Does Credit Karma Give Credit Reports

adminse

Apr 07, 2025 · 7 min read

Table of Contents

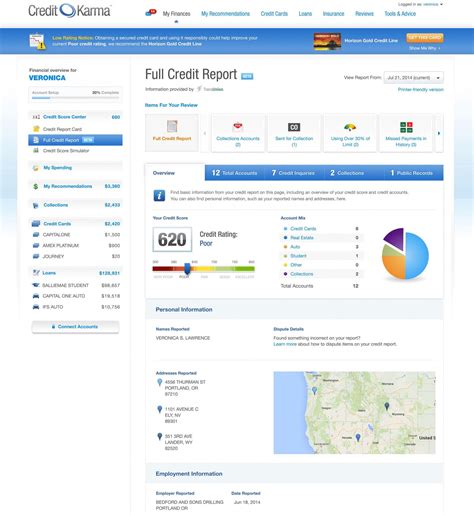

Does Credit Karma Give Credit Reports? Unlocking the Truth Behind Free Credit Scores

What if accessing your creditworthiness didn't require expensive subscriptions? Credit Karma, with its readily available free credit scores, is reshaping how consumers manage their financial health.

Editor’s Note: This article on Credit Karma and credit reports was published today, providing readers with the most up-to-date information and analysis. We've delved deep into the services offered to give you a clear understanding of what Credit Karma provides and doesn't provide.

Why Credit Reports Matter: Understanding Your Financial Footprint

Credit reports are the cornerstone of your financial identity. They're detailed records maintained by the three major credit bureaus – Equifax, Experian, and TransUnion – summarizing your credit history. Lenders, landlords, and even some employers use this information to assess your creditworthiness and risk level. A strong credit report can unlock opportunities like better loan interest rates, easier apartment approvals, and even employment advantages. Conversely, a poor credit report can significantly hinder your financial prospects.

Overview: What This Article Covers

This article meticulously examines Credit Karma's services, addressing the central question: does it provide full credit reports? We'll explore the differences between credit scores and reports, analyze the information Credit Karma offers, discuss its limitations, and ultimately provide a clear understanding of its value proposition. We will also examine alternative methods for obtaining credit reports and delve into the implications of using Credit Karma for credit monitoring.

The Research and Effort Behind the Insights

This analysis is based on extensive research, drawing upon Credit Karma's official website, consumer reviews, and expert opinions in the financial industry. We've scrutinized their terms of service, compared their offerings with those of other credit monitoring services, and analyzed user experiences to provide a balanced and informed perspective.

Key Takeaways:

- Definition of Credit Scores and Reports: A clear distinction between these crucial elements of your financial profile.

- Credit Karma's Offerings: A detailed breakdown of what information Credit Karma provides to users.

- Limitations of Credit Karma: Understanding what information Credit Karma doesn't provide and why.

- Alternatives for Obtaining Full Credit Reports: Exploring options for accessing your complete credit reports.

- Ethical Considerations: Addressing concerns regarding data privacy and the implications of using free credit monitoring services.

Smooth Transition to the Core Discussion

Now that we understand the vital importance of credit reports, let's delve into the specifics of Credit Karma and its role in helping consumers manage their credit.

Exploring the Key Aspects of Credit Karma

Definition and Core Concepts: Credit Karma is a free personal finance website that provides users with access to their VantageScore credit scores, derived from TransUnion and Equifax data. It's important to note that VantageScore is one of several credit scoring models, and it differs from the FICO scores used by many lenders. Credit Karma does not provide FICO scores directly.

Applications Across Industries: Credit Karma has significantly impacted the personal finance landscape by democratizing access to credit scores. It allows consumers to regularly track their credit health, identify potential issues, and take proactive steps to improve their creditworthiness. This proactive approach empowers individuals to make informed financial decisions.

Challenges and Solutions: A key challenge is the limited scope of information provided. While Credit Karma offers credit scores, it doesn't provide the comprehensive details found in full credit reports. Users need to understand these limitations and supplement Credit Karma's information with other resources to gain a complete picture of their credit history.

Impact on Innovation: Credit Karma's success has spurred competition in the free credit score market, pushing other companies to offer similar services. This increased accessibility to credit information empowers consumers and promotes financial literacy.

Closing Insights: Summarizing the Core Discussion

Credit Karma offers a valuable free service, providing a convenient way to monitor VantageScores. However, it's crucial to remember that this is not a substitute for obtaining full credit reports. The scores are a valuable snapshot, but the detailed information in a full report is essential for a thorough understanding of your credit health.

Exploring the Connection Between Credit Reports and Credit Karma

Credit Karma provides a simplified view of your credit health, focusing primarily on your VantageScore. It’s a powerful tool for monitoring your score changes over time, allowing you to identify potential red flags early. However, a full credit report offers significantly more detail.

Key Factors to Consider:

- Roles and Real-World Examples: While Credit Karma alerts you to changes in your score, it doesn’t reveal the specific accounts or inquiries that led to those changes. A full credit report from the bureaus details all open and closed accounts, payment history, public records, and inquiries.

- Risks and Mitigations: Relying solely on Credit Karma's limited information could lead to overlooking crucial details in your credit report that could negatively impact your financial future. Regularly checking your full credit reports from the bureaus directly mitigates this risk.

- Impact and Implications: Understanding the nuance between a credit score and a credit report is paramount. While your credit score is a numerical representation of your creditworthiness, the credit report is the foundation upon which that score is built.

Conclusion: Reinforcing the Connection

The relationship between Credit Karma and credit reports is one of partial inclusion. Credit Karma provides a glimpse, a useful tool for monitoring, but it does not replace the comprehensive information contained within a full credit report. Consumers should use Credit Karma strategically, supplementing it with direct access to their credit reports for a complete financial picture.

Further Analysis: Examining Credit Reports in Greater Detail

A credit report is a detailed document containing a comprehensive history of your credit activity. It typically includes:

- Identifying Information: Your name, address, social security number, and date of birth.

- Account Information: Details of all your credit accounts, including credit cards, loans, and mortgages. This includes account opening dates, balances, credit limits, payment history, and any delinquencies.

- Public Records: Information on bankruptcies, foreclosures, tax liens, and judgments against you.

- Inquiries: A record of all credit applications you've submitted, which can temporarily impact your credit score.

Understanding each element within your credit report is essential to addressing any inaccuracies and improving your overall credit profile.

FAQ Section: Answering Common Questions About Credit Karma

Q: What is Credit Karma? A: Credit Karma is a free online platform that provides users with access to their VantageScore credit scores from TransUnion and Equifax. It also offers other financial tools and resources.

Q: Does Credit Karma provide my full credit report? A: No, Credit Karma does not provide full credit reports from Equifax, Experian, or TransUnion. It only provides VantageScores, a different scoring model than the widely used FICO scores.

Q: How can I get my free credit report? A: You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once per year through AnnualCreditReport.com. This is a government-mandated service.

Q: What is the difference between a credit score and a credit report? A: Your credit score is a single number that summarizes your creditworthiness. Your credit report is the detailed document that contains all the information used to calculate your credit score.

Q: Is Credit Karma safe to use? A: Credit Karma utilizes industry-standard security measures to protect your data. However, as with any online platform, it's important to be mindful of your online security practices.

Practical Tips: Maximizing the Benefits of Credit Karma

- Regular Monitoring: Check your VantageScores on Credit Karma regularly to track your credit health.

- Identify Potential Issues: Use Credit Karma's alerts to promptly address any potential problems with your credit profile.

- Supplement with Full Reports: Obtain your free annual credit reports from AnnualCreditReport.com to gain a complete understanding of your credit history.

- Dispute Errors: If you find any inaccuracies in your credit report, dispute them immediately with the relevant credit bureau.

Final Conclusion: Wrapping Up with Lasting Insights

Credit Karma offers a convenient and free tool for monitoring your VantageScore. However, it is crucial to understand its limitations. It's a valuable supplementary tool, but it does not replace the necessity of regularly obtaining and reviewing your full credit reports from the credit bureaus themselves. By combining the convenience of Credit Karma with the comprehensive detail of your annual credit reports, you can take a proactive approach to managing your financial well-being and building a strong credit history.

Latest Posts

Latest Posts

-

Advance Refunding Definition

Apr 30, 2025

-

Advance Premium Fund Definition

Apr 30, 2025

-

Advance Premium Definition

Apr 30, 2025

-

Advance Funded Pension Plan Definition

Apr 30, 2025

-

Advance Commitment Definition

Apr 30, 2025

Related Post

Thank you for visiting our website which covers about Does Credit Karma Give Credit Reports . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.