Debt To Capital Ratio Definition Formula And Example

adminse

Mar 25, 2025 · 8 min read

Table of Contents

Understanding the Debt-to-Capital Ratio: Definition, Formula, and Examples

What if a company's financial health could be summarized in a single, easily understandable metric? The debt-to-capital ratio offers just that, providing a powerful snapshot of a company's financial leverage and risk.

Editor’s Note: This article on the debt-to-capital ratio provides a comprehensive overview of its definition, calculation, interpretation, and practical applications. Updated data and real-world examples ensure readers gain a current and relevant understanding of this crucial financial indicator.

Why the Debt-to-Capital Ratio Matters:

The debt-to-capital ratio is a fundamental financial metric used to assess a company's capital structure. It reveals the proportion of a company's financing that comes from debt relative to its total capital. Understanding this ratio is crucial for investors, lenders, and company management alike. A high ratio can signal increased financial risk, while a low ratio might suggest a conservative approach but potentially missed opportunities for growth. This ratio helps determine a company's ability to meet its obligations, its vulnerability to economic downturns, and its overall financial stability. It is regularly analyzed in credit ratings, financial modeling, and investment decisions.

Overview: What This Article Covers:

This article will delve into the intricacies of the debt-to-capital ratio. We will explore its precise definition, demonstrate its calculation using a clear formula and practical examples, analyze its interpretation, discuss its limitations, and highlight its significance in real-world financial analysis. We will also explore the nuances of different types of debt and their impact on the ratio.

The Research and Effort Behind the Insights:

This article is the result of extensive research, drawing upon established financial principles, publicly available company data, and recognized accounting standards. Numerous financial statements and industry reports have been reviewed to ensure accuracy and relevance. The examples used are illustrative and based on typical financial data to enhance reader understanding.

Key Takeaways:

- Definition and Core Concepts: A precise understanding of the debt-to-capital ratio and its constituent components.

- Formula and Calculation: A step-by-step guide to calculating the ratio with practical examples.

- Interpreting the Ratio: Guidance on understanding different ratio values and their implications.

- Applications and Limitations: Real-world applications of the ratio and an awareness of its limitations.

- Impact of Different Debt Types: The effect of various debt instruments on the ratio.

Smooth Transition to the Core Discussion:

Having established the importance of the debt-to-capital ratio, let's now proceed to a detailed examination of its definition, calculation, interpretation, and practical application.

Exploring the Key Aspects of the Debt-to-Capital Ratio:

1. Definition and Core Concepts:

The debt-to-capital ratio measures the proportion of a company's financing that is attributable to debt, compared to its total capital structure. Total capital encompasses both debt and equity financing. Essentially, it showcases how much a company relies on borrowed funds versus its own funds (equity) to finance its operations and assets. A higher ratio indicates greater reliance on debt, which generally translates to higher financial risk.

2. Formula and Calculation:

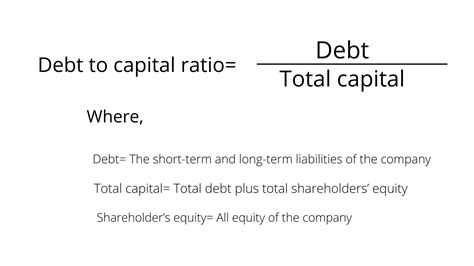

The formula for calculating the debt-to-capital ratio is straightforward:

Debt-to-Capital Ratio = Total Debt / (Total Debt + Total Equity)

-

Total Debt: This includes all forms of debt, such as long-term debt (bonds, loans), short-term debt (notes payable, overdrafts), and current portions of long-term debt. It represents the total amount of money borrowed by the company.

-

Total Equity: This represents the owners' stake in the company. It includes common stock, retained earnings, preferred stock, and any other equity accounts. It essentially signifies the company's net worth after deducting liabilities.

Example 1: Calculating the Debt-to-Capital Ratio

Let's consider Company A:

- Total Debt: $500,000

- Total Equity: $1,000,000

Debt-to-Capital Ratio = $500,000 / ($500,000 + $1,000,000) = 0.33 or 33%

This indicates that 33% of Company A's capital structure is financed by debt.

Example 2: A Higher Debt-to-Capital Ratio

Now, let's consider Company B:

- Total Debt: $800,000

- Total Equity: $200,000

Debt-to-Capital Ratio = $800,000 / ($800,000 + $200,000) = 0.80 or 80%

Company B has a significantly higher debt-to-capital ratio, indicating a much greater reliance on debt financing. This higher ratio carries a substantially higher risk profile.

3. Interpreting the Ratio:

The interpretation of the debt-to-capital ratio is relative. There is no universally agreed-upon "good" or "bad" ratio. The ideal ratio varies significantly across industries, company size, and overall economic conditions. However, some general observations can be made:

-

Low Ratio (below 0.33): Generally indicates a conservative capital structure with lower financial risk. The company relies more on equity financing.

-

Moderate Ratio (between 0.33 and 0.66): Represents a balanced capital structure. The company utilizes a mix of debt and equity.

-

High Ratio (above 0.66): Suggests a high reliance on debt financing. This increases financial risk as the company is more vulnerable to interest rate fluctuations and economic downturns. It may also signal difficulties in securing additional financing.

4. Applications and Limitations:

The debt-to-capital ratio is used extensively in various financial analyses:

-

Credit Rating Agencies: Used to assess a company's creditworthiness and determine its credit rating.

-

Investment Analysis: Investors utilize the ratio to assess the financial risk associated with an investment.

-

Financial Modeling: The ratio is a crucial input in various financial models, such as discounted cash flow (DCF) analysis.

-

Mergers and Acquisitions: The ratio helps evaluate the financial health of a target company.

Limitations:

-

Industry Differences: Comparing ratios across industries is challenging due to varying capital intensity.

-

Accounting Practices: Differences in accounting standards and practices can affect the ratio's accuracy.

-

Off-Balance Sheet Financing: The ratio may not fully capture debt that is not reflected on the balance sheet.

-

Qualitative Factors: The ratio should not be interpreted in isolation; qualitative factors need to be considered.

5. Impact of Different Debt Types:

The type of debt used significantly influences the overall risk profile and the interpretation of the debt-to-capital ratio. For example, short-term debt poses a higher risk than long-term debt because it needs to be repaid sooner. Similarly, secured debt (backed by collateral) is generally less risky than unsecured debt. The ratio doesn't explicitly distinguish between these debt types, but a detailed analysis of the company's debt profile is crucial for a complete understanding.

Exploring the Connection Between Interest Coverage Ratio and Debt-to-Capital Ratio:

The interest coverage ratio, which measures a company's ability to meet its interest payments, is closely related to the debt-to-capital ratio. A high debt-to-capital ratio often implies a higher interest expense. Therefore, a low interest coverage ratio alongside a high debt-to-capital ratio indicates a potentially unsustainable financial situation. Analyzing both ratios together provides a more comprehensive picture of a company’s financial health.

Key Factors to Consider:

-

Roles and Real-World Examples: Companies in capital-intensive industries (like utilities) typically have higher debt-to-capital ratios compared to less capital-intensive industries (like software). Analyzing companies within the same industry provides a more meaningful comparison.

-

Risks and Mitigations: A high debt-to-capital ratio increases the risk of bankruptcy, especially during economic downturns. Companies can mitigate this risk by improving profitability, reducing operating costs, or refinancing debt at lower interest rates.

-

Impact and Implications: A sustained high debt-to-capital ratio can lead to lower credit ratings, higher borrowing costs, and limited access to capital, potentially hindering growth and future opportunities.

Conclusion: Reinforcing the Connection:

The interplay between the interest coverage ratio and the debt-to-capital ratio highlights the importance of considering multiple financial metrics when assessing a company’s financial health. While the debt-to-capital ratio provides a concise overview of a company’s leverage, a comprehensive analysis requires a deeper dive into the company's cash flow, profitability, and overall financial strategy.

Further Analysis: Examining Interest Coverage Ratio in Greater Detail:

The interest coverage ratio (EBIT/Interest Expense) measures how many times a company's earnings before interest and taxes (EBIT) can cover its interest expenses. A higher ratio signifies better ability to service debt. A low ratio, especially combined with a high debt-to-capital ratio, raises serious concerns about the company's ability to manage its debt obligations.

FAQ Section: Answering Common Questions About the Debt-to-Capital Ratio:

-

What is the debt-to-capital ratio? The debt-to-capital ratio is a financial metric that measures the proportion of a company's financing that comes from debt relative to its total capital (debt plus equity).

-

How is the debt-to-capital ratio calculated? It's calculated by dividing total debt by the sum of total debt and total equity.

-

What is a good debt-to-capital ratio? There's no universally "good" ratio; it depends on the industry, company size, and economic conditions. However, generally, a lower ratio suggests lower risk.

-

What are the limitations of the debt-to-capital ratio? It doesn't consider off-balance sheet financing, qualitative factors, or the specific types of debt used. Comparisons across industries can be misleading.

Practical Tips: Maximizing the Benefits of Understanding the Debt-to-Capital Ratio:

-

Understand the context: Always consider the industry, economic climate, and company-specific factors when interpreting the ratio.

-

Compare to peers: Compare a company's ratio to its competitors to gain a better perspective.

-

Analyze trends: Track the ratio over time to identify potential shifts in a company's financial health.

-

Combine with other metrics: Use the ratio in conjunction with other financial metrics for a more comprehensive assessment.

Final Conclusion: Wrapping Up with Lasting Insights:

The debt-to-capital ratio is a powerful tool for assessing a company's financial leverage and risk. While not a standalone indicator, it provides crucial insights into a company's capital structure and its ability to manage its debt obligations. By understanding its calculation, interpretation, and limitations, investors, lenders, and company management can make more informed decisions and better navigate the complexities of financial analysis. Its consistent use, alongside other key metrics, strengthens the overall financial analysis process and reduces potential risks.

Latest Posts

Related Post

Thank you for visiting our website which covers about Debt To Capital Ratio Definition Formula And Example . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.