Does Chase Let You Check Your Credit Score

adminse

Apr 08, 2025 · 8 min read

Table of Contents

Does Chase Let You Check Your Credit Score? Unlocking Your Financial Insights

Knowing your credit score is crucial for financial health, and understanding how to access it is key.

Editor’s Note: This article on accessing your credit score through Chase was published today, providing readers with the most up-to-date information and practical guidance.

Why Checking Your Credit Score Matters:

A credit score is a three-digit number that lenders use to assess your creditworthiness. It reflects your history of borrowing and repaying debt. A higher score generally translates to better loan terms, lower interest rates, and increased approval chances for credit cards, mortgages, and other financial products. Regularly monitoring your credit score enables proactive management of your financial health, allowing for early detection and correction of any potential problems. Understanding your score empowers you to make informed financial decisions, from securing better rates to avoiding costly mistakes.

Overview: What This Article Covers

This article will comprehensively examine whether Chase provides direct access to credit scores and what alternative avenues Chase customers can utilize to obtain this crucial financial information. We will explore Chase's credit-related services, discuss the various credit scoring models, and outline the best strategies for effectively monitoring your credit health, regardless of your banking institution.

The Research and Effort Behind the Insights

This analysis is based on extensive research into Chase's official website, terms and conditions, associated financial products, and industry best practices regarding credit score access. Information gathered from reputable financial websites and consumer advocacy groups is also incorporated to ensure a comprehensive and reliable understanding of the topic.

Key Takeaways:

- Chase itself does not directly provide free credit scores to all its customers. While some Chase credit cards may offer credit score access through third-party providers, this is not a universal benefit across all Chase accounts.

- Several methods exist to access your credit score outside of Chase. These include utilizing services offered by credit bureaus directly, leveraging credit monitoring services, and exploring options through other financial institutions.

- Understanding different credit scoring models is vital. Knowing the differences between FICO scores and VantageScores helps interpret your credit reports accurately.

- Regular credit score monitoring is crucial. This allows for early detection of errors and enables proactive management of your credit health.

Smooth Transition to the Core Discussion:

Now that we've established the importance of knowing your credit score, let's delve into the specifics of how Chase interacts with credit information and what options are available to its customers.

Exploring the Key Aspects of Credit Score Access:

1. Chase's Credit Card Offerings and Credit Score Access:

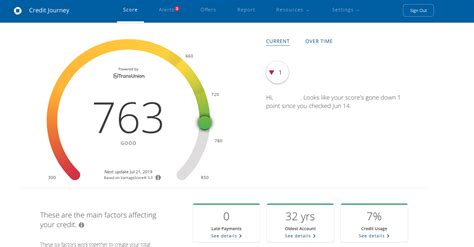

Many Chase credit cards partner with credit reporting agencies (like Experian, Equifax, or TransUnion) to offer credit score access to cardholders. This is often integrated directly into the Chase mobile app or online banking platform. However, the availability of this feature is tied to specific credit card products, and it's not a standard benefit provided with every Chase card. The terms and conditions of each card should be reviewed carefully to determine if credit score access is included. Sometimes, access might be limited to a certain period after card approval or require a specific level of card usage.

2. Credit Score Models: FICO vs. VantageScore:

Understanding the different types of credit scores is crucial. The two most prevalent models are FICO and VantageScore. FICO scores are widely used by lenders and are often considered more influential in loan applications. VantageScore is a newer model that also considers factors like payment behavior beyond the traditional credit report data. Chase's credit card partnerships may utilize either or both of these scoring models, so understanding the nuances of each can help interpret your credit score report effectively.

3. Alternative Methods for Accessing Your Credit Score:

If your Chase credit card doesn't offer credit score access, several other reliable avenues exist:

- Credit Reporting Agencies: Directly access your credit report from the three major credit bureaus – Equifax, Experian, and TransUnion. You're legally entitled to a free credit report from each agency annually through AnnualCreditReport.com. While these reports don't always include your credit score, they provide a detailed overview of your credit history, which you can use to understand your score's composition.

- Credit Monitoring Services: Many companies offer paid credit monitoring services. These services typically provide regular credit score updates, alerts for changes to your credit report, and additional features like identity theft protection. These can be valuable tools for actively managing your credit health, regardless of your banking institution.

- Other Financial Institutions: Some banks and financial institutions offer free credit score access to their customers as a value-added service. Explore options with other banks or credit unions to see if they provide this service.

4. Understanding Your Credit Report:

Beyond the credit score itself, a comprehensive understanding of your credit report is essential. The report details your credit history, including open accounts, payment history, amounts owed, and any inquiries. Carefully reviewing your credit report regularly helps identify errors or potential issues that might be negatively affecting your score.

Exploring the Connection Between Chase Services and Credit Score Access:

Chase offers a range of financial products and services, from checking and savings accounts to mortgages and investment options. While Chase doesn't provide universal free credit score access, many of their credit card products incorporate this feature as an added benefit. This connection highlights the strategic importance of credit scores in the financial industry, underscoring the need for customers to monitor their credit health actively.

Key Factors to Consider:

- Type of Chase Credit Card: The credit score access feature is not consistent across all Chase credit cards. The specific card's terms and conditions determine if this benefit is offered.

- Third-Party Providers: Chase partners with various third-party credit reporting companies. The specific provider and the data they furnish can vary.

- Data Accuracy: Always verify the accuracy of the credit score provided by Chase or any third-party provider, cross-referencing it with your reports from the credit bureaus.

- Subscription Services: Remember that some credit score access through Chase might be tied to paid subscription services associated with specific cards.

Risks and Mitigations:

One potential risk is relying solely on a credit score provided by a single source. Always cross-reference your credit score from multiple sources (Chase, if applicable, and credit bureaus) to ensure data consistency and accuracy. Another risk is neglecting to monitor your credit report for errors or fraudulent activity. Regular checks help mitigate such risks.

Impact and Implications:

Understanding and monitoring your credit score has far-reaching implications, impacting your ability to secure loans, obtain favorable interest rates, and manage your overall financial health. It's crucial for both short-term and long-term financial planning.

Conclusion: Reinforcing the Connection:

While Chase doesn't offer universal free credit score access to all account holders, many of their credit card offerings incorporate this feature as a significant benefit. Understanding the options available, both through Chase and other sources, is crucial for maintaining a strong financial foundation. The relationship between Chase services and credit score access emphasizes the importance of proactive credit monitoring and understanding the nuances of your credit report.

Further Analysis: Examining Credit Report Accuracy in Greater Detail:

Ensuring the accuracy of your credit report is paramount. Errors in your report can negatively impact your credit score, making it harder to access financial products at favorable terms. Dispute any inaccurate information promptly with the respective credit bureaus to correct any discrepancies.

FAQ Section: Answering Common Questions About Credit Score Access:

Q: Does Chase offer free credit scores to all its customers?

A: No, Chase does not provide free credit scores to all customers. This benefit is typically linked to specific Chase credit card products, and availability varies.

Q: How can I access my credit score through Chase?

A: If your Chase credit card offers credit score access, it’s usually available through the Chase mobile app or online banking platform. Check your card's terms and conditions.

Q: What if my Chase credit card doesn't offer credit score access?

A: You can access your credit score through the three major credit bureaus (AnnualCreditReport.com), paid credit monitoring services, or potentially through other financial institutions.

Q: What is the difference between FICO and VantageScore?

A: FICO and VantageScore are different credit scoring models. FICO scores are widely used by lenders, while VantageScore is a newer model. Both consider factors like payment history, but may weigh certain factors differently.

Q: How often should I check my credit score?

A: Aim to check your credit score at least once a year, or more frequently if you’re actively applying for loans or managing your credit.

Practical Tips: Maximizing the Benefits of Credit Score Monitoring:

- Check Your Credit Report Regularly: Regularly review your credit report from all three bureaus for accuracy and identify any potential issues early.

- Understand Your Credit Score: Familiarize yourself with your score, what factors influence it, and how you can improve it.

- Utilize Free Resources: Take advantage of your free annual credit report from AnnualCreditReport.com.

- Consider Paid Credit Monitoring: Evaluate the benefits of paid credit monitoring services to gain access to regular updates, alerts, and identity theft protection.

- Maintain Good Credit Habits: Practice responsible borrowing and repayment to maintain a healthy credit score.

Final Conclusion: Wrapping Up with Lasting Insights:

Understanding and managing your credit score is an essential aspect of maintaining strong financial health. While Chase offers credit score access through specific credit card products, it’s crucial to explore all available avenues to ensure comprehensive monitoring of your credit information. By actively checking your credit reports and scores, you can proactively identify and address any issues, ultimately securing better financial opportunities. Proactive credit management empowers you to make informed decisions, leading to greater financial security and success.

Latest Posts

Latest Posts

-

When Does Citi Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Ally Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Indigo Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Amazon Credit Card Report To Credit Bureaus

Apr 08, 2025

-

When Does Destiny Credit Card Report To Credit Bureaus

Apr 08, 2025

Related Post

Thank you for visiting our website which covers about Does Chase Let You Check Your Credit Score . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.