Do You Pay Interest If You Pay Minimum Payment

adminse

Apr 04, 2025 · 8 min read

Table of Contents

Do you pay interest if you pay only the minimum payment?

Making only minimum payments on your credit cards can significantly impact your finances.

Editor’s Note: This article on minimum credit card payments and interest accrual was published today, offering up-to-date insights for managing credit card debt effectively. Understanding how minimum payments affect interest charges is crucial for responsible credit card use.

Why Minimum Payments Matter: Relevance, Practical Applications, and Industry Significance

Credit cards offer convenience and financial flexibility, but understanding their terms is paramount to avoid accumulating substantial debt. Many cardholders are unaware of the implications of paying only the minimum payment. This seemingly small decision can have significant long-term financial consequences, impacting credit scores, overall debt, and ultimately, financial well-being. The information presented here is relevant to anyone managing credit card debt, seeking to improve their financial literacy, or aiming to optimize their credit card usage.

Overview: What This Article Covers

This article will delve into the mechanics of minimum payments and interest accrual on credit cards. We will explore how interest is calculated, the factors influencing the minimum payment amount, the long-term implications of consistently making only minimum payments, and strategies for managing credit card debt more effectively. Readers will gain actionable insights into responsible credit card management and learn how to avoid the debt trap.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon information from reputable financial institutions, consumer protection agencies, and established financial literacy resources. Data on average interest rates, minimum payment calculations, and the impact of debt on credit scores has been compiled to provide accurate and unbiased information.

Key Takeaways: Summarize the Most Essential Insights

- Definition and Core Concepts: Understanding how minimum payments are calculated and the impact of interest on outstanding balances.

- Practical Applications: Real-world scenarios demonstrating the long-term cost of paying only the minimum.

- Challenges and Solutions: Identifying the pitfalls of minimum payments and strategies for debt reduction.

- Future Implications: The long-term impact on credit scores and overall financial health.

Smooth Transition to the Core Discussion

With a clear understanding of the importance of managing credit card debt responsibly, let's delve deeper into the specifics of minimum payments and interest accrual. We will examine how these interact and the consequences of prioritizing minimum payments over more substantial repayments.

Exploring the Key Aspects of Minimum Payments and Interest

Definition and Core Concepts: Understanding the Mechanics

A credit card's minimum payment is the lowest amount a cardholder can pay each month and remain in good standing with the issuer. This amount typically includes a portion of the principal balance (the original amount borrowed) and the accrued interest. The calculation of the minimum payment varies depending on the credit card issuer and their policies, but it's usually a small percentage of the outstanding balance, often between 1% and 3%. Crucially, it often does not cover the full interest accrued during the billing cycle.

Interest, on the other hand, is the cost of borrowing money. Credit card companies charge interest on the outstanding balance, typically calculated daily and compounded monthly. This means interest is calculated on the unpaid balance, including any previously accrued interest. The Annual Percentage Rate (APR) determines the annual cost of borrowing. The APR is usually fixed but can be variable depending on market conditions and the cardholder's creditworthiness.

Applications Across Industries: The Universal Nature of Interest Charges

The mechanics of minimum payments and interest charges are consistent across the credit card industry, though specific percentages and calculation methods might vary slightly between issuers. Whether it’s a major national bank or a smaller credit union, the fundamental principle remains the same: paying only the minimum almost always results in continuing interest accrual.

Challenges and Solutions: The Debt Trap of Minimum Payments

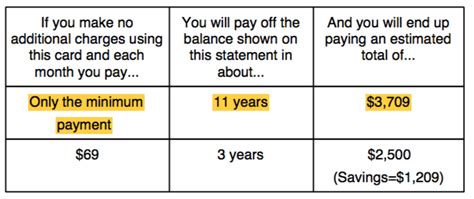

The primary challenge with paying only the minimum payment is that it can lead to a vicious cycle of debt. Because the minimum payment frequently doesn't cover the full interest, the outstanding balance remains high, leading to further interest accrual in subsequent months. This means that even though you're making consistent payments, you may be making little to no progress in reducing the principal balance. Over time, this can significantly increase the total amount paid and extend the repayment period for years or even decades.

The solution involves paying more than the minimum payment. This could involve allocating additional funds each month, creating a dedicated debt repayment plan, or exploring debt consolidation options. The goal is to bring down the principal balance faster than interest accrues. A budgeting tool or a financial advisor can assist in creating a realistic plan.

Impact on Innovation: Strategies for Debt Management

The credit card industry has responded to the challenge of high-interest debt by offering various tools and services to help consumers manage their debt effectively. These may include balance transfer options, which allow consumers to move their debt to a card with a lower interest rate, and debt management programs, which help individuals create a plan to repay their debt over time. However, it is critical that these tools are used responsibly and that consumers understand the terms and conditions before using them.

Exploring the Connection Between Interest Rates and Minimum Payments

Roles and Real-World Examples: Illustrating the Impact

Let's consider a real-world example. Suppose a cardholder has a balance of $5,000 with a 18% APR and a minimum payment of 2% ($100). If they consistently pay only the minimum payment, a significant portion of each monthly payment goes towards interest, leaving only a small amount to reduce the principal. After several years, the amount paid in interest could easily exceed the original balance, making the debt dramatically more expensive.

Conversely, if this same cardholder increased their monthly payments, even modestly, they would significantly reduce the principal balance and minimize the total interest paid over time. This highlights the substantial financial advantage of prioritizing higher payments.

Risks and Mitigations: Avoiding the Debt Spiral

The biggest risk associated with only paying the minimum is accumulating substantial interest charges, resulting in a longer repayment period and a higher overall cost. To mitigate this risk, individuals should prioritize paying more than the minimum amount whenever possible. This proactive approach is crucial in preventing the debt from snowballing out of control.

Building an emergency fund is a crucial mitigating factor. Unexpected expenses can strain finances, potentially leading to missed payments and further interest accrual. Having a financial safety net reduces the likelihood of needing to rely on credit cards for emergencies, avoiding the cycle of minimum payments and high interest.

Impact and Implications: Long-Term Financial Consequences

The long-term implications of consistently making minimum payments extend beyond just higher interest costs. It significantly impacts credit scores. A high credit utilization ratio (the percentage of available credit being used) negatively affects credit scores, making it harder to secure loans, mortgages, or even rent an apartment in the future. This can have a ripple effect on many aspects of financial life, hindering major financial decisions.

Conclusion: Reinforcing the Connection Between Minimum Payments and Interest

The connection between minimum payments and interest is undeniable. While paying the minimum keeps accounts in good standing, it rarely leads to efficient debt repayment. Prioritizing higher payments actively reduces the principal balance, minimizing interest accrual and accelerating the path to debt freedom.

Further Analysis: Examining Interest Calculation in Greater Detail

Interest calculations on credit cards are usually done daily on the outstanding balance. The daily interest rate is calculated by dividing the APR by 365. This daily interest is then added to the balance, and the process repeats daily. This compounding effect accelerates interest growth, making it crucial to pay down the principal as quickly as possible.

FAQ Section: Answering Common Questions About Minimum Payments

What is the minimum payment? The minimum payment is the smallest amount you can pay each month without incurring a late payment fee. This amount is usually a percentage of your outstanding balance (typically 1-3%) and may include some of the interest accrued.

How is the minimum payment calculated? Credit card issuers have proprietary algorithms for calculating minimum payments. However, it typically involves a percentage of the outstanding balance plus any fees or interest charges.

How does paying only the minimum affect my credit score? Paying only the minimum can negatively impact your credit score, primarily due to a high credit utilization ratio. Keeping your credit utilization low (generally below 30%) is crucial for maintaining a good credit score.

Can I negotiate a lower minimum payment? Negotiating a lower minimum payment is generally difficult. However, contacting your credit card issuer and explaining your financial situation might lead to alternative solutions like a hardship program or debt management plan.

What are the alternatives to minimum payments? Consider creating a debt repayment plan, focusing on paying more than the minimum to accelerate debt reduction. Explore options like debt consolidation or balance transfers to lower interest rates.

Practical Tips: Maximizing the Benefits of Responsible Credit Card Use

Understand the Basics: Learn how credit card interest is calculated, and understand your APR.

Track Your Spending: Monitor your spending meticulously to stay within your budget and avoid accumulating unnecessary debt.

Create a Budget: Develop a realistic budget that allocates sufficient funds towards paying down your credit card debt.

Prioritize Debt Reduction: Prioritize higher payments to accelerate debt reduction and minimize interest charges.

Explore Alternative Options: If facing financial difficulties, contact your credit card issuer to explore alternatives such as hardship programs or debt management plans.

Final Conclusion: Wrapping Up with Lasting Insights

Understanding the interplay between minimum payments and interest charges is essential for responsible credit card use. While minimum payments fulfill the basic requirement of avoiding late fees, prioritizing higher payments leads to quicker debt reduction, lower overall interest costs, and improved credit health. By proactively managing credit card debt and prioritizing higher payments, individuals can achieve long-term financial stability and avoid the pitfalls of the debt trap.

Latest Posts

Latest Posts

-

What Is The League Minimum Pay For An Nfl Player

Apr 05, 2025

-

Whats The League Minimum For Nfl Player

Apr 05, 2025

-

Whats The League Minimum Pay In The Nfl

Apr 05, 2025

-

Whats The League Minimum In Nfl

Apr 05, 2025

-

What Is Nfl League Minimum Salary

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about Do You Pay Interest If You Pay Minimum Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.