How Do I Do A Balance Transfer Between Credit Cards

adminse

Mar 31, 2025 · 9 min read

Table of Contents

Unlock Savings: Your Comprehensive Guide to Credit Card Balance Transfers

What if you could significantly reduce the interest you pay on your credit card debt? Strategic balance transfers are a powerful tool to achieve exactly that, offering substantial savings and improved financial health.

Editor’s Note: This article on credit card balance transfers was published today and provides up-to-date information on strategies, considerations, and potential pitfalls to help you navigate this financial maneuver successfully.

Why Credit Card Balance Transfers Matter:

High-interest credit card debt can feel overwhelming. Minimum payments often barely cover the interest, leaving the principal balance largely untouched. This cycle of debt can persist for years, costing you significantly more than the original purchase. Balance transfers offer a pathway to break free from this cycle by moving your debt to a card with a lower interest rate, typically a 0% introductory APR offer. This allows you to focus on paying down the principal balance faster, saving you substantial interest charges over time. This strategy is particularly beneficial for individuals with larger balances and those struggling to manage high-interest payments. Understanding the mechanics and implications of balance transfers is crucial for effective debt management and financial well-being.

Overview: What This Article Covers:

This article provides a comprehensive guide to performing a credit card balance transfer, covering everything from choosing the right card to understanding the associated fees and potential drawbacks. We will explore the various types of balance transfer offers, explain the application process, and offer practical tips to maximize your savings and avoid common mistakes. We'll also delve into the implications of your credit score and the importance of responsible debt management post-transfer.

The Research and Effort Behind the Insights:

This article draws upon extensive research, including analysis of various credit card offers, examination of industry best practices, and review of consumer financial resources. Information presented is based on verifiable data and aimed at providing readers with accurate and reliable guidance.

Key Takeaways:

- Definition and Core Concepts: Understanding balance transfers, introductory APRs, and associated fees.

- Choosing the Right Transfer Card: Factors to consider when selecting a new card.

- The Application Process: Step-by-step instructions on how to execute a balance transfer.

- Fees and Pitfalls: Common pitfalls and how to avoid them.

- Post-Transfer Strategies: Strategies for successful debt repayment after the transfer.

- Impact on Credit Score: Understanding the potential effects on your credit score.

Smooth Transition to the Core Discussion:

Now that we understand the significance of balance transfers, let's delve into the practical aspects of executing a successful transfer and maximizing its benefits.

Exploring the Key Aspects of Credit Card Balance Transfers:

1. Definition and Core Concepts:

A balance transfer involves moving your outstanding credit card debt from one credit card to another. Many credit card companies offer introductory periods (often 0% APR) for balance transfers, allowing you to pay down your debt without accruing interest during that time. This introductory period typically lasts for a set timeframe (e.g., 12-18 months), after which the regular APR of the new card kicks in. It’s crucial to understand the terms of the introductory offer, including the duration and the APR that applies after the introductory period ends. You should also be aware of any balance transfer fees.

2. Choosing the Right Transfer Card:

Selecting the right credit card is paramount to the success of your balance transfer. Consider the following factors:

- Introductory APR: Look for cards offering the longest possible 0% APR period.

- Balance Transfer Fee: This fee is usually a percentage of the transferred balance (e.g., 3-5%). Compare fees across multiple cards. A slightly higher APR might be offset by a lower balance transfer fee if you plan to pay off the balance quickly.

- Annual Fee: Avoid cards with annual fees unless the savings from the 0% APR significantly outweigh the annual cost.

- Credit Limit: Ensure the new card offers a credit limit sufficient to accommodate your existing balance.

- Credit Requirements: Understand the credit score requirements to qualify for the card.

3. The Application Process:

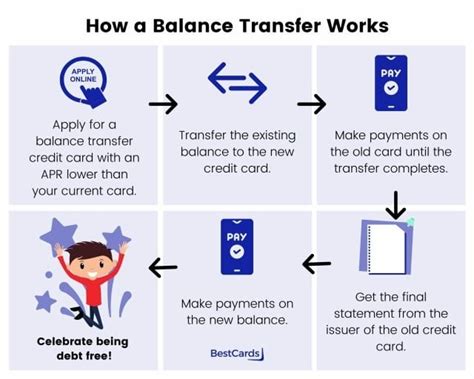

The application process typically involves these steps:

- Research and Compare: Identify cards with favorable terms based on the factors mentioned above.

- Apply for the Card: Submit an application online or via phone.

- Approval: The issuer will review your creditworthiness and notify you of the decision.

- Balance Transfer Request: Once approved, you'll need to initiate the balance transfer either online, through the mobile app, or by contacting customer service. You'll provide the details of the card you want to transfer from.

- Transfer Processing: The transfer process can take several weeks.

4. Fees and Pitfalls:

Be mindful of the following potential pitfalls:

- Balance Transfer Fees: As mentioned, these fees can be substantial. Factor them into your repayment plan.

- Late Payment Fees: Ensure timely payments to avoid late fees, which can negate the savings from a balance transfer.

- Regular APR After Introductory Period: Failing to pay off the balance before the introductory period ends will result in high interest charges.

- Credit Score Impact: Applying for multiple credit cards in a short period can negatively affect your credit score.

- Missed Payment Penalties: Make sure you carefully track the new due date and make timely payments, as missed payments can result in penalties and significant interest accrual.

5. Post-Transfer Strategies:

To maximize the benefits of a balance transfer, follow these strategies:

- Create a Realistic Repayment Plan: Develop a budget and payment schedule to ensure you pay off the balance within the introductory 0% APR period.

- Automate Payments: Set up automatic payments to avoid missed payments.

- Track Your Progress: Monitor your progress regularly to ensure you're on track to pay off the balance on time.

- Avoid New Charges: Refrain from using the card for new purchases until the balance is paid off to avoid accumulating new debt. The best strategy is to use only one card for payments.

- Consider Debt Consolidation: If you have multiple high-interest debts, debt consolidation might be a more effective solution.

6. Impact on Credit Score:

Applying for a new credit card can temporarily lower your credit score due to a "hard inquiry," but the impact is typically minor. However, paying down your debt effectively will eventually improve your credit score. Missing payments after a transfer will negatively impact your score even more significantly.

Exploring the Connection Between Financial Planning and Credit Card Balance Transfers:

The relationship between effective financial planning and credit card balance transfers is crucial. A well-defined financial plan helps you budget accurately and create realistic repayment plans for your transferred balance. Proper budgeting ensures you have enough disposable income to pay off the debt within the 0% APR period, preventing the accumulation of interest after the introductory rate expires. Careful financial planning is also essential for avoiding the pitfalls associated with balance transfers, such as late payments and accumulating new debt.

Key Factors to Consider:

Roles and Real-World Examples: A well-structured financial plan helps to avoid incurring additional debt, which might lead to multiple balance transfers becoming a vicious cycle. For example, someone might use a balance transfer to pay off a high-interest credit card, but if they don't address the underlying spending habits, they may find themselves using another card and repeating the process. Financial planning helps break that cycle.

Risks and Mitigations: The major risk is not paying off the debt before the introductory APR period ends. Mitigation involves creating a detailed repayment schedule, automating payments, and regularly tracking progress. Ignoring this risk may result in accumulating more interest than initially owed.

Impact and Implications: Successful use of balance transfers can result in considerable savings on interest payments, leading to a more stable financial situation. Failure to properly manage the transfer can result in deeper debt and negatively impact your credit score.

Conclusion: Reinforcing the Connection:

Financial planning is a critical element of successful credit card balance transfers. Without a plan, the potential benefits of the transfer are significantly reduced and the risks magnified. By understanding your income, expenses, and creating a realistic repayment plan, you substantially improve your chances of successfully consolidating and eliminating high-interest debt.

Further Analysis: Examining Financial Planning in Greater Detail:

Effective financial planning involves budgeting, tracking expenses, setting financial goals, and regularly reviewing your progress. Budgeting tools, financial advisors, and online resources can assist in creating and managing a personal financial plan. This plan should account for both short-term and long-term financial goals, such as eliminating debt, saving for retirement, and planning for major purchases. A sound financial plan is an essential foundation for responsible debt management and the successful execution of a balance transfer.

FAQ Section: Answering Common Questions About Credit Card Balance Transfers:

-

What is a balance transfer? It's moving your credit card debt from one card to another, often to take advantage of a lower interest rate, typically a 0% introductory APR offer.

-

How long does a balance transfer take? It can take several weeks for the transfer to process.

-

What is a balance transfer fee? A percentage of the transferred amount charged by the new card issuer.

-

Can a balance transfer hurt my credit score? Applying for a new card causes a "hard inquiry" which might slightly lower your score, but paying off the debt promptly will improve it over time. Conversely, missed payments will hurt your credit score significantly.

-

What happens after the 0% APR period ends? The regular APR of the new card will apply.

Practical Tips: Maximizing the Benefits of Credit Card Balance Transfers:

- Shop Around: Compare offers from multiple issuers before applying.

- Read the Fine Print: Carefully review the terms and conditions of the balance transfer offer.

- Create a Repayment Schedule: Develop a realistic plan to pay off the balance within the 0% APR period.

- Automate Payments: Set up automatic payments to avoid missed payments and late fees.

- Track Your Progress: Monitor your repayment progress regularly.

Final Conclusion: Wrapping Up with Lasting Insights:

Credit card balance transfers are a valuable tool for managing debt, but they require careful planning and responsible execution. By thoroughly researching options, understanding fees, and creating a well-defined repayment strategy, you can unlock significant savings and improve your financial health. However, neglecting these precautions can lead to unforeseen consequences and a potentially worsening financial situation. Remember, a balance transfer is a tool, and like any tool, its effectiveness depends on how you use it.

Latest Posts

Latest Posts

-

How Do You Add Cash Savings To Retirement Planning

Apr 29, 2025

-

Risk Based Mortgage Pricing Definition

Apr 29, 2025

-

Risk Based Haircut Definition

Apr 29, 2025

-

What Is The Best Retirement Planning Software

Apr 29, 2025

-

What Should I Consider For Life Expectancy In Retirement Planning

Apr 29, 2025

Related Post

Thank you for visiting our website which covers about How Do I Do A Balance Transfer Between Credit Cards . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.