budget and repayment schedule to pay off your balance before the promotional period ends to avoid higher interest charges.

- Automate Payments: Set up automatic payments to avoid late fees and ensure on-time payments.

- Monitor Your Account: Regularly check your account statements to ensure the balance transfer was processed correctly and to track your progress.

Final Conclusion: Wrapping Up with Lasting Insights:

Chase balance transfers provide a valuable tool for managing debt and saving money on interest. By understanding the process, carefully comparing offers, and planning your repayment strategy, you can effectively leverage this financial tool to improve your financial health and achieve your financial goals. Remember, careful planning and responsible debt management are crucial for successful balance transfers and long-term financial stability.

Latest Posts

Latest Posts

-

How Do Interest Rates Affect Retirement Planning

Apr 29, 2025

-

Rollercoaster Swap Definition

Apr 29, 2025

-

Roll Down Return Definition How It Works Example

Apr 29, 2025

-

Why Are An Increasing Number Of Firms Focusing On Retirement Planning

Apr 29, 2025

-

How To Include Federal Pension In Retirement Planning

Apr 29, 2025

Related Post

Thank you for visiting our website which covers about How Do I Do A Balance Transfer Chase . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.