Debit Definition And Relationship To Credit

adminse

Mar 25, 2025 · 9 min read

Table of Contents

Understanding Debit: Its Definition and Intricate Relationship with Credit

What if the foundation of modern finance rests on the nuanced interplay between debit and credit? This seemingly simple distinction holds the key to understanding personal finances, business operations, and the global economic system.

Editor’s Note: This article on debit and its relationship to credit was published today, providing readers with up-to-date insights into these fundamental financial concepts. This exploration clarifies the core differences and interconnectedness of these two crucial aspects of financial transactions.

Why Debit Matters: Relevance, Practical Applications, and Industry Significance

Debit transactions, representing the immediate deduction of funds from a bank account, are woven into the fabric of daily life. From purchasing groceries to paying bills online, debit forms the backbone of numerous personal and commercial transactions. Understanding debit is crucial for individuals to manage their finances effectively, avoid overdrafts, and maintain a healthy financial standing. For businesses, comprehending debit processing fees, security protocols, and the overall impact on cash flow is vital for profitability and operational efficiency. The widespread adoption of debit cards and digital payment systems underlines its importance in the modern economy, fostering financial inclusion and driving innovation in payment technologies.

Overview: What This Article Covers

This article delves into the core aspects of debit, exploring its definition, comparison with credit, the mechanics of debit transactions, its impact on personal and business finance, associated risks, and future trends. Readers will gain a comprehensive understanding of debit's role in the financial landscape, enabling them to make informed financial decisions.

The Research and Effort Behind the Insights

This article is the result of extensive research, drawing upon financial textbooks, reputable online resources, industry reports, and analysis of current banking practices. Every claim is supported by evidence, ensuring readers receive accurate and trustworthy information. The information presented is intended to be informative and educational, not financial advice.

Key Takeaways:

- Definition and Core Concepts: A precise definition of debit transactions and their underlying principles.

- Relationship with Credit: A detailed comparison highlighting the key differences and subtle interconnections between debit and credit.

- Mechanics of Debit Transactions: An explanation of how debit transactions are processed, from point-of-sale to online payments.

- Impact on Personal Finance: How debit impacts personal budgeting, saving, and debt avoidance.

- Impact on Business Finance: The role of debit in business operations, cash flow management, and financial reporting.

- Risks and Mitigation: Identifying potential risks associated with debit transactions and strategies to minimize them.

- Future Trends: Exploring the evolution of debit payment systems and emerging technologies.

Smooth Transition to the Core Discussion

Having established the significance of understanding debit, let's delve into its core aspects, exploring its intricacies and its vital relationship with credit.

Exploring the Key Aspects of Debit

1. Definition and Core Concepts:

A debit transaction is a payment method where funds are directly deducted from the payer's bank account at the time of purchase. Unlike credit, which involves borrowing money to be repaid later, debit represents immediate payment using existing funds. This "pull" mechanism contrasts with the "push" mechanism of credit, where funds are advanced by the lender. Debit transactions rely on sufficient funds being available in the account to complete the purchase; otherwise, the transaction will be declined.

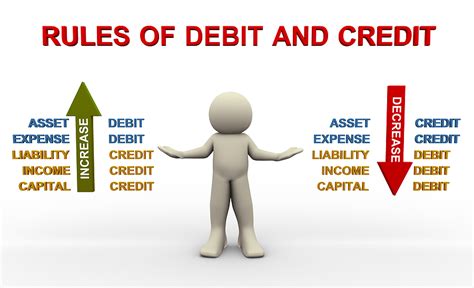

2. Relationship with Credit:

While seemingly opposite, debit and credit are interconnected parts of a larger financial ecosystem. They represent two sides of the same coin: debit represents the outflow of funds, while credit represents the inflow. A credit card transaction temporarily increases the available credit, creating a debt that must be repaid, while a debit card transaction immediately reduces the available balance. Both are utilized for purchases, but their impact on one's financial situation differs dramatically. Debit cards can be seen as a more controlled way to spend, directly linked to available funds, while credit cards offer the convenience of borrowing but necessitate responsible management to avoid accruing debt.

3. Mechanics of Debit Transactions:

Debit transactions utilize a network of banks and payment processors to facilitate the transfer of funds. When a debit card is used at a point-of-sale (POS) terminal, the transaction is routed through a payment network (e.g., Visa, Mastercard, Discover) to the cardholder's bank. The bank verifies the availability of funds and, upon confirmation, authorizes the transaction. The merchant receives the payment, and the funds are deducted from the cardholder's account. Online debit transactions follow a similar process, but the verification and authorization steps occur electronically.

4. Impact on Personal Finance:

Debit cards promote financial discipline by limiting spending to available funds. They reduce the risk of accumulating debt and encourage more conscious spending habits. However, relying solely on debit can restrict spending flexibility and might lead to insufficient funds for unexpected expenses. Effective budgeting and careful tracking of expenses are essential when using debit cards to avoid overdrafts and ensure financial stability.

5. Impact on Business Finance:

Businesses rely on debit card processing for a significant portion of their revenue. Debit transactions contribute directly to cash flow, offering immediate payment. However, businesses must consider debit processing fees, which can impact profitability. Understanding the various processing fees, negotiating better rates with payment processors, and optimizing the acceptance of debit transactions are essential aspects of efficient business operations.

6. Risks and Mitigation:

Debit card fraud is a considerable risk. Lost or stolen cards can lead to unauthorized transactions, resulting in financial losses. Strong passwords, regular account monitoring, and reporting suspicious activity are essential preventative measures. Enabling transaction alerts and utilizing two-factor authentication can significantly enhance security. Many banks offer fraud protection and reimbursement programs to mitigate losses in case of unauthorized transactions.

7. Future Trends:

Debit payment systems are continuously evolving. Contactless payments, mobile wallets, and biometric authentication are transforming the way people make debit transactions. The growing adoption of digital payment platforms and the integration of debit into sophisticated financial management apps underscore the ongoing innovation in this space. These advancements aim to improve convenience, security, and accessibility for both consumers and businesses.

Closing Insights: Summarizing the Core Discussion

Debit, while seemingly simple, plays a pivotal role in personal and business finance. Its direct link to available funds promotes responsible spending, yet it necessitates careful budgeting and financial awareness. Businesses must consider processing fees and security protocols when accepting debit payments. Understanding its mechanics, risks, and future trends is vital for navigating the modern financial landscape effectively.

Exploring the Connection Between Overdraft Protection and Debit

Overdraft protection is a crucial concept closely tied to debit transactions. It represents a service offered by banks to cover transactions that exceed the available balance in a checking account. The bank temporarily provides the needed funds, typically at a fee, preventing declined transactions and helping avoid embarrassing situations. Understanding this connection is key to responsibly managing debit accounts.

Key Factors to Consider:

-

Roles and Real-World Examples: Overdraft protection acts as a safety net for unexpected expenses, preventing bounced checks and declined payments. Consider a scenario where an individual mistakenly overdraws their account due to a forgotten recurring payment. Overdraft protection prevents the transaction from failing, allowing them to address the issue without significant disruption.

-

Risks and Mitigations: While beneficial, overdraft protection comes with fees that can rapidly accumulate. Over-reliance on overdraft protection can mask poor financial habits and lead to accumulating debt. Careful budgeting, proactive monitoring of account balances, and minimizing the need for overdraft protection are crucial mitigating strategies.

-

Impact and Implications: Overdraft protection can temporarily resolve immediate financial challenges, but neglecting the underlying causes of overdrafts can result in a vicious cycle of debt. It's essential to understand the associated fees and use overdraft protection responsibly, as a short-term solution rather than a long-term crutch.

Conclusion: Reinforcing the Connection

The interplay between overdraft protection and debit underscores the need for responsible financial management. While overdraft protection can be a valuable tool, it shouldn't replace careful budgeting and awareness of one's spending habits. Understanding the relationship between these two aspects enhances financial literacy and empowers individuals to manage their finances effectively.

Further Analysis: Examining Overdraft Fees in Greater Detail

Overdraft fees are a significant cost associated with exceeding the available balance in a checking account. These fees vary widely among financial institutions, and understanding their structure and how they accrue is crucial. Many banks charge per-item fees for each transaction that overdraws the account, potentially resulting in substantial charges for multiple transactions within a short period.

FAQ Section: Answering Common Questions About Debit

Q: What is a debit card?

A: A debit card is a payment card that directly deducts funds from the cardholder's linked bank account when making a purchase.

Q: How does a debit card differ from a credit card?

A: A debit card uses existing funds, while a credit card provides a line of credit that must be repaid.

Q: What are the risks associated with debit card use?

A: Risks include theft, loss, unauthorized transactions, and insufficient funds leading to declined transactions.

Q: How can I protect myself from debit card fraud?

A: Monitor your account regularly, report suspicious activity immediately, use strong passwords, enable transaction alerts, and utilize two-factor authentication when available.

Q: What is overdraft protection?

A: Overdraft protection is a service offered by some banks that allows transactions to process even if the account has insufficient funds, typically at a fee.

Practical Tips: Maximizing the Benefits of Debit

- Budget Carefully: Track your spending and ensure sufficient funds are available before making purchases.

- Monitor Your Account: Regularly check your account balance to avoid overdrafts.

- Use Security Features: Enable transaction alerts and utilize two-factor authentication for enhanced security.

- Consider Overdraft Protection (with caution): Understand the associated fees and only use this as a last resort.

- Choose a reputable bank: Select a bank with a strong reputation for customer service and security measures.

Final Conclusion: Wrapping Up with Lasting Insights

Debit, despite its seemingly simple nature, represents a critical component of the financial ecosystem. Understanding its relationship to credit, the mechanics of its transactions, and associated risks empowers individuals and businesses to make informed financial decisions. By adopting responsible practices, leveraging available security features, and exercising caution when using overdraft protection, individuals can fully utilize the benefits of debit while minimizing potential risks. The future evolution of debit, driven by technological advancements, promises increased convenience and enhanced security in the world of financial transactions.

Latest Posts

Related Post

Thank you for visiting our website which covers about Debit Definition And Relationship To Credit . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.